Technologies

Tariffs Explained: As Trump Alters Tariff Plans, Here’s What It All Means for You

The president’s global raft of tariffs was dubbed «worse than the worst-case scenario» by experts, but the most alarming parts of the plan were delayed on April 9.

After months of delays, President Donald Trump’s contentious tariff barrage was meant to fully take effect at midnight on Wednesday, but only a few hours later, the many of the most widespread duties were delayed — while the focus shifted to China in a big way.

This came after a week of historic stock market plunges and volatility following the president’s import tax policy reveal. Some experts dubbed the tariffs «worse than the worst-case scenario» and prompted even the most ardent Trump supporters on Wall Street to sound the alarm.

TAX SOFTWARE DEALS OF THE WEEK

-

$0 (save $0)

-

$56 (save $24)

-

$83 (save $32)

For many, one of the most alarming aspects of Trump’s tariff policies was the so-called «reciprocal» tariffs, which were meant to go into effect against most countries on April 9 at midnight. Around midday, however, Trump announced on social media that most of them were being delayed by 90 days, citing efforts by the affected countries to make new trade deals.

The tariffs imposed on China, however, were increased even further. Due to the fact that China is its third biggest trading partner, and given the extremely high new rate, experts noted that the US’s overall tariff rates remained the highest in roughly a century. The stock market certainly seemed to reflect that realization: While values soared after news of the delay, they plunged back down to Earth the next day.

The chaos and potential market damage of Trump’s tariff policies reportedly led Tesla CEO and White House advisor Elon Musk to urge the president against implementing them. Following that news, Musk took to X, lambasting a Trump trade advisor, Peter Navarro, as a «moron» over the tariff drama.

While the president once claimed (with little evidence) that his tariffs would cause no pain for US consumers, he has more recently admitted that some «pains» are likely, reigniting concerns about the cost of living as prices have continued to creep up. Tariffs against China, for example, prompted Acer to announce impending price hikes for its laptops, with similar price increases from other companies expected soon on smartphones, laptops, tablets and TVs.

A new survey conducted by CNET found considerable anxiety about prices among US adults. And Nintendo cited the tariffs as it delayed the start of preorders for its hotly anticipated Switch 2 video game console, making the impact of Trump’s tariffs all too real for many folks.

So, what exactly are these tariffs that are causing such a frenzy? And more to the point, what do they mean for the prices you’ll see when crossing things off your shopping list? The short answer: Expect to pay more for at least some goods and services. For the long answer, keep reading, and for more, find out how tariffs could affect the price of another popular gaming console.

What exactly is a tariff?

Put simply, a tariff is a tax on the cost of importing or exporting goods by a particular country. Therefore, a 60% tariff on Chinese imports would be a 60% tax on the price of importing, say, computer components from China.

Trump has been fixated on imports as part of his economic plans, often claiming that the money collected from taxes on imported goods would help finance other parts of his agenda. The US imports $3 trillion of goods from other countries annually.

While Trump deployed tariffs in his first term, notably against China, he ramped up his plans more significantly for the 2024 campaign, promising 60% tariffs against China and a universal 20% tariff on all imports into the US. «Tariffs are the greatest thing ever invented,» Trump said at a campaign stop in Michigan last year. More recently, he called himself «Tariff Man» in a post on Truth Social.

Who pays the cost of a tariff?

During the 2024 campaign, Trump repeatedly claimed that the country from which an imported good is coming pays the cost of the tariffs and that Americans would not see any price increases from them. However, as economists and fact-checkers stressed, this is not always the case.

The companies importing the tariffed goods — American companies or organizations in this case — pay the higher costs. To compensate for those new costs, companies can raise their prices or absorb the additional costs themselves.

So, who ends up paying the price for tariffs? In the end, usually you, the consumer. In February, Trump admitted consumers might «feel pain» financially as his tariffs take effect. For instance, a universal tariff on goods from Canada would increase Canadian lumber prices, which would have the knock-on effect of making construction and home renovations more expensive for US consumers.

Some companies may eat the new costs resulting from tariffs themselves rather than pass them onto consumers, at least temporarily. On March 2, Chipotle CEO Scott Boatwright told NBC Nightly News, «It is our intent as we sit here today to absorb those costs,» but he also stressed that prices could go up eventually.

Speaking with CNET, Ryan Reith, vice president of the International Data Corporation’s worldwide mobile device tracking programs, explained that price hikes from tariffs, especially on technology hardware, are inevitable in the short-term. He estimated that the full amount imposed on imports by Trump’s tariffs would be passed on to consumers, which he called the «cost pass-through.» Any potential efforts for company’s to absorb the new costs themselves would come in the future once companies have a better understanding of the tariffs, if at all.

Which Trump tariffs have gone into effect?

At a White House event on April 2, Trump laid out the new wave of tariffs, including:

- A 25% tariff on all foreign-made cars and auto parts went into effect at midnight on Thursday, April 3.

- A sweeping overall 10% tariff on all imported goods went into effect April 5. Despite Trump’s delay announcement on April 9, this one remains in effect.

- For a certain number of countries, which Trump said were more responsible for the US trade deficit, that number was set higher, the president calling them «reciprocal» tariffs: 20% for the 27 nations that make up the European Union, 26% for India, 24% for Japan and so on. These were meant to take effect on April 9, but were delayed by 90-days in the wake of historic stock market volatility, which would make the new effective date July 8.

A complete list was shared on X, claiming that the tariffs were set in proportion to the tariffs allegedly imposed against the US by each country:

— Rapid Response 47 (@RapidResponse47) April 2, 2025

Trump’s claims that these reciprocal tariffs are based on high tariffs imposed against the US by the countries in question have drawn intense pushback from experts and economists, who have argued that some of these numbers are false or potentially inflated. For example, the above chart claims a 39% tariff from the EU, despite its average tariff for US goods being around 3%. Some of the tariffs are against places that are not countries but tiny territories of other nations. The Heard and McDonald Islands, for example, are uninhabited. We’ll dig into the confusion around these calculations below.

These join a handful of Trump tariffs already in effect:

- A 25% tariff on all steel and aluminum imports.

- A preexisting 20% tariff on all Chinese imports, previously set at 10% in February but doubled in early March. This had been in addition to what was initially a 34% reciprocal tariff, but after a series of back-and-forth responses between the two nations, the Trump White House ultimately hiked the reciprocal rate for China to 125%, later clarifying that the total tax on Chinese imports was now a staggering 145%.

- 25% tariffs on imports from Canada and Mexico not covered under the 2018 USMCA trade agreement brokered during Trump’s first term. The deal covers roughly half of all imports from Canada and about a third of those from Mexico, so the rest are subject to the new tariffs. Energy imports not covered by USMCA will only be taxed at 10%.

Notably, that minimum 10% tariff will not be on top of those steel, aluminum and auto tariffs. Canada and Mexico were also spared from the 10% minimum additional tariff imposed on all countries the US trades with.

How were the Trump reciprocal tariffs calculated?

The numbers released by the Trump administration for its barrage of «reciprocal» tariffs led to widespread confusion from experts. Trump’s own claim that these new rates were derived by halving the tariffs already imposed against the US by certain countries was widely disputed, with critics noting that some of the numbers listed for certain countries were much higher than the actual rates, and some countries had tariff rates listed despite not specifically having tariffs against the US at all.

In a post to X that spread fast across social media, finance journalist James Surowiecki said that the new reciprocal rates appeared to have been reached by taking the trade deficit the US has with each country and dividing it by the amount the country exports to the US. This, he explained, consistently produced the reciprocal tariff percentages revealed by the White House across the board.

Just figured out where these fake tariff rates come from. They didn’t actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country’s exports to us.

So we… https://t.co/PBjF8xmcuv— James Surowiecki (@JamesSurowiecki) April 2, 2025

«What extraordinary nonsense this is,» Surowiecki wrote about the finding.

What will tariffs do to prices in the US?

Speaking about Trump’s tariff plans just before they were announced, Navarro said that they would generate $6 trillion in revenue over the next decade. Owing to the reality that tariffs are most often paid by consumers, CNN characterized this as potentially «the largest tax hike in US history.»

New estimates from the Yale Budget Lab, cited by Axios, predict that Trump’s new tariffs will cause a 2.3% increase in inflation throughout 2025. This translates to about a $3,800 increase in expenses for the average American household.

In an email to CNET, Patti Brennan, CEO of Key Financial, predicted that no products would be safe from these price hikes and that tariffs «could have a systemic effect» on the cost of goods, even ones not coming from targeted countries.

«Even if products aren’t coming from the countries affected, companies can increase prices and just blame it on rising costs due to tariffs,» she wrote. «They’ll assume the consumer is well aware of the issue of tariffs and test the boundaries until demand falls off.»

This speculative and uncertain nature of tariff impacts might already extend to consumers. In the wake of Nintendo’s Switch 2 event, speculation was rampant online that the higher-than-expected prices ($450 for the system and $80 for certain games) were because of tariffs. This concern was later disproven, but in a way that showed how gamers might still get hurt by Trump’s policies: Nintendo later delayed the start of system preorders as it reckoned with how to handle the new tariffs, meaning the Switch 2 might be getting even more expensive.

Brennan noted the cost of services should be safe for now. As opposed to goods, which are the tangible products you buy, services are the things you pay for people or companies to do for you, ranging from haircuts and deliveries to legal work and medical care. «Services should be relatively resilient, and consumers (already) spend more on services than on goods,» she explained.

In February, Taiwanese computer hardware company Acer announced that the prices of its products would increase by 10% in March, directly resulting from the Trump tariff on Chinese imports. Acer is the world’s sixth-largest personal PC vendor by sales. Other PC makers like Dell and Asus are expected to make similar moves eventually.

When the Canada and Mexico tariffs initially took effect on March 4, Target CEO Brian Cornell warned that customers could expect higher prices in stores «over the next couple of days.» Echoing that sentiment, Best Buy CEO Corie Barry warned that price hikes were «highly likely» because of the tariffs, as China and Mexico are two of the company’s biggest suppliers.

Will tariffs impact prices immediately?

In the immediate, short-term future — think the next couple of days or weeks after a tariff takes effect — you might not see any major price changes. Tariffs are a tax on imports, so companies won’t need to hike prices on things currently on the shelves, which obviously they’ve already imported. However, once they need to import more products to restock the shelves, that’s when you might start to see inflated prices. So while the stock market might be immediately reacting with historically bad plunges in value, actual prices might take a bit to increase.

Naturally, that new reality has got a lot of folks concerned about when to make certain purchases, with American consumers now feeling anxiety over planned buys being affected by tariffs. As found in CNET’s recent survey, around 38% of shoppers feel pressured to make certain purchases before tariffs make them more expensive. Around 10% say they have already made certain purchases in hopes of getting in before the price hikes, while 27% said they have delayed purchases for things over $500. Generally, this worry is the most acute concerning electronics — like smartphones, laptops and home appliances — which are highly likely to be impacted by Trump’s tariffs.

Mark Cuban, the billionaire businessman and noted Trump critic, voiced these concerns about when to buy certain things in a post to Bluesky just after Trump’s «Liberation Day» announcements. In it, he suggested that consumers might want to stock up on certain items before tariff inflation hits.

«It’s not a bad idea to go to the local Walmart or big box retailer and buy lots of consumables now,» Cuban wrote. «From toothpaste to soap, anything you can find storage space for, buy before they have to replenish inventory.Even if it’s made in the USA, they will jack up the price and blame it on tariffs.»

What is the goal of the White House tariff plan?

The typical goal behind tariffs is to discourage consumers and businesses from buying the tariffed goods and encourage them to buy domestically produced goods instead. When implemented in the right way, tariffs are generally seen as a useful way to protect domestic industries. One of the stated intentions for Trump’s tariffs is along those lines: to restore American manufacturing and production.

However, tariffs are a better tool for protecting industries that already exist because importers can fall back on them right away. Building up the factories and plants needed for this in the US could take at least two years, leaving Americans to suffer under higher prices until then. That problem is worsened by the fact that the materials needed to build those factories will also be tariffed, making the costs of «reshoring» production in the US too heavy for companies to stomach. These issues, and the general instability of American economic policies under Trump, are part of why experts warn that Trump’s tariffs could have the opposite effect: keeping manufacturing out of the US and leaving consumers stuck with inflated prices. Any factories that do get built in the US because of tariffs also have a high chance of being automated, canceling out a lot of job creation potential.

Trump has reportedly been fixated on the notion that Apple’s iPhone — the most popular smartphone in the US market — can be manufactured entirely in the US. This has been broadly dismissed by experts, for a lot of the same reasons mentioned above, but also because an American-made iPhone could cost upwards of $3,500. One report from 404 Media dubbed the idea «a pure fantasy.»

The claims from Trump officials like Navarro that tariffs will be a massive tax windfall for the US are also at odds with the idea of bringing domestic manufacturing back. In order for tariffs to raise tax revenue, importers and consumers need to keep buying the tariffed goods but if the tariffs actually resulted in the mass switchover to American-made goods, the tariffs would not be raising any money. Basically, the Trump administration’s stated goals contradict themselves and the most likely result in the end is higher prices for consumers and no new jobs. It is also increasingly likely that Trump’s tariffs will see certain products disappear from the US market completely, especially with the new 145% tax on Chinese imports.

It’s also important to note that the changes hypothetically needed to brace for Trump’s tariffs are beyond the means of smaller businesses. In another post to Bluesky, Cuban echoed this sentiment, predicting that the tariffs would hurt the majority of the businesses and workers in the US, because they will be unable to respond to them.

«There are 33 [million] companies in the USA,» Cuban wrote. «Only 21k employ 500 or more. And they only make up 23% of workers. Trump and Elon [Musk] are ignoring the more than 32 [million] entrepreneurs that can’t afford to build a new factory or pay tariffs or absorb canceled contracts.»

In her correspondence with CNET before the April 2 announcement, Brennan said that it’s tough to predict right now if tariffs will benefit the US economy long-term after the initial price shocks.

«It will be painful short-term, but it will reveal how resilient our economy is (or isn’t),» she wrote. «If tariffs are successful in raising revenue, it could reduce the amount of our annual deficit (shortfall). This could postpone the need to increase taxes on all Americans. In the end, no one really knows what the outcome will be; for example, in spite of higher inflation than the Federal Reserve’s target of 2%, the dollar grew in value. Just as we don’t always win other types of wars, I’m not sure a trade war is going to accomplish the stated goals.»

For more, see how tariffs might raise the prices of Apple products and find some expert tips for saving money.

Technologies

Today’s NYT Mini Crossword Answers for Saturday, Feb. 21

Here are the answers for The New York Times Mini Crossword for Feb. 21.

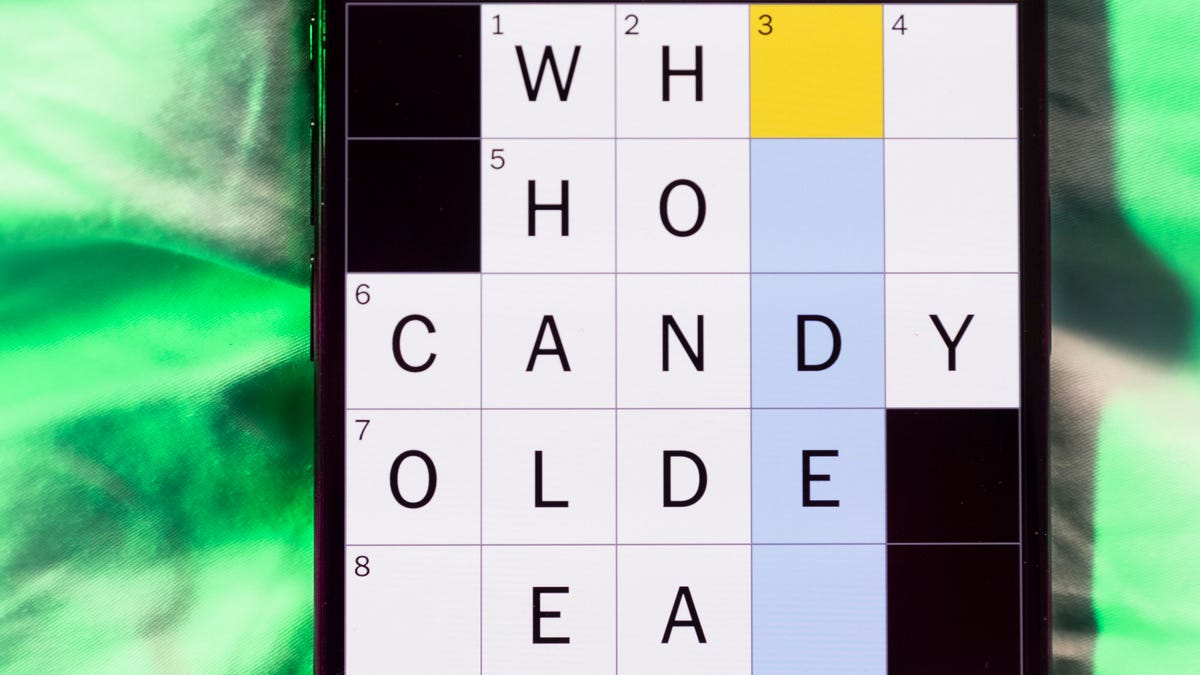

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? It’s the long Saturday version, and some of the clues are stumpers. I was really thrown by 10-Across. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: «Jersey Shore» channel

Answer: MTV

4A clue: «___ Knows» (rhyming ad slogan)

Answer: LOWES

6A clue: Second-best-selling female musician of all time, behind Taylor Swift

Answer: MADONNA

8A clue: Whiskey grain

Answer: RYE

9A clue: Dreaded workday: Abbr.

Answer: MON

10A clue: Backfiring blunder, in modern lingo

Answer: SELFOWN

12A clue: Lengthy sheet for a complicated board game, perhaps

Answer: RULES

13A clue: Subtle «Yes»

Answer: NOD

Mini down clues and answers

1D clue: In which high schoolers might role-play as ambassadors

Answer: MODELUN

2D clue: This clue number

Answer: TWO

3D clue: Paid via app, perhaps

Answer: VENMOED

4D clue: Coat of paint

Answer: LAYER

5D clue: Falls in winter, say

Answer: SNOWS

6D clue: Married title

Answer: MRS

7D clue: ___ Arbor, Mich.

Answer: ANN

11D clue: Woman in Progressive ads

Answer: FLO

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 21, #516

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 21, No. 516.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition is a tough one. I actually thought the purple category, usually the most difficult, was the easiest of the four. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Old Line State.

Green group hint: Hoops legend.

Blue group hint: Robert Redford movie.

Purple group hint: Vroom-vroom.

Answers for today’s Connections: Sports Edition groups

Yellow group: Maryland teams.

Green group: Shaquille O’Neal nicknames.

Blue group: Associated with «The Natural.»

Purple group: Sports that have a driver.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is Maryland teams. The four answers are Midshipmen, Orioles, Ravens and Terrapins.

The green words in today’s Connections

The theme is Shaquille O’Neal nicknames. The four answers are Big Aristotle, Diesel, Shaq and Superman.

The blue words in today’s Connections

The theme is associated with «The Natural.» The four answers are baseball, Hobbs, Knights and Wonderboy.

The purple words in today’s Connections

The theme is sports that have a driver. The four answers are bobsled, F1, golf and water polo.

Technologies

Wisconsin Reverses Decision to Ban VPNs in Age-Verification Bill

The law would have required websites to block VPN users from accessing «harmful material.»

Following a wave of criticism, Wisconsin lawmakers have decided not to include a ban on VPN services in their age-verification law, making its way through the state legislature.

Wisconsin Senate Bill 130 (and its sister Assembly Bill 105), introduced in March 2025, aims to prohibit businesses from «publishing or distributing material harmful to minors» unless there is a reasonable «method to verify the age of individuals attempting to access the website.»

One provision would have required businesses to bar people from accessing their sites via «a virtual private network system or virtual private network provider.»

A VPN lets you access the internet via an encrypted connection, enabling you to bypass firewalls and unblock geographically restricted websites and streaming content. While using a VPN, your IP address and physical location are masked, and your internet service provider doesn’t know which websites you visit.

Wisconsin state Sen. Van Wanggaard moved to delete that provision in the legislation, thereby releasing VPNs from any liability. The state assembly agreed to remove the VPN ban, and the bill now awaits Wisconsin Governor Tony Evers’s signature.

Rindala Alajaji, associate director of state affairs at the digital freedom nonprofit Electronic Frontier Foundation, says Wisconsin’s U-turn is «great news.»

«This shows the power of public advocacy and pushback,» Alajaji says. «Politicians heard the VPN users who shared their worries and fears, and the experts who explained how the ban wouldn’t work.»

Earlier this week, the EFF had written an open letter arguing that the draft laws did not «meaningfully advance the goal of keeping young people safe online.» The EFF said that blocking VPNs would harm many groups that rely on that software for private and secure internet connections, including «businesses, universities, journalists and ordinary citizens,» and that «many law enforcement professionals, veterans and small business owners rely on VPNs to safely use the internet.»

More from CNET: Best VPN Service for 2026: VPNs Tested by Our Experts

VPNs can also help you get around age-verification laws — for instance, if you live in a state or country that requires age verification to access certain material, you can use a VPN to make it look like you live elsewhere, thereby gaining access to that material. As age-restriction laws increase around the US, VPN use has also increased. However, many people are using free VPNs, which are fertile ground for cybercriminals.

In its letter to Wisconsin lawmakers prior to the reversal, the EFF argued that it is «unworkable» to require websites to block VPN users from accessing adult content. The EFF said such sites cannot «reliably determine» where a VPN customer lives — it could be any US state or even other countries.

«As a result, covered websites would face an impossible choice: either block all VPN users everywhere, disrupting access for millions of people nationwide, or cease offering services in Wisconsin altogether,» the EFF wrote.

Wisconsin is not the only state to consider VPN bans to prevent access to adult material. Last year, Michigan introduced the Anticorruption of Public Morals Act, which would ban all use of VPNs. If passed, it would force ISPs to detect and block VPN usage and also ban the sale of VPNs in the state. Fines could reach $500,000.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow