Technologies

You Can Free Up iPhone Storage Without Deleting Anything Important

If you don’t want to permanently get rid of your favorite apps, offline movies and text message threads — you don’t have to.

If storage is tight on your iPhone, you have very few options. You can of course delete large files, like downloaded TV shows, movies and albums, but maybe you don’t really want to give these up. There are also various cloud options, but that requires shifting files around and deleting things. Or maybe you could buy a new phone with more internal storage, but that can be expensive.

That’s why, if these options aren’t appealing to you, you can and should take advantage of certain iOS features to free up storage without having to delete anything or spend money.

That’s right. There are two built-in iOS settings that can help you clean up a significant amount of storage on your iPhone — one permanent and the other temporary — so that you can install the latest software update, take more photos and videos and download more apps. Here’s what you need to know.

If you want more tips on getting more iPhone storage, check out how to free up space on your iPhone with these easy tricks and the best cloud storage options in 2022.

Optimize your iPhone photos and videos

It’s not always easy to just delete what’s in your camera roll, so if you want to keep your precious memories, or even just your meme screenshots, but still want to free up device storage, the easiest way to do that is by optimizing the photos and videos already stored on your device.

By default, every time you take a photo or video, it is saved in full-resolution on your device. If you’re capturing photos and videos in the highest resolution possible, they can take up quite a bit of space. A minute of video shot in 4K at 60fps takes up approximately 400MB — nearly half a GB. That’s pretty significant.

To optimize your photos and videos, go to Settings > Photos and toggle on Optimize iPhone Storage (for this to work, you’ll need to have the iCloud Photos setting above it enabled). Depending on how many photos and videos you have on your iPhone, this can take up quite a bit of time, but once it’s finished, you should see significant more space on your device storage.

All of your full-resolution photos and videos are then transferred over to your iCloud, while smaller, lower-resolution versions are kept on your device, to take up less space. If you want to access your higher-resolution photos and videos, you can go into the Photos app and download any file that’s being optimized, but this requires a decent internet connection. Your more recently taken photos and videos may exist in full-resolution, so you won’t need to download every photo or video.

If you don’t have enough iCloud storage, it’s easier to upgrade your cloud than get a new phone. In the US, you can upgrade to 50GB for only a dollar a month, or you can go bigger: 200GB for $3 a month or 2TB for $10 a month. Prices range depending on your country or region.

To upgrade your iCloud on your iPhone, go to Settings > (your name) > iCloud > Manage Account Storage > Buy More Storage. Choose a plan and then follow the instructions. If you upgrade to any paid iCloud subscription, you’ll get access to iCloud+, which also offers the iCloud Private Relay and Hide My Email features.

Offload your biggest apps

You don’t use every application stored on your iPhone. Many of them just sit there, like apps for your favorite airlines, third-party cameras and music production. And even if you use them only every once in a while, you probably don’t need consistent, daily access to most apps, which is why you should consider offloading apps in case you desperately need storage.

Say for example you want to download and install the latest iOS update. If it’s a major update, like iOS 16, you may need a little over 5GB to successfully install the software. If it’s a point update, like iOS 16.1, you’re looking at around 1GB. And if you don’t have enough storage space to update, you can quickly offload apps, which is a middle ground between keeping and deleting your apps.

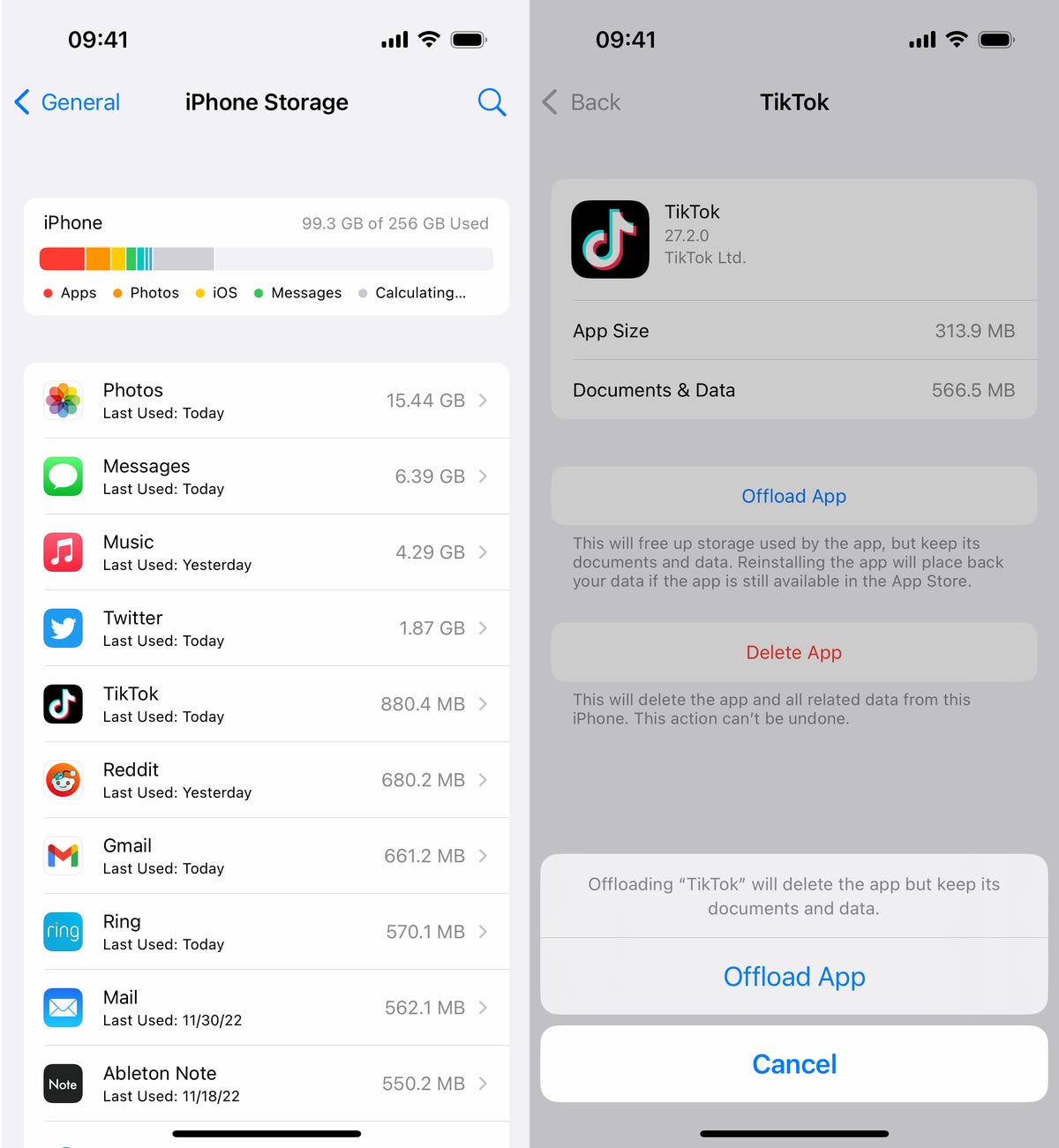

Go to Settings > General > iPhone Storage and check which apps are taking up the most storage. Certain built-in apps like Photos and Messages cannot be offloaded, so be warned. If you find a sizable app you want to offload, tap on it and hit Offload App. Wait a little bit and the app should then be removed offline, while your documents and data will stay saved on your device.

If you need temporary storage, for a software download, just go through the list and offload every app you can. The amount that’s offloaded for each app will vary, but you should see the number next to App Size. Discard the number next to Documents & Data, because that will stay on your device. The only way to get rid of that is to actually delete the app.

Offload as many apps as you need until you have enough storage. Obviously you can’t use an app that’s offloaded, but if you want to get an offloaded app back, go to your App Library and tap on the iCloud button to redownload it. If the offloaded app is on your home screen, simply tap on it to download it. You won’t have to re-sign in or anything — you’ll have access to the app as if it was never deleted.

Technologies

Today’s NYT Connections Hints, Answers and Help for Feb. 2, #967

Here are some hints and the answers for the NYT Connections puzzle for Feb. 2 #967

Looking for the most recent Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections: Sports Edition and Strands puzzles.

Today’s NYT Connections puzzle is a fun one for fans of Agatha Christie, as the last name of one of her detectives shows up in the grid. Read on for clues and today’s Connections answers.

The Times has a Connections Bot, like the one for Wordle. Go there after you play to receive a numeric score and to have the program analyze your answers. Players who are registered with the Times Games section can now nerd out by following their progress, including the number of puzzles completed, win rate, number of times they nabbed a perfect score and their win streak.

Read more: Hints, Tips and Strategies to Help You Win at NYT Connections Every Time

Hints for today’s Connections groups

Here are four hints for the groupings in today’s Connections puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Time.

Green group hint: Need to get in.

Blue group hint: Characters in a certain genre of books.

Purple group hint: They grow in the forest, sometimes, but there’s a twist.

Answers for today’s Connections groups

Yellow group: Duration.

Green group: Credentials for entry.

Blue group: Modern crime series protagonists.

Purple group: Trees plus a letter.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections answers?

The yellow words in today’s Connections

The theme is duration. The four answers are interval, period, span and stretch.

The green words in today’s Connections

The theme is credentials for entry. The four answers are lanyard, pass, stamp and wristband.

The blue words in today’s Connections

The theme is modern crime series protagonists. The four answers are Bosch, Cross, Reacher and Ryan.

The purple words in today’s Connections

The theme is trees plus a letter. The four answers are fair (fir), Marple (maple), popular (poplar) and psalm (palm).

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Technologies

I Found the 9 Best Gifts for Someone Who Isn’t Gonna Watch the Super Bowl

Here are some great gifts for loved ones who see Super Bowl Sunday as just a regular Sunday.

CHEAP GAMING LAPTOP DEALS OF THE WEEK

Super Bowl LX is this Sunday at 6:30 p.m. ET, and a lot of us are excited to watch the game, the halftime or both. But let’s face it, NFL games aren’t everyone’s cup of tea. If you know someone whose birthday falls around now or want to show a non-football fan how much you appreciate them, we’ve got a list of gifts that’ll do the trick.

Technologies

NordVPN Software Blocked 92% of Phishing Emails in Independent Testing

Phishing attempts continue to grow with help from generative AI and its believable deepfakes and voice impersonations.

NordVPN’s anti-malware software Threat Protection Pro blocked 92% of phishing websites in an independent lab test of several antivirus products, browsers and VPNs in results released this week.

AV-Comparatives, based in Austria, attacked 15 products with 250 websites — all verified to be valid phishing URLs — in a test that ran Jan. 7 to 19. The lab said the products were tested in parallel and with active internet/cloud access. The Google Chrome browser was used for antivirus and VPN testing.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Phishing is a form of cyberattack in which a malicious actor tries to get someone to go «fishing,» with malicious URLs as bait. These phishing attempts might be sent in emails, but they also appear on websites, in texts and in voicemails.

You might get an email that says your bank account has been hacked and you should click on a URL to solve the problem. Or an email says you’ve won a big prize, instructing you to click on a URL to redeem. During tax season, the amount of scam emails and texts increases dramatically, with AI often used to ramp up the numbers. CNET offers tips for how to detect phishing attempts on even the most sophisticated of emails.

«By creating a sense of trust and urgency, cybercriminals hope to prevent you from thinking critically about their bait message so that they can gain access to your sensitive or personal information like your password, credit card numbers, user data, etc,» warns the US State Department website. «These cybercriminals may target specific individuals, known as spear phishing, or cast a wide net to attempt to catch as many victims as possible.»

In the AV-Comparatives test, which evaluated phishing-page detection and false-positive rates, NordVPN’s Threat Protection Pro ranked fourth among security products, blocking 92% of the 250 phishing URLs tested. The highest scoring included:

- Avast Free Antivirus 95%

- Norton Antivirus Plus 95%

- Webroot SecureAnywhere Internet Security Plus 93%

On its website, NordVPN says Threat Protection Pro protects devices even when they are not connected to a VPN. The company says the software can thwart phishing attempts and prevent malware from infecting your computer in several ways — alerts about malicious websites; blocking cookies that can learn about your browsing habits; and stopping pop-ups and intrusive ads.

According to cybersecurity company Hoxhunt, the total volume of phishing attacks has skyrocketed by 4,151% since the advent of ChatGPT in 2022, with a cost to companies of $4.88 million per phishing breach.

With the rapid expansion of AI across the internet, the volume of phishing attacks is growing. Some AI-generated phishing scams are able to get past email filters, but Hoxhunt found that only 0.7% to 4.7% of phishing emails were written by AI. However, cybercriminals are using AI to expand their phishing tools. AI can create deepfake videos and voice-impersonation phone calls to redirect payments or gain access to sensitive data.

AI scams will be tough to root out. CNET reported that 62% of executives had been targets of phishing attempts, including voice- and text-based scams, with 37% reporting invoice or payment fraud, all from generative AI.

Although NordVPN’s product might be effective at preventing malware from infecting your computer, it can’t eliminate malware that may already be on it. To clean up those issues, CNET lists the best antivirus software of 2026 and the best free antivirus apps. Those products can scan your computer and hopefully eradicate any malware and viruses that might be there.

More from CNET: Best VPN Service for 2026: Our Top Picks in a Tight Race

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow