Technologies

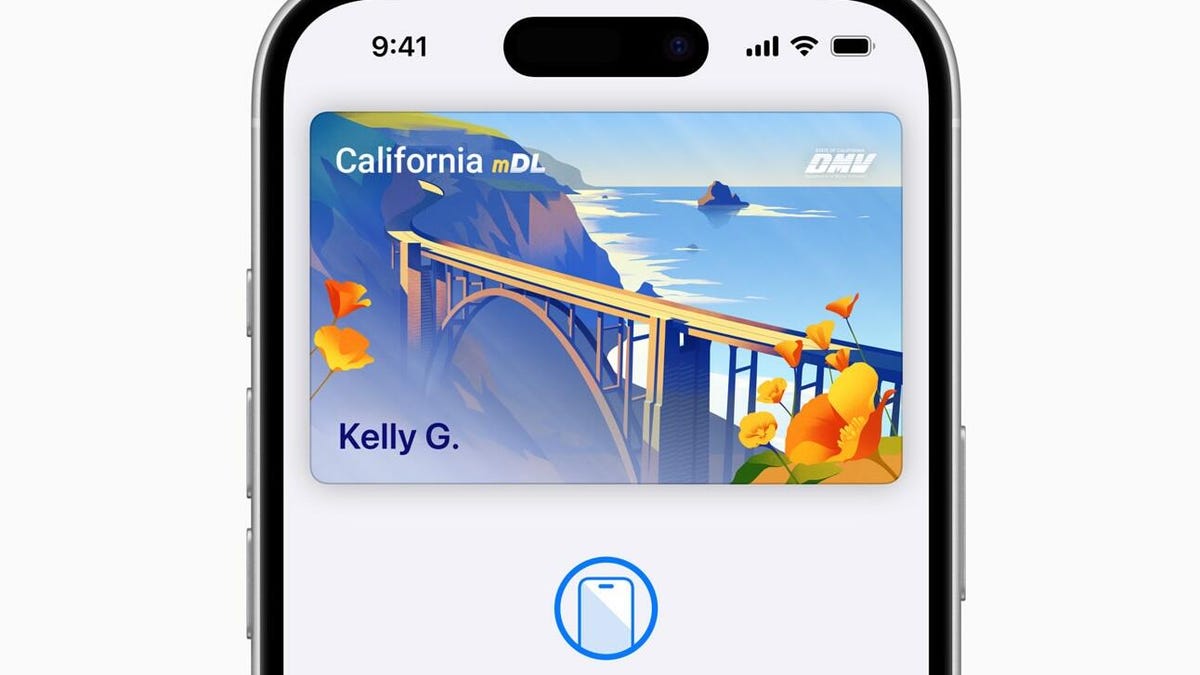

Your iPhone Can Now Hold a Digital Driver’s License. Here Are the States That Let You Do It

You might only need an iPhone to fly if you live in states that support digital identify verification.

Apple Wallet on your iPhone has made some physical items like concert tickets or boarding passes unnecessary — just swipe your iPhone and off you go. Now Apple is looking to make physical wallets obsolete by enabling digital driver’s licenses that you can use for identify verification or flying domestically in the US.

Right now, a select number of states currently allow you to add your driver’s license to Apple Wallet. People that enable the feature in Apple Wallet will be able to use their iPhones to get through TSA checkpoints at airports for a much snappier security experience.

It’s going to take some time before all states have a digital ID system up and running. Below, we’ll cover what states currently support digital IDs via Apple Wallet and how to add one to your iPhone. Plus, we’ll go over some of the new features headed to Apple Wallet once iOS 26 is released later this fall.

For more, don’t miss our visual comparison of iOS 18 to iOS 26.

What states currently support digital ID in Apple Wallet?

Only a handful of states support digital IDs in Apple Wallet, and a key factor is how the state implements its Mobile Driver’s License system. For instance, Louisiana, New York, Utah and Virginia all support mobile driver’s licenses but require separate apps to add and present digital IDs.

States and regions that support digital IDs in Apple Wallet:

- Arizona

- California

- Colorado

- Georgia

- Hawaii

- Iowa

- Maryland

- New Mexico

- Ohio

- Puerto Rico

Some states were originally announced to support Apple’s digital ID, but haven’t quite got there yet.

The number of states supported in Apple Wallet is about half of what the TSA currently allows. Collectively, it accepts digital IDs across Apple Wallet, Google Wallet, Samsung Wallet and state-based mobile apps in 15 states.

How to add your ID or driver’s license to Apple Wallet

If you live in a state that supports digital IDs for Apple Wallet, it’s easy to add it. After it’s added, you’ll need to verify your identity, which can take a little longer, but is still a straightforward process.

- Open Apple Wallet.

- Tap the Add button.

- Tap Driver’s License or ID and select your location.

- If applicable, choose whether you want to add your ID to your iPhone only or both your iPhone and your Apple Watch.

- Follow the steps to scan your license or ID.

(Make sure you scan your ID in a well-lit environment and the photo is in focus.)

Once it’s scanned, you’ll be prompted to confirm your identity with a selfie photo. According to Apple, you may be asked to complete a number of facial or head movements for identification purposes.

To ensure an easier verification process, Apple suggests that you:

- Stand in front of a plain background with neutral, light paint.

- Be in a well-lit area, ideally indoors.

- Take off sunglasses, masks, hats or other accessories that could block your face.

- Hold your iPhone steady.

When you’re finished, submit your information by confirming with Touch or Face ID. Your biometrics will be bound to the ID, so only you can use it.

Transferring your digital ID to another iPhone

If you upgrade your iPhone, you’ll need to transfer your ID or driver’s license to it.

- During initial setup, tap Wallet.

- Select your ID.

- Follow the steps.

- Tap to confirm you want to move your driver’s license or ID to the new device.

iOS 26 will allow you to create a digital passport in Apple Wallet

While states are taking time to implement digital ID systems, Apple announced a new feature coming in iOS 26 later this year: You can add a digital passport to Apple Wallet.

When that feature is available, iPhone users will be able to scan their passports to create a digital version for identity verification during domestic travel. You won’t be able to use it for international travel, and it’s not a full replacement for a physical passport (so keep your physical one on you), but it should work at the 250-plus supported TSA checkpoints.

During its WWDC keynote earlier this month, Apple said that the digital ID made from your passport can also be used «in apps and in person,» but it didn’t give any specifics.

This is essentially what can be done on Android through Google Wallet.

Verify with Wallet will make proving your age easier on your next wine delivery

Also headed to iPhones this fall is an easier way for you to prove your age using your digital ID. Say you want to have a bottle of wine sent to your place via Uber Eats. Typically, when the driver arrives, you’ll need to present your ID and have it scanned to complete the transaction, but with the new Verify with Wallet, your stored digital ID will be used to verify your age. (I do wonder if things might get more complicated when the delivery arrives if you’re not the one receiving it.)

Verify with Wallet will be supported by Chime, Turo, Uber Eats and U.S. Bank.

For more, don’t miss what you should know about flying domestically without a Real ID in 2025.

Technologies

TMR vs. Hall Effect Controllers: Battle of the Magnetic Sensing Tech

The magic of magnets tucked into your joysticks can put an end to drift. But which technology is superior?

Competitive gamers look for every advantage they can get, and that drive has spawned some of the zaniest gaming peripherals under the sun. There are plenty of hardware components that actually offer meaningful edges when implemented properly. Hall effect and TMR (tunnel magnetoresistance or tunneling magnetoresistance) sensors are two such technologies. Hall effect sensors have found their way into a wide variety of devices, including keyboards and gaming controllers, including some of our favorites like the GameSir Super Nova.

More recently, TMR sensors have started to appear in these devices as well. Is it a better technology for gaming? With multiple options vying for your lunch money, it’s worth understanding the differences to decide which is more worthy of living inside your next game controller or keyboard.

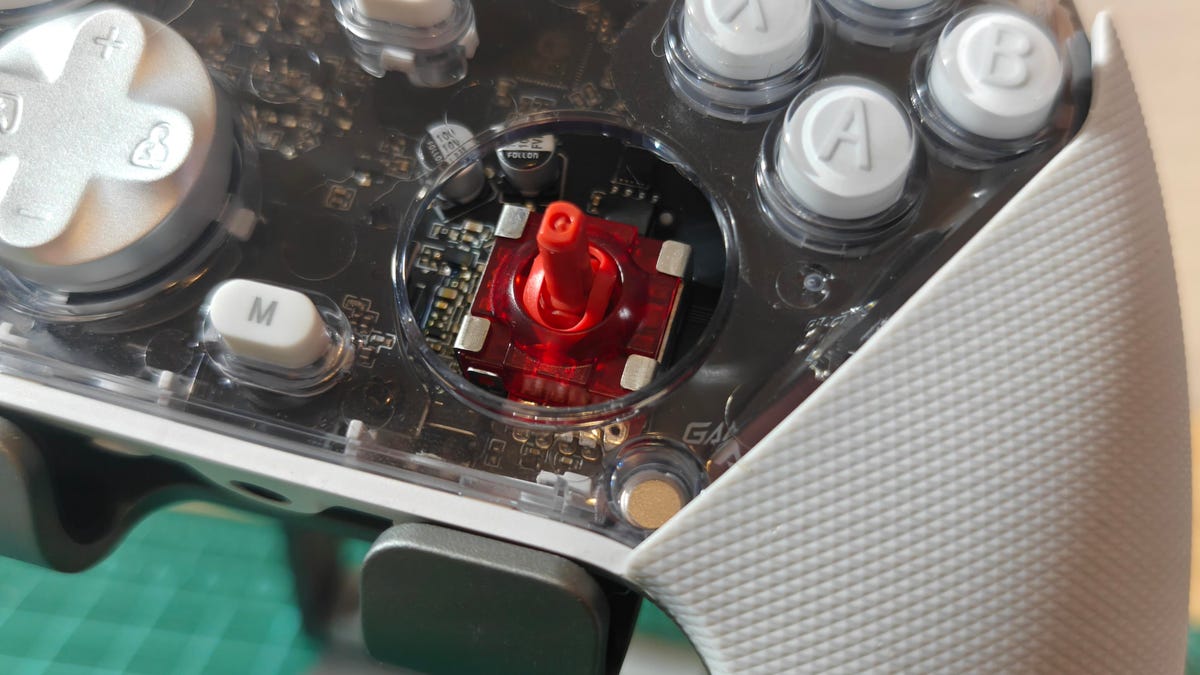

How Hall effect joysticks work

We’ve previously broken down the difference between Hall effect tech and traditional potentiometers in controller joysticks, but here’s a quick rundown on how Hall effect sensors work. A Hall effect joystick moves a magnet over a sensor circuit, and the magnetic field affects the circuit’s voltage. The sensor in the circuit measures these voltage shifts and maps them to controller inputs. Element14 has a lovely visual explanation of this effect here.

The advantage this tech has over potentiometer-based joysticks used in controllers for decades is that the magnet and sensor don’t need to make physical contact. There’s no rubbing action to slowly wear away and degrade the sensor. So, in theory, Hall effect joysticks should remain accurate for the long haul.

How TMR joysticks work

While TMR works differently, it’s a similar concept to Hall effect devices. When you move a TMR joystick, it moves a magnet in the vicinity of the sensor. So far, it’s the same, right? Except with TMR, this shifting magnetic field changes the resistance in the sensor instead of the voltage.

There’s a useful demonstration of a sensor in action here. Just like Hall effect joysticks, TMR joysticks don’t rely on physical contact to register inputs and therefore won’t suffer the wear and drift that affects potentiometer-based joysticks.

Which is better, Hall effect or TMR?

There’s no hard and fast answer to which technology is better. After all, the actual implementation of the technology and the hardware it’s built into can be just as important, if not more so. Both technologies can provide accurate sensing, and neither requires physical contact with the sensing chip, so both can be used for precise controls that won’t encounter stick drift. That said, there are some potential advantages to TMR.

According to Coto Technology, who, in fairness, make TMR sensors, they can be more sensitive, allowing for either greater precision or the use of smaller magnets. Since the Hall effect is subtler, it relies on amplification and ultimately requires extra power. While power requirements vary from sensor to sensor, GameSir claims its TMR joysticks use about one-tenth the power of mainstream Hall effect joysticks. Cherry is another brand highlighting the lower power consumption of TMR sensors, albeit in the brand’s keyboard switches.

The greater precision is an opportunity for TMR joysticks to come out ahead, but that will depend more on the controller itself than the technology. Strange response curves, a big dead zone (which shouldn’t be needed), or low polling rates could prevent a perfectly good TMR sensor from beating a comparable Hall effect sensor in a better optimized controller.

The power savings will likely be the advantage most of us really feel. While it won’t matter for wired controllers, power savings can go a long way for wireless ones. Take the Razer Wolverine V3 Pro, for instance, a Hall effect controller offering 20 hours of battery life from a 4.5-watt-hour battery with support for a 1,000Hz polling rate on a wireless connection. Razer also offers the Wolverine V3 Pro 8K PC, a near-identical controller with the same battery offering TMR sensors. They claim the TMR version can go for 36 hours on a charge, though that’s presumably before cranking it up to an 8,000Hz polling rate — something Razer possibly left off the Hall effect model because of power usage.

The disadvantage of the TMR sensor would be its cost, but it appears that it’s negligible when factored into the entire price of a controller. Both versions of the aforementioned Razer controller are $199. Both 8BitDo and GameSir have managed to stick them into reasonably priced controllers like the 8BitDo Ultimate 2, GameSir G7 Pro and GameSir Cyclone 2.

So which wins?

It seems TMR joysticks have all the advantages of Hall effect joysticks and then some, bringing better power efficiency that can help in wireless applications. The one big downside might be price, but from what we’ve seen right now, that doesn’t seem to be much of an issue. You can even find both technologies in controllers that cost less than some potentiometer models, like the Xbox Elite Series 2 controller.

Caveats to consider

For all the hype, neither Hall effect nor TMR joysticks are perfect. One of their key selling points is that they won’t experience stick drift, but there are still elements of the joystick that can wear down. The ring around the joystick can lose its smoothness. The stick material can wear down (ever tried to use a controller with the rubber worn off its joystick? It’s not pleasant). The linkages that hold the joystick upright and the springs that keep it stiff can loosen, degrade and fill with dust. All of these can impact the continued use of the joystick, even if the Hall effect or TMR sensor itself is in perfect operating order.

So you might not get stick drift from a bad sensor, but you could get stick drift from a stick that simply doesn’t return to its original resting position. That’s when having a controller that’s serviceable or has swappable parts, like the PDP Victrix Pro BFG, could matter just as much as having one with Hall effect or TMR joysticks.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 18, #513

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 18, No. 513.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition has a fun yellow category that might just start you singing. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: I don’t care if I never get back.

Green group hint: Get that gold medal.

Blue group hint: Hoops superstar.

Purple group hint: Not front, but…

Answers for today’s Connections: Sports Edition groups

Yellow group: Heard in «Take Me Out to the Ball Game.»

Green group: Olympic snowboarding events.

Blue group: Vince Carter, informally.

Purple group: ____ back.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is heard in «Take Me Out to the Ball Game.» The four answers are Cracker Jack, home team, old ball game and peanuts.

The green words in today’s Connections

The theme is Olympic snowboarding events. The four answers are big air, giant slalom, halfpipe and slopestyle.

The blue words in today’s Connections

The theme is Vince Carter, informally. The four answers are Air Canada, Half-Man, Half-Amazing, VC and Vinsanity.

The purple words in today’s Connections

The theme is ____ back. The four answers are diamond, drop, quarter and razor.

Technologies

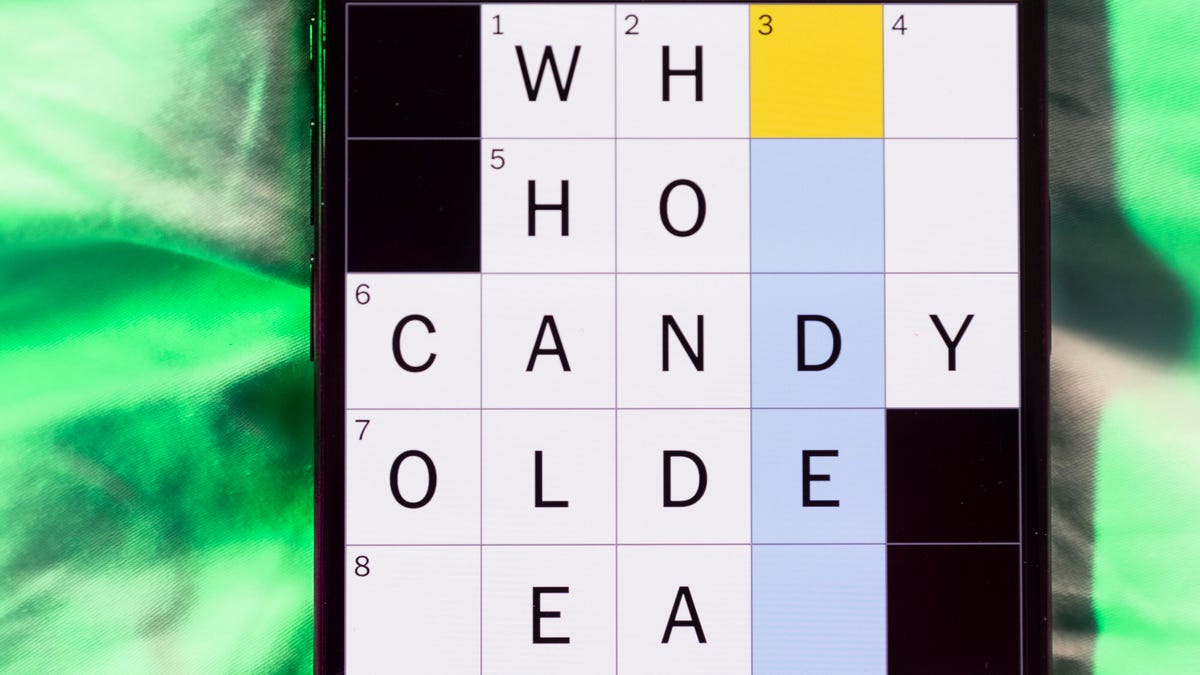

Today’s NYT Mini Crossword Answers for Wednesday, Feb. 18

Here are the answers for The New York Times Mini Crossword for Feb. 18.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Today’s Mini Crossword is a fun one, and it’s not terribly tough. It helps if you know a certain Olympian. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: ___ Glenn, Olympic figure skater who’s a three-time U.S. national champion

Answer: AMBER

6A clue: Popcorn size that might come in a bucket

Answer: LARGE

7A clue: Lies and the Lying ___ Who Tell Them» (Al Franken book)

Answer: LIARS

8A clue: Close-up map

Answer: INSET

9A clue: Prepares a home for a new baby

Answer: NESTS

Mini down clues and answers

1D clue: Bold poker declaration

Answer: ALLIN

2D clue: Only U.S. state with a one-syllable name

Answer: MAINE

3D clue: Orchestra section with trumpets and horns

Answer: BRASS

4D clue: «Great» or «Snowy» wading bird

Answer: EGRET

5D clue: Some sheet music squiggles

Answer: RESTS

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow