Technologies

Is AppleCare Plus a Better Deal Than Phone Insurance? We Do the Math

Pricing out whether Apple’s plans or your wireless carrier’s insurance are the better value.

Losing access to your phone — whether it gets lost, stolen or broken — feels like quickly getting cut off from the rest of the world. I learned this the hard way when I lost my phone while riding a roller coaster, and the staff let me know the chances of it being recovered were slim to none. At the time, I had a cell phone insurance plan through my wireless carrier. That plan allowed me to pay a deductible fee to replace the phone, saving me hundreds of dollars compared to having to buy a brand-new device.

Now, there are several options for insurance to protect your device from damage or loss. On top of that, Apple makes it very easy to set up the Find My app for free, which should allow you to track your phone down in most situations including when it is turned off. That said, for slightly more money you can opt for either an AppleCare Plus plan or a phone insurance plan through your wireless carrier that covers theft or loss incidents too.

But what’s the main difference between these phone insurance plans, and which one will save you the most money? For CNET’s We Do the Math, we took a closer look at both kinds of programs, comparing AppleCare Plus to Verizon, T-Mobile and AT&T’s respective phone insurance plans to determine which one is best for you.

While AppleCare Plus is typically the cheapest option, another may better fit your needs and save you more money in the long run. (For more We Do the Math, check out if streaming is really cheaper than cable, and if Xbox Game Pass costs less than buying the games.)

AppleCare vs. wireless carrier insurance plans (iPhone 14 prices)

| Monthly/2-year cost | Screen repair cost | Accidental damage repair deductible | Replacement deductible for theft and loss | |

|---|---|---|---|---|

| AppleCare Plus | $8/$149 | $29 | $99 | $149 |

| AppleCare Plus with Theft and Loss | $11.49/$219 | $29 | $99 | $149 |

| Verizon Mobile Protect (Single Line) | $17/$408 | $29 ($0 after April 27) | $229 ($99 after April 27) | $229 |

| AT&T Protect Advantage (Single Line) | $17/$408 | $29 | $0 when repairing battery, $275 when replacing device | $275 |

| T-Mobile Protection 360 | $18/$432 | $29 | $99 | $249 |

And just a note: You should not sign up for both AppleCare Plus and your wireless carrier insurance. It can be easy to do so by accident. I was once erroneously signed up for T-Mobile’s Protection 360 plan for my Apple Watch SE when I added it as a new line to my account, resulting in a $13 charge that was initially placed on my bill.

That extra charge was eventually refunded after making it clear to customer service that I never signed up for the service. As a precaution, keep an eye out for any similar mistakes when signing up for service at any wireless carrier.

In this article:

- AppleCare Plus: When you want Apple to handle everything

- Phone insurance from your wireless provider

- Verizon Wireless protection plans are getting better in April

- AT&T Protect Advantage plans

- T-Mobile Protection 360 and Basic Device Protection

- AppleCare Plus is cheaper, but make sure it works for you

The Apple Store in Palo Alto, California.

James Martin/CNETAppleCare Plus: When you want Apple to handle everything

When you buy an iPhone, AppleCare Plus will be heavily advertised as a protection option. You can sign up directly from your phone’s settings menu for 60 days after you purchase the device.

The benefits of going with AppleCare Plus come down to whether you’d prefer to work with Apple over your carrier should anything happen to your iPhone. If you live near an Apple retail store, you can use that location or a provider authorized by Apple for local assistance. Otherwise, you’ll work with Apple’s customer support team to arrange mail-away repairs.

AppleCare Plus plans come in two varieties: A base plan that covers device repairs, and a slightly more expensive one that covers theft along with loss. The actual cost of your plan varies based on the type of iPhone you own and whether you decide to buy a two-year plan or go monthly.

Under the current AppleCare Plus with Theft and Loss plans, a monthly plan for an iPhone 14 Pro or an iPhone 14 Pro Max costs $13.49 per month, or $269 over two years. For an iPhone 14 Plus, you’ll pay $12.49 a month or $249 for two years. The base iPhone 14, iPhone 13, iPhone 13 Mini and iPhone 12 are $11.49 per month, or $219 for two years. And the cheapest is the iPhone SE at $7.49 per month and $149 for two years.

If you don’t need Theft and Loss coverage and are only interested in phone repairs, AppleCare Plus prices are slightly cheaper. The iPhone 14 Pro and Pro Max plans are $10 per month or $199 for two years. The iPhone 14 Plus is $9 per month or $179 for two years. The base iPhone 14, 13, 12 and 13 Mini are $8 per month or $149 for two years. And the iPhone SE comes in at $4 per month or $79 for two years.

Both types of AppleCare Plus plans cover unlimited repairs for accidental damage to the iPhone itself, the battery inside of the iPhone and the included USB-C to Lightning cable. You should note that a repair will still incur a service fee or deductible. These costs range from $29 for screen or back glass repairs to $99 for most other accidental damage incidents or $149 to replace a stolen device.

The plans also include customer support for iOS issues, including assistance using iOS, help connecting to Wi-Fi and questions about other Apple services like FaceTime.

AppleCare Plus is also included with the iPhone Upgrade Program, Apple’s monthly payment program that allows for yearly trade-ins toward the next year’s device. Under that program, you’ll either pay for your phone over the course of 24 months or make 12 payments to upgrade early. This begins at $39.50 per month for the iPhone 14 and costs as much as $74.91 per month for the iPhone 14 Pro Max with 1TB of storage.

The most obvious downside to relying on AppleCare Plus is that Apple’s plans focus solely on the phone itself, with limited access to supporting you through changes to your wireless service. If you would prefer to work with your wireless provider on all things pertaining to your device, carriers themselves also offer a series of insurance options that provide comparable coverage for repairs, theft and loss.

AppleCare Plus vs. AppleCare Plus with Theft and Loss

| AppleCare Plus monthly/2-year prices | AppleCare Plus with Theft and Loss monthly/2-year prices | |

|---|---|---|

| Apple iPhone 14 Pro/Pro Max | $10/$199 | $13.49/$269 |

| Apple iPhone 14 Plus | $9/$179 | $12.49/$249 |

| Apple iPhone 12/13/13 Mini/14 | $8/$149 | $11.49/$219 |

| Apple iPhone SE | $4/$79 | $7.49/$149 |

Phone insurance from your wireless provider

Verizon, T-Mobile and AT&T all offer phone insurance plans similar to AppleCare Plus — and sometimes will even process your repair through Apple. The wireless carriers also have multidevice insurance options, which allow you to bundle together coverage for other devices like a cellular-connected smartwatch or tablet.

Some carriers include additional benefits beyond just repair and replacement services. For instance, the program could include subscriptions to security software or a hardware upgrade option.

Verizon’s Mobile Protect plans will include unlimited screen repair after April 27.

Angela Lang/CNETVerizon Wireless protection plans are getting better in April

Verizon includes an extensive list of device insurance and phone protection plans, but its best offerings aren’t arriving until April 27. Starting at that date, the carrier will reduce or eliminate some of the service fees associated with device repair and add data recovery services (more on that below). Existing plans and prices will remain the same.

The sheer number of paths you can take for device protection at Verizon will vary. The most basic is the Wireless Phone Protection plan, which covers lost, stolen or damaged devices. The step-up Total Equipment Coverage plan includes extended warranty coverage. And the most expensive insurance packages are Verizon’s Mobile Protect plans, which can be purchased for a single device or in a multidevice bundle for three to 10 devices.

The Mobile Protect plans include the carrier’s Mobile Secure apps for services like identity theft monitoring and blocking robocalls. Also included is access to Verizon’s Tech Coach support team, meant for help with device setup, optimization and ongoing support.

The monthly rates are roughly the same across most recent iPhone models, starting at $7.25 per month for Wireless Phone Protection. This goes up to $11.40 per month for the Total Equipment Coverage plan, $17 per month for Verizon Mobile Protect Single Device and $50 per month for Verizon Mobile Protect Multi-Device. For the latter, each additional line after the first three devices will cost another $11.40.

Deductibles however vary between models, with the iPhone SE costing $129 per incident and the iPhone 14 Pro Max reaching $249 per incident. Both deductibles are substantially cheaper than buying a new phone, but they are still fairly expensive. Starting April 27, Verizon’s Mobile Protect plan is reducing deductibles to $99 and removing the screen repair deductible. The cheaper Wireless Phone Protection plan will continue to offer higher deductible prices for loss and theft after April 27. But that plan will also offer the $99 deductible for damage, along with including cracked screen repair for no additional cost.

If you have a particular habit of breaking your screen regularly, Verizon’s plans could be appealing after April 27 when that service is essentially made free. The multidevice plans are also notable since they include coverage for smartwatches and tablets in addition to phones. However, if your primary concern is device recovery after accidental damage beyond a cracked screen or a theft, the AppleCare Plus plans appear to be cheaper on both the monthly fee price and the deductible price.

AppleCare Plus vs. AppleCare Plus with Theft and Loss vs. Verizon Mobile protect single device (iPhone 14 prices)

| Monthly/2-year cost | Screen repair cost | Accidental damage repair deductible | Replacement deductible for theft and loss | |

|---|---|---|---|---|

| AppleCare Plus | $8/$149 | $29 | $99 | $149 |

| AppleCare Plus with Theft and Loss | $11.49/$219 | $29 | $99 | $149 |

| Verizon Mobile Protect (Single Line) | $17/$408 | $29 ($0 after April 27) | $229 ($99 after April 27) | $229 |

AT&T Protect Advantage plans

AT&T offers device insurance through its Protect Advantage plans, which include perks alongside device repairs and replacements. The carrier offers Protect Advantage as either a single-device plan or a multiple-device plan, with the former pricing at $14 or $17 per month depending on your device. The multiple-device plan supports up to four phones, tablets, smartwatches or connected laptops at $45 per month.

For each eligible device, the carrier will do repairs or replacements relating to the device itself, the battery, the charger and the SIM card. Services include next-day delivery and setup for replacement devices, unlimited screen repairs at $29 per occurrence, unlimited battery replacement and unlimited out-of-warranty malfunction claims. Battery replacements do not have an additional cost. Each approved repair claim will come with a service fee or replacement deductible, ranging from $25 to $275 depending on the device and if a replacement is necessary.

AT&T’s plans also include services that are being offered by Asurion Tech Repair and Solutions and uBreakiFix stores, promising that subscribers can use in-store services like device cleaning, data recovery and performance optimization. In-person support for data recovery and performance could be useful for those who don’t consider themselves tech-savvy, but I put less stock into the device sanitizing service. You can easily do that yourself with cleaning wipes or a microfiber cloth.

The Protect Advantage plans also include unlimited photo and video storage, which could be an alternative to subscribing to a different cloud service (though your photos would be stored with AT&T).

From left to right: iPhone 14 Pro Max, iPhone 14 Pro, iPhone 14 Plus and iPhone 14.

Celso Bulgatti/CNETNew York state residents get the option to purchase AT&T’s Protect Advantage services individually. For instance, a subscriber in that state could choose between device insurance starting at $2.25 per month, an extended service contract starting at $6 per month or the in-store ProTech services starting at $6 per month. This could be particularly useful for a New York-based subscriber who does not expect to ever handle these replacements by visiting a physical store, since you can choose to opt out of that ProTech cost.

Another wrinkle to AT&T’s Protect Advantage plans is that they work similarly to signing up for health insurance: You can enroll either within 30 days of activating a new device or during an open enrollment period — one’s currently running until March 15. After March 15, you’ll have to wait until the next open enrollment to register. An AT&T rep said the enrollment periods take place sporadically, with no set schedule.

Like Verizon’s Mobile Protect Plans, AT&T’s options could be useful for people who want their device insurance to encompass a wide variety of devices under the same plan. However, some of the perks offered might not be of immediate use or interest, which is worth considering if deciding between AT&T’s offering or an AppleCare Plus plan.

AppleCare Plus vs. AppleCare Plus with Theft and Loss vs. AT&T Protect Advantage single device (iPhone 14 prices)

| Monthly/2-year cost | Screen repair cost | Accidental damage repair deductible | Replacement deductible for theft and loss | |

|---|---|---|---|---|

| AppleCare Plus | $8/$149 | $29 | $99 | $149 |

| AppleCare Plus with Theft and Loss | $11.49/$219 | $29 | $99 | $149 |

| AT&T Protect Advantage (Single Line) | $17/$408 | $29 | $0 when repairing battery, $275 when replacing device | $275 |

T-Mobile Protection 360 and Basic Device Protection

T-Mobile offers two phone insurance plans that cover the device itself. The Basic Device Protection plan is exclusively focused on repairing a damaged phone or replacing it in the event of theft, while the Protection 360 plan throws in early device upgrades along with some security software. That latter Protection 360 plan even includes AppleCare Plus for two years, which might be an option if you like the idea of getting support from both your carrier and Apple.

The Basic Device Protection plan is available across the US except in New York state and provides coverage in the event of hardware failure, accidental damage and theft. However, the plan’s terms do not cover cosmetic damage like scratches and dents or damage caused by «normal wear and tear.» This is notable, as screen repair isn’t listed as a guaranteed benefit for this plan.

T-Mobile’s Protection 360 wraps together T-Mobile’s Jump program — where you can trade in an enrolled device for a new one after either 12 months of device payments or paying half of a device’s cost — alongside repair services provided by AppleCare Plus for two years. If AppleCare isn’t part of the repair, Protection 360 will provide device repairs handled through Assurant or replacements by T-Mobile.

Deductibles under Protection 360 are similar to Verizon and AT&T’s offerings. When calculated using an iPhone 14 Pro Max, there’s no charge for hardware service repairs such as defects or a battery holding less than 80% of its charge capacity. But there is a $5 processing fee if you exchange a device through T-Mobile. Most accidental and damage incidents will have a $99 deductible, while screen repair incidents will have a $29 deductible. A replacement will cost $249.

Basic Device Protection costs $14 per month when calculated on the iPhone 14 and iPhone 14 Pro Max. Like with AT&T, customers in New York have the option to purchase the individual benefits offered within Protection 360, which include the option to get device insurance only at a similar price.

Protection 360’s monthly pricing is between $7 and $25 per month, depending on your device. These prices can be found when buying a device on T-Mobile’s website and is $18 per month for the iPhone 14.

AppleCare Plus vs. AppleCare Plus with Theft and Loss vs. T-Mobile Protection 360 single device (iPhone 14 prices)

| Monthly/2-year cost | Screen repair cost | Accidental damage repair deductible | Replacement deductible for theft and loss | |

|---|---|---|---|---|

| AppleCare Plus | $8/$149 | $29 | $99 | $149 |

| AppleCare Plus with Theft and Loss | $11.49/$219 | $29 | $99 | $149 |

| T-Mobile Protection 360 | $18/$432 | $29 | $99 | $249 |

AppleCare Plus is cheaper, but make sure it works for you

In nearly every price comparison, AppleCare Plus is the cheaper device protection plan, primarily due to the lower monthly rates in comparison to the carriers. However, when it comes to deductible costs per incident, most of the carriers match AppleCare Plus prices. This includes the $99 deductible for accidental damage and $29 for screen repair. Device replacement deductibles, however, cost more at the carriers compared to AppleCare Plus, with Verizon’s $229 per incident coming closest to Apple’s $149.

If you already subscribe to Verizon and are prone to breaking your screen, the carrier’s $0 screen repair policy is an appealing bonus. But the $17 per month cost of Verizon’s plan is higher than the $13.49 per month cost of AppleCare Plus with Theft and Loss for an iPhone 14 Pro Max.

While Verizon and AT&T’s device insurance plans are bundled with services, it’s unclear whether those perks are actually useful. In particular, AT&T’s bundled performance optimization and device sanitization services can be easily duplicated with a couple of quick guides to decluttering your phone and cleaning wipes, respectively.

When it comes to the monthly cost, AppleCare Plus is generally cheaper than wireless carrier insurance. Deductible prices however are about the same.

Sarah Tew/CNETT-Mobile’s offering, however, does at least include AppleCare itself, which could be a compelling option for someone who is already looking to upgrade their phone more often.

And despite Apple and the carriers offering various insurance programs for the iPhone and other devices, you should also be aware of protection programs that are included with your iPhone purchase. Apple includes a one-year warranty that covers many repairs with every new iPhone as well as for refurbished devices sold by Apple.

Plus, if you buy your phone using a credit card with an extended warranty benefit, you could get an additional year of coverage by filing a claim with your credit card company. Some cards also provide for cell phone protection — usually up to $800 per claim — as long as you pay your wireless carrier bill using that credit card.

Yet for some people, having direct access to repairs and customer service from either Apple or a wireless carrier could provide some peace of mind. In all cases, make sure that you know how to use these benefits and that an Apple or carrier store is nearby should you need them.

Technologies

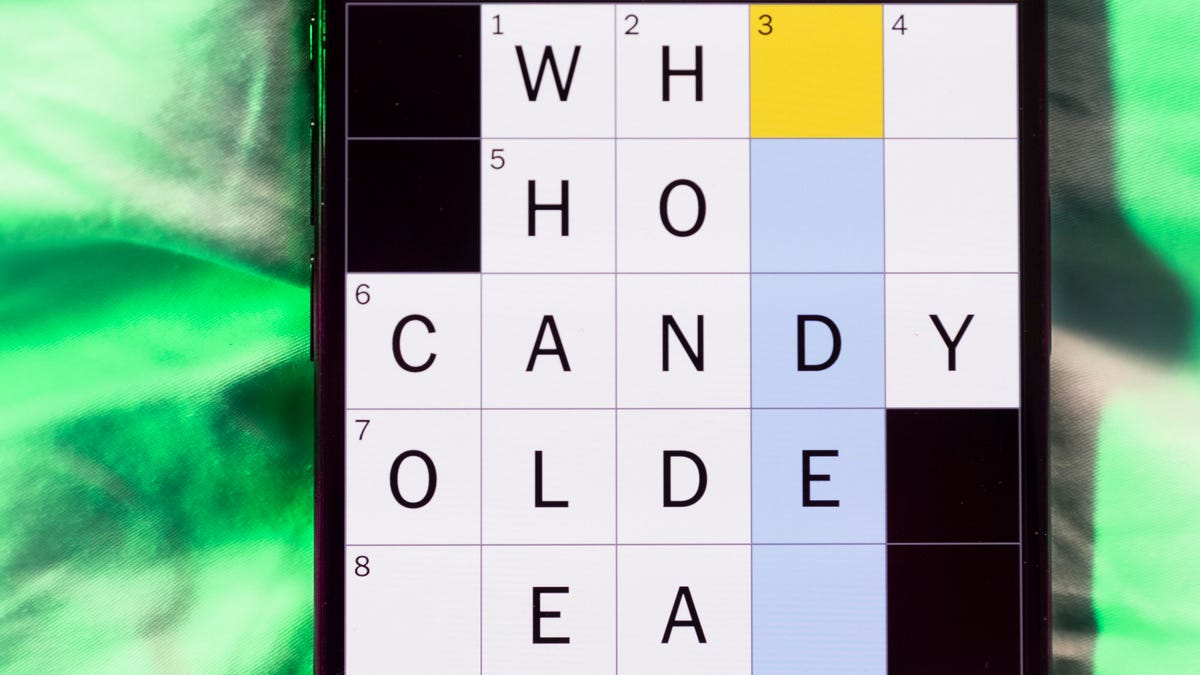

Today’s NYT Mini Crossword Answers for Saturday, Feb. 21

Here are the answers for The New York Times Mini Crossword for Feb. 21.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? It’s the long Saturday version, and some of the clues are stumpers. I was really thrown by 10-Across. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: «Jersey Shore» channel

Answer: MTV

4A clue: «___ Knows» (rhyming ad slogan)

Answer: LOWES

6A clue: Second-best-selling female musician of all time, behind Taylor Swift

Answer: MADONNA

8A clue: Whiskey grain

Answer: RYE

9A clue: Dreaded workday: Abbr.

Answer: MON

10A clue: Backfiring blunder, in modern lingo

Answer: SELFOWN

12A clue: Lengthy sheet for a complicated board game, perhaps

Answer: RULES

13A clue: Subtle «Yes»

Answer: NOD

Mini down clues and answers

1D clue: In which high schoolers might role-play as ambassadors

Answer: MODELUN

2D clue: This clue number

Answer: TWO

3D clue: Paid via app, perhaps

Answer: VENMOED

4D clue: Coat of paint

Answer: LAYER

5D clue: Falls in winter, say

Answer: SNOWS

6D clue: Married title

Answer: MRS

7D clue: ___ Arbor, Mich.

Answer: ANN

11D clue: Woman in Progressive ads

Answer: FLO

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 21, #516

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 21, No. 516.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition is a tough one. I actually thought the purple category, usually the most difficult, was the easiest of the four. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Old Line State.

Green group hint: Hoops legend.

Blue group hint: Robert Redford movie.

Purple group hint: Vroom-vroom.

Answers for today’s Connections: Sports Edition groups

Yellow group: Maryland teams.

Green group: Shaquille O’Neal nicknames.

Blue group: Associated with «The Natural.»

Purple group: Sports that have a driver.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is Maryland teams. The four answers are Midshipmen, Orioles, Ravens and Terrapins.

The green words in today’s Connections

The theme is Shaquille O’Neal nicknames. The four answers are Big Aristotle, Diesel, Shaq and Superman.

The blue words in today’s Connections

The theme is associated with «The Natural.» The four answers are baseball, Hobbs, Knights and Wonderboy.

The purple words in today’s Connections

The theme is sports that have a driver. The four answers are bobsled, F1, golf and water polo.

Technologies

Wisconsin Reverses Decision to Ban VPNs in Age-Verification Bill

The law would have required websites to block VPN users from accessing «harmful material.»

Following a wave of criticism, Wisconsin lawmakers have decided not to include a ban on VPN services in their age-verification law, making its way through the state legislature.

Wisconsin Senate Bill 130 (and its sister Assembly Bill 105), introduced in March 2025, aims to prohibit businesses from «publishing or distributing material harmful to minors» unless there is a reasonable «method to verify the age of individuals attempting to access the website.»

One provision would have required businesses to bar people from accessing their sites via «a virtual private network system or virtual private network provider.»

A VPN lets you access the internet via an encrypted connection, enabling you to bypass firewalls and unblock geographically restricted websites and streaming content. While using a VPN, your IP address and physical location are masked, and your internet service provider doesn’t know which websites you visit.

Wisconsin state Sen. Van Wanggaard moved to delete that provision in the legislation, thereby releasing VPNs from any liability. The state assembly agreed to remove the VPN ban, and the bill now awaits Wisconsin Governor Tony Evers’s signature.

Rindala Alajaji, associate director of state affairs at the digital freedom nonprofit Electronic Frontier Foundation, says Wisconsin’s U-turn is «great news.»

«This shows the power of public advocacy and pushback,» Alajaji says. «Politicians heard the VPN users who shared their worries and fears, and the experts who explained how the ban wouldn’t work.»

Earlier this week, the EFF had written an open letter arguing that the draft laws did not «meaningfully advance the goal of keeping young people safe online.» The EFF said that blocking VPNs would harm many groups that rely on that software for private and secure internet connections, including «businesses, universities, journalists and ordinary citizens,» and that «many law enforcement professionals, veterans and small business owners rely on VPNs to safely use the internet.»

More from CNET: Best VPN Service for 2026: VPNs Tested by Our Experts

VPNs can also help you get around age-verification laws — for instance, if you live in a state or country that requires age verification to access certain material, you can use a VPN to make it look like you live elsewhere, thereby gaining access to that material. As age-restriction laws increase around the US, VPN use has also increased. However, many people are using free VPNs, which are fertile ground for cybercriminals.

In its letter to Wisconsin lawmakers prior to the reversal, the EFF argued that it is «unworkable» to require websites to block VPN users from accessing adult content. The EFF said such sites cannot «reliably determine» where a VPN customer lives — it could be any US state or even other countries.

«As a result, covered websites would face an impossible choice: either block all VPN users everywhere, disrupting access for millions of people nationwide, or cease offering services in Wisconsin altogether,» the EFF wrote.

Wisconsin is not the only state to consider VPN bans to prevent access to adult material. Last year, Michigan introduced the Anticorruption of Public Morals Act, which would ban all use of VPNs. If passed, it would force ISPs to detect and block VPN usage and also ban the sale of VPNs in the state. Fines could reach $500,000.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow