Technologies

Trump’s ‘One Big Beautiful Bill’: The Huge Tax and Medicaid Implications You Need to Know

The GOP’s contentious budget bill narrowly passed in the House, faces dissent in the Senate and has drawn the ire of Elon Musk in a big way.

President Donald Trump has made the extension of the 2017 tax cuts one of his major second-term economic goals — you know, aside from all those tariffs — but as the so-called «One Big Beautiful Bill» has moved forward, it’s faced major pushback. Some of this opposition might lead to significant changes to the bill and how it might ultimately impact you, especially when it comes to taxes and services like Medicaid.

After much back-and-forth, negotiation and failed votes, the bill passed in the House of Representatives by the thinnest margin possible, 215-214-1. The bill is now moving through the Senate, where it is expected to face more alterations before getting across the finish line. While the GOP has been attempting to use the reconciliation process to avoid the bill being filibustered by Democrats, it is still expected to face intra-party dissent similar to what it went through in the House over its cuts either being too severe or not severe enough.

Elon Musk, the Tesla CEO and one-time Trump adviser who led the «DOGE» government consolidation efforts, spoke out against the bill in an unsparing fashion in a Tuesday post to X, decrying it as too heavy on spending. This disagreement with Trump and his agenda led to a prolonged public spat between the president and his one-time senior advisor.

«This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination,» Musk wrote. «Shame on those who voted for it: you know you did wrong. You know it.»

Despite the broad nature of the bill, one of its central goals remains the extension of the 2017 Trump tax cuts. Passed for the first time early in his first term, the Tax Cuts and Jobs Act, as it was officially known, was one of Trump’s signature legislative accomplishments and has generally become known as the «Trump tax cuts.» Given the nature of how that bill was passed initially, a lot of its provisions are set to expire next year if a new extension isn’t passed, so doing just that has unsurprisingly emerged as a major priority for Trump and the GOP-led houses of Congress.

The president and his allies have also tried to claim that his aggressive tariff agenda could help offset the extension of the tax cuts, although, as we’ve touched on before at CNET, that is just one of the often-contradictory stated goals for the tariffs.

Details about the budget bill Republicans have emerged in the past few weeks as it moved through the House Ways and Means Committee approval process. The Congressional Budget Office, an agency that provides estimates about the economic impacts of budgetary bills that is not affiliated with any party, estimated that the cuts called for in this bill would cost millions of people their health insurance and food benefits. The proposal initially failed to pass a vote in the House, leading to its cuts for Medicaid becoming even heavier.

All this comes in addition to the longstanding criticism from Democrats and other critics that Trump’s tax cuts disproportionately help the wealthiest Americans more than the working class. While there is truth to that argument, and to the Republican counter that the tax cuts would provide some help to taxpayers at all incomes, the new proposed cuts unveiled this week have given more weight to the notion that they will be more harmful for the least wealthy Americans.

For all the details about what extending the tax cuts will actually mean and what the current terms mean for things like Medicaid, keep reading. For more, find out if Trump could actually abolish the Department of Education.

How will the budget bill impact Medicaid?

According to the estimates from the Congressional Budget Office mentioned at the start of this piece, at least 7.6 million Americans would lose Medicaid health insurance under the provisions in the budget proposal. That’s nearly 11% of the 70 million Americans who are currently insured by Medicaid. The proposal would, among other things, require people without dependent children or a disability to meet an 80-hour-a-month work requirement to qualify for Medicaid and increase the frequency with which people will need to confirm their continued eligibility.

These new requirements were originally set to take effect in 2029 under the bill’s failed House version, but they were moved forward to 2026 in the bill’s passed version.

What would extending the Trump tax cuts mean?

While the phrase «Trump tax cuts» has become a common media shorthand for the Tax Cuts and Jobs Act, the current conversation around it might suggest that new cuts could be on the way. Although Trump has floated ideas for additional cuts, it’s important to note that extending the 2017 provisions would, for the most part, keep tax rates and programs at the levels they’ve been at since then.

So while it may be a better option than having the provisions expire — which would increase certain tax rates and decrease certain credits — extending the tax cuts most likely won’t change how you’ve been taxed the past eight years. However, some estimates have predicted that extending the cuts would boost income in 2026, with the conservative-leaning Tax Foundation in particular predicting a 2.9% rise on average, based on a combination of other economic predictions combined with tax rates staying where they are.

What would change if the Trump tax cuts expire?

Republicans contend that the tax cuts helped a wide swath of Americans, and the Tax Foundation predicted that 60% of tax filers would see higher rates in 2026 without an extension.

A big part of that has to do with tax bracket changes. The 2017 provisions lowered the income tax rates across the seven brackets, aside from the first (10%) and the sixth (35%). If the current law expires, those rates would go up by between 1% and 3%.

Income limits for each bracket would also revert to pre-2017 levels. Lending credence to the Democrats’ counterarguments, these shifts under the Trump tax cuts appeared to be more beneficial to individuals and couples at higher income levels than to those making closer to the average US income.

If you’re interested in the nitty-gritty numbers, you can check out the Tax Foundation’s full breakdown. Another point in Democrats’ favor? The Tax Cuts and Jobs Act also cut corporate tax rates from 35% to 21%, and unlike many of its other provisions, this one was permanent and won’t expire in 2026.

What would happen to the standard deduction?

This is another area in which a lot of people would be hit hard. The standard deduction lets taxpayers lower their taxable income, as long as they forgo itemizing any deductions.

For the 2025 tax year, the standard deduction is $15,000 for individual filers and $30,000 for joint filers. If the tax cuts expire, these numbers will drop by nearly half, down to $8,350 for individuals and $16,700 for joint filers.

Under the current reconciliation bill, the deduction would increase to $16,000 for individuals and $32,000 for joint filers, but only through 2028.

What would happen to the child tax credit?

The child tax credit is one of the most popular credits. Its current levels — $2,000 per qualifying child, which phases out starting at a gross income of $200,000 for single filers and $400,000 for joint filers — were actually set by the Tax Cuts and Jobs Act.

If an extension or new bill isn’t passed, next year the child tax credit would revert to its old levels: $1,000 per child, which starts phasing out at $75,000 for single filers and $110,000 for joint filers.

If the current budget bill is implemented, the credit will be upped to $2,500 per child through 2028, before dropping to $2,000 as its new permanent rate.

Do the Trump tax cuts really favor the wealthy?

Higher-income individuals and couples fared notably better with the changes the Trump tax cuts made to tax brackets. An estimate from the Institute on Taxation and Economic Policy, a left-leaning think tank, found that the poorest 20% of Americans would see only about 1% of the bill’s net tax cuts. Numerous similar estimates agree that these small benefits for the poorest taxpayers would be outweighed by rising costs caused by tariffs.

Conversely, ITEP’s estimate found that the richest 20% of US taxpayers would benefit from around 67% of the bill’s net tax cuts, with the richest 5% benefitting from half of them.

How much would extending the tax cuts cost?

Both the Congressional Budget Office and the Tax Foundation have estimated that the reconciliation bill’s tax cut extension would raise the US deficit by $4.5 trillion over the course of 10 years. The Tax Foundation also estimated that it could raise the country’s GDP to offset that number, but only by about $710 billion, or about 16% of the deficit increase.

For more, see how Trump’s tariffs might be affecting the prices of several key products in our daily tracker.

Technologies

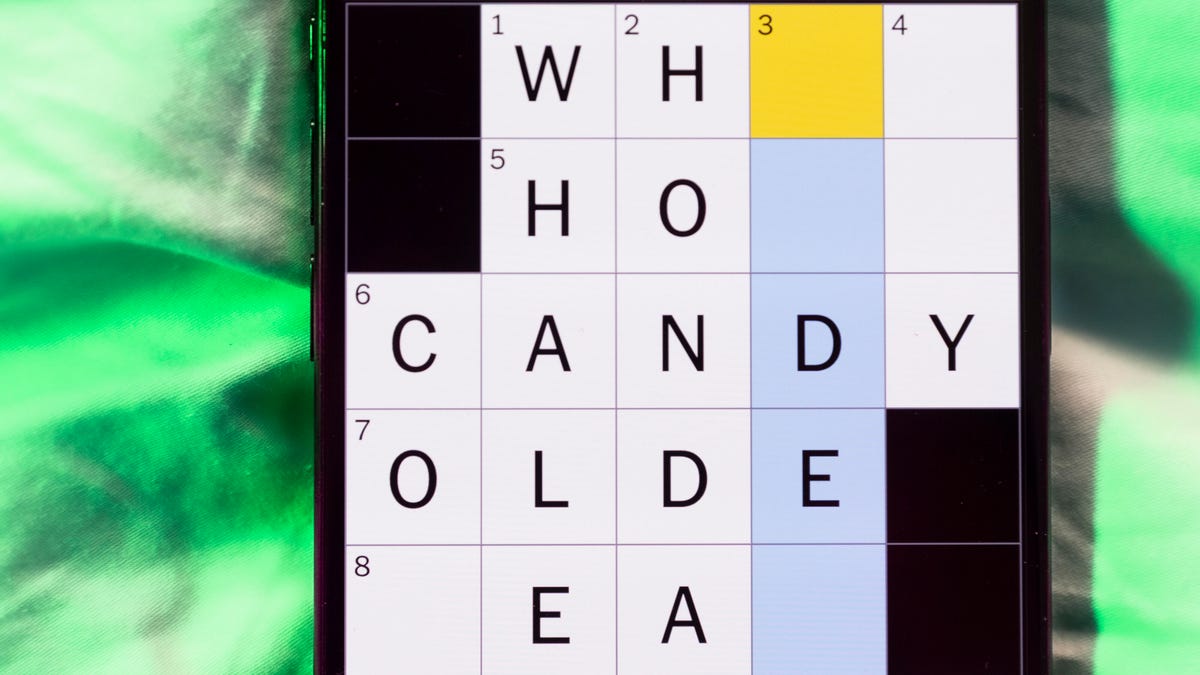

Today’s NYT Mini Crossword Answers for Wednesday, Jan. 28

Here are the answers for The New York Times Mini Crossword for Jan. 28.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Remove from a position of power

Answer: OUST

5A clue: Not cool

Answer: UNHIP

7A clue: «Fine, see if ___!»

Answer: ICARE

8A clue: Kind of bored

Answer: JADED

9A clue: Primatologist’s subjects

Answer: APES

Mini down clues and answers

1D clue: Kind of board

Answer: OUIJA

2D clue: Prepare to use, as a pen

Answer: UNCAP

3D clue: Desirable place to sit on a hot day

Answer: SHADE

4D clue: Pair on a bicycle

Answer: TIRES

6D clue: ___ Xing (street sign)

Answer: PED

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Jan. 28, #492

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Jan. 28, No. 492.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition is a tough one. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Stats about an athlete.

Green group hint: Where to watch games.

Blue group hint: There used to be a ballpark.

Purple group hint: Names are hidden in these words.

Answers for today’s Connections: Sports Edition groups

Yellow group: Player bio information.

Green group: Sports streamers.

Blue group: Former MLB ballparks.

Purple group: Ends in a Hall of Fame QB.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is player bio information. The four answers are alma mater, height, number and position.

The green words in today’s Connections

The theme is sports streamers. The four answers are Netflix, Paramount, Peacock and Prime.

The blue words in today’s Connections

The theme is former MLB ballparks. The four answers are Ebbets, Kingdome, Three Rivers and Tiger.

The purple words in today’s Connections

The theme is ends in a Hall of Fame QB. The four answers are forewarner, Harbaugh, honeymoon and outmanning.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Technologies

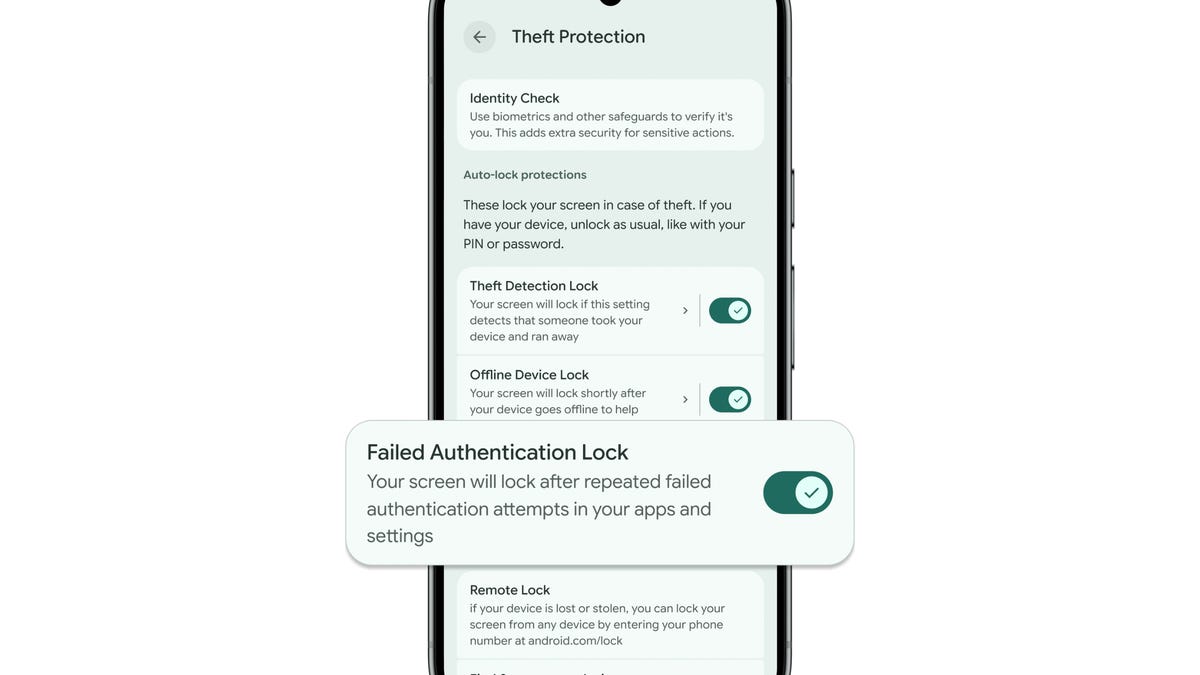

Google Rolls Out Expanded Theft Protection Features for Android Devices

The latest Android security update makes it harder for thieves to break into stolen phones, with stronger biometric requirements and smarter lockouts.

Google on Tuesday announced a significant update to its Android theft-protection arsenal, introducing new tools and settings aimed at making stolen smartphones harder for criminals to access and exploit. The updates, detailed on Google’s official security blog, build on Android’s existing protections and add both stronger defenses and more flexible user controls.

Smartphones carry your most sensitive data, from banking apps to personal photos, and losing your device to theft can quickly escalate into identity and financial fraud. To counter that threat, Google is layering multiple protective features that work before, during and after a theft.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

At the center of the update is a revamped Failed Authentication Lock. Previously introduced in Android 15, this feature now gets its own toggle in Android 16 settings, letting you decide whether your phone should automatically lock itself after repeated incorrect PIN or biometric attempts. This gives you more control over how aggressively your phone defends against brute-force guessing without weakening security.

Google is also beefing up biometric security across the platform. A feature called Identity Check, originally rolled out in earlier Android versions, has been broadened to apply to all apps and services that use Android’s Biometric Prompt — the pop-up that asks for your fingerprint or face to confirm it’s really you — including third-party banking apps and password managers. This means that even if a thief somehow bypasses your lock screen, they’ll face an additional biometric barrier before accessing sensitive apps.

On the recovery side, Google improved Remote Lock, a tool that allows you to lock a lost or stolen device from a web browser by entering a verified phone number. The company added an optional security challenge to ensure only the legitimate owner can initiate a remote lock, an important safeguard against misuse.

And finally, in a notable regional rollout, Google said it is now enabling both Theft Detection Lock and Remote Lock by default on new Android device activations in Brazil, a market where phone theft rates are comparatively high. Theft Detection Lock uses on-device AI to detect sudden movements consistent with a snatch-and-run theft, automatically locking the screen to block immediate access to data.

With stolen phones often used to access bank accounts and personal data, Google says these updates are meant to keep a single theft from turning into a much bigger problem.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow