Technologies

Extending the 2017 Trump Tax Cuts? Here’s Who Might and Might Not Benefit

Republicans in both chambers of Congress have passed plans to extend the 2017 Trump tax cuts, which continue to face fierce criticism for favoring the wealthy.

It’s not just the tariffs. President Donald Trump’s economic plans also call for an extension of his 2017 tax overhaul before it expires. These changes — commonly known as the «Trump tax cuts» — lowered tax rates and increased the value of certain tax incentives but also have been a political lightning rod over the years because of their benefits for corporations and the wealthy. It’s the sort of heated discourse that can leave the basic facts of the bill a bit murky.

That 2017 tax plan, officially known as the Tax Cuts and Jobs Act, was one of the signature legislative accomplishments of Trump’s first term, and passing an extension has been a priority for the president since he entered his second term. While extending the cuts carries a big estimated price tag, Trump administration officials have suggested that newly imposed tariffs could raise enough money to cover the cost of extending the tax cuts, an important consideration in the budget reconciliation process. But the clock is ticking: Many of its provisions are set to expire by the end of 2025 without action from Congress.

TAX SOFTWARE DEALS OF THE WEEK

-

$0 (save $0)

-

$56 (save $24)

-

$83 (save $32)

That action is getting underway. As of April 10, the House and Senate have passed separate versions of a plan that would extend Trump’s tax cuts and slash more government spending to pay for them. The situation remains contentious, as shown by the slim margins by which the bills passed: 216-212 in the House, and 51-48 in the Senate. With two bills passed, they will now be merged in a process known as «reconciliation,» which can help Republicans bypass the 60-vote limit usually needed to overcome a filibuster. While the GOP has characterized extending the tax cuts as a bid for stability that will benefit everyone, Democrats have long countered that the benefits of the Tax Cuts and Jobs Act are overly weighted toward the wealthiest taxpayers.

For all the details about why there might be some truth to both statements, keep reading, and stick around to the end to find out how much it might cost. For more, find out if Trump could actually abolish the Department of Education.

What would extending the Trump tax cuts mean?

While the phrase «Trump tax cuts» has become a common media shorthand for the Tax Cuts and Jobs Act, the current conversation around it might suggest that new cuts could be on the way. Although Trump has floated ideas for additional cuts, it’s important to note that extending the 2017 provisions would for the most part keep tax rates and programs at the levels they’ve been at since then.

So while it may be a better option than having the provisions expire — which would increase certain tax rates and decrease certain credits — extending the tax cuts most likely won’t change how you’ve been taxed the past eight years. However, some estimates have predicted that extending the cuts would boost income in 2026, with the conservative-leaning Tax Foundation in particular predicting a 2.9% rise on average, based on a combination of other economic predictions combined with tax rates staying where they are.

What would change if the Trump tax cuts expire?

Republicans contend that the tax cuts helped a wide swath of Americans, and the Tax Foundation predicted that 60% of tax filers would see higher rates in 2026 without an extension.

A big part of that has to do with tax bracket changes. The 2017 provisions lowered the income tax rates across the seven brackets, aside from the first (10%) and the sixth (35%). If the current law expires, those rates would go up 1% to 3%.

Income limits for each bracket would also revert to pre-2017 levels. Lending credence to the Democrats’ counterarguments, these shifts under the Trump tax cuts appeared to be more beneficial to individuals and couples at higher income levels than to those making closer to the average US income.

If you’re interested in the nitty-gritty numbers, you can check out the Tax Foundation’s full breakdown. Another point in Democrats’ favor? The Tax Cuts and Jobs Act also cut corporate tax rates from 35% to 21%, and unlike many of its other provisions, this one was permanent and won’t expire in 2026.

The cuts also capped the total amount that taxpayers can deduct based on «state and local property, income, and sales tax,» otherwise known as SALT, at $10,000. There was previously no limit, and as Lisa Greene-Lewis, a tax prep expert and analyst for TurboTax, told CNET in an email correspondence, this is a policy that could be detrimental to certain taxpayers if the TCJA is extended.

«Filers living in states with high state and property taxes are capped at a $10,000 deduction for total state and local property, income and sales tax — even when many of them may pay way beyond that amount,» Greene-Lewis explained. «If this part of the provision went back to the way it was prior to the Tax Cuts and Jobs Act (TCJA) without caps, filers in states with high state and property taxes would be able to deduct the full amounts paid.»

Greene-Lewis also noted that there is talk about removing the SALT cap from the plan to extend the TCJA.

What would happen to the standard deduction?

This is another area in which a lot of people would be hit hard. The standard deduction lets taxpayers lower their taxable income, as long as they forgo itemizing any deductions.

For the 2025 tax year, the standard deduction is $15,000 for individual filers, and $30,000 for joint filers. If the tax cuts expire, these numbers will drop by nearly half, down to $8,350 for individuals and $16,700 for joint filers.

What would happen to the child tax credit?

The child tax credit is one of the most popular credits out there. Its current levels — $2,000 per qualifying child, which phases out starting at a gross income of $200,000 for single filers and $400,000 for joint filers — were actually set by the Tax Cuts and Jobs Act.

If an extension or new bill isn’t passed, next year the child tax credit would revert to its old levels: $1,000 per child, which starts phasing out at $75,000 for single filers and $110,000 for joint filers.

Do the Trump tax cuts really favor the wealthy?

As mentioned above, higher-income individuals and couples made out notably better with the changes the Trump tax cuts made to tax brackets. Overall, numerous estimates have predicted that the wealthiest Americans would experience a greater proportion of the benefits, with the Urban-Brookings Tax Policy Center specifically estimating that households making more than $450,000 a year would reap around 45% of the tax cut benefits.

How much would extending the tax cuts cost?

Tax cuts more favorable to the wealthy are a big part of why some analysts say extension of the Trump tax cuts would add trillions of dollars to the national debt. An early estimate from the Tax Policy Center in 2018 found that extending the provisions through 2038 would add $3.8 trillion to the US deficit. A 2024 estimate from the Committee for a Responsible Federal Budget predicted that it would add $3.9 trillion to $4.7 trillion to the deficit through 2035, depending on which provisions were included.

The blueprint passed by the House last week included about $4.5 trillion in tax cuts, to be supported by $1.5 trillion in further government spending cuts. The rest would either go to the deficit or have to be made up for with additional cuts, adding fuel to the concerns that Republicans intend to substantially cut funding for Medicare, Medicaid and Social Security to pay for their tax plans.

For more, find out if IRS layoffs will hurt your tax return.

Technologies

Today’s NYT Strands Hints, Answers and Help for Jan. 24 #692

Here are hints and answers for the NYT Strands puzzle for Jan. 24, No. 692.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle is one of those where the answers only make sense in pairs. There are six answers to find, and each of them matches up with one of the other answers. Some of them are difficult to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: A work of art.

If that doesn’t help you, here’s a clue: On museum walls.

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- FINS, FINE, FINES, GARB, BOAT, GATES, GATES, FIST, RATE, RATS, STAR, PAINT, SILL, SPAT

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- STARRY, NIGHT, WATER, LILIES, BOATING, PARTY

Today’s Strands spangram

Today’s Strands spangram is FAMOUSPAINTING. To find it, start with the F that’s four letters down on the far-left vertical row, and wind up, across, and then down.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Toughest Strands puzzles

Here are some of the Strands topics I’ve found to be the toughest.

#1: Dated slang. Maybe you didn’t even use this lingo when it was cool. Toughest word: PHAT.

#2: Thar she blows! I guess marine biologists might ace this one. Toughest word: BALEEN or RIGHT.

#3: Off the hook. Again, it helps to know a lot about sea creatures. Sorry, Charlie. Toughest word: BIGEYE or SKIPJACK.

Technologies

San Diego Comic-Con Draws a Line: No AI Art Allowed at 2026 Event

The long-running fan convention is banning AI-created works from its popular art show.

Like Sarah Connor in The Terminator, San Diego Comic-Con is fighting back against AI. The prestigious, long-running pop culture convention has banned all artwork created by artificial intelligence from the 2026 Comic-Con art show. Rules posted on the Comic-Con website now state that AI-generated art won’t be shown in any form.

«Material created by Artificial Intelligence (AI) either partially or wholly, is not allowed in the art show. If there are questions, the Art Show Coordinator will be the sole judge of acceptability,» the website reads.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

A representative for San Diego Comic-Con did not immediately respond to a request for comment.

In the past, the convention allowed participants to display AI artwork, provided it was clearly marked as such and wasn’t sold. But now, those artists can’t even bring it through the door. The rule change is a response to artist-led pushback, according to a 404 Media report. San Diego Comic-Con is one of the world’s most famous pop culture conventions, uniting comics, movies, television, gaming, cosplay and collectibles.

Jim Zub, writer for the Conan the Barbarian and Dungeons and Dragons comic book series, told CNET he supports Comic-Con’s decision and hopes other conventions will follow their lead.

«Hundreds of thousands of people attend San Diego Comic-Con each year, and the excitement that generates isn’t because they’re eager to meet a computer spitting out homogenized slop,» Zub said.

Zub, who’s also an artist, is scheduled to appear at Comic-Con in 2026.

Entertaining AI

The use of generative AI in comic book and pop culture art has generated controversy in recent years as AI programs have become more skilled at imitating creators.

A central focus of the 2023 actor’s strike involved backlash against the use of AI in movies and television. The issue has continued to roil Hollywood, as actors, special effects designers, and other film workers see the technology as a threat, while some movie studios view AI as a way to reduce production costs.

Netflix has already begun using AI-generated imagery in at least one series, Argentine sci-fi show El Eternauta. CEO Ted Sarandos praised the technology during a 2025 earnings call.

«We remain convinced that AI represents an incredible opportunity to help creators make films and series better, not just cheaper,» Sarandos said at the time.

AI is also an issue in the video game industry, with publishers facing swift backlash whenever fans discover AI was used in a game. The Indie Game Awards rescinded two awards for the hit RPG, Clair Obscur: Expedition 33, after they found out that AI-made placeholder assets were included when the game launched. The game developer quickly patched the assets out.

While the movie and video game industries appear to have mixed views on using AI, Comic-Con has taken a firm stance, at least for now.

«Artists, writers, actors and other creatives gather and celebrate the popular arts in person because the people part of the equation is what matters most,» Zub said.

Technologies

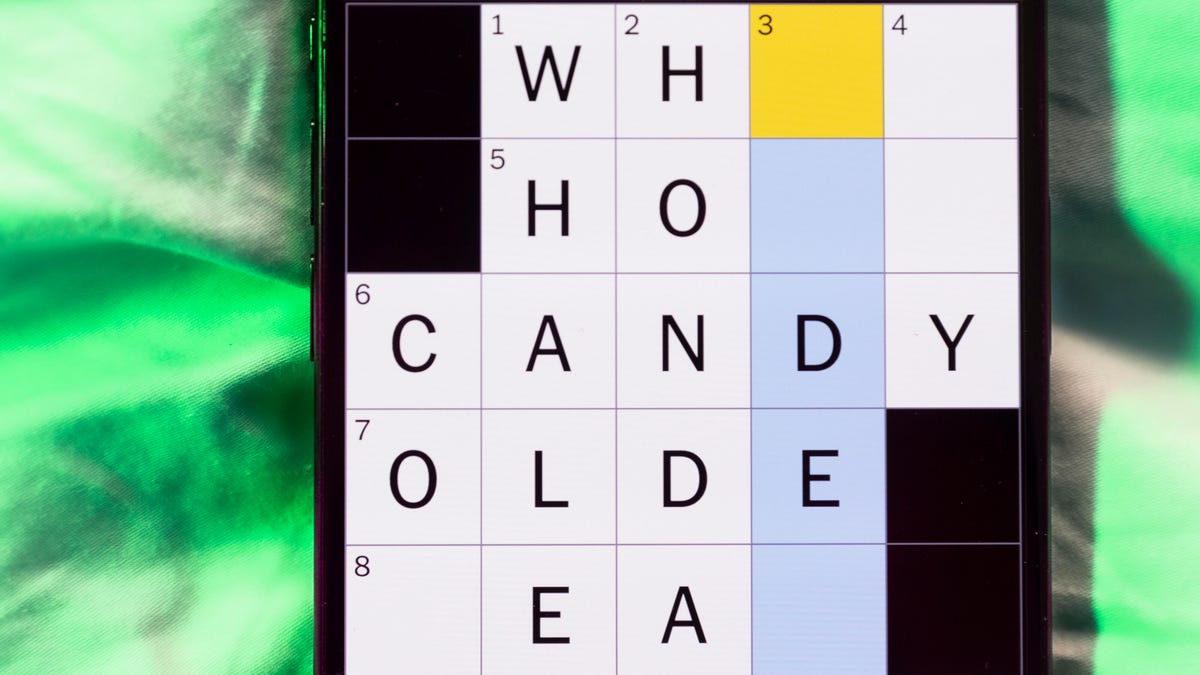

Today’s NYT Mini Crossword Answers for Saturday, Jan. 24

Here are the answers for The New York Times Mini Crossword for Jan. 24.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? It’s a long one, as per usual on Saturday. 1-Down made me awfully hungry! Read on. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Snow day vehicle

Answer: PLOW

5A clue: Steam room alternative

Answer: SAUNA

6A clue: Show on which Jon Hamm had his breakout role

Answer: MADMEN

7A clue: Subject of negotiations with a 3-year-old

Answer: BEDTIME

8A clue: Respected veteran, in slang

Answer: OLDHEAD

9A clue: Gain back, as trust

Answer: REEARN

10A clue: Spooky

Answer: EERIE

Mini down clues and answers

1D clue: Noodle dish garnished with lime wedges and crushed peanuts

Answer: PADTHAI

2D clue: Singing candlestick in «Beauty and the Beast»

Answer: LUMIERE

3D clue: ___ band

Answer: ONEMAN

4D clue: Decreased in size, as the moon

Answer: WANED

5D clue: More blue

Answer: SADDER

6D clue: Chaotic fight

Answer: MELEE

7D clue: Total snoozefest

Answer: BORE

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Technologies4 года agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow