Technologies

iOS 16 Cheat Sheet: Everything You Need to Know About the iPhone Update

From what’s included in iOS 16.4 to hidden features, here’s what to know about iOS 16.

This story is part of Focal Point iPhone 2023, CNET’s collection of news, tips and advice around Apple’s most popular product.

Apple released iOS 16 less than a week after its September «Far Out» event, when the company announced the next line of iPhones, Apple Watches — including the Apple Watch Ultra — and the AirPods Pro. We put together this cheat sheet to help you learn about iOS 16, what’s been included in each point update since then and how to use the new features on your iPhone.

iOS 16 updates

- iOS 16.4: The New Features to Land On Your iPhone

- iOS 16.3.1: What the Update Brings to Your iPhone

- iOS 16.3: New iPhone Features You Have to Try

- What iOS 16.2 Brings to Your Phone

- Everything Apple Added in iOS 16.1

- iOS 16.0.3 Update Brings Security, Bug Fixes

- iOS 16.0.2 Update Released, Fixes Camera Shake and More

- iOS 16.1 Beta 2 Brought These Features to iPhones

Getting started with iOS 16

- 4 Things to Know About iOS 16

- Will iOS 16 Run on Your iPhone?

- What to Do Before Downloading iOS 16

- How to Download iOS 16 Now

Using iOS 16

- Now That You’ve Installed iOS 16, Do These 3 Things First

- Everything New on Your iPhone with iOS 16

- 7 Hidden iOS 16 Features You Need to Know About

- How to Fix Annoying Features in iOS 16

- You Can Unsend and Edit Messages in iOS 16

- Hidden iOS 16 Feature Will Change How You Use Your iPhone Keyboard

- Get Rid of the Search Button in iOS 16

- Set Up iOS 16’s New Customizable Lock Screen

- iOS 16 Lock Screen: Which Widgets Should You Add?

- iOS 16’s Photo Editing Tools Work Like Magic

- View Saved Wi-Fi Passwords in iOS 16

- Get the Battery Status Bar Back in iOS 16

- 2 Major Updates iOS 16 Brings to Maps

- Apple Pay Later: How the iOS 16 Feature Works

- iOS 16’s Lockdown Mode Can Protect You From Cyberattacks

- Passkeys Arrive in iOS 16

- Why You Might Be Missing Some iOS 16 Features

Other things to know about iOS 16

- All the New Emoji Added With iOS 16.4

- iOS 16 Features We’re Still Waiting For

- Why You Might Be Getting a ‘Cannot Verify AirPods’ Alert

- You Can Use Your Switch Joy-Cons on iOS 16

- New iOS Login Tech Makes It Hard to Hack Your iCloud Account

- How to Become an Apple Beta Tester

Check back periodically for more iOS 16 tips and how to use new iOS 16 features as Apple releases more updates.

Technologies

Google Gives Chrome an AI Side Panel and Lets Gemini Browse for You

The update also includes Nano Banana image tools and deeper integrations with Google apps like Gmail, Calendar, Maps and Flights.

Google is turning Chrome into something closer to a digital copilot.

In the next wave of Gemini updates rolling out, Google on Wednesday revealed a set of new AI-powered features coming directly to its browser, aimed at reducing the frustrations of exploring the internet each day. Built on Gemini 3, the updates introduce an always-available side panel, deeper app integrations, creative image tools and a new browser agent called auto browse that can complete multistep tasks on your behalf.

Essentially, Google wants Chrome to be like an AI wingman that browses, compares and multitasks for you.

Read more: More AI Is Coming to Google Search, Including a Chatbot-Like Interface

Now you can automate browsing

To me, the standout new addition is auto browse, a browser agent designed to handle tedious and time-consuming chores. Instead of hopping between tabs, filling out forms or manually comparing prices of things like products or flights, you can ask Chrome to do the legwork.

Auto browse can research flights and hotels across different dates, collect documents, schedule appointments, manage subscriptions and help with tasks like renewing a driver’s license or filing expense reports.

In a live demo I saw, Product Lead Charmaine D’Silva used the new tools to plan a family vacation. Gemini compared destinations and prices across multiple travel sites, checked school calendars to see when her kids were off and lined up schedules to find workable travel windows. When it came time to book, though, D’Silva emphasized that the final decision and purchase were still hers, underscoring Google’s plan to keep humans in control for key tasks like booking and purchases.

The feature is rolling out to AI Pro and Ultra subscribers in the US now, signaling Google’s broader push toward more agentic AI experiences.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

A new side panel experience

Another update rolling out now is a redesigned Gemini side panel in Chrome, available across MacOS, Windows and Chromebook Plus. Instead of opening a separate tab, Gemini now lives alongside whatever you’re working on, making it easier to multitask without breaking your flow. Testers have used it to summarize reviews across sites, compare shopping options and juggle packed calendars while keeping their main task front and center.

AI image editing with Nano Banana

Chrome is also trying to become more creative. Google is bringing Nano Banana, its AI image editing and generation tool, directly into the browser. You can now edit and reimagine images you find on the web without downloading files or switching apps — whether that’s mocking up a living room redesign or turning raw data into an infographic at work.

Chrome connects with other Google apps

Under the hood, Gemini in Chrome is becoming more connected to the rest of Google’s ecosystem. Integrations with Gmail, Calendar, Maps, YouTube, Google Flights and Shopping will allow the assistant to pull in relevant context and take action across apps. Planning a trip, for example, could involve referencing an old email, checking flight options and drafting a follow-up email to your travel companions. Now all in one place.

More to come

Looking ahead, Google says personal intelligence is coming to Chrome in the coming months. With user opt-in, Gemini will remember context from past interactions to deliver more tailored, proactive help across the web, while giving you control over what data is connected and when.

Technologies

If You Drink Decaf, Read This: More Than 80,000 Keurig Pods Recalled

Here’s how to get a full refund if you bought these coffee pods.

If you’re a decaf K-Cup drinker, this message is for you. Keurig has recalled the McCafe Premium Roast Decaf Coffee K-Cup Pods because they may contain caffeine.

Here’s everything to know.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

What was recalled?

Keurig Dr Pepper voluntarily recalled 960 cartons of McCafe Premium Roast Decaf Coffee K-Cup Pods, according to a US Food and Drug Administration memo. The reason listed for the recall reads: «Product is labeled as decaf, but might contain caffeine.»

CNET chose McCafé Premium Roast as the best K-Cup, although the decaffeinated version was not included. It is unclear at this time how many states sold the cartons.

A representative for Keurig Dr Pepper did not immediately respond to a request for comment.

How to know if you have a recalled product

The recalled items will have the following information:

- Best by date: 17 NOV 2026

- Batch number: 5101564894

- Material number: 5000358463

- ASIN: B07GCNDL91

- UPC: 043000073438

The recall is ongoing. If you have a recalled product, you can return it to your place of purchase for a full refund.

Technologies

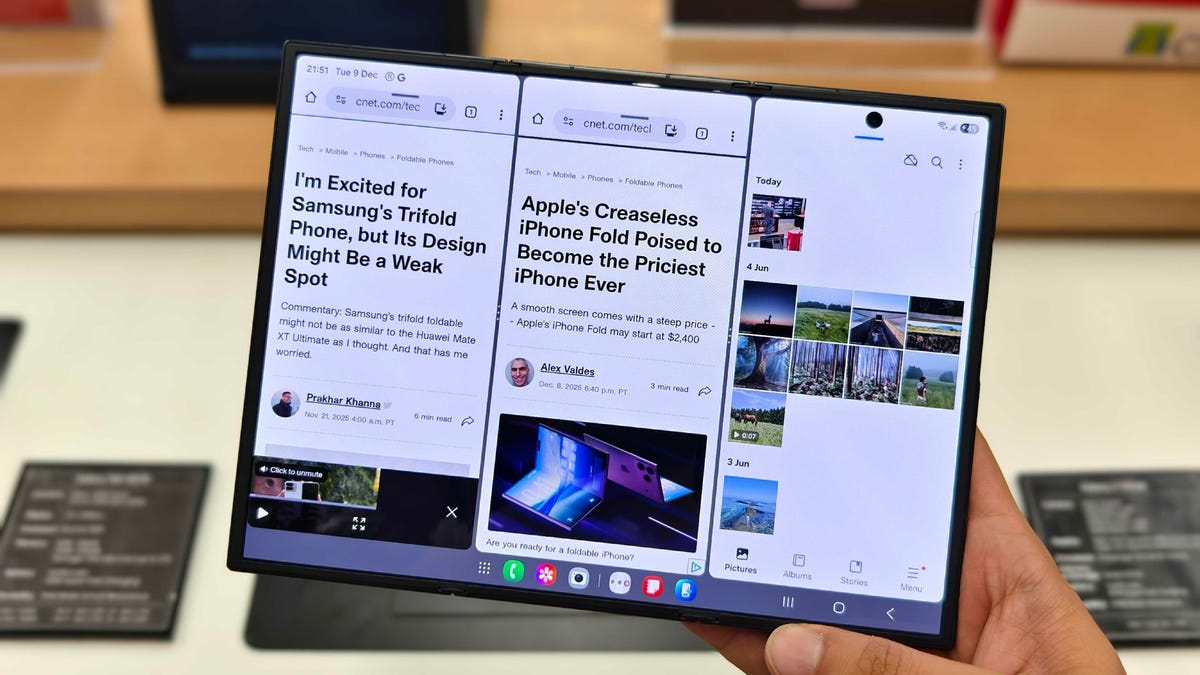

The Samsung Galaxy Z TriFold’s Nearly $3,000 Price Might Unfold Your Whole Wallet

This double-folding phone will be the most expensive mainstream handset released in the US.

Samsung’s twin-hinged Galaxy Z TriFold is nearly on sale, coming before the Galaxy S26 launch next month. Starting Jan. 30, foldable phone fans who want the most advanced device in the US can pick one up, but they’ll have to pay a hefty price: The device starts at a jaw-dropping $2,900.

Yes, for over three times the price of a Galaxy S25, you can pick up the most advanced smartphone — and certainly the most expensive — Samsung has ever rolled out. Even the Galaxy Z Fold 7, which starts at $2,000 with 256GB of storage, only reaches $2,420 at the highest 1TB storage configuration.

As products across all industries get costlier, phone-makers have priced foldables in an even more premium tier than the most innovative flat smartphones (like the iPhone 17 Pro Max and Galaxy S25 Ultra). It seems Samsung will use the twin-hinged Galaxy Z TriFold to set an even higher price ceiling for smartphones.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Anyone who buys the Galaxy Z TriFold will get one of the most technically impressive handsets released in the US. But is the technology worth the cost?

The Galaxy Z TriFold unfolds into a 10-inch inner display that rivals the screens of full-size tablets. It’s noticeably larger than the 8-inch inner screen on the single-hinged Galaxy Z Fold 7 foldable. Its two hinges, built of titanium, are tested to endure 200,000 folds, according to Samsung.

When unfolded, the Z TriFold is 3.9mm at its thinnest point. That’s slightly outdone by the slimmer Huawei Mate XT’s 3.6mm, which beat Samsung to market by an entire year with a trifold that’s not available in the US. That might be nearing the limit for phone thinness, as it’s barely enough to accommodate the USB-C port at the bottom of either device.

The Galaxy Z TriFold and Huawei Mate XT are roughly comparable in size and specs, though the Huawei phone’s EMUI operating system and the lack of familiar Google apps (due to the ban on US companies working with the Chinese phone-maker) mean Android fans may prefer Samsung’s. The Huawei foldable is also more expensive, starting at 3,499 euros (about $4,150 today), and may not be compatible with US carriers out of the box.

Read more: Galaxy Z TriFold vs. Huawei Mate XT: One Is the Most Versatile Phone I’ve Ever Used

The Galaxy Z TriFold has a customized Snapdragon 8 Elite chip, the same one that powers last year’s Galaxy S25 series. It won’t feature the latest Snapdragon 8 Elite Gen 5 silicon, which is likely to power this year’s most advanced Android handsets (potentially including the upcoming, but not yet announced, Samsung Galaxy S26 series).

The Galaxy Z TriFold will start at 512GB of storage and packs a 5,600-mAh battery, larger than the Z Fold 7’s 4,400-mAh capacity unit. It recharges at 45 watts, which is typical for Samsung phones, though other premium Android handsets have long ago surpassed that rate, like the OnePlus 15 with 80-watt charging. It has three rear cameras (a 200-megapixel main, a 12-megapixel ultrawide and a 10-megapixel telephoto) and comes in a single color, crafted black.

All told, the Galaxy Z Trifold offers only marginal upgrades over the Galaxy Z Fold 7, and its hardware will likely be surpassed soon when the Galaxy S26 series launches with newer chips.

At $1,000 to $2,000 above other Android phones and foldables, the Z TriFold seems to offer only a single advantage: its massive inner display. While undeniably a technical marvel, that’s not nearly enough added value for most people to justify the steep upsell on your standard smartphone, or even another book-style foldable. For folks who «crave» the most advanced phone on the market, though, maybe it’s worth the expense.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow