Technologies

Worse Than a Recession? Trump’s Tariffs Risk ‘Self-Inflicted’ Stagflation

Stagflation isn’t just a thing of the past. High inflation and economic stagnation could bring it back.

President Donald Trump’s turbulent tariff agenda, combined with mass deportations and increased national debt, has created heightened volatility in financial markets. Though many economists say there’s low risk of a job-loss recession, others say we’re at a critical crossroads, as consumer sentiment sours and the labor market sputters.

Some analysts have even posited that the economy could be circling the drain toward stagflation, a rare and toxic scenario of slowing growth and high inflation. In the 1970s, stagflation — a combination of inflation and stagnation — was a major economic crisis characterized by double-digit inflation, steep interest rates and soaring unemployment.

In a June study by Apollo Global Management, chief economist Torsten Sløk warned of ongoing stagflationary risks. «Tariff hikes are typically stagflationary shocks — they simultaneously increase the probability of an economic slowdown while putting upward pressure on prices,» Sløk wrote. «The current tariff regime increases the chance of a US recession to 25% over the next 12 months.»

Stagflation is considered to be an even worse economic prognosis than a typical downturn, as the government lacks effective policy prescriptions to control it. «There may not be an easy path to monetary or fiscal stabilization,» said James Galbraith, economics professor at the Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin.

US households, already struggling to afford the high cost of living, are preparing for what’s next. Whether we’re headed for a recession or a period of stagflation, taking steps to proactively safeguard your finances becomes all the more critical.

Are we still at risk of a recession?

Rampant economic uncertainty often triggers recessionary conditions as companies and households start to reduce spending and investment. During a recession, unemployment goes up, and the prices of goods begin to decline. It’s generally harder to obtain financing, as banks tighten their requirements to minimize their risk of lending to borrowers who may default on loans.

The economy regularly experiences periods of booms and busts, with downturns occurring roughly every five to seven years. «We are due for a reset and a slowdown in the economy,» said Greg Sher, managing director at NFM Lending.

Certain macroeconomic hallmarks, like shrinking GDP and rising joblessness, are consistent across all recessions. But every US recession is also unique, with a different historical trigger. The Great Recession of 2007-09, which kicked off with the subprime mortgage crisis and the collapse of financial institutions, was the longest. The COVID-19 pandemic recession, resulting from lockdowns and the loss of 24 million jobs, was the shortest recession on record.

Working-class and middle-class households experience the day-to-day hardship of a recession well before the National Bureau of Economic Research makes the official call. Folks on the margins also experience a much slower recovery after a recession is declared to be over.

Relying on hard data like GDP and employment to determine recessions is faulty. Because those figures are backward-looking, they tell us where the economy was before, not necessarily where it’s heading. Many economists note that unemployment is worse than what the headline figures report.

Here are some of the key warning signs of a recession:

|

Declining gross domestic product (GDP) |

A sustained drop (typically two consecutive quarters of negative growth) in the country’s total output of goods and services signals the economy is shrinking. |

|

Rising unemployment |

When businesses cut costs, hiring slows down and layoffs increase for a sustained period. Households receive less income and spend less. |

|

Declining retail sales |

When people buy fewer goods in stores and online, it shows weakening demand, a key driver of the economy. |

|

Stock market slumps |

A significant and lasting drop in stock prices often reflects investor worry about the economy’s future. |

|

Inverted yield curve |

When short-term bond interest rates become higher than long-term rates, it can signal that investors expect a weaker economy ahead. |

Could we be facing stagflation?

Stagflation would mean having less purchasing power as prices go up and saving becomes more difficult. Jobs become harder to find, investments might take hits and interest rates could rise. Stagflation is typically measured by the «misery index,» the sum of the unemployment rate and the inflation rate, reflecting the level of economic distress felt by the average person.

For decades, experts didn’t believe stagflation was possible because it goes against basic principles of supply and demand. Usually, when more people are out of work, prices go down because demand for goods and services is lower.

But stagflation began to rear its head in the 1970s. Growing government debt, fueled by military spending on the Vietnam War, sent prices soaring. Soon after, the energy crisis hit. In 1973, OPEC’s oil embargo resulted in a massive supply shock, worsening inflation and depressing output.

Official unemployment peaked at 9% while inflation kept ratcheting higher and eventually surpassed 14% year over year. A second oil supply shock in 1979 prompted the Federal Reserve to raise interest rates to record highs, above 20%. While that approach worked to bring inflation down, it prompted a severe recession.

Most economists say the likelihood of entering a period of stagflation is still quite low, but others like Sløk warn that Trump’s trade policies could fuel the fire. At the same time, the dollar and the balance sheets of major financial institutions are in a much stronger position than in the 1970s.

What role do tariffs play?

Since February, new import taxes have been announced, delayed, raised and reduced in quick succession. If tariffs are eventually implemented as announced, the average rate on US imports will be the highest in a century, back to the levels last witnessed during the Great Depression.

Tariffs, which are import taxes on goods from another country paid by the importer, can have a similar effect to oil supply shocks, causing widespread disruptions and cost increases along supply chains. Companies either pass on those increases to domestic customers, triggering more inflation, or they cut back on investments and output, leading to layoffs and weakened growth.

«Big tariffs right now wouldn’t just make inflation worse — they could set off a chain reaction of economic trouble that central banks and governments aren’t ready to handle,» said Sher. According to Sher, there’s a misguided assumption that consumers will be willing to pay the higher cost of goods brought on by tariffs. «Consumers will be more likely to sit on their hands and stop spending, which will further stoke the recession flames,» said Sher.

There are signs that tariff-related uncertainty is causing cracks in the labor market. Even as unemployment remains relatively low, currently at 4.1% according to the Bureau of Labor Statistics, hiring has slowed and those currently out of work are finding it nearly impossible to find gainful employment.

Is there a solution to stagflation?

There’s an established, if imperfect, playbook for diminishing the impact of a recession. The Fed, which is in charge of maintaining price stability and maximizing employment, usually lowers interest rates to stimulate the economy and buoy employment during a downturn.

When inflation is high, however, the Fed typically raises interest rates to combat price growth and slow down the economy by making credit and borrowing more expensive for consumers and businesses. The two approaches can’t be taken simultaneously.

«While prices are on the firm side and growth has cooled from a too-warm pace, unemployment remains closer to historic lows than not,» said Keith Gumbinger, vice president at housing market news site HSH.com. «We don’t have stagflation per se, at least as yet.»

Gumbinger said stagflation is more intractable than a recession. It has a trickier path because the go-to policies used to address one problem often worsen the other.

Right now the Fed is in a bind. Lower interest rates can boost a weaker economy, but they can also stoke inflation. If inflation remains sticky, the central bank is more likely to continue pausing rate cuts. The president’s habit of making knee-jerk policy announcements, only to delay or reverse them weeks later, makes it even harder for policymakers to course correct.

That kind of government paralysis could drag out economic hardship, especially for the most financially and socially vulnerable populations. While the average recession lasts about 11 months, the last bout of stagflation in the US lasted more than 10 years.

If a recession or stagflation materializes, it would be a «self-inflicted» injury resulting directly from US government policy, said Kathryn Anne Edwards, labor economist and independent policy consultant.

How can you prepare for an economic downturn?

Stagflation could feel like a recession with the added pain of high prices, making it difficult to prepare for and even harder to navigate. Still, experts say you’ll want to take some of the same steps you would ahead of an economic downturn.

Establish your emergency fund. Having an emergency fund is a good idea in any economy. During an economic downturn, high unemployment can make it harder to get back on solid financial footing if you have a sudden expense. If your savings cover at least three to six months of living expenses, you can more easily weather a financial storm without relying on credit cards or retirement savings.

Make a financial plan. Focus on paying down debt, particularly high interest credit card debt, so you don’t have to carry a balance when times are tougher. Postpone making any major purchases that overstretch your budget and that you’ll regret having to pay off in a year or two. Avoid panic buying things like laptops, phones or cars just to get ahead of expected price increases.

Review your investments. Given the level of economic uncertainty, expect the stock market to have more volatility. If you mostly have high-risk investments, consider diversifying with a variety of low-risk accounts, or combining stocks and bonds. Consult with an adviser about inflation-resistant assets and having a more balanced portfolio based on your individual risk tolerance, age and financial goals.

More on today’s economy

- How to Prepare for a Recession: 6 Money Rules Experts Recommend

- Tariff Pricing Tracker: We’re Watching 11 Products You Might Need to Buy

- I Bought Only Essentials for a Month. What I Learned Surprised Me

- Mortgage Rates at a Tipping Point. Why Trump’s Tariffs Have the Housing Market on Edge

- 3 Ways to Get Your Student Loans in Good Standing Before Paycheck Garnishment Starts

- DoorDash Wants Me to Finance My Fries. That’s a Hard No

Technologies

TMR vs. Hall Effect Controllers: Battle of the Magnetic Sensing Tech

The magic of magnets tucked into your joysticks can put an end to drift. But which technology is superior?

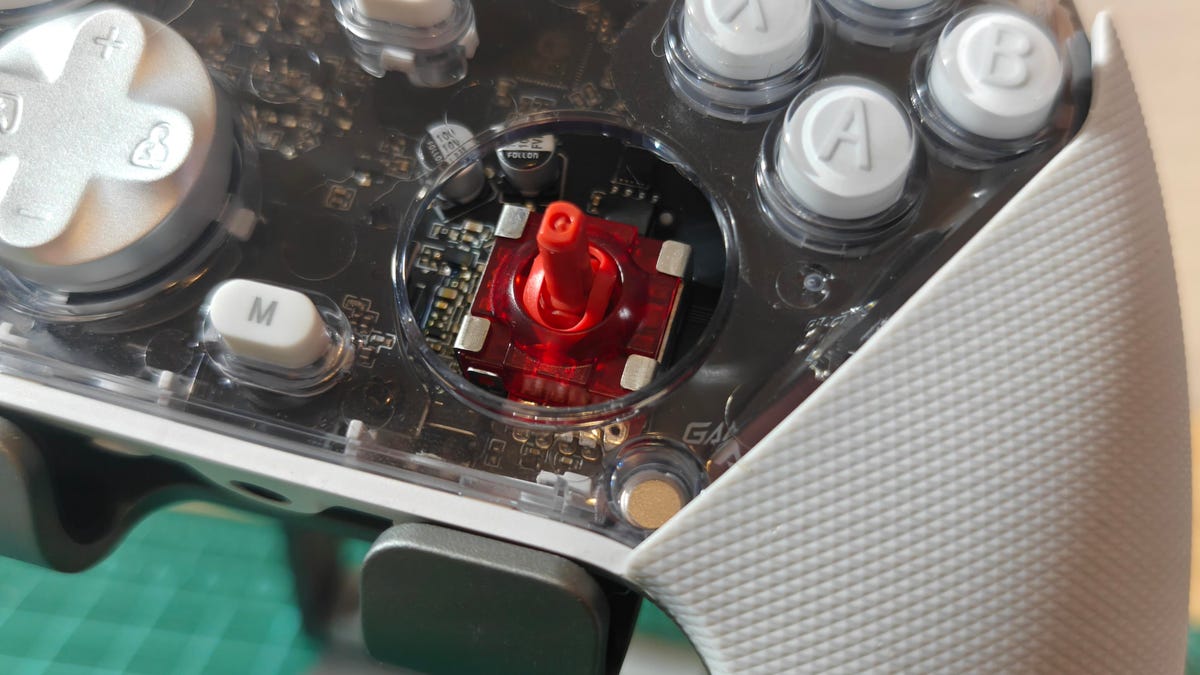

Competitive gamers look for every advantage they can get, and that drive has spawned some of the zaniest gaming peripherals under the sun. There are plenty of hardware components that actually offer meaningful edges when implemented properly. Hall effect and TMR (tunnel magnetoresistance or tunneling magnetoresistance) sensors are two such technologies. Hall effect sensors have found their way into a wide variety of devices, including keyboards and gaming controllers, including some of our favorites like the GameSir Super Nova.

More recently, TMR sensors have started to appear in these devices as well. Is it a better technology for gaming? With multiple options vying for your lunch money, it’s worth understanding the differences to decide which is more worthy of living inside your next game controller or keyboard.

How Hall effect joysticks work

We’ve previously broken down the difference between Hall effect tech and traditional potentiometers in controller joysticks, but here’s a quick rundown on how Hall effect sensors work. A Hall effect joystick moves a magnet over a sensor circuit, and the magnetic field affects the circuit’s voltage. The sensor in the circuit measures these voltage shifts and maps them to controller inputs. Element14 has a lovely visual explanation of this effect here.

The advantage this tech has over potentiometer-based joysticks used in controllers for decades is that the magnet and sensor don’t need to make physical contact. There’s no rubbing action to slowly wear away and degrade the sensor. So, in theory, Hall effect joysticks should remain accurate for the long haul.

How TMR joysticks work

While TMR works differently, it’s a similar concept to Hall effect devices. When you move a TMR joystick, it moves a magnet in the vicinity of the sensor. So far, it’s the same, right? Except with TMR, this shifting magnetic field changes the resistance in the sensor instead of the voltage.

There’s a useful demonstration of a sensor in action here. Just like Hall effect joysticks, TMR joysticks don’t rely on physical contact to register inputs and therefore won’t suffer the wear and drift that affects potentiometer-based joysticks.

Which is better, Hall effect or TMR?

There’s no hard and fast answer to which technology is better. After all, the actual implementation of the technology and the hardware it’s built into can be just as important, if not more so. Both technologies can provide accurate sensing, and neither requires physical contact with the sensing chip, so both can be used for precise controls that won’t encounter stick drift. That said, there are some potential advantages to TMR.

According to Coto Technology, who, in fairness, make TMR sensors, they can be more sensitive, allowing for either greater precision or the use of smaller magnets. Since the Hall effect is subtler, it relies on amplification and ultimately requires extra power. While power requirements vary from sensor to sensor, GameSir claims its TMR joysticks use about one-tenth the power of mainstream Hall effect joysticks. Cherry is another brand highlighting the lower power consumption of TMR sensors, albeit in the brand’s keyboard switches.

The greater precision is an opportunity for TMR joysticks to come out ahead, but that will depend more on the controller itself than the technology. Strange response curves, a big dead zone (which shouldn’t be needed), or low polling rates could prevent a perfectly good TMR sensor from beating a comparable Hall effect sensor in a better optimized controller.

The power savings will likely be the advantage most of us really feel. While it won’t matter for wired controllers, power savings can go a long way for wireless ones. Take the Razer Wolverine V3 Pro, for instance, a Hall effect controller offering 20 hours of battery life from a 4.5-watt-hour battery with support for a 1,000Hz polling rate on a wireless connection. Razer also offers the Wolverine V3 Pro 8K PC, a near-identical controller with the same battery offering TMR sensors. They claim the TMR version can go for 36 hours on a charge, though that’s presumably before cranking it up to an 8,000Hz polling rate — something Razer possibly left off the Hall effect model because of power usage.

The disadvantage of the TMR sensor would be its cost, but it appears that it’s negligible when factored into the entire price of a controller. Both versions of the aforementioned Razer controller are $199. Both 8BitDo and GameSir have managed to stick them into reasonably priced controllers like the 8BitDo Ultimate 2, GameSir G7 Pro and GameSir Cyclone 2.

So which wins?

It seems TMR joysticks have all the advantages of Hall effect joysticks and then some, bringing better power efficiency that can help in wireless applications. The one big downside might be price, but from what we’ve seen right now, that doesn’t seem to be much of an issue. You can even find both technologies in controllers that cost less than some potentiometer models, like the Xbox Elite Series 2 controller.

Caveats to consider

For all the hype, neither Hall effect nor TMR joysticks are perfect. One of their key selling points is that they won’t experience stick drift, but there are still elements of the joystick that can wear down. The ring around the joystick can lose its smoothness. The stick material can wear down (ever tried to use a controller with the rubber worn off its joystick? It’s not pleasant). The linkages that hold the joystick upright and the springs that keep it stiff can loosen, degrade and fill with dust. All of these can impact the continued use of the joystick, even if the Hall effect or TMR sensor itself is in perfect operating order.

So you might not get stick drift from a bad sensor, but you could get stick drift from a stick that simply doesn’t return to its original resting position. That’s when having a controller that’s serviceable or has swappable parts, like the PDP Victrix Pro BFG, could matter just as much as having one with Hall effect or TMR joysticks.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 18, #513

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 18, No. 513.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition has a fun yellow category that might just start you singing. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: I don’t care if I never get back.

Green group hint: Get that gold medal.

Blue group hint: Hoops superstar.

Purple group hint: Not front, but…

Answers for today’s Connections: Sports Edition groups

Yellow group: Heard in «Take Me Out to the Ball Game.»

Green group: Olympic snowboarding events.

Blue group: Vince Carter, informally.

Purple group: ____ back.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is heard in «Take Me Out to the Ball Game.» The four answers are Cracker Jack, home team, old ball game and peanuts.

The green words in today’s Connections

The theme is Olympic snowboarding events. The four answers are big air, giant slalom, halfpipe and slopestyle.

The blue words in today’s Connections

The theme is Vince Carter, informally. The four answers are Air Canada, Half-Man, Half-Amazing, VC and Vinsanity.

The purple words in today’s Connections

The theme is ____ back. The four answers are diamond, drop, quarter and razor.

Technologies

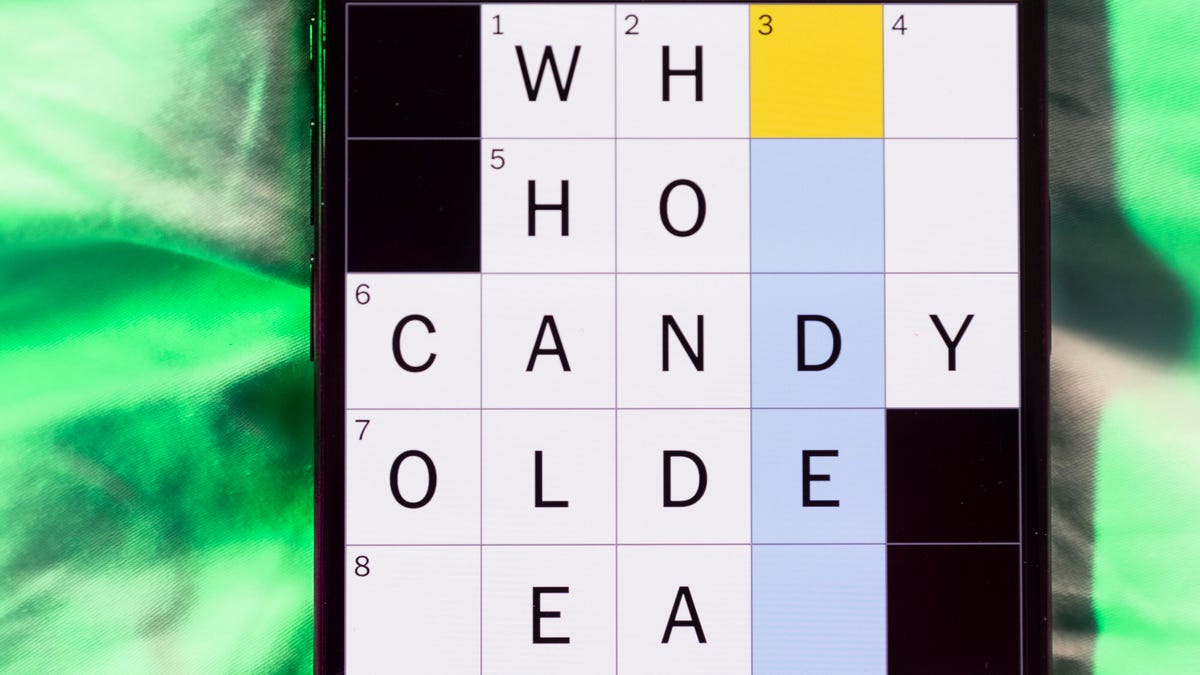

Today’s NYT Mini Crossword Answers for Wednesday, Feb. 18

Here are the answers for The New York Times Mini Crossword for Feb. 18.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Today’s Mini Crossword is a fun one, and it’s not terribly tough. It helps if you know a certain Olympian. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: ___ Glenn, Olympic figure skater who’s a three-time U.S. national champion

Answer: AMBER

6A clue: Popcorn size that might come in a bucket

Answer: LARGE

7A clue: Lies and the Lying ___ Who Tell Them» (Al Franken book)

Answer: LIARS

8A clue: Close-up map

Answer: INSET

9A clue: Prepares a home for a new baby

Answer: NESTS

Mini down clues and answers

1D clue: Bold poker declaration

Answer: ALLIN

2D clue: Only U.S. state with a one-syllable name

Answer: MAINE

3D clue: Orchestra section with trumpets and horns

Answer: BRASS

4D clue: «Great» or «Snowy» wading bird

Answer: EGRET

5D clue: Some sheet music squiggles

Answer: RESTS

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow