Technologies

Apple Watch Ultra 3 Preorders: Upgrade to Apple’s New Rugged Smartwatch

Technologies

How Team USA’s Olympic Skiers and Snowboarders Got an Edge From Google AI

Google engineers hit the slopes with Team USA’s skiers and snowboarders to build a custom AI training tool.

Team USA’s skiers and snowboarders are going home with some new hardware, including a few gold medals, from the 2026 Olympics. Along with the years of hard work that go into being an Olympic athlete, this year’s crew had an extra edge in their training thanks to a custom AI tool from Google Cloud.

US Ski and Snowboard, the governing body for the US national teams, oversees the training of the best skiers and snowboarders in the country to prepare them for big events, such as national championships and the Olympics. The organization partnered with Google Cloud to build an AI tool to offer more insight into how athletes are training and performing on the slopes.

Video review is a big part of winter sports training. A coach will literally stand on the sidelines recording an athlete’s run, then review the footage with them afterward to spot errors. But this process is somewhat dated, Anouk Patty, chief of sport at US Ski and Snowboard, told me. That’s where Google came in, bringing new AI-powered data insights to the training process.

Google Cloud engineers hit the slopes with the skiers and snowboarders to understand how to build an actually useful AI model for athletic training. They used video footage as the base of the currently unnamed AI tool. Gemini did a frame-by-frame analysis of the video, which was then fed into spatial intelligence models from Google DeepMind. Those models were able to take the 2D rendering of the athlete from the video and transform it into a 3D skeleton of an athlete as they contort and twist on runs.

Final touches from Gemini help the AI tool analyze the physics in the pixels, according to Ravi Rajamani, global head of Google’s AI Blackbelt team. which worked on the project. Coaches and athletes told the engineers the specific metrics they wanted to track — speed, rotation, trajectory — and the Google engineers coded the model to make it easy to monitor them and compare between different videos. There’s also a chat interface to ask Gemini questions about performance.

«From just a video, we are actually able to recreate it in 3D, so you don’t need expensive equipment, [like] sensors, that get in the way of an athlete performing,» Rajamani said.

Coaches are undeniably the experts on the mountain, but the AI can act as a kind of gut check. The data can help confirm or deny what coaches are seeing and give them extra insight into the specifics of each athlete’s performance. It can catch things that humans would struggle to see with the naked eye or in poor video quality, like where an athlete was looking while doing a trick and the exact speed and angle of a rotation.

«It’s data that they wouldn’t otherwise have,» Patty said. The 3D skeleton is especially helpful because it makes it easier to see movement obscured by the puffy jackets and pants athletes wear, she said.

For elite athletes in skiing and snowboarding, making small adjustments can mean the difference between a gold medal and no medal at all. Technological advances in training are meant to help athletes get every available tool for improvement.

«You’re always trying to find that 1% that can make the difference for an athlete to get them on the podium or to win,» Patty said. It can also democratize coaching. «It’s a way for every coach who’s out there in a club working with young athletes to have that level of understanding of what an athlete should do that the national team athletes have.»

For Google, this purpose-built AI tool is «the tip of the iceberg,» Rajamani said. There are a lot of potential future use cases, including expanding the base model to be customized to other sports. It also lays the foundation for work in sports medicine, physical therapy, robotics and ergonomics — disciplines where understanding body positioning is important. But for now, there’s satisfaction in knowing the AI was built to actually help real athletes.

«This was not a case of tech engineers building something in the lab and handing it over,» Rajamani said. «This is a real-world problem that we are solving. For us, the motivation was building a tool that provides a true competitive advantage for our athletes.»

Technologies

Virtual Boy Review: Nintendo’s Oddest Switch Accessory Yet Is an Immersive ’90s Museum

No one needs a Virtual Boy. But I always wanted one. And now it’s living with me at last.

On my desk is a Nintendo device that looks like equipment stolen from a cyberpunk optical shop. It’s big, it’s red and black, it sits on a tripod, it has an eyepiece, and it has a Nintendo Switch 2 nestled inside. Hello, Virtual Boy, you’re back.

Nintendo has made a lot of weird consoles over the years, but the Virtual Boy was the weirdest. And the shortest lived. Released in 1995 and discontinued a year later, it lived for a blink of an eye during my final year in college. I never really had time to consider buying one.

It would have been perfect for me, a Game Boy fan who was in love with the idea of VR even back then. Nintendo has been flirting with virtual reality in various forms for decades, and the Virtual Boy was the biggest swing. But it wasn’t VR at all, really. It was a 3D game console in red and black monochrome, a 3D Game Boy in tripod form.

I’m setting the stage because right now you can order a $100 Virtual Boy recreation that’s a big, strange Switch accessory. It’s staring at me now, taking up a lot of space. It’s too big to fit in a bag. It’s a tabletop console, really, and Nintendo has created this Virtual Boy viewer as a way to play a set of free-with-subscription games on the Switch and Switch 2.

Is it worth your money? I’d call it a museum-piece collectible, not a serious piece of gaming hardware. Still, my kid stuck his head in, played 3D Wario Land, and came out declaring it was really cool. He loves old retro games. But I don’t know how often he’ll pop his head back in.

Nintendo’s first stab at 3D now feels like a museum piece

For comparison, I pulled my old Nintendo 3DS XL out of the drawer where it had been tucked away and booted it up, marveling again that Nintendo actually made a glasses-free 3D game handheld once upon a time. The 3DS is a far more capable and advanced game system, but consider the Virtual Boy an ancient attempt to get there first.

The Virtual Boy was a monochrome red-and-black LED display system, a tabletop-only device that was neither handheld nor TV-connected. The Nintendo Switch’s tabletop-style game modes feel like a bit of an evolutionary link to the Virtual Boy, so it’s poetic that the Switch pops into the new Virtual Boy to power the games and provide the display.

The plastic Virtual Boy is just an odd set of VR goggles for the Switch, but with a red filter on the lenses. Also, you can’t wear it. You keep your head stuck in it.

Awkward and easy to use

All the trappings on this recreation look like the old Virtual Boy but don’t work: You can see a simulated headphone jack, controller port, a sort of knob on top. I just unsnap the plastic case and slide the Switch in, carefully, and then snap it back over. That’s all it is.

To control it, you use the Switch controllers detached or another Switch-compatible controller. Launching the Virtual Boy app — free on the eShop, but you need a Switch Online Plus Expansion Pack account, which costs $50 a year, or $80 for a family membership — splits the Switch display into two smaller, distorted screens. In the Virtual Boy, it looks properly 3D. When I’m done playing, I pop the Switch back out.

As I said in my first hands-on, the big foam-covered eyepiece is more than wide enough for big glasses, and was fine to dip my face into. Getting a comfortable angle to stay playing for a while is another challenge. The Virtual Boy’s included tripod-like stand can adjust the angle, but not as wide as I’d like. I’m sort of hunched over while playing, which gives me a bit of pain. Leaning on the table with my controllers in hand helps.

The red-lensed front eyepiece can be removed, and a later software update will allow Virtual Boy games to be played in several color mixes beyond red and black. Also, you can unscrew an inner bracket to hold the Switch 2 and swap in an included Switch-sized bracket instead. The Switch Lite doesn’t work with the Virtual Boy, however.

The weirdness is my type of indie

All you get right now are seven of the 16 games Nintendo has promised to release for the Virtual Boy. Believe it or not, there were only 22 games ever released for this system. The 16 will include two that were never released before, which is a fun collector’s novelty.

But what’s amazing to me now is that, sinking into these oddball retro games with their pixelated NES-slash-Game Boy aesthetics in red and black, they feel weirdly timely. The janky, oddball, almost-parallel-universe Nintendo vibe feels like the indie retro aesthetic that’s been big for a while now. After all these years, is the Virtual Boy now finally awesome?

Games like UFO 50 (a compilation of new indie games made to feel like an archive of ’80s games for a console that never was) and indie consoles like Panic Playdate (still my favorite black and white mini handheld, a home for all sorts of homebrew retro games) match my feeling diving into these Virtual Boy games and figuring them out.

Wario Land is probably the best: A side-scrolling Wario game with multiple depth levels, it gives me Game Boy Mario game vibes. Golf has multiple holes and an aiming system, and it’s relaxed and basic (and hard to perfect). 3D Tetris has you dropping blocks down a well to fill in layers, with a Tron-like puzzle feel. Red Alert’s wireframe 3D shooter design is like Star Fox, but boiled all the way down to simple vector lines. Galactic Pinball has several tables, and it’s some lovely, very old-school 3D Nintendo pinball fun. Teleroboxer is Punch-Out with robots, with a style that also reminds me of the early Switch game Arms. And The Mansion of Innsmouth is a creepy 3D dungeon-crawling game (in Japanese) where you try to get to exits before time runs out… or monsters get you.

The remaining games coming this year include Mario Tennis, another Tetris game, a wireframe 3D racer, a 3D reinvention of the original Mario Bros. game called Mario Clash and a 3D Space Invaders. By the end of Nintendo’s release schedule, a good chunk of Virtual Boy’s catalog will be there.

A novelty that’s niche as hell

Worth it? Again, if you love weird and retro, and are intrigued by lost Nintendo 3D games, then yes. But if you’re looking for cutting-edge, then no.

Keep in mind: You can buy a cheaper $25 cardboard set of goggles for the Switch that lets you play the Virtual Boy games, too (or use the old Labo VR goggles Nintendo made in 2019, if you have them). That’s a more sensible path. There are even unofficial emulators for Virtual Boy games on the Meta Quest and Apple Vision Pro. But who said the Virtual Boy was sensible?

A Nintendo game system that’s a big set of red goggles on a tripod is inherently absurd. And I welcome its weird footprint in my home, because that’s exactly who I am. But it’s also a testament to Nintendo’s perpetual interest in the bleeding edge of gaming. VR, glasses-free 3D, AR, modular consoles… Nintendo’s poking around the edges.

Is the Virtual Boy a sign that Nintendo could make its own VR or AR game system again someday soon, or as an extension of the Switch 2? Who knows? Shigeru Miyamoto, Nintendo’s legendary video game designer, sounded intrigued and elusive about it when I asked him last year. But there’s never any real way to guess where Nintendo’s heading. The Virtual Boy is a museum-piece reminder of that.

Technologies

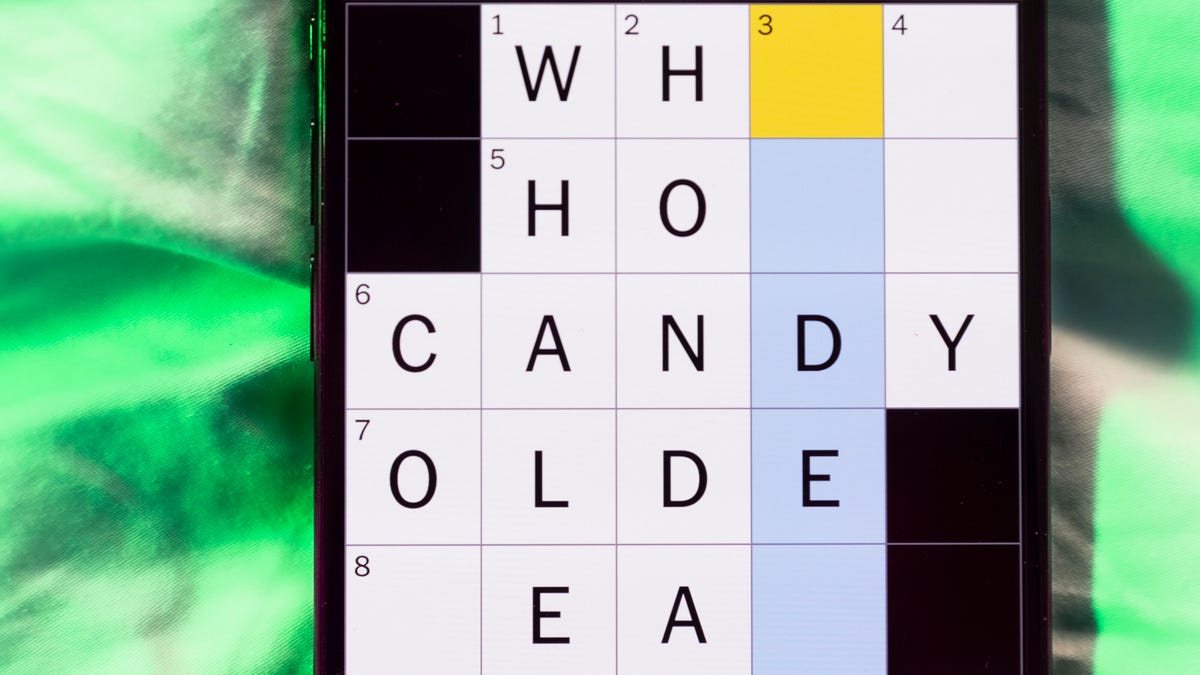

Today’s NYT Mini Crossword Answers for Friday, Feb. 20

Here are the answers for The New York Times Mini Crossword for Feb. 20.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Today’s Mini Crossword expects you to know a little bit about everything — from old political parties to architecture to video games. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Political party that competed with Democrats during the 1830s-’50s

Answer: WHIGS

6A clue: Four Seasons, e.g.

Answer: HOTEL

7A clue: Dinosaur in the Mario games

Answer: YOSHI

8A clue: Blizzard or hurricane

Answer: STORM

9A clue: We all look up to it

Answer: SKY

Mini down clues and answers

1D clue: «Oh yeah, ___ that?»

Answer: WHYS

2D clue: Says «who»?

Answer: HOOTS

3D clue: «No worries»

Answer: ITSOK

4D clue: Postmodern architect Frank

Answer: GEHRY

5D clue: Narrow

Answer: SLIM

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow