Technologies

Homebuyers Are Scoring 5% Mortgage Rates With These Simple Strategies

You don’t have to settle for high rates in 2025. Here’s how to cut your mortgage rate by 1% or more.

If you’re looking to buy a home, you probably know that housing affordability is in the dumps. Record-high prices and high mortgage rates are serving a double whammy to prospective buyers everywhere.

But mortgage rates aren’t set in stone. Although current rates are hovering near 7%, more borrowers are finding creative ways to snag rates below what lenders advertise. Last year, nearly half of buyers purchased a home at a rate below 5%, according to Zillow.

«With borrowing costs elevated, buyers can take steps to reduce their housing expenses by securing a lower mortgage rate,» said Hannah Jones, senior research analyst at Realtor.com.

The market forces that influence mortgage rates are out of your control. However, if you’re financially prepared and shop around, you can save up to 1.5% on your personalized rate. Optimizing your credit score, making a larger down payment and negotiating with multiple lenders could also help you unlock homeownership in 2025.

Even a 1% difference in your rate can translate to about 10% savings on your monthly mortgage payment and tens of thousands of dollars in savings over the course of your loan.

Here are several ways to reduce your mortgage rate.

1. Improve your credit score

If your credit needs work, consider taking steps to raise your credit score before applying for a mortgage.

Lenders look at your credit score to decide whether you qualify for a home loan and what interest rate you receive. FICO credit scores range from 300 to 850, with 850 being the best score possible. Higher credit scores show you’ve managed debt responsibly in the past so it lowers your risk to a lender. This can help you secure a lower interest rate and save big.

«The best mortgage rates and products are typically reserved for those with a credit score of 740 or better,» said Sarah DeFlorio, vice president of mortgage banking at William Raveis Mortgage.

According to a 2024 Lending Tree study, when borrowers moved from the «fair» credit score range (580 to 669) to the «very good» range (740 to 799), they shaved 0.22% percentage points off their interest rate. That rate difference helped borrowers save $16,677 over the lifetime of a home loan.

2. Increase your down payment

Your down payment is the amount of money you contribute to your home purchase upfront. Each type of home loan comes with a minimum down payment, usually ranging from zero to 5%, but a higher down payment means a cheaper interest rate. That’s because the lender takes on less risk when you contribute more toward the loan.

Because a down payment lowers your mortgage rate and builds your home equity, home loan experts often recommend making a large down payment of at least 20%.

3. Take out an adjustable-rate mortgage

An adjustable-rate mortgage, or ARM, is a home loan with a fixed rate for a set introductory period, such as five years. Once that period ends, the interest rate can go up or down in regular intervals for the remaining term.

The big appeal of ARMs is that the introductory interest rate is often lower than the rate on traditional mortgages. In general, the average 5/1 ARM rate is about 0.5% lower for the first several years than the average rate for 30-year fixed-rate mortgages.

4. Negotiate your mortgage rate

When you’re applying for mortgage loans, you don’t have to go with the company that did your preapproval. In fact, research shows that getting rate quotes from multiple lenders and comparing offers can result in significant savings.

If you want to use this strategy, start by submitting a mortgage application with lenders that fit your criteria. Once you have a few loan estimates in hand, use the best one to negotiate with the lender you want to work with.

The loan officer may lower your rate, help you save on closing costs or offer other incentives to get you onboard. In a 2023 LendingTree survey, 39% of homebuyers negotiated the interest rate on their most recent home purchase. Out of that pool of buyers, 80% were able to get a better deal.

5. Choose a shorter home loan term

Nearly 90% of homebuyers choose a 30-year fixed mortgage term because it offers the most flexibility and monthly payment affordability. Payments are lower because they’re stretched over a longer timeline, but you can always put more toward the principal here and there.

But when you take out a longer-term home loan, «you’re holding up the lender’s money, and there’s an opportunity cost for the funds to be invested elsewhere,» said Nicole Rueth, SVP of the Rueth Team Powered by Movement Mortgage.

Shorter loan terms, such as 10-year and 15-year mortgages and ARMs, have lower interest rates, so you can reduce your rate now.

Choosing a shorter repayment term could help you save money because you’ll be paying less in interest over the long term. But don’t make the homebuying mistake of choosing a shorter loan term just for the lower rate. Shorter loan terms mean you’ll have less time to repay the money you borrow, resulting in higher monthly payments, so it’s important to ensure they fit within your budget.

6. Buy mortgage points

A mortgage point, also known as a mortgage discount point, is an upfront fee you can pay the lender in exchange for a lower interest rate on your home loan.

Each point costs 1% of the purchase price of a home and usually knocks the rate down by 0.25%. On a $400,000 home, you’d pay $4,000 for one discount point. The lender may even allow you to buy four mortgage points to lower the rate from 7% to 6%, although you’d have to shell out $16,000 to get there.

To check whether this strategy is worthwhile, take the total cost of the points and compare it to the overall monthly savings. In this case, when you pay $16,000 to buy four points and save $210 per month, it would take you more than six years to reach your break-even point.

Some experts encourage putting any extra money you have toward a down payment instead of buying points. That’s because if you sell the home or refinance before reaching your break-even point, you lose money. But the amount you spent on your down payment becomes part of your equity.

7. Get a temporary mortgage rate buydown

A temporary mortgage rate buydown involves paying a fee at closing to lower your interest rate for the first few years of your loan term. Because of the considerable upfront cost, this strategy only makes financial sense when someone else pays that fee. Home builders, sellers and even some lenders may offer to cover this type of buydown to boost sales, especially when market rates are elevated.

For example, a lender may offer a «3-2-1» buydown, where the interest rate is slashed by 3 percentage points in the first year, 2 percentage points in the second year and 1 percentage point in the third. Starting in the fourth year, you pay the full rate for the rest of the loan term.

Buyers often choose a temporary buydown and plan to refinance later on. Your buydown funds are refundable and you can use them toward closing costs when you refinance (if rates do drop).

What is a ‘good’ mortgage rate?

The majority of US adults would consider purchasing a home if rates were to drop to 4% or below. Yet most mortgage forecasts don’t project average rates dipping below 6.5% this year.

In a historical sense, a good mortgage rate is generally at or below the national average. Since 1971, the 30-year fixed mortgage rate has averaged 7.72%, according to Freddie Mac. In the last year, average mortgage rates have mostly fluctuated between 6% and 7%.

Affordability is relative to your overall financial situation. And because mortgage rates can change daily and even hourly, the definition of a «good» rate can change quickly.

«What matters is the rate you can get today,» said Colin Robertson, founder of The Truth About Mortgage. According to Robertson, the only way to know if you’re getting a good deal is to speak with a few different lenders and brokers and then compare their quotes against the daily or weekly averages.

Buying a home is a personal decision so it should feel right for your situation and budget. As you shop for a home, consider multiple strategies to lower your rate. A mortgage calculator can help you estimate what you’d pay each month.

Read more: Still Chasing 2% Mortgage Rates? Here’s Why It’s Time to Let Them Go

Technologies

TMR vs. Hall Effect Controllers: Battle of the Magnetic Sensing Tech

The magic of magnets tucked into your joysticks can put an end to drift. But which technology is superior?

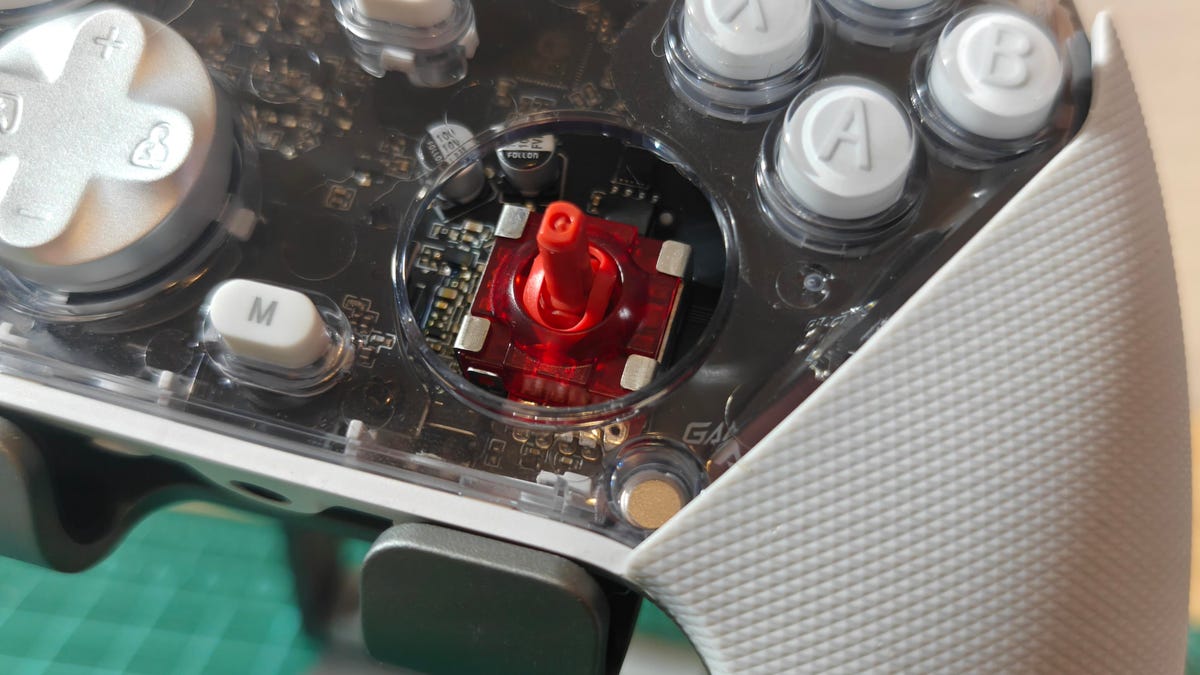

Competitive gamers look for every advantage they can get, and that drive has spawned some of the zaniest gaming peripherals under the sun. There are plenty of hardware components that actually offer meaningful edges when implemented properly. Hall effect and TMR (tunnel magnetoresistance or tunneling magnetoresistance) sensors are two such technologies. Hall effect sensors have found their way into a wide variety of devices, including keyboards and gaming controllers, including some of our favorites like the GameSir Super Nova.

More recently, TMR sensors have started to appear in these devices as well. Is it a better technology for gaming? With multiple options vying for your lunch money, it’s worth understanding the differences to decide which is more worthy of living inside your next game controller or keyboard.

How Hall effect joysticks work

We’ve previously broken down the difference between Hall effect tech and traditional potentiometers in controller joysticks, but here’s a quick rundown on how Hall effect sensors work. A Hall effect joystick moves a magnet over a sensor circuit, and the magnetic field affects the circuit’s voltage. The sensor in the circuit measures these voltage shifts and maps them to controller inputs. Element14 has a lovely visual explanation of this effect here.

The advantage this tech has over potentiometer-based joysticks used in controllers for decades is that the magnet and sensor don’t need to make physical contact. There’s no rubbing action to slowly wear away and degrade the sensor. So, in theory, Hall effect joysticks should remain accurate for the long haul.

How TMR joysticks work

While TMR works differently, it’s a similar concept to Hall effect devices. When you move a TMR joystick, it moves a magnet in the vicinity of the sensor. So far, it’s the same, right? Except with TMR, this shifting magnetic field changes the resistance in the sensor instead of the voltage.

There’s a useful demonstration of a sensor in action here. Just like Hall effect joysticks, TMR joysticks don’t rely on physical contact to register inputs and therefore won’t suffer the wear and drift that affects potentiometer-based joysticks.

Which is better, Hall effect or TMR?

There’s no hard and fast answer to which technology is better. After all, the actual implementation of the technology and the hardware it’s built into can be just as important, if not more so. Both technologies can provide accurate sensing, and neither requires physical contact with the sensing chip, so both can be used for precise controls that won’t encounter stick drift. That said, there are some potential advantages to TMR.

According to Coto Technology, who, in fairness, make TMR sensors, they can be more sensitive, allowing for either greater precision or the use of smaller magnets. Since the Hall effect is subtler, it relies on amplification and ultimately requires extra power. While power requirements vary from sensor to sensor, GameSir claims its TMR joysticks use about one-tenth the power of mainstream Hall effect joysticks. Cherry is another brand highlighting the lower power consumption of TMR sensors, albeit in the brand’s keyboard switches.

The greater precision is an opportunity for TMR joysticks to come out ahead, but that will depend more on the controller itself than the technology. Strange response curves, a big dead zone (which shouldn’t be needed), or low polling rates could prevent a perfectly good TMR sensor from beating a comparable Hall effect sensor in a better optimized controller.

The power savings will likely be the advantage most of us really feel. While it won’t matter for wired controllers, power savings can go a long way for wireless ones. Take the Razer Wolverine V3 Pro, for instance, a Hall effect controller offering 20 hours of battery life from a 4.5-watt-hour battery with support for a 1,000Hz polling rate on a wireless connection. Razer also offers the Wolverine V3 Pro 8K PC, a near-identical controller with the same battery offering TMR sensors. They claim the TMR version can go for 36 hours on a charge, though that’s presumably before cranking it up to an 8,000Hz polling rate — something Razer possibly left off the Hall effect model because of power usage.

The disadvantage of the TMR sensor would be its cost, but it appears that it’s negligible when factored into the entire price of a controller. Both versions of the aforementioned Razer controller are $199. Both 8BitDo and GameSir have managed to stick them into reasonably priced controllers like the 8BitDo Ultimate 2, GameSir G7 Pro and GameSir Cyclone 2.

So which wins?

It seems TMR joysticks have all the advantages of Hall effect joysticks and then some, bringing better power efficiency that can help in wireless applications. The one big downside might be price, but from what we’ve seen right now, that doesn’t seem to be much of an issue. You can even find both technologies in controllers that cost less than some potentiometer models, like the Xbox Elite Series 2 controller.

Caveats to consider

For all the hype, neither Hall effect nor TMR joysticks are perfect. One of their key selling points is that they won’t experience stick drift, but there are still elements of the joystick that can wear down. The ring around the joystick can lose its smoothness. The stick material can wear down (ever tried to use a controller with the rubber worn off its joystick? It’s not pleasant). The linkages that hold the joystick upright and the springs that keep it stiff can loosen, degrade and fill with dust. All of these can impact the continued use of the joystick, even if the Hall effect or TMR sensor itself is in perfect operating order.

So you might not get stick drift from a bad sensor, but you could get stick drift from a stick that simply doesn’t return to its original resting position. That’s when having a controller that’s serviceable or has swappable parts, like the PDP Victrix Pro BFG, could matter just as much as having one with Hall effect or TMR joysticks.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 18, #513

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 18, No. 513.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition has a fun yellow category that might just start you singing. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: I don’t care if I never get back.

Green group hint: Get that gold medal.

Blue group hint: Hoops superstar.

Purple group hint: Not front, but…

Answers for today’s Connections: Sports Edition groups

Yellow group: Heard in «Take Me Out to the Ball Game.»

Green group: Olympic snowboarding events.

Blue group: Vince Carter, informally.

Purple group: ____ back.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is heard in «Take Me Out to the Ball Game.» The four answers are Cracker Jack, home team, old ball game and peanuts.

The green words in today’s Connections

The theme is Olympic snowboarding events. The four answers are big air, giant slalom, halfpipe and slopestyle.

The blue words in today’s Connections

The theme is Vince Carter, informally. The four answers are Air Canada, Half-Man, Half-Amazing, VC and Vinsanity.

The purple words in today’s Connections

The theme is ____ back. The four answers are diamond, drop, quarter and razor.

Technologies

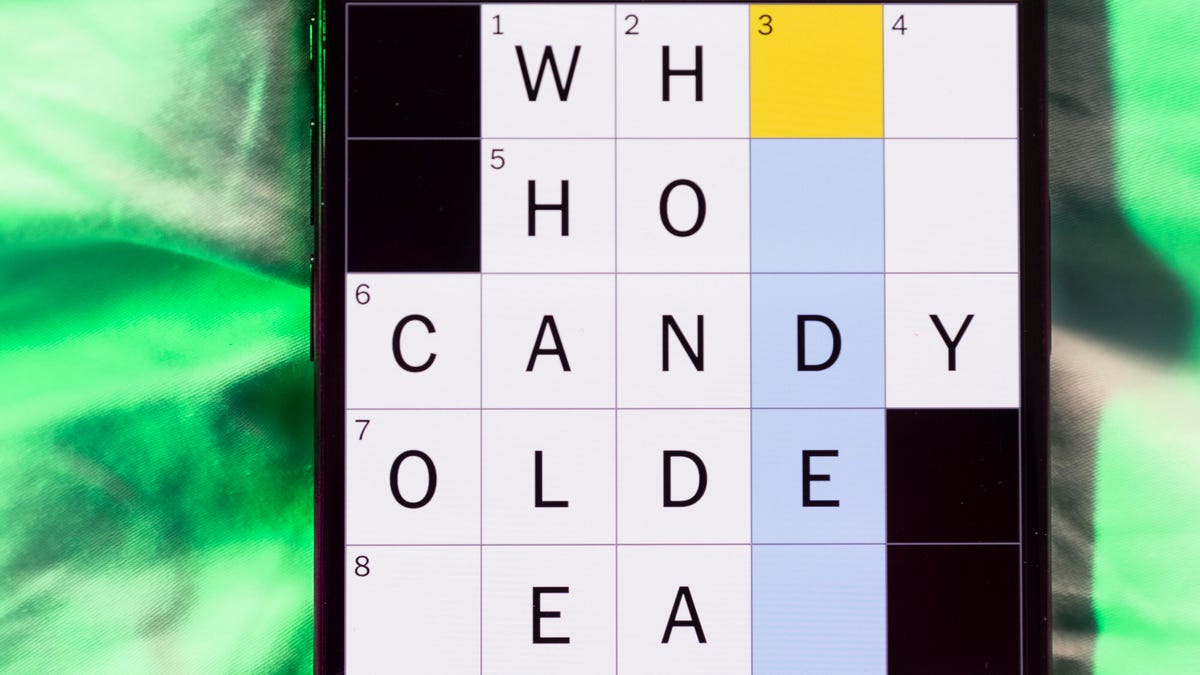

Today’s NYT Mini Crossword Answers for Wednesday, Feb. 18

Here are the answers for The New York Times Mini Crossword for Feb. 18.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Today’s Mini Crossword is a fun one, and it’s not terribly tough. It helps if you know a certain Olympian. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: ___ Glenn, Olympic figure skater who’s a three-time U.S. national champion

Answer: AMBER

6A clue: Popcorn size that might come in a bucket

Answer: LARGE

7A clue: Lies and the Lying ___ Who Tell Them» (Al Franken book)

Answer: LIARS

8A clue: Close-up map

Answer: INSET

9A clue: Prepares a home for a new baby

Answer: NESTS

Mini down clues and answers

1D clue: Bold poker declaration

Answer: ALLIN

2D clue: Only U.S. state with a one-syllable name

Answer: MAINE

3D clue: Orchestra section with trumpets and horns

Answer: BRASS

4D clue: «Great» or «Snowy» wading bird

Answer: EGRET

5D clue: Some sheet music squiggles

Answer: RESTS

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow