Technologies

Trump’s ‘One Big Beautiful Bill’: The Huge Tax and Medicaid Implications You Need to Know

The GOP’s contentious budget bill narrowly passed in the House, faces dissent in the Senate and has drawn the ire of Elon Musk in a big way.

President Donald Trump has made the extension of the 2017 tax cuts one of his major second-term economic goals — you know, aside from all those tariffs — but as the so-called «One Big Beautiful Bill» has moved forward, it’s faced major pushback. Some of this opposition might lead to significant changes to the bill and how it might ultimately impact you, especially when it comes to taxes and services like Medicaid.

After much back-and-forth, negotiation and failed votes, the bill passed in the House of Representatives by the thinnest margin possible, 215-214-1. The bill is now moving through the Senate, where it is expected to face more alterations before getting across the finish line. While the GOP has been attempting to use the reconciliation process to avoid the bill being filibustered by Democrats, it is still expected to face intra-party dissent similar to what it went through in the House over its cuts either being too severe or not severe enough.

Elon Musk, the Tesla CEO and one-time Trump adviser who led the «DOGE» government consolidation efforts, spoke out against the bill in an unsparing fashion in a Tuesday post to X, decrying it as too heavy on spending. This disagreement with Trump and his agenda led to a prolonged public spat between the president and his one-time senior advisor.

«This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination,» Musk wrote. «Shame on those who voted for it: you know you did wrong. You know it.»

Despite the broad nature of the bill, one of its central goals remains the extension of the 2017 Trump tax cuts. Passed for the first time early in his first term, the Tax Cuts and Jobs Act, as it was officially known, was one of Trump’s signature legislative accomplishments and has generally become known as the «Trump tax cuts.» Given the nature of how that bill was passed initially, a lot of its provisions are set to expire next year if a new extension isn’t passed, so doing just that has unsurprisingly emerged as a major priority for Trump and the GOP-led houses of Congress.

The president and his allies have also tried to claim that his aggressive tariff agenda could help offset the extension of the tax cuts, although, as we’ve touched on before at CNET, that is just one of the often-contradictory stated goals for the tariffs.

Details about the budget bill Republicans have emerged in the past few weeks as it moved through the House Ways and Means Committee approval process. The Congressional Budget Office, an agency that provides estimates about the economic impacts of budgetary bills that is not affiliated with any party, estimated that the cuts called for in this bill would cost millions of people their health insurance and food benefits. The proposal initially failed to pass a vote in the House, leading to its cuts for Medicaid becoming even heavier.

All this comes in addition to the longstanding criticism from Democrats and other critics that Trump’s tax cuts disproportionately help the wealthiest Americans more than the working class. While there is truth to that argument, and to the Republican counter that the tax cuts would provide some help to taxpayers at all incomes, the new proposed cuts unveiled this week have given more weight to the notion that they will be more harmful for the least wealthy Americans.

For all the details about what extending the tax cuts will actually mean and what the current terms mean for things like Medicaid, keep reading. For more, find out if Trump could actually abolish the Department of Education.

How will the budget bill impact Medicaid?

According to the estimates from the Congressional Budget Office mentioned at the start of this piece, at least 7.6 million Americans would lose Medicaid health insurance under the provisions in the budget proposal. That’s nearly 11% of the 70 million Americans who are currently insured by Medicaid. The proposal would, among other things, require people without dependent children or a disability to meet an 80-hour-a-month work requirement to qualify for Medicaid and increase the frequency with which people will need to confirm their continued eligibility.

These new requirements were originally set to take effect in 2029 under the bill’s failed House version, but they were moved forward to 2026 in the bill’s passed version.

What would extending the Trump tax cuts mean?

While the phrase «Trump tax cuts» has become a common media shorthand for the Tax Cuts and Jobs Act, the current conversation around it might suggest that new cuts could be on the way. Although Trump has floated ideas for additional cuts, it’s important to note that extending the 2017 provisions would, for the most part, keep tax rates and programs at the levels they’ve been at since then.

So while it may be a better option than having the provisions expire — which would increase certain tax rates and decrease certain credits — extending the tax cuts most likely won’t change how you’ve been taxed the past eight years. However, some estimates have predicted that extending the cuts would boost income in 2026, with the conservative-leaning Tax Foundation in particular predicting a 2.9% rise on average, based on a combination of other economic predictions combined with tax rates staying where they are.

What would change if the Trump tax cuts expire?

Republicans contend that the tax cuts helped a wide swath of Americans, and the Tax Foundation predicted that 60% of tax filers would see higher rates in 2026 without an extension.

A big part of that has to do with tax bracket changes. The 2017 provisions lowered the income tax rates across the seven brackets, aside from the first (10%) and the sixth (35%). If the current law expires, those rates would go up by between 1% and 3%.

Income limits for each bracket would also revert to pre-2017 levels. Lending credence to the Democrats’ counterarguments, these shifts under the Trump tax cuts appeared to be more beneficial to individuals and couples at higher income levels than to those making closer to the average US income.

If you’re interested in the nitty-gritty numbers, you can check out the Tax Foundation’s full breakdown. Another point in Democrats’ favor? The Tax Cuts and Jobs Act also cut corporate tax rates from 35% to 21%, and unlike many of its other provisions, this one was permanent and won’t expire in 2026.

What would happen to the standard deduction?

This is another area in which a lot of people would be hit hard. The standard deduction lets taxpayers lower their taxable income, as long as they forgo itemizing any deductions.

For the 2025 tax year, the standard deduction is $15,000 for individual filers and $30,000 for joint filers. If the tax cuts expire, these numbers will drop by nearly half, down to $8,350 for individuals and $16,700 for joint filers.

Under the current reconciliation bill, the deduction would increase to $16,000 for individuals and $32,000 for joint filers, but only through 2028.

What would happen to the child tax credit?

The child tax credit is one of the most popular credits. Its current levels — $2,000 per qualifying child, which phases out starting at a gross income of $200,000 for single filers and $400,000 for joint filers — were actually set by the Tax Cuts and Jobs Act.

If an extension or new bill isn’t passed, next year the child tax credit would revert to its old levels: $1,000 per child, which starts phasing out at $75,000 for single filers and $110,000 for joint filers.

If the current budget bill is implemented, the credit will be upped to $2,500 per child through 2028, before dropping to $2,000 as its new permanent rate.

Do the Trump tax cuts really favor the wealthy?

Higher-income individuals and couples fared notably better with the changes the Trump tax cuts made to tax brackets. An estimate from the Institute on Taxation and Economic Policy, a left-leaning think tank, found that the poorest 20% of Americans would see only about 1% of the bill’s net tax cuts. Numerous similar estimates agree that these small benefits for the poorest taxpayers would be outweighed by rising costs caused by tariffs.

Conversely, ITEP’s estimate found that the richest 20% of US taxpayers would benefit from around 67% of the bill’s net tax cuts, with the richest 5% benefitting from half of them.

How much would extending the tax cuts cost?

Both the Congressional Budget Office and the Tax Foundation have estimated that the reconciliation bill’s tax cut extension would raise the US deficit by $4.5 trillion over the course of 10 years. The Tax Foundation also estimated that it could raise the country’s GDP to offset that number, but only by about $710 billion, or about 16% of the deficit increase.

For more, see how Trump’s tariffs might be affecting the prices of several key products in our daily tracker.

Technologies

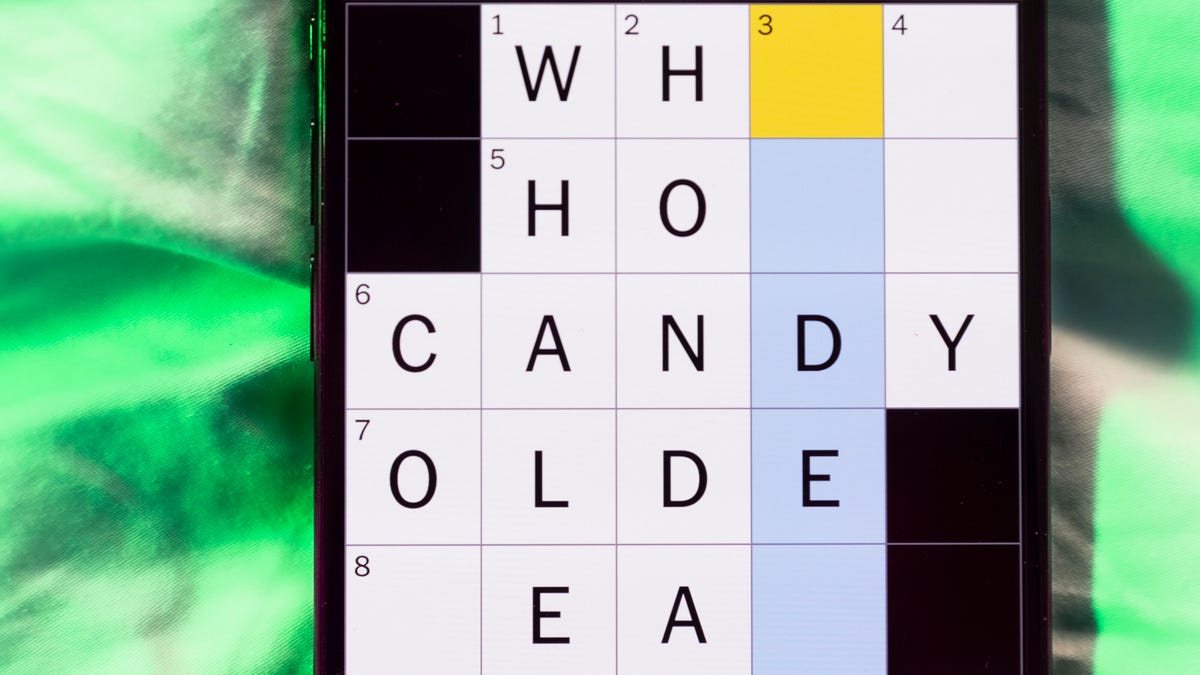

Today’s NYT Mini Crossword Answers for Friday, Feb. 20

Here are the answers for The New York Times Mini Crossword for Feb. 20.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Today’s Mini Crossword expects you to know a little bit about everything — from old political parties to architecture to video games. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Political party that competed with Democrats during the 1830s-’50s

Answer: WHIGS

6A clue: Four Seasons, e.g.

Answer: HOTEL

7A clue: Dinosaur in the Mario games

Answer: YOSHI

8A clue: Blizzard or hurricane

Answer: STORM

9A clue: We all look up to it

Answer: SKY

Mini down clues and answers

1D clue: «Oh yeah, ___ that?»

Answer: WHYS

2D clue: Says «who»?

Answer: HOOTS

3D clue: «No worries»

Answer: ITSOK

4D clue: Postmodern architect Frank

Answer: GEHRY

5D clue: Narrow

Answer: SLIM

Technologies

PlayStation 6 Rumors: Potential 2029 Release, Specs, Pricing and More

While the PS6’s release is still years away, here’s what we know so far about the next-gen console from Sony.

The PlayStation 5 will turn six years old this year. For a game console, that means it’s coming into its twilight years. So, it’s understandable that gamers are starting to wonder what’s next. There’s is nothing official so far from Sony on when the PlayStation 6 might arrive, though.

Still, reports and rumors are circulating about Sony’s next-gen game console. While Sony has a sizable market lead over Microsoft’s Xbox, it now has different competition coming from the new powered-up Nintendo Switch 2 and the upcoming Steam Machine home console from Valve. Both devices offer different challenges for Sony in terms of portability, library of games and pricing.

Here’s what we know about the PS6 so far.

When will the PS6 come out?

Sony, for obvious reasons, hasn’t provided a window for when the PS6 will come out. Speculation puts the console’s release in 2027, which would be seven years after the release of the PS5, and consoles have generally been on a seven-year cycle.

Sony could push the release to 2028, according to a report from David Gibson, senior analyst at MST Financial. He believes the new PlayStation will likely be delayed as the company is expanding the lifecycle of the PS5, according to VideoGame Chronicles. However, a new report from Bloomberg says the release date could be pushed back to 2029, thanks to the current RAM shortage.

Will the PS6 be a handheld?

It does appear that Sony might be developing both a console and a handheld. Rumors were circulating that Sony was creating a handheld on par with the Nintendo Switch to complement the console.

The speculation is that this handheld will be able to play new PS6 games, as well as PS5 and PS4 games. While this seems unlikely from a handheld, it’s possible the device would have enough power to run PS5 games and, in turn, PS4 titles, while PS6 games would be playable at a lower visual quality.

The YouTube channel Moore’s Law Is Dead reported in December that this PS6 handheld is already being tested by developers but that its lower-power mode reportedly doesn’t play PS5 games well, as it lowers the frames of the game when in use.

Sony’s strategy for this generation could be about keeping players in the PlayStation ecosystem at home and on the go, so they won’t be tempted by competitor handhelds such as the Xbox ROG Ally or Steam Deck.

How much will the PS6 cost?

Figuring out the potential pricing for this upcoming generation of consoles is tricky. There are so many unknown factors that complicate the answer.

Current tariffs, for example, have caused Sony, like Microsoft and Nintendo, to raise console prices, making it hard to predict what will happen in the coming years. The tariffs could go away, but if they continue, Sony may have to move its console production to another country that has a minimal tariff or hope that the countries that manufacture its hardware — Vietnam and China — strike a deal with the US.

Another issue is the RAM shortage and the resulting skyrocketing prices. Brought on by the demands of data centers across the globe being built out to handle the growth in AI usage, memory prices have already jumped. Those increases are leading to more expensive desktops, laptops and, really, anything that uses RAM, like tablets, phones and gaming devices.

The sweet spot for any console release would be $500, but that seems more like a pipe dream at this point. What could be used as a marker for hardware prices is Valve’s upcoming Steam Machine later this year, which is speculated to stay in the $600 to $700 range.

As for the handheld portion, the pricing could be more aggressive than the offering of the current handheld market. A video from August, from the YouTube channel Moore’s Law Is Dead, says the pricing for the PS6 portable could be in the range of $400 to $500. This could mean that to get the full PS6 experience, gamers will have to drop at least $1,000.

What are the PS6 specs?

Like other gaming hardware makers, Sony is working closely with AMD for its components. Back in October, the lead architect for the PS5, Mark Cerny, hosted a video with Jack Huynh, SVP and GM of AMD’s computing and graphics group. The video was uploaded to the PlayStation YouTube channel.

While the talk between the two didn’t confirm what technology will power the PS6, they hinted a bit about what’s next with a collaboration between the two companies, called Project Amethyst.

Huynh introduced Radiance Cores, which are AMD’s new technology for ray tracing and path tracing. Another technology, introduced to handle the GPU demands of AMD’s Fidelity Super Resolution and PlayStation Spectral Super Resolution upscaling, is Neural Arrays. And AMD’s Universal Compression can help relieve bottlenecks with the GPU memory bandwidth limitations.

While there are few verifiable details about the chips powering the PS6, Sony will work with AMD to create customized hardware for its PS6, just like Nintendo did with the Switch 2 and Microsoft is doing with the next Xbox.

The PS6 is likely to have at least 16GB of RAM and a 1TB solid-state drive for storage. It will also likely have the latest standards for wireless technology, such as Wi-Fi 7, and the newest media interface, HDMI 2.2.

Sony will also develop some other PlayStation-focused features in the same fashion as the adaptive triggers on the DualSense PS5 controller and more functionality with cloud gaming for PS Plus subscribers.

Many questions are still left to be answered about the PS6, with the ultimate question on whether the 10th generation of game consoles will, in fact, be the last.

Technologies

Google Rolls Out Latest AI Model, Gemini 3.1 Pro

Starting Thursday, Gemini 3.1 Pro can be accessed via the AI app, NotebookLM and more.

Google took the wraps off its latest AI model, Gemini 3.1 Pro, on Thursday, calling it a «step forward in core reasoning.» The software giant says its latest model is smarter and more capable for complex problem-solving.

Google shared a series of bookmarks and examples of the latest model’s capabilities, and is rolling out Gemini 3.1 to a series of products for consumers, enterprise and developers.

The overall AI model landscape seems to change weekly. Google’s release comes just a few days after Anthropic dropped the latest version of Claude, Sonnet 4.6, which can operate a computer at a human baseline level.

Benchmarks of Gemini 3.1

Google shared some details about AI model benchmarks for Gemini 3.1 Pro.

The announcement blog post highlights that the Gemini 3.1 Pro benchmark for the ARC-AGI-2 test for solving abstract reasoning puzzles sits at 77.1%. This is noticeably higher than Gemini 3 Pro’s 31.1% score for the same test.

The ARC-AGI-2 benchmark is one of multiple improvements coming from Gemini 3.1 Pro, Google says.

3.1 Pro enhancements

With better benchmarks nearly across the board, Google highlighted some of the ways that translate in general use:

Code-based animations: The latest Gemini model can easily create animated SVG images that are scalable without quality loss and ready to be added to websites with a text prompt.

Creative coding: Gemini 3.1 Pro generated an entire website based on a character from Emily Brontë’s novel Wuthering Heights, if she were a landscape photographer showing off her portfolio.

Interactive design: 3.1 Pro was used to create a 3D interactive starling murmuration that allows the flock to be controlled in an assortment of ways, all while a soundscape is generated that changes with the movement of the birds.

Availability

As of Thursday, Gemini 3.1 Pro is rolling out in the Gemini app for those with the AI Pro or Ultra plans. NotebookLM users subscribed to one of those plans will also be able to take advantage of the new model.

Both developers and enterprises can also access the new model via the Gemini API through a range of products, including AI Studio, Gemini Enterprise, Antigravity and Android Studio.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow