Technologies

CNET’s Daily Tariff Price Tracker: I’m Following 11 Key Products to Help Monitor Tariff Impacts

As inconsistent as things have been, Donald Trump’s tariff policies are still certain to cause price hikes in the US, and I’m here to help track the price moves for things you might want to buy.

President Donald Trump ramped up his clashes with companies over their reactions to his contentious tariff agenda in the past few weeks. For starters, he demanded that Walmart eat the cost of the new import taxes after the company said its prices would go up by the summer because of his import taxes. To close out last week, he threatened Apple with a 25% duty on its products if it doesn’t move manufacturing to the US, a prospect that has been widely dismissed as a fantasy. The president also threatened a 50% tariff on the European Union but pushed that idea back to July after speaking with trade representatives for the union.

The basic truth of the situation is that tariffs are almost certainly going to cause prices to climb and with this piece I’ve been tracking just that: the daily effect of Trump’s tariffs on the prices of 11 popular products you might want or need to buy, whether it be a new phone, laptop or your daily coffee. So far, we’ve seen notable price hikes for the flagship Xbox game console, while everything else has, as Amazon claimed, remained steady aside from occasional fluctuations that might not be tariff-related. That sort of consistency is far from certain, however, given the recent warnings from major retailers like Target and Walmart.

CNET Tariff Tracker Index

Above, you can check out a chart with the average price of the 11 included items over the course of 2025. This will help give you a sense of the overall price changes and fluctuations going on. Further down, you’ll be able to check out charts for each individual product being tracked.

A recent tariff agreement with China, much hyped by the White House, did significantly cut tariff rates against the US’s biggest trading partner. The new 30% rate is only temporary, however, and still historically high. It just looks more reasonable next to the ludicrous 145% rate that was previously in place. As those negotiations move along, companies continue to warn of impending price hikes to deal with the new tariffs, including Sony, which could potentially mean a price hike for its ever-popular PlayStation 5 consoles.

We’ll be updating this article regularly as prices change. It’s all in the name of helping you make sense of things so be sure to check back every so often. For more, check out CNET’s guide to whether you should wait to make big purchases or buy them now and get expert tips about how to prepare for a recession.

Methodology

We’re checking prices daily and will update the article and the relevant charts right away to reflect any changes. The following charts show a single bullet point for each month, with the most recent one labeled «Now» and showing the current price. For the past months, we’ve gone with what was the most common price for each item in the given month.

In most cases, the price stats used in these graphs were pulled from Amazon using the historical price-tracker tool Keepa. For the iPhones, the prices come from Apple’s official materials and are based on the 128-gigabyte base model of the latest offering for each year: the iPhone 14, iPhone 15 and iPhone 16. For the Xbox Series X, the prices were sourced from Best Buy using the tool PriceTracker. If any of these products happen to be on sale at a given time, we’ll be sure to let you know and explain how those price drops differ from longer-term pricing trends that tariffs can cause.

The 11 products we’re tracking

Mostly what we’re tracking in this article are electronic devices and digital items that CNET covers in depth, like iPhones and affordable 4K TVs — along with a typical bag of coffee, a more humble product that isn’t produced in the US to any significant degree.

The products featured were chosen for a few reasons: Some of them are popular and/or affordable representatives for major consumer tech categories, like smartphones, TVs and game consoles. Others are meant to represent things that consumers might buy more frequently, like printer ink or coffee beans. Some products were chosen over others because they are likely more susceptible to tariffs. Some of these products have been reviewed by CNET or have been featured in some of our best lists.

- iPhone 16, 128GB

- Duracell AA batteries, 24-pack

- Samsung DU7200 65-inch TV

- Xbox Series X

- Apple AirPods Pro 2 with USB-C case

- HP 962 CMY Printer Ink

- Anker 10,000-mAh, 30-watt power bank

- Bose TV speaker

- Oral-B Pro 1000 electric toothbrush

- Lenovo IdeaPad Flex 5i Chromebook, 256GB

- Starbucks 28-ounce ground dark roast coffee

Below, we’ll get into more about each individual product.

iPhone 16

The iPhone is the most popular smartphone brand in the US, so this was a clear priority for price tracking. The iPhone has also emerged as a major focal point for conversations about tariffs, given its popularity and its susceptibility to import taxes because of its overseas production, largely in China. Trump has reportedly been fixated on the idea that the iPhone can and should be manufactured in the US, an idea that experts have dismissed as a fantasy. Estimates have also suggested that a US-made iPhone would cost as much as $3,500.

Something to note about this graph: The price listed is the one you’ll see if you buy your phone through a major carrier. If you, say, buy direct from Apple or Best Buy without a carrier involved, you’ll be charged an extra $30, so in some places, you might see the list price of the standard iPhone 16 listed as $830.

Apple has made several moves this year to protect its prices in the US as much as possible, like flying in bulk shipments of product ahead of the tariffs taking effect and working to move production for the American market from China to India, where tariff rates are less severe. This latter move provoked a response from Trump, given his noted fixation on the iPhone, saying last week that he «had a little problem» with Tim Cook over the move, claiming without evidence that the Apple CEO pledged to bring more manufacturing to the US. Cook and others close to the company for years say that the supply chains for its products are too complex to move manufacturing entirely to the US.

This week, Trump further threatened a 25% penalty rate against Apple products if it did not move manufacturing to the US. How that will play out is still unclear, but notably, foreign-made iPhones with 25% tax would still probably be much cheaper than iPhones predominantly made in the US.

Duracell AA batteries

A lot of the tech products in your home might boast a rechargeable energy source but individual batteries are still an everyday essential and I can tell you from experience that as soon as you forget about them, you’ll be needing to restock. The Duracell AAs we’re tracking are some of the bestselling batteries on Amazon.

Samsung DU7200 TV

Alongside smartphones, televisions are some of the most popular tech products out there, even if they’re an infrequent purchase. This particular product is a popular entry-level 4K TV and was CNET’s pick for best overall budget TV for 2025. Unlike a lot of tech products that have key supply lines in China, Samsung is a South Korean company so it might have some measure of tariff resistance.

For most of 2025, this model has hovered around $400 but it’s currently sitting at about $429. Whether this is a temporary fluctuation or a more permanent price hike, we’ll let you know as time goes on.

Xbox Series X

Video game software and hardware are a market segment expected to be hit hard by the Trump tariffs. Microsoft’s Xbox is the first console brand to see price hikes — the company cited «market conditions» along with the rising cost of development. Most notably, this included an increase in the price of the flagship Xbox Series X, up from $500 to $600. Numerous Xbox accessories also were affected and the company also said that «certain» games will eventually see a price hike from $70 to $80.

Initially, we were tracking the price of the much more popular Nintendo Switch as a representative of the gaming market. Nintendo has not yet hiked the price of its handheld-console hybrid and stressed that the $450 price tag of the upcoming Switch 2 has not yet been inflated because of tariffs. Sony, meanwhile, has so far only increased prices on its PlayStation hardware in markets outside the US.

AirPods Pro 2

The latest iteration of Apple’s wildly popular true-wireless earbuds are here to represent the headphone market. Much to the chagrin of the audiophiles out there, a quick look at sales charts on Amazon shows you just how much the brand dominates all headphone sales. Earlier in the year, they tended to hover around $199 on the site, a notable discount from its $249 list price. In the past month, however, its gotten closer to that price on Amazon, so if you’re looking to buy a pair, you might want to consider doing it sooner rather than later.

HP 962 CMY printer ink

This HP printer ink includes cyan, magenta and yellow all in one product and recently saw its price jump from around $72 — where it stayed for most of 2025 — to $80, which is around its highest price over the last five years. We will be keeping tabs to see if this is a long-term change or a brief uptick.

This product replaced Overture PLA Filament for 3D printers in this piece, but we’re still tracking that item.

Anker 10,000-mAh, 30-watt power bank

Anker’s accessories are perennially popular in the tech space and the company has already announced that some of its products will get more expensive as a direct result of tariffs. This specific product has also been featured in some of CNET’s lists of the best portable chargers. While the price has remained steady throughout the year, it is currently on sale for $16 on Amazon, but only for Prime members.

Bose TV speaker

Soundbars have become important purchases, given the often iffy quality of the speakers built into TVs. While not the biggest or the best offering in the space, the Bose TV Speaker is one of the more affordable soundbar options out there, especially hailing from a brand as popular as Bose. This product has been one of the steadiest on this list in terms of price throughout the year, but it’s currently on sale for $199, potentially as part of Amazon’s Memorial Day sale. So, if you’re looking for an affordable, tariff-free TV speaker, now might be the time.

Oral-B Pro 1000 electric toothbrush

They might be a lot more expensive than their traditional counterparts but electric toothbrushes remain a popular choice for consumers because of how well they get the job done. I know my dentist won’t let up on how much I need one. This particular Oral-B offering was CNET’s overall choice for the best electric toothbrush for 2025.

Lenovo IdeaPad Flex 5i Chromebook

Lenovo is notable among the big laptop manufacturers for being a Chinese company making its products especially susceptible to Trump’s tariffs.

Starbucks Ground Coffee (28-ounce bag)

Coffee is included in this tracker because of its ubiquity —I’m certainly drinking too much of it these days —and because it’s uniquely susceptible to Trump’s tariff agenda. Famously, coffee beans can only be grown within a certain distance from Earth’s equator, a tropical span largely outside the US and known as the «Coffee Belt.»

Hawaii is the only part of the US that can produce coffee beans, with data from USAFacts showing that 11.5 million pounds were harvested there in the 2022-23 season — little more than a drop in the mug, as the US consumed 282 times that amount of coffee during that period. Making matters worse, Hawaiian coffee production has declined in the past few years.

All that to say: Americans get almost all of their coffee from overseas, making it one of the most likely products to see price hikes from tariffs.

Technologies

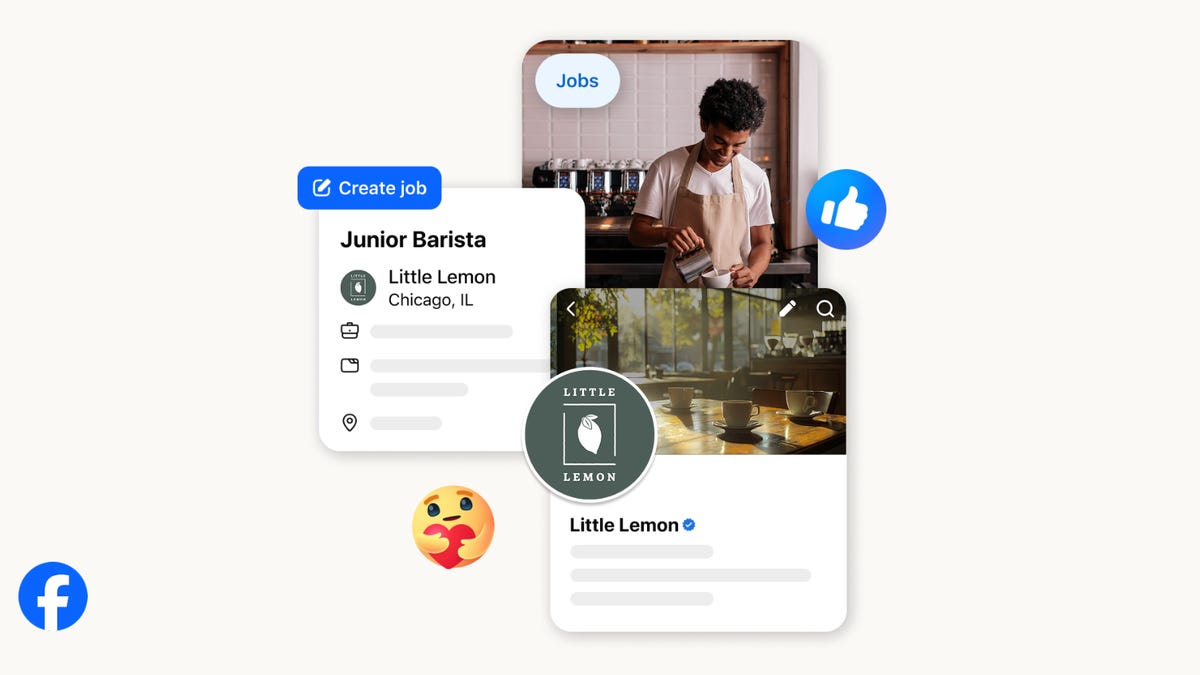

Facebook Brings Back Local Job Listings: How to Apply

One of Facebook’s most practical features from 2022 is being revived by Meta.

On the hunt for work? A Local Jobs search is being rolled out by Meta to make it easier for people in the US to discover and apply for nearby work directly on Facebook. The feature is inside Facebook Marketplace, Groups and Pages, Meta said last week, letting employers post openings and job seekers filter roles by distance, category or employment type.

You can apply or message employers directly through Facebook Messenger, while employers can publish job listings with just a few taps — similar to how you would post items for sale on Marketplace.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Facebook offered a Jobs feature before discontinuing it in 2022, pushing business hiring toward its other platforms. Its return suggests Meta is attempting to expand Facebook’s usefulness beyond social networking and to position it once again as a hub for community-driven opportunities.

Read more: Meta’s All In on AI Creating the Ads You See on Instagram, Facebook and WhatsApp

«We’ve always been about connecting with people, whether through shared interests or key life events,» the press release states. «Now, if you’re looking for entry-level, trade and service industry employment in your community, Facebook can help you connect with local people and small businesses who are hiring.»

Read more: What Is Meta AI? Everything to Know About These AI Tools

How to get started with Local Jobs on Facebook

According to Meta, Local Jobs will appear as a dedicated section in Facebook Marketplace starting this week. If you’re 18 or older, you can:

- Tap the Marketplace tab on the Facebook app or website.

- Select Jobs to browse available positions nearby.

- Use filters for job type, category and distance.

- Tap Apply or message the employer directly via Messenger.

Businesses and page admins can post jobs by creating a new listing in Marketplace or from their Facebook Page. Listings can include job details, pay range, and scheduling information and will appear in local searches automatically.

The Local Jobs feature is rolling out across the US now, with Meta saying it plans to expand it in the months ahead.

Technologies

Tesla Has a New Range of Affordable Electric Cars: How Much They Cost

The new, stripped-back versions of the Model Y and Model 3 have a more affordable starting price.

Technologies

Today’s NYT Strands Hints, Answers and Help for Oct. 22 #598

Here are hints and answers for the NYT Strands puzzle for Oct. 22, No. 598.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle is a fun one — I definitely have at least two of these in my house. Some of the answers are a bit tough to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: Catch all.

If that doesn’t help you, here’s a clue: A mess of items.

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- BATE, LICE, SLUM, CAPE, HOLE, CARE, BARE, THEN, SLAM, SAMBA, BACK

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- TAPE, COIN, PENCIL, BATTERY, SHOELACE, THUMBTACK

Today’s Strands spangram

Today’s Strands spangram is JUNKDRAWER. To find it, look for the J that’s five letters down on the far-left row, and wind down, over and then up.

Quick tips for Strands

#1: To get more clue words, see if you can tweak the words you’ve already found, by adding an «S» or other variants. And if you find a word like WILL, see if other letters are close enough to help you make SILL, or BILL.

#2: Once you get one theme word, look at the puzzle to see if you can spot other related words.

#3: If you’ve been given the letters for a theme word, but can’t figure it out, guess three more clue words, and the puzzle will light up each letter in order, revealing the word.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow