Technologies

IRS Has Issued Over $211 Billion in Tax Refunds, With 2025’s Filing Season Ending Today

With today’s federal income tax deadline, the IRS surpasses numbers from 2024.

The 2025 tax season has been underway since late January, and for many tax payers, the filing season officially wraps up today (unless you’ve filed an extension or the IRS issued you more time to file due to local natural disasters). That means more than 100 million taxpayers have already filed their tax return and have already received their refund money or are patiently tracking their tax refunds.

Last Friday, the IRS said it has received over 101 million tax returns and issued more than 67 million tax refunds. Through the final week of the 2024 tax season, the average refund amount had risen by approximately 3.5% compared to 2023’s season.

TAX SOFTWARE DEALS OF THE WEEK

-

$0 (save $0)

-

$56 (save $24)

-

$83 (save $32)

Read on for a breakdown of how the IRS has been performing up to Tax Day.

For more tax tips, check out our essential tax filing cheat sheet and how to track your refund from the IRS into your bank account. Check out our pick for the best tax software of 2025.

How many tax returns has the IRS processed so far in 2025?

On Friday, the IRS released statistics comparing its progress through the 10th week of tax season 2024 (ending April 5, 2024) with its progress through the 10th week of 2025 (ending April 4, 2025). So far this year, the IRS has processed 100.3 million federal income tax returns, up 0.2% from the 100.1 million returns it had processed by the same time last year.

The IRS has received more than 101.4 million tax returns total so far, compared with 101.8 million last year, marking a 0.4% decrease.

The agency also breaks down how returns have been filed, with 98.1 million returns received electronically (53.3 million filed by tax professionals and 44.7 million self-prepared).

How many tax refunds has the IRS issued in 2025?

The IRS has issued 67.7 million refunds, a 1.4% increase from the approximate 66.8 million sent out at this point in 2024.

The average tax refund amount so far is $3,116, up 3.5% from last year’s average of $3,011 at this time last year.

How do 2025’s tax refunds compare to 2024’s so far?

So far, the IRS has issued more than $211 billion in tax refunds, a 5% increase from the $201 billion in tax refunds it had issued by this time in 2024.

The IRS noted that large percentage differences in filing statistics are typical for the beginning of each tax season. It accurately predicted that the numbers would even out as more people gathered important tax documents and filed before today’s Tax Day deadline.

Technologies

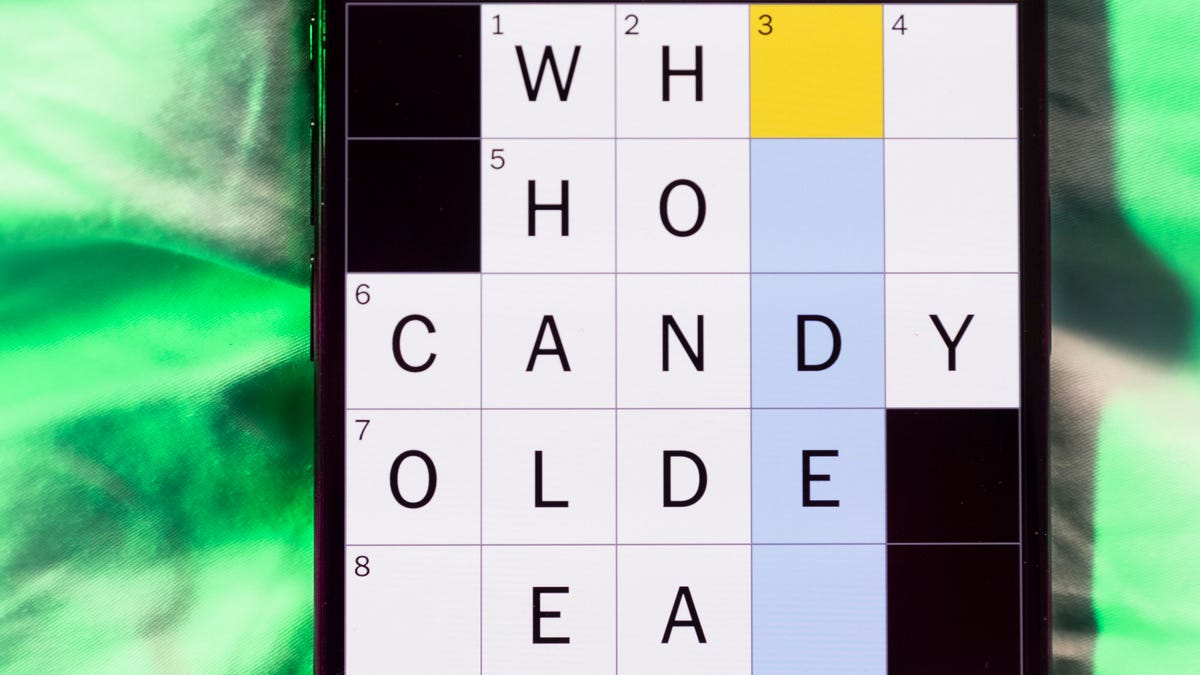

Today’s NYT Mini Crossword Answers for Saturday, Feb. 21

Here are the answers for The New York Times Mini Crossword for Feb. 21.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? It’s the long Saturday version, and some of the clues are stumpers. I was really thrown by 10-Across. Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: «Jersey Shore» channel

Answer: MTV

4A clue: «___ Knows» (rhyming ad slogan)

Answer: LOWES

6A clue: Second-best-selling female musician of all time, behind Taylor Swift

Answer: MADONNA

8A clue: Whiskey grain

Answer: RYE

9A clue: Dreaded workday: Abbr.

Answer: MON

10A clue: Backfiring blunder, in modern lingo

Answer: SELFOWN

12A clue: Lengthy sheet for a complicated board game, perhaps

Answer: RULES

13A clue: Subtle «Yes»

Answer: NOD

Mini down clues and answers

1D clue: In which high schoolers might role-play as ambassadors

Answer: MODELUN

2D clue: This clue number

Answer: TWO

3D clue: Paid via app, perhaps

Answer: VENMOED

4D clue: Coat of paint

Answer: LAYER

5D clue: Falls in winter, say

Answer: SNOWS

6D clue: Married title

Answer: MRS

7D clue: ___ Arbor, Mich.

Answer: ANN

11D clue: Woman in Progressive ads

Answer: FLO

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Feb. 21, #516

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Feb. 21, No. 516.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition is a tough one. I actually thought the purple category, usually the most difficult, was the easiest of the four. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Old Line State.

Green group hint: Hoops legend.

Blue group hint: Robert Redford movie.

Purple group hint: Vroom-vroom.

Answers for today’s Connections: Sports Edition groups

Yellow group: Maryland teams.

Green group: Shaquille O’Neal nicknames.

Blue group: Associated with «The Natural.»

Purple group: Sports that have a driver.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is Maryland teams. The four answers are Midshipmen, Orioles, Ravens and Terrapins.

The green words in today’s Connections

The theme is Shaquille O’Neal nicknames. The four answers are Big Aristotle, Diesel, Shaq and Superman.

The blue words in today’s Connections

The theme is associated with «The Natural.» The four answers are baseball, Hobbs, Knights and Wonderboy.

The purple words in today’s Connections

The theme is sports that have a driver. The four answers are bobsled, F1, golf and water polo.

Technologies

Wisconsin Reverses Decision to Ban VPNs in Age-Verification Bill

The law would have required websites to block VPN users from accessing «harmful material.»

Following a wave of criticism, Wisconsin lawmakers have decided not to include a ban on VPN services in their age-verification law, making its way through the state legislature.

Wisconsin Senate Bill 130 (and its sister Assembly Bill 105), introduced in March 2025, aims to prohibit businesses from «publishing or distributing material harmful to minors» unless there is a reasonable «method to verify the age of individuals attempting to access the website.»

One provision would have required businesses to bar people from accessing their sites via «a virtual private network system or virtual private network provider.»

A VPN lets you access the internet via an encrypted connection, enabling you to bypass firewalls and unblock geographically restricted websites and streaming content. While using a VPN, your IP address and physical location are masked, and your internet service provider doesn’t know which websites you visit.

Wisconsin state Sen. Van Wanggaard moved to delete that provision in the legislation, thereby releasing VPNs from any liability. The state assembly agreed to remove the VPN ban, and the bill now awaits Wisconsin Governor Tony Evers’s signature.

Rindala Alajaji, associate director of state affairs at the digital freedom nonprofit Electronic Frontier Foundation, says Wisconsin’s U-turn is «great news.»

«This shows the power of public advocacy and pushback,» Alajaji says. «Politicians heard the VPN users who shared their worries and fears, and the experts who explained how the ban wouldn’t work.»

Earlier this week, the EFF had written an open letter arguing that the draft laws did not «meaningfully advance the goal of keeping young people safe online.» The EFF said that blocking VPNs would harm many groups that rely on that software for private and secure internet connections, including «businesses, universities, journalists and ordinary citizens,» and that «many law enforcement professionals, veterans and small business owners rely on VPNs to safely use the internet.»

More from CNET: Best VPN Service for 2026: VPNs Tested by Our Experts

VPNs can also help you get around age-verification laws — for instance, if you live in a state or country that requires age verification to access certain material, you can use a VPN to make it look like you live elsewhere, thereby gaining access to that material. As age-restriction laws increase around the US, VPN use has also increased. However, many people are using free VPNs, which are fertile ground for cybercriminals.

In its letter to Wisconsin lawmakers prior to the reversal, the EFF argued that it is «unworkable» to require websites to block VPN users from accessing adult content. The EFF said such sites cannot «reliably determine» where a VPN customer lives — it could be any US state or even other countries.

«As a result, covered websites would face an impossible choice: either block all VPN users everywhere, disrupting access for millions of people nationwide, or cease offering services in Wisconsin altogether,» the EFF wrote.

Wisconsin is not the only state to consider VPN bans to prevent access to adult material. Last year, Michigan introduced the Anticorruption of Public Morals Act, which would ban all use of VPNs. If passed, it would force ISPs to detect and block VPN usage and also ban the sale of VPNs in the state. Fines could reach $500,000.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow