Technologies

Your Venmo Privacy Could Be Compromised. How to Protect Your Account

When it comes to your funds, it’s important to be aware of privacy risks for payment apps.

Millions of people use mobile payment apps like PayPal’s Venmo and Square’s Cash App everyday to transfer money directly from their bank accounts to friends, family and merchants. These platforms offer convenience, but they aren’t without security risks, due in part to their combination of finance and social media. Users can also be targets for hackers looking to drain financial accounts.

But don’t worry — there are plenty of ways for you to secure your Venmo and Cash App accounts with a few simple settings changes and privacy best practices. Here’s what to do.

Basic tips for protecting your privacy on Venmo and Cash App

Both payment apps use encryption and fraud detection technology to protect account information. But to better ensure your security, you should take a few extra steps.

Use a randomly generated password

We know — you’re tired of hearing about how you need to use unique, hard-to-guess passwords for every account. But it’s still true, especially when your money’s involved. One easy way to do this is to use a password manager. Our favorites — including LastPass

, 1Password and Bitwarden — offer a free tier of service with all of the basics: password storage, strong and secure password generation and autofill capabilities.

A password manager can help keep your Venmo and Cash App accounts secure.

Angela Lang/CNETBeware of common scams

Criminals target users of apps like Venmo and PayPal in all kinds of clever ways. There have been reports of hackers posing as Venmo and Cash App support staff, calling or texting users, «helping» them change their passwords and then draining the accounts.

Scammer landlords have asked prospective renters for a deposit before offering apartment tours. Scammer pet owners have used a similar bait-and-switch, offering purebred animals at extremely low prices, asking for advance payment and then disappearing. Cash App’s support page is full of these types of calamities.

«Nobody at Venmo will ever contact you to request a password or verification code to your account,» according to the app’s security support page. The same is true for Cash App.

If you fall victim to a scam on either app, you should contact support@venmo.com or access resources through Cash App’s site.

Don’t use banking apps on public Wi-Fi (or invest in a VPN)

When you log into a financial app on any public Wi-Fi network — at a hotel, airport or coffee shop, for example — it can give malicious actors an opportunity to break into your account. It’s happened on cash-sharing apps before.

If you absolutely need to access your account and can’t use a reliable network, we recommend using a VPN to hide your activity from spying eyes. Here’s how to set up a VPN on your iPhone or Android and our list of the best VPNs of 2022.

Using a VPN while on public Wi-Fi is a good way to protect yourself while using any app related to finance.

Sarah Tew/CNETDon’t send money to strangers

Avoid sending payments to people you don’t know and trust through Venmo and Cash App. Neither app is currently optimized for buying or selling goods or services, though Venmo is working on a business profiles feature to make retail and commercial sales more secure. If you’re a vendor considering using Cash App, you’re better off creating a business account through Square Payments.

Read more: 6 Best Payment Apps

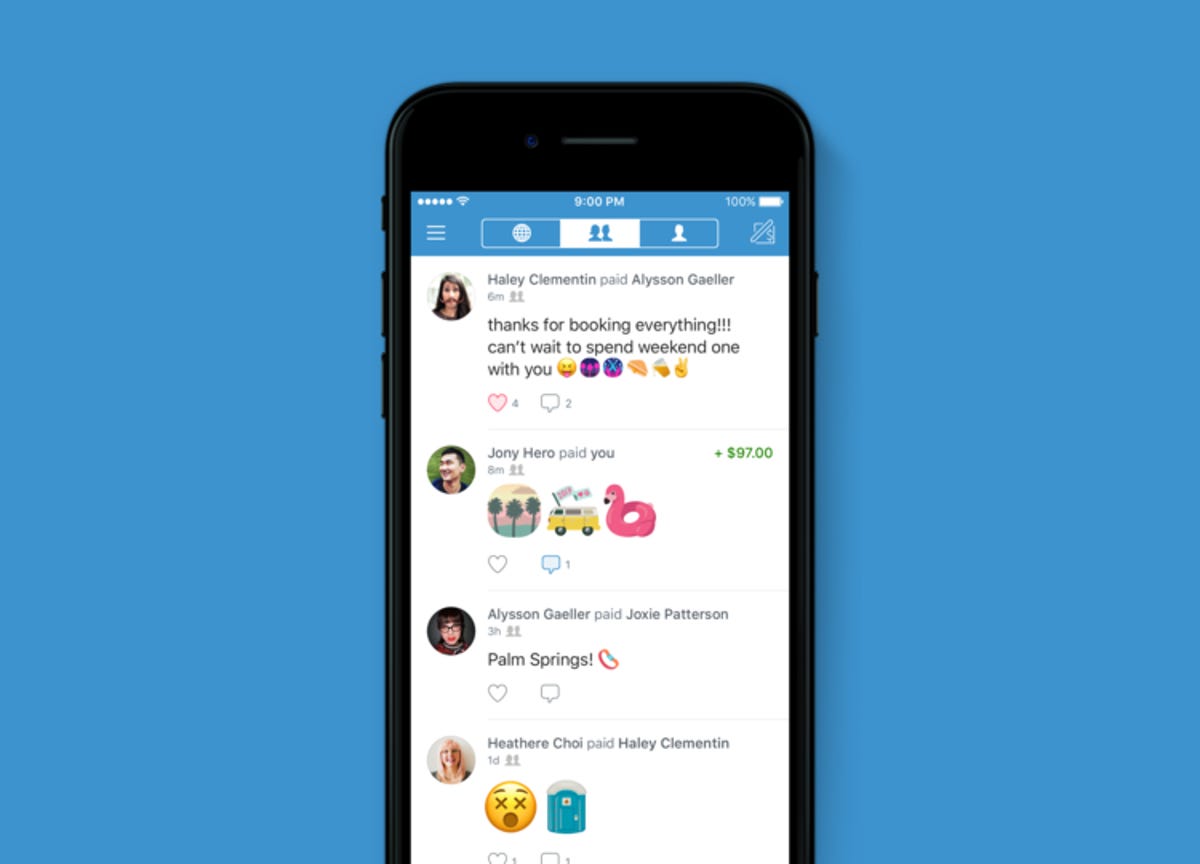

Make all of your Venmo transactions private

This is an absolute must. When you create a Venmo account, by default all of your transactions are public — which means anyone on the internet can see exactly what you’re sending, and to whom. This public record has been used to figure out everything from who won The Bachelor before a season aired to an alleged political sex trafficking investigation.

Making all of your transactions private by default is extremely easy. Open the Venmo app, and tap the three lines in the upper right corner for the menu. Tap Settings > Privacy, and under Default Privacy Setting, tap Private. Now all of your future payments will only be visible to you and the recipient.

You can also change the privacy settings for past transactions. On the same Privacy page, under more, tap Past Transactions. You’ll see the option to Change to Friends, or Change All to Private.

One benefit of Cash App: All transactions are private by default.

If you don’t make your Venmo transactions private, anyone can see them.

VenmoEnable two-factor authentication

Two-factor authentication is a solid way to add another layer of security to your account. When you sign in on a new device, Venmo will send a code to the phone number registered with your account, that you’ll need to enter correctly to access your account.

To enable two-factor authentication on Venmo, open the app and tap the three lines in the upper right corner for the menu. Tap Settings, and under security, tap Remembered Devices. You’ll see the device you’re currently using, and possibly others you’ve used in the past. When you sign on with any of the devices on your list, you won’t need to enter a verification code. To remove any of the devices, swipe left and tap Delete. If you want to enable two-factor authentication on all devices, you can delete them all from this list.

On Cash App, every time you sign into your account on a new device, you’ll be sent a one-time login code. The app recommends adding two-factor authentication to your email account associated with the app for better protection.

Set up a pin or turn on Face ID

Enabling Face ID or a pin adds more security to your account when opening the app or making a transaction.

On Venmo, you can set this up so that every time you open the app, you’ll need to enter either your Face ID (or fingerprint scan depending on device) or your pin. To get started, tap the three lines in the upper right corner for the menu. Tap Settings, and under security, tap Face ID & PIN. Tap the toggle to Enable Face ID & PIN. The app will prompt you to enter a new passcode, and, if you’re on an iPhone, you’ll get a pop up notification asking if you’d like to allow Venmo to use Face ID to unlock your account. Tap OK. If you’re on an Android phone, it may say PIN code & biometric unlock.

On Cash App, you can set up a security lock that requires your Face ID, Touch ID or a pin to transfer funds. Tap your profile icon in the top right corner. Tap Privacy & Security, and under Security, toggle on Security Lock. The app will prompt you to enter a pin, and then enter your email address to confirm your selection with a code.

Setting up a pin or biometric login can help secure your accounts.

Brett Pearce/CNETTurn on payment send notifications

Get alerted to any unauthorized activity on your Venmo or Cash App accounts by turning on notifications.

On Venmo, go to Settings > Notifications. Choose from push, text or email notifications. Under Push notifications, you can toggle on and off notifications for bank transfers, payment received, payment sent and lots more. Turning on at least the payment sent notification is a good way to get an immediate alert of anyone else sending money through your account.

On Cash App, tap your profile icon, and tap Notifications. Tap to turn on push notifications by text or email.

Link a credit card instead of your bank account

Though you can add a checking or savings account to Venmo, it’s more secure to link it to a credit card. Though you’ll be subject to a 3% transaction fee, credit cards typically have much stronger theft and fraud protection than a conventional bank account.

To change your payment method on Venmo, go to Settings > Payment methods, and tap Add bank or card. Then tap Card, and enter your credit card information.

On Cash App, you need to enter your bank account information before entering a credit card. However, you can sign up for a free Cash Card debit card so you can use funds people send you through the app on the card.

For more, check out the best checking accounts, best savings accounts and best credit monitoring services.

Technologies

Apple to Build the Mac Mini in the United States for the First Time

Apple will begin manufacturing the wee desktop computer in Houston later this year.

Houston, we have some production. Apple announced Tuesday that it will be making its Mac Mini desktop computer in the US for the first time, shifting some manufacturing from its Asian plants, and will also increase AI server production at its existing Houston facility.

The California-based tech giant also said it will open the Advanced Manufacturing Center, a 20,000-square-foot facility where students, supplier employees and businesses will receive hands-on training in making Apple products, in the same city.

In its statement, Apple said the new Mac Mini production and increased AI server production will create thousands of jobs.

The Mac Mini will be manufactured at a 220,000-square-foot facility in North Houston. The other main building at that site is where Apple makes AI servers. The new Advanced Manufacturing Center will also be built at that location. The buildings are owned by Foxconn, the Chinese manufacturing giant that Apple initially partnered with in 2000 to produce the iMac.

Sabih Khan, Apple’s chief operating officer, said there will still be Mac Mini production in Asia after the Houston plant is up and running, according to a Wall Street Journal report.

By beginning Mac Mini production in the US, Apple is furthering its pledge to invest $600 billion in the US over four years. That promise, made last August, was in response to pressure from President Donald Trump’s administration to increase manufacturing in the US and to avoid Trump-imposed tariffs.

Apple also said it is sourcing more than 20 billion chips from 24 US factories, and that, by the end of 2026, every new iPhone and Apple Watch will have cover glass made at Corning’s facility in Harrodsburg, Kentucky.

CEO Tim Cook said his company is «deeply committed to the future of American manufacturing,» with production of the Mac Mini marking one step toward that commitment.

The Mac Mini, which initially went on sale in 2005 — CNET was there from the beginning — is the cheapest of the Apple desktops ($599 at the Apple store). It’s known as a BYODKM, an acronym coined by the late Apple co-founder Steve Jobs that stands for «Bring Your Own Display, Keyboard, Mouse.» In other words, the Mac Mini — only 5 inches long and 5 inches wide — comes without those peripherals, making it cheaper for those who already have them.

«The Mini can fit in your hand and be everything from an everyday home office computer to a full-on professional content-creation machine,» CNET’s Joshua Goldman wrote in his review of the latest model in 2024.

Goldman also said the Mac Mini is a «perfect pairing» with Apple Intelligence, the company’s AI system that is integrated with iPhones, iPads and Macs.

Market research firm Consumer Intelligence Research Partners estimates that the Mini accounts for less than 5% of its global Mac sales, according to the WSJ report.

Apple will also ramp up production of its AI servers. The company said manufacturing is ahead of schedule, months after beginning production in October. The servers are used in Apple data centers around the US.

Technologies

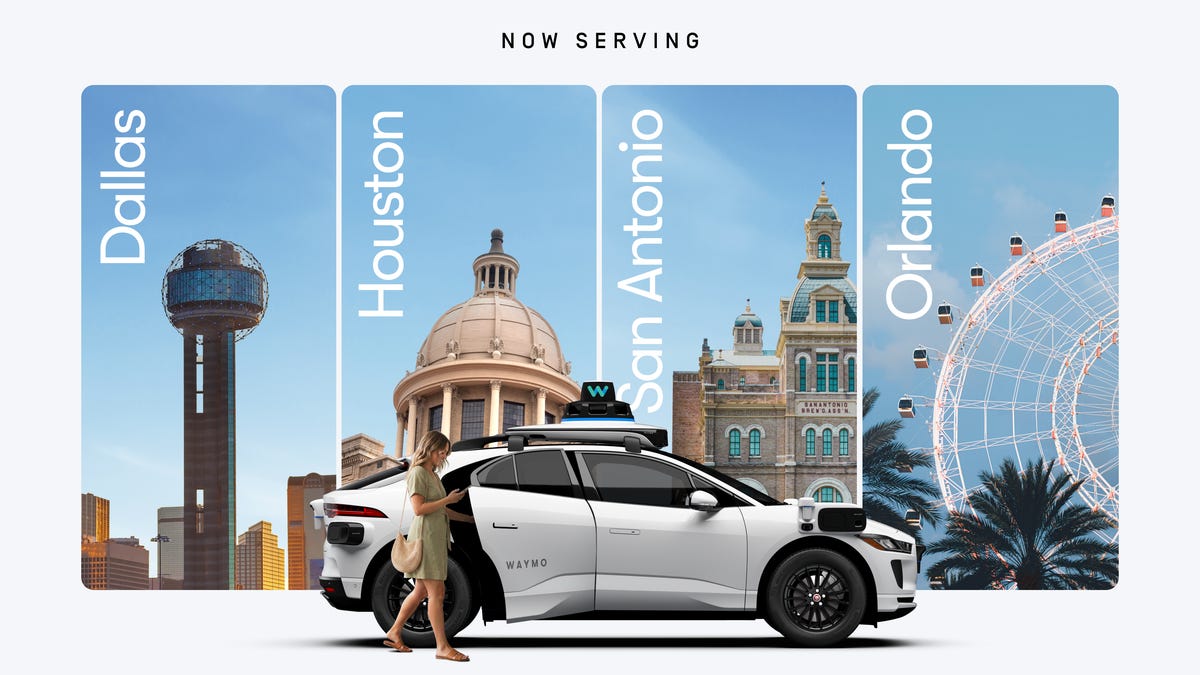

Waymo’s Autonomous Ride Service Expands to 4 New Cities

The company has doubled its operating area for robotaxi services over the past several months.

Technologies

Today’s NYT Connections Hints, Answers and Help for Feb. 25, #990

Here are some hints and the answers for the NYT Connections puzzle for Feb. 25 #990.

Looking for the most recent Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections: Sports Edition and Strands puzzles.

Today’s NYT Connections puzzle is kind of tough. That purple category, once again, expects you to spot hidden words that are related to each other within four of the grid words. It’s fun once you see the answer, but tough to figure out on your own. Read on for clues and today’s Connections answers.

The Times has a Connections Bot, like the one for Wordle. Go there after you play to receive a numeric score and to have the program analyze your answers. Players who are registered with the Times Games section can now nerd out by following their progress, including the number of puzzles completed, win rate, number of times they nabbed a perfect score and their win streak.

Read more: Hints, Tips and Strategies to Help You Win at NYT Connections Every Time

Hints for today’s Connections groups

Here are four hints for the groupings in today’s Connections puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: What a parent should do for a child.

Green group hint: «____ my dear Watson.»

Blue group hint: Some go by Jim.

Purple group hint: Look for hidden words.

Answers for today’s Connections groups

Yellow group: Care for.

Green group: Elementary.

Blue group: Jameses.

Purple group: Ending in family words.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections answers?

The yellow words in today’s Connections

The theme is care for. The four answers are baby, foster, mother and nurse.

The green words in today’s Connections

The theme is elementary. The four answers are basic, key, primary and principal.

The blue words in today’s Connections

The theme is Jameses. The four answers are Brown, Cook, Dean and Harden.

The purple words in today’s Connections

The theme is ending in family words. The four answers are alkaline (line), Declan (clan), diatribe (tribe) and napkin (kin).

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow