Technologies

Tax Scams Are Preying on Last-Minute Filers

If you still haven’t filed your taxes, think before you click.

There’s less than a month to go before this year’s income tax filing deadline, and security experts are warning consumers to be on the lookout for tax-related scams and other attempts to steal their refunds and personal information.

Just a heads up that like last year, this year’s federal income tax deadline is April 18 — three days later than usual — thanks to a weekend and Emancipation Day, which is observed in Washington, DC. But the more you procrastinate, the more likely you are to fall victim to some kind of tax-related cybercrime.

Scammers can capitalize on your last-minute efforts to play catch-up if you don’t take a beat before clicking on a dubious link or handing over personal information. Either action could put you at risk for financial fraud or identity theft.

Tax-season scammers often impersonate the IRS, tax professionals or online filing websites, said David Putnam, head of identity and protection for LifeLock, a provider of consumer identity theft protections.

Phishing emails, texts and even phone calls designed to look like they’re from the IRS, or an IRS agent, are a common sight this time of year. They might threaten jail time or big fines if the targeted person doesn’t pay what the cybercriminals might claim are back or overdue taxes.

Those are all sure signs of a scam, Putnam said.

«The IRS only communicates through snail mail, so if you get a text message claiming to be from the IRS, you’ll know you’re actually being contacted by a scammer,» he said.

The IRS also doesn’t take payments in the forms of cryptocurrency or gift cards, making requests for back taxes in those forms obvious signs of a scam too.

Phishing emails could also carry fake tax forms that look like they’re coming from an employer or a bank, said Ravi Srinivasan, CEO of Votiro, a cybersecurity company that specializes in the secure transfer of data.

Srinivasan said consumers are used to getting lots of these files from lots of different places. They’re not necessarily going to think twice before opening up an attachment that could contain malware instead of a tax form.

«Do they know that it’s clean? Do they know that it’s safe?» he asked. «They don’t. They just hope that it is and the bad actors know that.»

When consumers do file, it’s critical that they make sure they’re using a legitimate tax preparation service, since tax returns are chock full of people’s most sensitive personal information, including their Social Security numbers.

Unsolicited offers to file your taxes for you should be regarded with skepticism, Putnam said. They could be part of a «ghost preparation scam,» where a cybercriminal impersonates a tax professional and promises a large refund that never appears or steals your refund by routing it to another account.

They also could collect your personal information through a website spoofing of a legitimate tax preparation service, then use it to file a false tax return and claim your refund, he said.

«Remember, if you enter any personal information on a spoofed website, scammers will have access to it,» he said.

Here are a few tips from the IRS and others for staying alert.

File early. OK. The ship may have already sort of sailed on this one, but the earlier you file, the less time cybercriminals have to use your identity to commit fraud.

Watch out for phishing and smishing. The IRS won’t send unsolicited emails or texts. Skip the links and attachments and go straight to the IRS or the applicable state and city websites.

Get a PIN. File this tip under things to remember for next year. Taxpayers who can validate their identities with the IRS can obtain an identity protection PIN, a six-digit code that prevents a cybercriminal from filing a fraudulent tax return with your Social Security number.

Fight back against fraud. If you discover someone has filed a tax return in your name, complete a paper return and include form 14039 (Identity Theft Affidavit), Putnam said. Report the fraud to local law enforcement and the Federal Trade Commission. Monitor your credit reports and account statements and contact the three major credit bureaus to ask for a freeze so that no one can request new credit in your name.

Always use good passwords and 2FA. These are both a must for any account related to your tax returns and documents. Make sure you’re using good antivirus software and that it, along with your operating system, is up to date. While you’re at it, back up your tax information to a removable drive or encrypted cloud storage. Paper copies and drives should be securely stored.

Know who you’re dealing with. If you’re self-filing online, make sure you’re using a reputable service. If you hire someone to do it for you, make sure they’re who they say they are. Be especially careful when submitting documents both online and on paper. Any decent tax professional or service will use a secure portal, not ask you to email them unprotected. Paper documents shouldn’t be left on a desk for anyone to find.

Shred everything. Tax documents that are no longer needed must be properly destroyed. Dumpster diving still happens. Don’t be tempted to toss them in the trash and definitely don’t put them in the recycling.

Technologies

Apple’s AI Health Coach Project May Need a Wellness Check

The company’s ambitious plans to introduce a virtual health coach may be going back to the drawing board, according to a report.

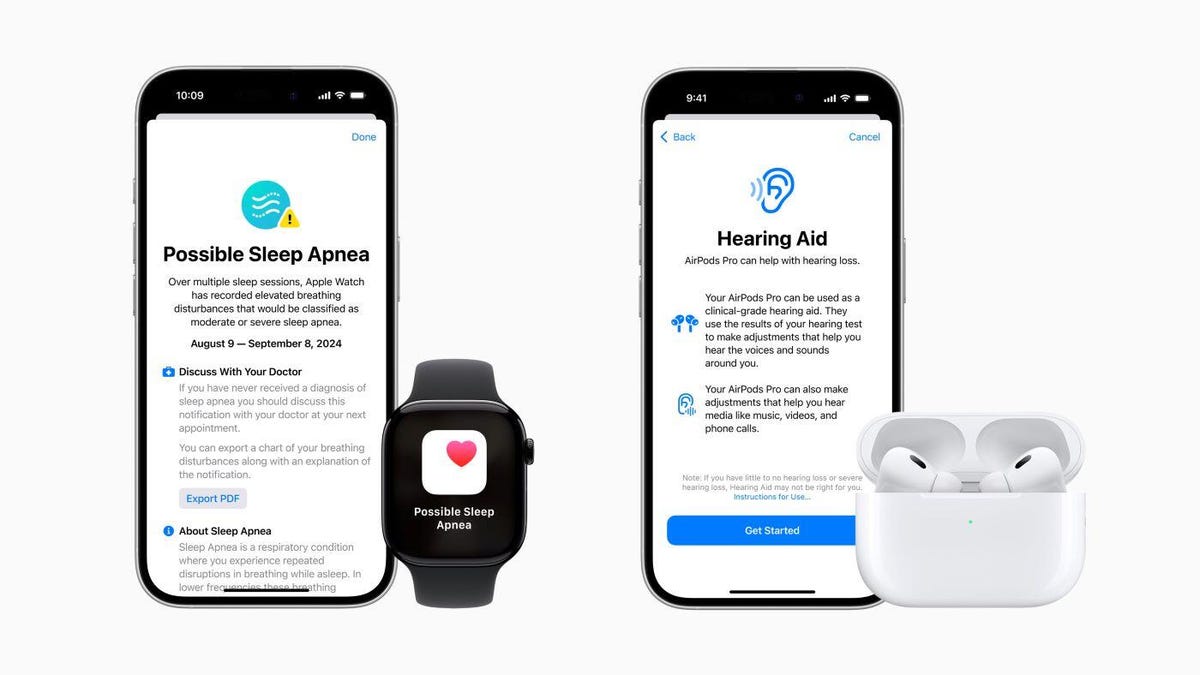

Apple is scaling back and rethinking its ambitious plans to introduce an AI-powered health coach, according to a Bloomberg report by Mark Gurman citing anonymous sources privy to the company’s plans.

The project, known inside Apple as Mulberry, was first reported last year, with the company expected to roll together health-related AI features as a coach or assistant. But now, Bloomberg reports, that project will be broken down into individual features introduced over time, as it has done with tools such as the sleep apnea and hearing tests added to Apple Watch and Apple AirPods.

A representative for Apple did not immediately respond to a request for comment.

Bloomberg’s sources point to a change in leadership over Apple’s health technology. Veteran services head Eddy Cue is overseeing those projects and addressing pressure from competitors pushing into the health space, including Oura and Peloton as well as tech giants like Google and OpenAI, which just launched ChatGPT Health.

(Disclosure: Ziff Davis, CNET’s parent company, filed a lawsuit against OpenAI in April, alleging that it infringed Ziff Davis copyrights in training and operating its AI systems.)

Apple was also said to have built a studio for a revamped health services app that would have included virtual and video wellness instructions, and integration with existing health tools and Apple devices. It is likely that some of that content and software will still be released publicly, just not in one package, according to Bloomberg.

Technologies

Here’s Why Taylor Swift’s Opalite Music Video Isn’t on YouTube Yet

The video is now available on Apple Music and Spotify, but it isn’t landing on YouTube for a couple more days.

YouTube may still be where many people instinctively go to watch music videos, but when Taylor Swift dropped her video for Opalite on Friday, it was noticeably absent from the platform. In fact, it won’t be landing on YouTube until Sunday, two days after its release on other streaming platforms.

So, why is the Opalite music video only available on Apple Music and Spotify Premium right now? It likely has to do with a disagreement between YouTube and Billboard, which ranks the most popular songs and albums of the week.

In December, Billboard shifted its charting methodology so paid and subscription-based streams are weighted even more favorably than ad-supported streams. Billboard started weighting paid streams higher than ad-supported ones in 2018. This most recent shift narrows that ratio from 1:3 to 1:2.5, putting numbers from platforms like YouTube at more of a disadvantage.

Following the change, YouTube posted a statement about its dispute with Billboard, calling the charting company’s methodology «an outdated formula.» It added, «This doesn’t reflect how fans engage with music today and ignores the massive engagement from fans who don’t have a subscription…We’re simply asking that every stream is counted fairly and equally, whether it is subscription-based or ad-supported—because every fan matters and every play should count.»

YouTube said that starting Jan. 16, 2026, its data would «no longer be delivered to Billboard or factored into their charts.»

For artists like Taylor Swift who count on early streams to boost their Billboard rankings, that could make YouTube a less appealing option for debuting new content. So the Opalite video will still be making its way to YouTube, but you’ll have to wait until Sunday, Feb. 8, at 8 a.m. ET to watch it there. Representatives for Swift, YouTube and Billboard did not immediately respond to a request for comment.

YouTube has an ad-supported streaming service as well as a paid one called YouTube Premium. However, even YouTube Premium subscribers can’t see the Opalite music video on Friday. (I’m a subscriber and can confirm it’s nowhere to be found.) According to Statista, in March 2025, YouTube had 125 million paid subscribers across its Premium and Music services. (YouTube Music is included in its Premium subscription.) That pales in comparison with the estimated 2.5 billion total users on YouTube, the majority of whom still rely on that ad-supported offering.

It remains to be seen whether or when YouTube and Billboard will mend their affairs and whether, in the words of Taylor Swift in Opalite, «this is just a temporary speed bump.»

Technologies

Valve Delays Steam Frame and Steam Machine Pricing as Memory Costs Rise

The company says its 2026 release window remains intact, but final prices and dates are still in flux.

Valve revealed its lineup of upcoming hardware in November, including a home PC-gaming console called the Steam Machine and the Steam Frame, a VR headset. At the time of the reveal, the company expected to release its hardware in «early 2026,» but the current state of memory and storage prices appears to have changed those plans.

Valve says its goal to release the Steam Frame and Steam Machine in the first half of 2026 has not changed, but it’s still deliberating on final shipping dates and pricing, according to a post from the company on Wednesday. While the company didn’t provide specifics, it said it was mindful of the current state of the hardware and storage markets. All kinds of computer components have rocketed in price due to massive investments in AI infrastructure.

«When we announced these products in November, we planned on being able to share specific pricing and launch dates by now. But the memory and storage shortages you’ve likely heard about across the industry have rapidly increased since then,» Valve said. «The limited availability and growing prices of these critical components mean we must revisit our exact shipping schedule and pricing (especially around Steam Machine and Steam Frame).»

Valve says it will provide more updates in the future about its hardware lineup.

What are the Steam Frame and Steam Machine?

The Steam Frame is a standalone VR headset that’s all about gaming. At the hardware reveal in November, CNET’s Scott Stein described it as a Steam Deck for your face. It runs on SteamOS on an ARM-based chip, so games can be loaded onto the headset and played directly from it, allowing gamers to play games on the go. There’s also the option to wirelessly stream games from a PC.

The Steam Machine is Valve’s home console. It’s a cube-shaped microcomputer intended to be connected to a TV.

When will the Steam Frame and Steam Machine come out?

Valve didn’t provide a specific launch date for either. The initial expectation after the November reveal was that the Steam Frame and Steam Machine would arrive in March. Valve’s statement about releasing its hardware in the first half of 2026 suggests both will come out in June at the latest.

How much will the Steam Frame and Steam Machine cost?

After the reveal, there was much speculation on their possible prices. For the Steam Frame, the expectation was that it would start at $600. The Steam Machine was expected to launch at a price closer to $700. Those estimates could easily increase by $100 or more due to the current state of pricing for memory and storage.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow