Technologies

Gift card scams are growing, and we’re all paying the price

Every year, scammers trick Americans into handing over millions of dollars in gift card payments. Retailers aren’t doing much about it.

The scams start out innocently enough.

Maybe a phone call from someone who says he works for Amazon, claiming he noticed someone hacked into your account. Maybe someone who says she works for Microsoft, offering a refund for a computer security service you bought a few years ago that stopped working.

Lisa Hernandez was trying to reach Match.com, the dating site, to cancel her account when it happened to her. The 50-year-old single mother of four had signed up for the service but decided she didn’t want to stay with it.

She searched on Google for a customer service number to call. What she found instead was a fake website, built to look legitimate but with a phone number that connected her to a scammer posing as Match customer service. Kevin, the man on the other end of the line, said he could help. First, though, he told her she needed to install a program called TeamViewer, which allowed him remote control of her computer.

He then directed Hernandez to log into her bank’s website. «We’re going to directly refund you your money,» he promised and asked her to fill out a computer-generated form for her refund of $93. Instead, Kevin set his scam in motion by manipulating the code on her computer to make it look like he had deposited $9,000 into her bank account instead, effectively doubling her savings.

The only way to fix the mistake, he told her, was to buy gift cards with the extra money she’d received and give him the numbers. Then he could put the money back into Match’s bank accounts and all would be settled. «I need you to go to the store to get Target cards,» she remembers him saying. Otherwise, he’d lose his job. She did as he asked, giving him nearly $9,000 worth of gift cards.

Moments just like this happen to tens of millions of Americans every year. While it’s easy to assume most victims are elderly, surveys suggest it’s much broader. Victims are old and young, rich and poor. Some people get scammed multiple times. Some victims have family members who fight fraud for a living. It’s struck my family. Likely, it’s happened to yours, too.

When you think of computer crimes, identity theft usually comes first to mind. That’s because it cost Americans a staggering $56 billion last year, according to Javelin Strategy and Research. But it tends to feel more like an inconvenience than theft, because you usually get your money back thanks to a nearly half-century-old law designed to protect consumers from any «unauthorized» credit charges. The fees we pay help cover the losses to that fraud. But it’s different with gift cards — they have no such legal protections. When a victim shares the card number with a scammer, they’ve effectively authorized its use. Even identity fraud insurance, which would cover ID theft in the case of a data breach, often doesn’t apply when you’ve given the information willingly.

«If someone coerces you, then you’re out of luck,» said Kathy Stokes, director of fraud prevention programs at AARP.

It’s impossible to fathom how much money these scammers have taken. Many victims don’t report the crime to authorities, often because they’re embarrassed and quickly learn the hard truth that they’re unlikely to get their money back. So when the Federal Trade Commission counted more than $245 million in money lost to gift card scams since 2018, most experts said the actual number is likely many multiples worse than that.

«This is only the tip of the iceberg,» said John Breyault, vice president for public policy, telecommunications and fraud at the National Consumers League.

The anecdotal data suggests he’s right. The FBI’s Internet Crime Complaint Center, for example, said it receives more than 2,000 complaints each day about all sorts of internet scams, from fraudulent business impersonation to fake romances to gift card scams. All told, the FBI tallied $4.2 billion in fraud losses reported by victims last year.

Some stores put up signs next to gift card racks and checkout counters warning about fraud. Others say they’re training employees to spot potential victims. But they aren’t doing much else. «The business incentive in the gift card space is for these cards to be used with as little friction as possible,» Breyault said. «They don’t want to get into the way of someone buying a gift card and buying a Coke on the way out.»

From gift to fraud

The gift card industry is already larger than the gross domestic product of all but a handful of countries. It’s still growing, too, and surveys suggest its use is pretty evenly split along racial, gender and economic lines.

By 2027, gift card spending is expected to reach $2.7 trillion — topping all but the US, China, Japan, Germany and the UK. That’s already up from $1 trillion in 2020 when the COVID-19 pandemic supercharged consumer spending, according to Research and Markets. And this year, as a congested global supply chain is causing a shortage of some popular gifts, more than one in five people plan to use gift cards when shopping during the holidays, according to a YouGov survey commissioned by CNET parent company Red Ventures.

Retailers love gift cards, too. They get to hold onto any money we don’t spend for years, industry experts say. And when we do use up our gift cards, we tend to buy things more expensive than the gift card can cover, a term some companies internally call «up-spend.» So retailers try to make gift cards as easy to buy as they can. You can find all manner of gift cards for all sorts of things at drug stores, convenience shops and grocery chains.

After reading the FTC’s data last year, Stokes at AARP set out to take on gift card scams. In April, the organization began a three-year program to throw its educational and marketing weight behind the problem, and for good reason. One study it commissioned found that a quarter of US adults were unsure whether it’s a sign of a scam for a business to ask for payment in gift cards, something no legitimate business would do. AARP also built up parts of its website, Fraud Watch Network, publishing articles about the scams and examples of the scripts they use, and it expanded its fraud hotline with hopes of helping victims spot a scam as it’s happening.

So far, things haven’t gone as she’d hoped. «We thought it would be an easy message,» she said. But it turns out most of the people who end up coming to AARP for help do so after they’ve been scammed.

People like Hernandez. She got in touch after she was scammed in August. Though she’s accepted that the money’s mostly gone, she can’t shake how violating the whole experience was. As a nurse in the San Francisco Bay Area, Hernandez built her career on trust. She works a second job as a caregiver too, where she’s regularly given her client’s bank card to withdraw money from an account or buy stuff from the store. «I would never think of taking from them,» Hernandez says. «I would never betray that.»

Which is maybe why she trusted Kevin, who was begging her to buy gift cards. Hernandez spent $3,500 on seven Target cards, then withdrew another $5,000 to buy more. As she gave him the card numbers, Kevin told her not to look at her bank account for a couple days. She did anyway and found that the extra money he’d manipulated the bank webpage to show in her account was gone. Instead, she had just about $500 balance left.

Kevin called her again, saying one of the $500 cards didn’t go through. When she began to ask questions, one of Kevin’s colleagues got on the phone and began yelling at her. As they kept demanding Hernandez get more gift cards, the horrible realization dawned on her. «I said, ‘You just took my money.'»

Read more: You’d better watch out: ‘Tis the season for holiday shopping scams

New twist

The confidence game, as some call it, has been around since ancient times. Con artists are even in the Bible where they’re referred to as false prophets, «who come to you in sheep’s clothing, but inwardly they are ravening wolves.» Scammers are the reason we all bristle about snake oil, the fake cure-all elixir sold in the 18th century and 19th century, born from supposedly old Chinese medicinal techniques.

To be successful, a con artist typically needs to be charismatic, quick-witted and intelligent. After all, they have to be good at gaining people’s confidence.

«It exploits people’s trust,» Cathy Scott, a true crime author, wrote in Psychology Today. «Even the most rational people have proven susceptible to crimes of trickery.»

The internet’s anonymity and quick communication helped to supercharge fraud. Gift card scammers can come from all over the world, too. All they need is a mic and an easily downloaded phone app installed on their computer. The phone app hides their location behind a toll-free number or a seemingly local US one.

The scam that victimized Hernandez isn’t the only one out there. A scammer might pretend to be an FBI agent, calling with a warrant for your arrest. They might pose as an IRS agent threatening to cancel your Social Security number for some offense of which you’re innocent. In those schemes, the only way to stop the police supposedly coming to your door is with the help of another scammer who pretends to be a lawyer, conveniently a phone call away, who takes payment in gift cards.

Sometimes the scammers pretend to be tech support, calling to repair your printer. Or they say your internet is hacked and then get you to install screen-sharing software like TeamViewer or AnyDesk to show technical gobbledygook that they say is proof the hackers have taken over. You just need to buy security, they say, with gift cards.

«Scammers know if they make it emotional and create this sense of urgency and fear, the logical part of your brain disconnects and the fight-or-flight kicks in — which is great for protecting you, but it’s terrible at making decisions,» said Eva Velasquez, head of the nonprofit Identity Theft Resource Center, and a former law enforcement investigator of economic and financial crimes.

Her team’s research found that if you can interrupt that emotional response, the logical side has a chance to kick in. That’s partly why retailers have put signs up at gift card racks, warning about potential fraud. «Have you been asked to buy gift cards to pay a fine, taxes, fees or to help someone?» one sign at a Giant grocery store in Maryland reads. «Never provide numbers to ANYONE over the phone or by email.»

Still, Velasquez said, scams of all sorts have become even more prevalent during the pandemic. «It’s been growing and growing, and the explosion over the last 18 months is unprecedented,» she said. «It’s going to take at least a decade to unwind and get to the bottom of how big a problem it is.»

Read more: Don’t fall for these clever Black Friday scams this year

Trust betrayed

One of the first things Mark told me when recounting his experience being scammed was how bad it made him feel. It had only happened a few weeks earlier, in October, and it still stung. He requested his full name be withheld to avoid embarrassment with his family.

The call from the scammers started out seemingly normal. The person calling claimed to be from Amazon, concerned about a rogue $750 purchase with his credit card.

The person on the other end of the phone claimed Amazon had already stopped the supposed charge but asked Mark to buy gift cards that they could use as bait to track down scammers. Once all the scammers were caught, Mark was told, they’d give the gift cards back.

«Dumb me, I believed that,» he said.

Mark is in his 70s and retired after a successful career as crew for some of the most memorable summer blockbuster films from the 1990s. But he says he’s not computer savvy. «I have trouble getting along on it,» he said. «I mostly use it to play puzzles and stuff.»

At first, the scammers asked Mark to buy $3,000 in gift cards from Target and Apple. If a store employee asked why he was spending so much money, the scammers told him to say the cards were gifts for a party.

Retailers have a blind spot for situations like Mark’s. The companies have sophisticated software and entire teams devoted to detecting customers who are trying to scam them. But when a customer comes in, buying gift cards, «the retailers are learning it’s very difficult to track,» said David Fletcher, senior vice president at ClearSale, which helps detect fraud at the online stores of more than 4,000 merchants, including Motorola, Under Armour and Bath & Body Works.

That’s why some retailers train employees to ask probing questions at checkout. Best Buy, in a statement, said it’s also added warning signs to gift card displays and checkout counters. Its systems flash a warning on the credit card reader screen when customers purchase gift cards above a certain limit.

But it still isn’t enough. Fletcher himself became a victim when scammers emptied a $100 gift card his mother had bought for the fishing store Bass Pro Shops. He suspects scammers took photos of the account codes on the back of cards while they were still on the rack and waited until they were activated.

«Gift cards are so hard to trace back to fraudsters,» he said.

Not that any of the questions the clerk asked Mark made any difference.

Read more: Cryptocurrency scams are all over social media. Don’t get duped

At his first stop, the teller would only let him buy a couple cards, at $500 each. «It was kind of a surprise,» he said of the limit. In retrospect, he appreciates it now.

But the scammers convinced Mark to go to more stores. Mark remembers checkout clerks asking what the cards were for a couple times. The scammers kept asking Mark for more money until he became suspicious and checked the value on the Target cards he had purchased. That’s when he learned most of the money was gone.

When Mark contacted the police, they took down his information but didn’t ask for the phone numbers the scammers called from. Experts say it’s nearly impossible to track fraudsters through their numbers anyway. Instead, the police suggested Mark contact AARP for support and also to help guide him through reporting and other things to do. His bank, from which he’d ultimately withdrawn $5,000, declined to refund his losses.

«I feel so stupid about the whole thing,» he said.

Like Hernandez, the nurse, Mark hopes that sharing his story will help people learn some of the tricks the scammers use and avoid the same mistakes he made.

While Mark said his savings are enough to cover the losses he suffered, the fraudsters made off with nearly all of Hernandez’s money. And she gave up getting a refund from Match too.

«It’s tough and embarrassing, and I feel kind of dumb,» Hernandez said, adding that she tends to keep the tough things that happen in her life to herself, though eventually she did tell some details to her kids. «I had to go and pray a lot.»

She also decided she’s going to stay away from dating for now. But she did have one last confrontation with Kevin, who promised to make it better.

Hernandez was desperate to get her money back, but she was also upset. «I don’t know how you can do this to people,» she remembers saying. Kevin asked for her address and ended the conversation saying he’d send her the money in the mail. She hoped his conscience might have changed him.

She hasn’t heard from Kevin since.

The story continues Friday, when we look at efforts to fight back at the scammers.

Technologies

OpenAI Launches ChatGPT Health: A Dedicated Tab for Medical Inquiries

The company wants you to upload your medical records and connect the wellness apps you use.

ChatGPT is expanding its presence in the health care realm. OpenAI said Wednesday that its popular AI chatbot will begin rolling out ChatGPT Health, a new tab dedicated to addressing all your medical inquiries. The goal of this new tab is to centralize all your medical records and provide a private area for your wellness issues.

Looking for answers about a plethora of health issues is a top use for the chatbot. According to OpenAI, «hundreds of millions of people» sign in to ChatGPT every week to ask a variety of health and wellness questions. Additionally, ChatGPT Health (currently in beta testing) will encourage you to connect any wellness apps you also use, such as Apple Health and MyFitnessPal, resulting in a more connected experience with more information about you to draw from.

Online privacy, especially in the age of AI, is a significant concern, and this announcement raises a range of questions regarding how your personal health data will be used and the safeguards that will be implemented to keep sensitive information secure — especially with the proliferation of data breaches and data brokers.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

«The US doesn’t have a general-purpose privacy law, and HIPAA only protects data held by certain people like health care providers and insurance companies,» Andrew Crawford, senior counsel for privacy and data at the Center for Democracy and Technology, said in an emailed statement.

He continued: «The recent announcement by OpenAI introducing ChatGPT Health means that a number of companies not bound by HIPAA’s privacy protections will be collecting, sharing and using people’s health data. And since it’s up to each company to set the rules for how health data is collected, used, shared and stored, inadequate data protections and policies can put sensitive health information in real danger.»

OpenAI says the new tab will have a separate chat history and a memory feature that can keep your health chat history separate from the rest of your ChatGPT usage.

Further protections, such as encryption and multifactor authentication, will defend your data and keep it secure, the company says. Health conversations won’t be used to train the chatbot, according to the company.

Privacy issues aside, another concern is how people intend to use ChatGPT Health. OpenAI’s blog post states the service «is not intended for diagnosis or treatment.»

The slope is slippery here. In August 2025, a man was hospitalized after allegedly being advised by the AI chatbot to replace salt in his diet with sodium bromide. There are other examples of AI providing incorrect and potentially harmful advice to individuals, leading to hospitalization.

OpenAI’s announcement also doesn’t touch on mental health concerns, but a blog post from October 2025 says the company is working to strengthen its responses in sensitive conversations. Whether these mental health guardrails will be enough to keep people safe remains to be seen.

OpenAI didn’t immediately respond to a request for comment.

If you’re interested in ChatGPT Health, you can join a waitlist, as the tab isn’t yet live.

(Disclosure: Ziff Davis, CNET’s parent company, in April filed a lawsuit against OpenAI, alleging it infringed Ziff Davis copyrights in training and operating its AI systems.)

Technologies

I Tested the Honor Magic 8 Pro and Found a Huge Problem With the Camera

I discovered a catastrophic problem with this phone’s cameras and it needs to be fixed fast.

I’ve found a big problem with the Honor Magic 8 Pro’s camera that urgently needs addressing. I’ve taken hundreds of test photos in my weeks with the company’s latest flagship phone, and while plenty of them are perfectly decent, many of the images I’ve taken with the ultrawide lens display horrendous image processing issues around the edges that ruin them completely.

I discovered the issue when I first got the phone late last year, and while it’s had several significant software updates since then, the problems persist. So what’s gone wrong? It’s possible that I’m monumentally unlucky and happen to have been given a broken unit. If so, I fully expect the replacement models I’ll be testing to be free of any issues. Or, maybe it’s a more widespread problem and I’ll see the same issues cropping up again. I personally think it’s more likely to be an issue at the software level, and as such, it could be a simple fix for Honor to push out in the coming days and weeks.

I’ve spoken to Honor about this and, unsurprisingly, the company is keen to say that this isn’t widespread, stating «Our internal investigation confirmed that the issue was limited to an isolated hardware anomaly in that specific early development sample. It doesn’t reflect the hardware or software polish of the final retail units now launching in the European market.» And sure, my test unit was an early non-EU version, but it is also the phone that the company did send me to review. Receiving early prerelease samples is common in the industry and while small hiccups can sometimes be expected, I rarely find such significant problems as this.

Honor is sending additional retail units for further testing and I hope that I’m able to confirm that this isn’t an issue seen on all models. I was prepared to write a full review of this new flagship phone, but these camera issues are severe and raise more questions than answers. I will update this article with more information and my testing results as they become available.

Read more: Best Phone to Buy in 2026

Even if it is an isolated incident, it’s still disappointing to see such significant problems on a new phone, especially a flagship that costs £1,099 in the UK. Honor doesn’t officially sell its phones in the US, but for reference, that price converts to roughly $1,480.

The phone does have some positives. I like its processor performance and display, for example, which I’ll come on to later. But the camera issues I’ve seen mean I can’t recommend buying this phone until it’s clear whether they’re limited to my review device or if they’re issues common across all models.

Let’s take a closer look at what’s going on.

Honor Magic 8 Pro camera troubles

Taken with the camera’s standard zoom, the shot above is fine — there’s a decent amount of detail and the exposure is even overall.

But switch to the ultrawide mode and things go horribly wrong. There’s a vibrant purple fringe around the edge that’s full of image processing artifacts that ruin the shot.

It’s not a subtle problem; it’s a huge red flag that something is very wrong with this phone.

For reference, here’s the iPhone 16 Pro’s ultrawide shot. Notice the difference?

As you can see, it’s not an isolated incident. It seems to be more apparent when there are areas of shadow in the edges. It makes me suspect that the phone is seeing these dark patches and trying — and failing — to brighten them and add detail back into the scene. It’s not dissimilar to the early problems I found on Google’s Pixel 8 Pro, which also struggled with shadow detail, suggesting to me that this is a software fault, rather than a mechanical problem with my unit.

It also doesn’t seem to affect the ultrawide lens when recording video, which again suggests it’s not a hardware issue as I’d expect to see the same problems from the lens in any mode. The downside of that is that it could theoretically affect all models of the Honor Magic 8 Pro. However, the big upside is that software problems can be easily remedied with over-the-air updates.

To be honest, I don’t love the camera elsewhere, either. The image processing has gone overboard in this image, brightening the shadows and trying to rescue the highlights in the background excessively. It’s resulted in an over-processed image that looks unnatural.

The iPhone 16 Pro’s attempt has allowed those shadows to remain what they are — shadows — and I vastly prefer this version as a result.

I’ve also noticed that there can be significant color shifts when switching between the main and ultrawide lenses, which I would again prefer not to see on a camera phone of this price.

However, this could be attributed to the same software processing issues I’ve already discussed, so I’ll have to leave my verdict on the camera for when I’ve done more testing.

On the upside, this shot of the Tennents brewery in Glasgow looks good.

And I like the colors and tones in this sunset scene in Edinburgh. So it’s not all bad — it can take a decent photo sometimes. So what about the rest of the phone?

Honor Magic 8 Pro: Display, performance and battery life

I like the phone’s 6.71-inch display, which is bright and vibrant. It’s lovely for gaming, too, thanks to its max 120Hz refresh rate. It’s powered by Qualcomm’s latest Snapdragon Elite Gen 5 processor, which puts in some of the best scores we’ve ever seen on our benchmark tests for both processor performance and graphics processing.

It certainly feels nippy in everyday use. Games like Genshin Impact, unsurprisingly, played smoothly at max graphics settings. The phone runs on a 6,270-mAh battery, which, while sizable, only gave average results on our battery drain tests. Battery performance sits alongside phones like the Galaxy S25 or Google Pixel 10, but it’s a big step below the iPhone 17 Pro Max or OnePlus 15.

If it feels like I’m glossing over the rest of the phone somewhat, it’s because I am. With the issues I’ve seen so far, it’s possible that there may be other early teething troubles elsewhere, so I’m going to hold off giving any kind of definitive verdict on any part of the phone until I’ve tested more models and have a full appreciation of what the phone is really like to use.

Honor Magic 8 Pro: Should you buy it?

Right now, I absolutely don’t think you should. The issues I’ve seen with the camera are significant and badly need addressing. It could be that it’s a simple software fix that can be rolled out in the coming weeks, or it might be an isolated incident that affects me and me alone. I’ll be retesting on multiple devices and it could be that they’re absolutely fine.

But unless you’re desperate for a new phone today and you absolutely have to have an Honor phone, then I recommend waiting until we’ve got more clarity about how deep these problems lie.

Technologies

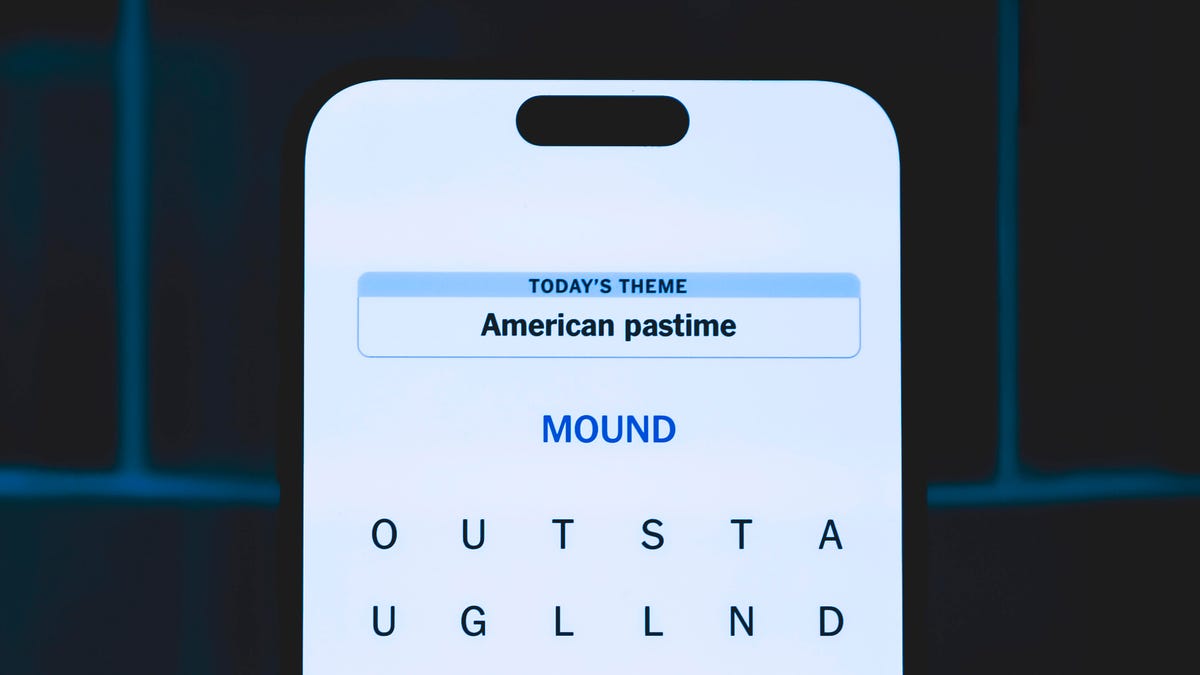

Today’s NYT Strands Hints, Answers and Help for Jan. 8 #676

Here are hints and answers for the NYT Strands puzzle for Jan. 8, No. 676.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle was almost impossible for me, because it’s all focused on a certain TV show that I have never watched and barely know anything about. (Its fourth season premieres today, if you want to check it out.) If you’re like me, you need hints and answers, so read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page

Hint for today’s Strands puzzle

Today’s Strands theme is: That’s just reality (TV)

If that doesn’t help you, here’s a clue: Show with plenty of trickery.

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- SIDE, HIDE, START, TART, FAITH, TENS, BANS, FATE, SILT, CAST, TRAIT

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- CASTLE, SHIELD, MISSION, FAITHFUL, BANISHMENT

Today’s Strands spangram

Today’s Strands spangram is THETRAITORS. To find it, start with the T that’s three letters down on the far-left row, and wind across and then down.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Technologies4 года agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Technologies4 года agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow