Technologies

Tariffs Explained: Everything You Need to Know as Trump Doubles Another Tariff

While Donald Trump’s wide-ranging taxes on imports face scrutiny in court, rates on steel and aluminum have been doubled. Here’s what it’ll all mean for you.

President Donald Trump’s second-term economic plan can be summed up in one word: tariffs. When his barrage of import taxes went into overdrive a month ago, markets trembled and business leaders sounded alarms about the economic damage they would cause. After weeks of uncertainty and clashes with major companies, Trump’s tariffs hit their biggest roadblock yet in court before being reinstated ahead of a final ruling, allowing him to double the rate on imported steel and aluminum this week.

Late Wednesday, the US Court of International Trade ruled that Trump had overstepped his authority when he imposed tariffs, effectively nullifying the tariffs, after concluding that Congress has the sole authority to issue tariffs and decide other foreign trade matters, and that the International Emergency Economic Powers Act of 1977 — which Trump has used to justify his ability to impose them — doesn’t grant the president «unlimited» authority on tariffs. The next day, an appeals court allowed the tariffs to go back into effect for the time being, while the administration calls for the Supreme Court to overturn the trade court ruling altogether.

However things shake out in the end, the initial ruling certainly came as a relief to many, given the chaos and uncertainty that Trump’s tariffs how caused thus far. For his part, Trump has recently lashed out against companies — like Apple and Walmart — that have reacted to the tariffs or discussed their impacts in ways he dislikes. Apple has been working to move manufacturing for the US market from China to relatively less-tariffed India, to which Trump has threatened them with a 25% penalty rate if they don’t bring manufacturing to the US instead. Experts have predicted that a US-made iPhone, for example, would cost consumers about $3,500. During a recent earnings call, Walmart warned that prices would rise on things like toys, tech and food at some point in the summer, which prompted Trump to demand the chain eat the costs themselves, another unlikely scenario.

Amid all this noise, you might still be wondering: What exactly are tariffs and what will they mean for me?

The short answer: Expect to pay more for at least some goods and services. For the long answer, keep reading, and for more, check out CNET’s price tracker for 11 popular and tariff-vulnerable products.

What are tariffs?

Put simply, a tariff is a tax on the cost of importing or exporting goods by a particular country. So, for example, a «60% tariff» on Chinese imports would be a 60% tax on the price of importing, say, computer components from China.

Trump has been fixated on imports as the centerpiece of his economic plans, often claiming that the money collected from taxes on imported goods would help finance other parts of his agenda. The US imports $3 trillion of goods from other countries annually.

The president has also, more recently, shown a particular fixation on trade deficits, claiming that the US having a trade deficit with any country means that country is ripping the US off. This is a flawed understanding of the matter, as a lot of economists have said, deficits are often a simple case of resource realities: Wealthy nations like the US buy specific things from nations that have them, while those nations might in turn not be wealthy enough to buy much of anything from the US.

While Trump deployed tariffs in his first term, notably against China, he ramped up his plans more significantly for the 2024 campaign, promising 60% tariffs against China and a universal 20% tariff on all imports into the US. Now, tariffs against China are more than double that amount and a universal tariff on all exports is a reality.

«Tariffs are the greatest thing ever invented,» Trump said at a campaign stop in Michigan last year. At one point, he called himself «Tariff Man» in a post on Truth Social.

Who pays the cost of tariffs?

Trump repeatedly claimed, before and immediately after returning to the White House, that the country of origin for an imported good pays the cost of the tariffs and that Americans would not see any price increases from them. However, as economists and fact-checkers stressed, this is not the case.

The companies importing the tariffed goods — American companies or organizations in this case — pay the higher costs. To compensate, companies can raise their prices or absorb the additional costs themselves.

So, who ends up paying the price for tariffs? In the end, usually you, the consumer. For instance, a universal tariff on goods from Canada would increase Canadian lumber prices, which would have the knock-on effect of making construction and home renovations more expensive for US consumers. While it is possible for a company to absorb the costs of tariffs without increasing prices, this is not at all likely, at least for now.

Speaking with CNET, Ryan Reith, vice president of International Data’s worldwide mobile device tracking programs, explained that price hikes from tariffs, especially on technology and hardware, are inevitable in the short term. He estimated that the full amount imposed on imports by Trump’s tariffs would be passed on to consumers, which he called the «cost pass-through.» Any potential efforts for companies to absorb the new costs themselves would come in the future, once they have a better understanding of the tariffs, if at all.

Which Trump tariffs have gone into effect?

Following Trump’s «Liberation Day» announcements on April 2, the following tariffs are in effect:

- A 50% tariff on all steel and aluminum imports, doubled from 25% as of June 4.

- A 30% tariff on all Chinese imports until Aug. 10 while negotiations continue. China being a major focus of Trump’s trade agenda, this rate has been notably higher than others and has steadily increased as Beijing returned fire with tariffs of its own, peaking at 145%, which it could return to down the line if a deal is not reached.

- 25% tariffs on imports from Canada and Mexico not covered under the 2018 USMCA trade agreement brokered during Trump’s first term. The deal covers roughly half of all imports from Canada and about a third of those from Mexico, so the rest are subject to the new tariffs. Energy imports not covered by USMCA only will be taxed at 10%.

- A 25% tariff on all foreign-made cars and auto parts.

- A sweeping overall 10% tariff on all imported goods.

For certain countries that Trump said were more responsible for the US trade deficit, Trump imposed what he called «reciprocal» tariffs that exceed the 10% level: 20% for the 27 nations that make up the European Union, 26% for India, 24% for Japan and so on. These were meant to take effect on April 9 but were delayed by 90 days as a result of historic stock market volatility, which makes the new effective date July 8.

— Rapid Response 47 (@RapidResponse47) April 2, 2025

Trump’s claim that these reciprocal tariffs are based on high tariffs imposed against the US by the targeted countries has drawn intense pushback from experts and economists, who have argued that some of these numbers are false or potentially inflated. For example, the above chart claims a 39% tariff from the EU, despite its average tariff for US goods being around 3%. Some of the tariffs are against places that are not countries but tiny territories of other nations. The Heard and McDonald Islands, for example, are uninhabited. We’ll dig into the confusion around these calculations below.

Notably, that minimum 10% tariff will not be on top of those steel, aluminum and auto tariffs. Canada and Mexico were also spared from the 10% minimum additional tariff imposed on all countries the US trades with.

On April 11, the administration said smartphones, laptops and other consumer electronics, along with flat panel displays, memory chips and semiconductors, were exempt from reciprocal tariffs. But it wasn’t clear whether that would remain the case or whether such products might face different fees later.

How were the Trump reciprocal tariffs calculated?

The numbers released by the Trump administration for its barrage of «reciprocal» tariffs led to widespread confusion among experts. Trump’s own claim that these new rates were derived by halving the tariffs already imposed against the US by certain countries was widely disputed, with critics noting that some of the numbers listed for certain countries were much higher than the actual rates and some countries had tariff rates listed despite not specifically having tariffs against the US at all.

In a post to X that spread fast across social media, finance journalist James Surowiecki said that the new reciprocal rates appeared to have been reached by taking the trade deficit the US has with each country and dividing it by the amount the country exports to the US. This, he explained, consistently produced the reciprocal tariff percentages revealed by the White House across the board.

Just figured out where these fake tariff rates come from. They didn’t actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country’s exports to us.

So we… https://t.co/PBjF8xmcuv— James Surowiecki (@JamesSurowiecki) April 2, 2025

«What extraordinary nonsense this is,» Surowiecki wrote about the finding.

The White House later attempted to debunk this idea, releasing what it claimed was the real formula, though it was quickly determined that this formula was arguably just a more complex version of the one Surowiecki deduced.

What will the Trump tariffs do to prices?

In short: Prices are almost certainly going up, if not now, then eventually. That is, if the products even make it to US shelves at all, as some tariffs will simply be too high for companies to bother dealing with.

While the effects of a lot of tariffs might not be felt straight away, some potential real-world examples have already emerged. Microsoft has increased prices across the board for its Xbox gaming brand, with its flagship Xbox Series X console jumping 20% from $500 to $600. Elsewhere, Kent International, one of the main suppliers of bicycles to Walmart, announced that it would be stopping imports from China, which account for 90% of its stock.

Speaking about Trump’s tariff plans just before they were announced, White House trade adviser Peter Navarro said that they would generate $6 trillion in revenue over the next decade. Given that tariffs are most often paid by consumers, CNN characterized this as potentially «the largest tax hike in US history.» New estimates from the Yale Budget Lab, cited by Axios, predict that Trump’s new tariffs will cause a 2.3% increase in inflation throughout 2025. This translates to about a $3,800 increase in expenses for the average American household.

Reith, the IDC analyst, told CNET that Chinese-based tech companies, like PC makers Acer, Asus and Lenovo, have «100% exposure» to these import taxes as they currently stand, with products like phones and computers the most likely to take a hit. He also said that the companies best positioned to weather the tariff impacts are those that have moved some of their operations out of China to places like India, Thailand and Vietnam, singling out the likes of Apple, Dell and HP. Samsung, based in South Korea, is also likely to avoid the full force of Trump’s tariffs.

In an effort to minimize its tariff vulnerability, Apple has begun to move the production of goods for the US market from China to India.

Will tariffs impact prices immediately?

In the short term — the first days or weeks after a tariff takes effect — maybe not. There are still a lot of products in the US imported pre-tariffs and on store shelves, meaning the businesses don’t need a price hike to recoup import taxes. Once new products need to be brought in from overseas, that’s when you’ll see prices start to climb because of tariffs or you’ll see them become unavailable.

That uncertainty has made consumers anxious. CNET’s survey revealed that about 38% of shoppers feel pressured to make certain purchases before tariffs make them more expensive. About 10% say they have already made certain purchases in hopes of getting them in before the price hikes, while 27% said they have delayed purchases for products that cost more than $500. Generally, this worry is the most acute concerning smartphones, laptops and home appliances.

Mark Cuban, the billionaire businessman and Trump critic, voiced concerns about when to buy certain things in a post on Bluesky just after Trump’s «Liberation Day» announcements. In it, he suggested that consumers might want to stock up on certain items before tariff inflation hits.

«It’s not a bad idea to go to the local Walmart or big box retailer and buy lots of consumables now,» Cuban wrote. «From toothpaste to soap, anything you can find storage space for, buy before they have to replenish inventory. Even if it’s made in the USA, they will jack up the price and blame it on tariffs.»

CNET’s Money team recommends that before you make any purchase, especially of a high-ticket item, be sure that the expenditure fits within your budget and your spending plans in the first place. Buying something you can’t afford now because it might be less affordable later can be burdensome, to say the least.

What is the goal of the White House tariff plan?

The typical goal behind tariffs is to discourage consumers and businesses from buying the tariffed, foreign-sourced goods and encourage them to buy domestically produced goods instead. When implemented in the right way, tariffs are generally seen as a useful way to protect domestic industries.

One of the stated intentions for Trump’s tariffs is along those lines: to restore American manufacturing and production. However, the White House also claims to be having negotiations with numerous countries looking for tariffs exemptions and some officials have also floated the idea that the tariffs will help finance Trump’s tax cuts.

You don’t have to think about those goals for too long before you realize that they’re contradictory: If manufacturing moves to the US or if a bunch of countries are exempt from tariffs then tariffs aren’t actually being collected and can’t be used to finance anything. This and many other points have led a lot of economists to allege that Trump’s plans are misguided.

In terms of returning — or «reshoring» — manufacturing in the US, tariffs are a better tool for protecting industries that already exist because importers can fall back on them right away. Building up the factories and plants needed for this in the US could take years, leaving Americans to suffer under higher prices in the interim.

That problem is worsened by the fact that the materials needed to build those factories will also be tariffed, making the costs of «reshoring» production in the US too heavy for companies to stomach. These issues, and the general instability of American economic policies under Trump, are part of why experts warn that Trump’s tariffs could have the opposite effect: keeping manufacturing out of the US and leaving consumers stuck with inflated prices. Any factories that do get built in the US because of tariffs also have a high chance of being automated, canceling out a lot of job creation potential. To give you one real-world example of this: When warning customers of future price hikes, toy maker Mattel also noted that it had no plans to move manufacturing to the US.

Trump has reportedly been fixated on the notion that Apple’s iPhone — the most popular smartphone in the US market — can be manufactured entirely in the US. This has been broadly dismissed by experts, for a lot of the same reasons mentioned above, but also because an American-made iPhone could cost upward of $3,500. One report from 404 Media dubbed the idea «a pure fantasy.» The overall sophistication and breadth of China’s manufacturing sector has also been cited, with CEO Tim Cook stating in 2017 that the US lacks the number of tooling engineers to make its products.

For more, see how tariffs might raise the prices of Apple products and find some expert tips for saving money.

Technologies

Connect Your iPhone or Android to Any TV: A Guide for AirPlay, Chromecast and HDMI

When visiting friends and family, you can likely share videos from your phone to your TV without needing to log in to any built-in apps.

When visiting your friends and family this holiday season, you may want to show off your latest photos or stream movies to their television while spending time together. However, it can be a pain to log in to your streaming service account on someone’s television.

Thankfully, with most recent televisions, you probably don’t need to log in at all to do this. In most cases, the phone you carry right now can connect directly to a TV, and you can share or cast your screen using your own accounts saved on your phone.

Many TVs now ship with built-in support for AirPlay, Chromecast or Miracast, all of which let you wirelessly connect your phone. The trickiest part isn’t whether you can connect your phone to your TV (because you probably can). Rather, you’ll need to know which wireless casting connection your phone supports and make sure the TV you want to connect to also supports it.

We’ll talk about how this works, based on whether you’re using an iPhone or an Android phone. We’ll also point out when you’ll be using AirPlay, Chromecast or Miracast to make the connection, depending on what device you have.

iPhone supports AirPlay and Chromecast

Apple’s iPhone devices have two ways of connecting wirelessly to a television. On a system level, an iPhone can use AirPlay to cast media from video and music apps to any device that also supports AirPlay. This originally was exclusive to the Apple TV, but AirPlay now supports many televisions made by Samsung, LG, TCL and Vizio, along with Roku’s streaming devices. Odds are if your device supports the Apple TV app, somewhere in its settings is also support for AirPlay.

You can access AirPlay in one of two ways. If you’re using a supported app like Paramount Plus, you’ll want to tap the AirPlay icon represented by a TV with a triangle. You can also access AirPlay from your phone’s Control Center by tapping the icon represented by two rectangles and then picking the device you’re casting to. Using the latter option, you can also mirror your phone’s screen to your TV to display apps like Instagram or TikTok that don’t include AirPlay from within.

If you are trying to connect with a television with the Google TV operating system or the Google TV Streamer, the iPhone also supports Chromecast. Similar to using AirPlay from a media app, you’ll tap the Chromecast icon represented by a rectangle with three wavy lines. You’ll then tap the device you want to cast to. The biggest difference between how AirPlay and Chromecast work on the iPhone is that you won’t be able to mirror your iPhone’s display over Chromecast.

Certain apps like YouTube will blend these casting options together for convenience. When tapping Google’s Chromecast button, a submenu will let you choose between using AirPlay or Chromecast or linking directly to your TV’s YouTube app using a code.

And if you want to connect your iPhone to your television using an HDMI cable, you can use either a USB-C to HDMI adapter if you have an iPhone 15 or newer or a Lightning-to-HDMI adapter for the iPhone 14 and earlier. That adapter will allow for screen mirroring without using AirPlay.

Android always supports Chromecast, sometimes supports Miracast

Android phones don’t support AirPlay, but they sometimes support two wireless casting options that connect to nearly any television.

First, all Android phones include Chromecast support. So if your TV has Chromecast built-in or has a Google TV streamer attached, you’ll be able to connect your phone by tapping the Cast icon from an app. You can also set up a screen cast shortcut in the quick settings drop-down panel, which will provide an even faster way to quickly cast to your TV. CNET’s Nelson Aguilar has put together a guide for this.

And while it’s not supported on every Android phone, Samsung and Motorola both make Android phones that support Miracast for screen mirroring. These features are labeled as Smart View and Ready For, respectively, and will let you connect your phone to televisions or displays that support a setting that’s often labeled Screen Mirroring. More recent Motorola phones, like the Razr Ultra, are calling this feature Smart Connect. What’s unique about Miracast is that many Windows PCs also support this style of casting, and during my recent trip, that came in handy in order to play some Jackbox Games.

An additional note about these features from Samsung and Motorola is that both support connecting your phone to a television or computer monitor using a USB-C to HDMI cable, should you have one on hand. This could be particularly helpful if you’re trying to do a more data-intensive activity on your phone, such as connecting to a bigger screen in order to use your phone more like a computer.

More tips about wirelessly connecting your phone to a TV

Even though many televisions and streaming devices support one or more of these methods, it’s still entirely possible that when traveling, you won’t have a perfect match. For instance, you might have an Android phone, but the TV in your hotel room supports only AirPlay or blocks access to the HDMI port. But for home use, now that many televisions support multiple connection options, you have a good chance to be able to set up a method that works for day-to-day viewing.

You’ll also want to keep in mind that much like with video streaming, your network could also affect how effective a wireless connection will be to your TV. With that in mind, you will want to have your phone as close to a router as possible, which will help with the connection. If your video quality degrades while streaming, you may also want to turn casting off and on again to reset the connection.

But as long as your phone and television can connect with one of the above methods, you should otherwise be free to stream any movie or music from your phone onto your TV.

Technologies

Want to Save Some Cash After the Holidays? Check Out These 18 Hidden Amazon Prime Perks

Prime members can get cheaper gas and groceries, plus unlimited photo storage.

You already know that your Amazon Prime membership is great for free two-day shipping. But what about all the other perks? Whether you’re prepping for New Year’s Eve festivities on a budget, or just trying to save some cash as the holidays wind down, this service has a ton of hidden benefits waiting for you.

From discounted gas to streaming extras, there’s a lot more value packed into your Prime membership than most people realize, and a lot of those discounts can be used beyond Amazon.

You can take advantage of limited-time deals with a 30-day free trial, but that only lets you scratch the surface of all that a membership has to offer. It might surprise you to learn what else you can get by being a Prime member. Below, we’ll break down some of the best perks you may not know about.

Spoiler: Some of them are bangers.

For more, check out the latest Amazon products and see how you can get great savings on Amazon right now with coupons.

1. Watch HBO or other premium TV channels without cable

You probably know about Prime Video and Amazon Music Prime but you might not know all the special details. Amazon Prime members have access to a large number of feature-length movies and hit original TV shows like The Boys and The Lord of the Rings: Rings of Power, as well as an Amazon Music Prime library featuring 2 million songs and thousands of curated playlists.

Prime members can also download movies and TV shows for watching later offline.

If a show or movie you want to watch is not included as part of your basic Prime subscription, you can subscribe to premium channels such as HBO, Showtime and Starz for $5 to $15 a month, with no need for cable or satellite service.

Music lovers can upgrade to Amazon Music Unlimited to get a library of 90 million songs that can be streamed to multiple devices for $9 a month or $89 a year.

2. Get money back by choosing no-rush shipping

If you don’t need your purchase to be delivered quickly, you can opt out of two-day or shorter delivery options by selecting «no-rush shipping» and receive your package in about six days. In return for your patience, Amazon will give you rewards.

There’s no standard for no-rush shipping rewards — they vary from item to item — but they generally provide discounts on products and services that you might buy from Amazon.

Some common rewards are $1 credits for Amazon digital services like movies, music and ebooks, $3 coupons for Amazon’s Happy Belly-branded snacks, $10 to $20 off TV or furniture purchases and $10 to $20 off Amazon Home Services.

The value of no-rush shipping will depend on whether you’ll use any of the rewards. It might not seem like much, but a few no-rush shipping selections could easily earn you the $3 to $4 you need for a free movie rental from Prime Video.

3. Whole Foods grocery discounts

If you’re a frequent shopper at Whole Foods, an Amazon Prime membership can reap serious dividends. Prime Member Deals available in physical Whole Foods stores give members discounts of 10% to 20% on selected items marked with blue Amazon stickers.

Yellow tags indicate even further savings, usually at least another 10% off an already discounted price. Prime members who scan the Whole Foods Market or Amazon app at checkout get an extra 10% off storewide sales. Prime membership also gives you access to special online deals.

4. Exclusive access to Thursday night NFL football games

It’s the second year that Amazon Prime has had exclusive rights to air Thursday Night Football, and Prime seems to be killing the game. It received five Sports Emmys nominations for its 2022 coverage and boasts a stacked cast of experts, commentators and former players.

If you are a Prime subscriber, you can stream 2025-2026 Thursday Night Football games on Prime Video, NFL +, Amazon.com or Twitch. There is also a Spanish-language broadcast available on Prime Video. Pregame coverage begins at 7 p.m. EST each Thursday.

5. Free same-day Amazon Fresh delivery

Whole Foods isn’t the only grocery option available to Amazon Prime members. Subscribers also have access to the online grocery store Amazon Fresh, which provides free deliveries to some locations. Amazon Fresh has some similar products to Whole Foods but generally focuses on a broader range of groceries and home products at lower prices.

Anyone can purchase products from Amazon Fresh but only Prime members get free same-day delivery. Amazon Fresh also has 44 physical locations that offer special weekly deals for Prime members.

6. Free same-day delivery for perishable groceries

Similar to Amazon Fresh, a new service gives Amazon users access to perishable groceries with same-day delivery service. More than 1,000 cities and towns in the US can now get groceries delivered within hours and Amazon plans to expand the service to more than 2,300 locations by the end of 2025.

Same-day delivery is available to all Amazon customers for $12.99 but it’s free for Prime members who order at least $25 worth of groceries (it costs $2.99 if your order is less than $25). If you’re running low on milk and eggs and you don’t have time to make a trip to the grocery store, this is a great way to stock up without leaving the house.

7. Borrow unlimited books, magazines and comics

Amazon Prime members gain access to Prime Reading, a service similar to Kindle Unlimited with a different collection of materials. You can borrow as many books as you like, and many include audible narration, so you can switch back and forth between reading and listening. The electronic downloads don’t require a Kindle or Fire device.

Amazon First Reads gives Prime members access to editors’ selections of early book releases. Anyone with a Prime membership gets one free Kindle book a month, as well as regular discounts on selected titles.

8. Prime-exclusive deals and promos

Amazon offers Prime-exclusive deals all-year round on top products meaning you can make back the cost of your membership in savings. For big shopping seasons like Black Friday or Prime Day, there are even more member-only prices to shop.

Plus, Prime subscribers often get early access to Lightning Deals. These are sort of like Amazon’s version of a fire sale, featuring very low prices for a limited number of products that usually sell out very quickly. The good news for Amazon Prime members is that they get access to these deals earlier than everyone else. The bad news? There are a lot of Amazon Prime members.

9. Exclusive Zappos deals, faster shipping and a test month for running shoes

Amazon acquired the online shoe giant Zappos in 2009, and it now provides a number of benefits for Prime members who link their accounts on Zappos.com. Prime members get faster shipping, bonus reward points for shopping and exclusive deals on certain products.

Zappos also lets Prime members participate in Runlimited, a 30-day guarantee program for running shoes.

10. Save money on prescription drugs online

Prime members have exclusive access to Amazon RxPass. The subscription service provides all of your eligible medications for a single payment of $5 a month, regardless of how many prescriptions you have. More than 50 commonly prescribed medications are available.

Amazon says that the average member with an RxPass saves 38% on medications but it’s important to note that Amazon’s Prime Rx savings program does not work with health insurance. You’ll need to be sure that any savings you get from the program are more than you’d get from insurance coverage.

11. One Medical membership discounts

One Medical is a membership-based health service that provides primary in-person and virtual health care. Its concierge-like medical service is designed to allow members to easily schedule appointments and care using the company’s mobile app or website.

Amazon acquired One Medical in 2023 and is now offering a major discount for Prime members. Instead of the usual price of $199 a year, Amazon Prime members can subscribe for $99 a year, or $9 per month. To activate the discount, Prime members should visit this page. Existing One Medical subscribers who are Prime members can also take advantage of the discount starting with their next payment.

12. Access to Amazon Luna

Amazon Luna delivers access to a library of games that you can play without paying a dime since they’re included with Amazon Prime and Prime Video. There is a rotating library of games that you can claim, including super popular options like the Fallout Series and XCOM2.

Along with single-player games, Amazon has added a GameNight section. These games are all multiplayer games that can be controlled with a smartphone, making it a great way to spend time with friends or family playing games. There are more than 25 options in GameNight include Ticket to Ride, Jackbox and Exploding Kittens.

13. Unlimited photo storage with Amazon Photos

With a subscription to Amazon Prime, you can store unlimited photos and 5GB of video on Amazon Photos. Without Amazon Prime, you’re limited to a total of 5GB of videos and photos total.

You can view or share your photos and videos on Amazon Photos using the iOS or Android app, or on a computer with the desktop or web app. Your photo and video files are fully encrypted, so they’re only visible to people with whom you intentionally share them.

14. Get discounts on Shutterfly

Amazon has partnered with photography company Shutterfly to offer Prime members 45% off most regular-priced products. Shoppers also can get free shipping on orders of $35 or more. To get the discount, you’ll have to link your Shutterfly and Amazon accounts.

If you store your photos with Amazon, you can now access your Amazon Photos directly from Shutterfly. This makes it extra convenient for Prime members to share images from their extensive photo library.

15. Get a free Grubhub Plus membership

Don’t feel like cooking tonight? There’s a perk for that, too.

When Amazon announced it would offer Grubhub Plus free for a year in 2022, it was a solid, but temporary, perk added to Prime. In 2023, Prime members were treated to another free year. For 2024, instead of renewing the food delivery service’s premium membership again for another year, Grubhub Plus became a permanent Amazon Prime perk.

Grubhub Plus typically costs $9.99 a month and provides unlimited free delivery for all orders over $12 in more than 4,000 cities nationwide.

16. Save on Amazon Kids Plus

If you have Amazon Prime, you also get access to discounted Amazon Kids Plus. The subscription service features a range of ad-free content, including books, games and videos for children ages 3 to 12. Parents can limit the amount of screen time available to their children and manage up to four profiles on iOS and Android.

The Amazon Kids Plus subscription is normally $79 a year but Prime members can get it for $48 a year.

17. Get your package on the day you want it with Amazon Day

If none of the usual delivery dates work for you, you have one additional option as a Prime member. Amazon Day is a free perk that lets you schedule your packages to arrive on your day of choice. Next time you’re on vacation, you don’t have to arrange for the neighbors to help you bring in your boxes, and you won’t have to worry about porch pirates stealing your delivery on days when you’re not home.

Amazon Day is also a great option to cut down on the number of boxes for your packages, as you can schedule multiple purchases to arrive as a single delivery.

18. Save money on gas

Do you spend several hours each week driving to and from work? If you’re an Amazon Prime member living in the US, your dollar will now stretch a little farther at the gas pump. You can save 10 cents per gallon at BP, Amoco and AM/PM gas stations — there are about 7,000 locations across the 50 states. Amazon estimates that this perk will save the average American nearly $70 per year.

To get the full 10-cent-per-gallon discount, Prime members must create a free earnify™ account and link it to their Prime account. You can use the earnify™ app to find stations, then simply go to the pump and enter your phone number or linked payment method for instant savings. (Using the earnify™ app is optional — it just needs to be linked to your Prime account.)

For more about Amazon Prime and what to expect from this year’s back-to-school deals. Plus, check out these Amazon deals on tech and home goods and tips for getting the best Amazon deals.

Technologies

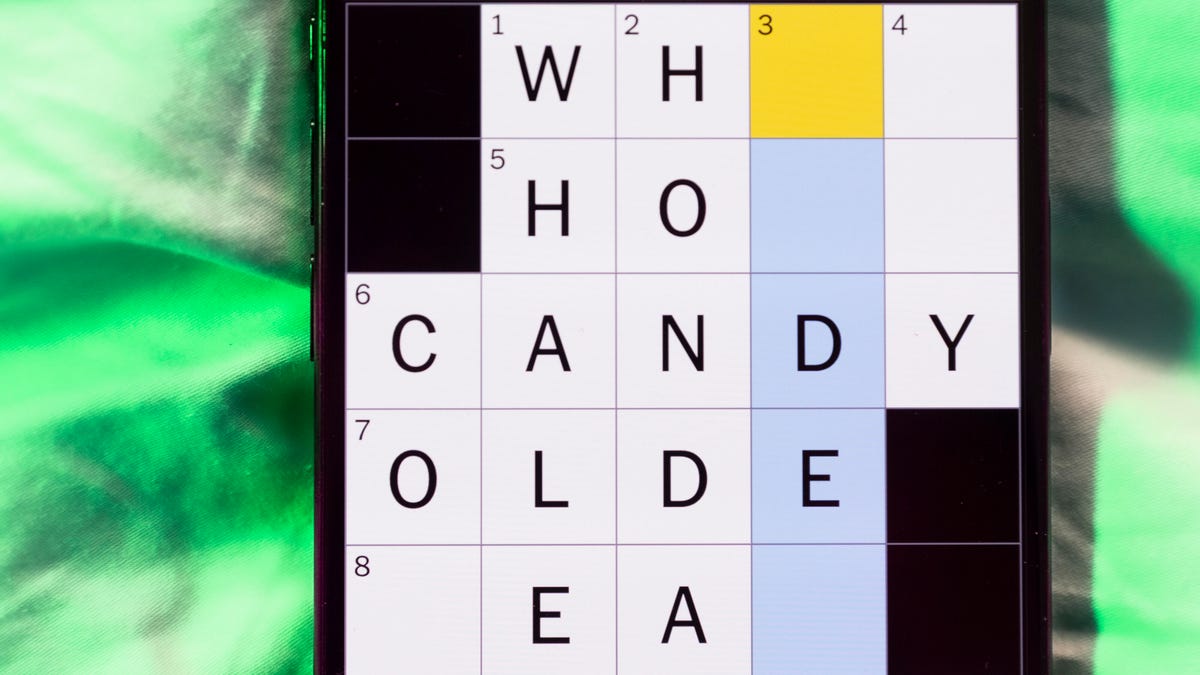

Today’s NYT Mini Crossword Answers for Friday, Dec. 26

Here are the answers for The New York Times Mini Crossword for Dec. 26.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? Some of the clues are tough today — I thought maybe 1-Across was referring to the Grinch, or even Oscar the Grouch, but was I ever wrong! Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Furry and green, say

Answer: MOSSY

6A clue: State known for its potatoes

Answer: IDAHO

7A clue: Like a faithful friend

Answer: LOYAL

8A clue: Had a beverage

Answer: DRANK

9A clue: Pronoun frequently paired with «her»

Answer: SHE

Mini down clues and answers

1D clue: Not spicy, as salsa

Answer: MILD

2D clue: Reasons for wrinkled noses

Answer: ODORS

3D clue: Words from a doctor checking your tonsils

Answer: SAYAH

4D clue: Comedian Gillis

Answer: SHANE

5D clue: Part of an egg used to make hollandaise sauce

Answer: YOLK

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Technologies4 года agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow