Technologies

Meta Will Use AI to Place Teens Into Stricter Account Settings

The company may override user-provided ages if it suspects the account belongs to a teen.

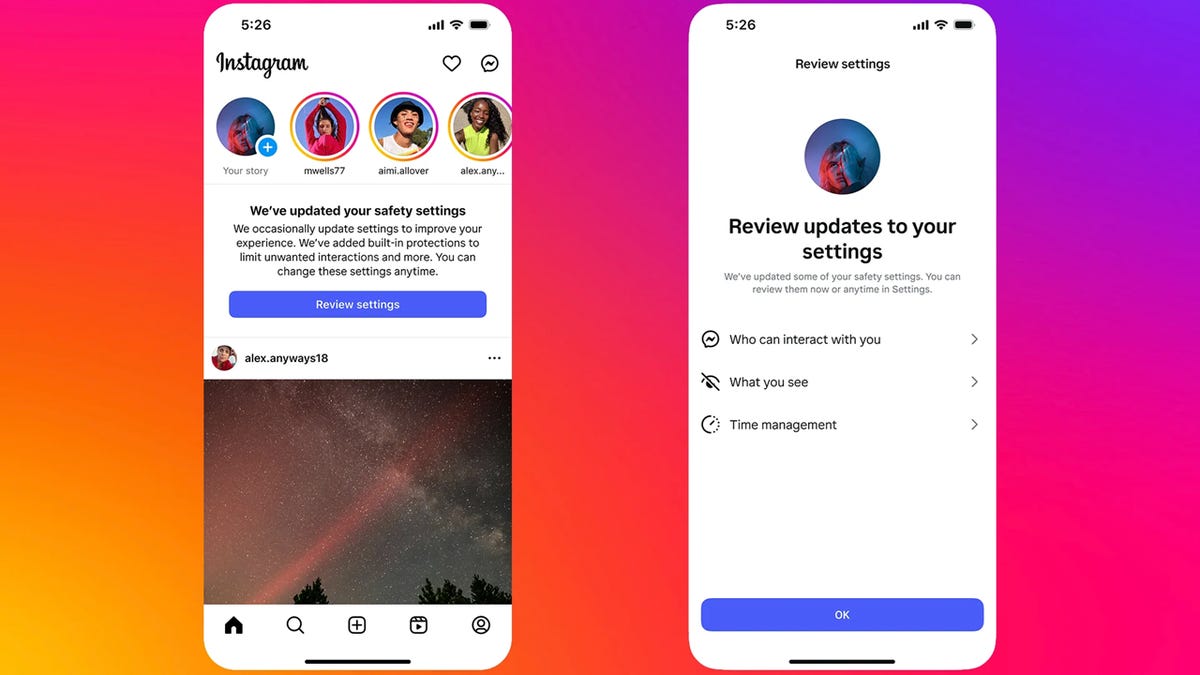

Meta is expanding its age-verification tools by using AI to detect teenaged users and then automatically placing them into more restrictive Teen Account settings even if the user entered an adult birthday.

The company said in a blog post Monday that it will proactively identify accounts it suspects belong to teens and move them into these stricter settings. It acknowledged the system may make mistakes, and users will have the ability to adjust their settings back if needed.

«We’ve been using artificial intelligence to determine age for some time, but leveraging it in this way is a big change,» Meta said.

This move is part of a broader effort by Meta and other social media platforms to better protect young users amid growing pressure from parents and lawmakers who argue that tech companies aren’t doing enough to safeguard the safety and mental health of teens.

Instagram Teen Accounts, which launched last year, include built-in protections that limit who can contact teens, what content they can see and how long they can spend on the platform. Last year, the company automatically enabled these safety features for all teen users, requiring parental or guardian approval for anyone under 16 to make changes.

The company said about 97% of users under 16 keep these protections in place. It also recently extended the Teen Account experience to Facebook and Messenger.

Meta said it will begin sending notifications to Instagram parents with information about why it’s important to talk with their teens about providing accurate age information online.

«Understanding the age of people online is an industry-wide challenge,» the company said. «We’ll continue our efforts to help ensure teens are placed in age-appropriate online experiences, like Teen Accounts, but the most effective way to understand age is by obtaining parental approval and verifying age on the app store.»

Although some organizations have applauded these types of age verification methods, others like Devorah Heitner, author of Growing Up in Public, call the privacy implications «frightening.»

«For AI to be effective at determining user age, it would have to know more than it should, especially for a newer user with a limited digital footprint,» she said. «We need to see social apps do more to protect all users from invasive algorithms and harassment rather than focus on age-gating.»

Technologies

Today’s NYT Strands Hints, Answers and Help for Dec. 25 #662

Here are hints and answers for the NYT Strands puzzle for Dec. 25, No. 662.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

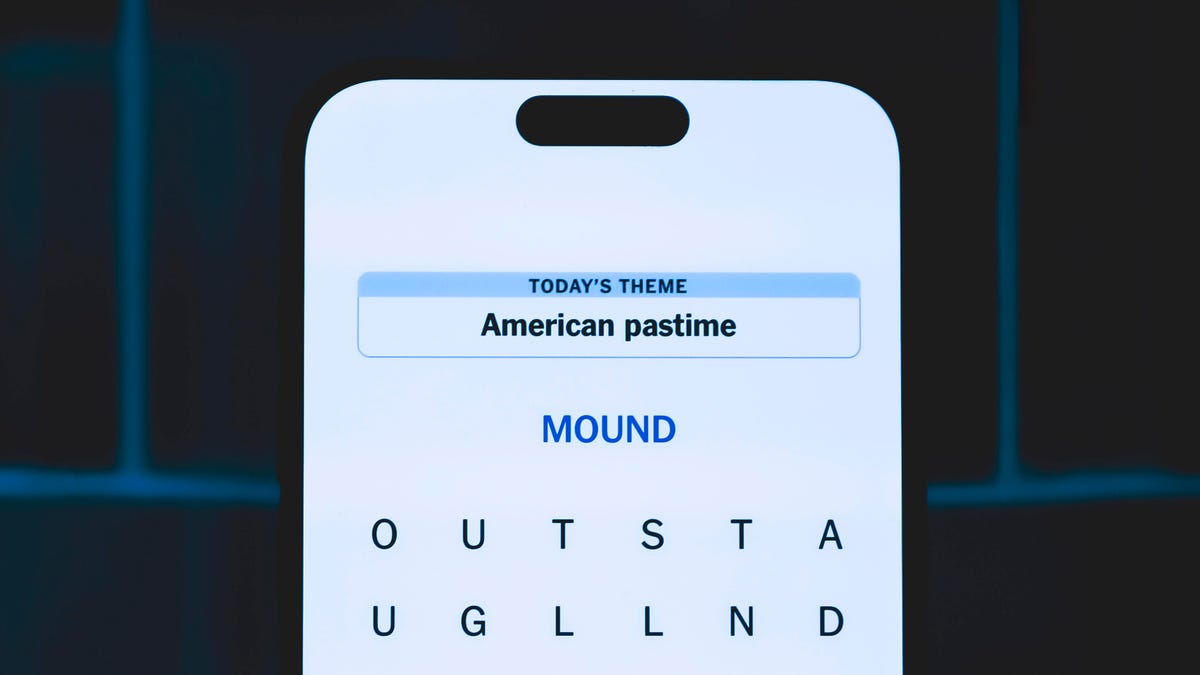

Today’s NYT Strands puzzle has a holiday theme, and if you know a certain Christmas carol, you’ll quickly determine which words to hunt down. Some of the answers are difficult to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: Carolers count.

If that doesn’t help you, here’s a clue: Five golden rings.

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- RIMS, HIMS, MARS, CHIME, CHIMES, MADS, DATE, DIAL, WAIL

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- LORDS, MAIDS, SWANS, LADIES, PIPERS, DRUMMERS

Today’s Strands spangram

Today’s Strands spangram is CHRISTMASDAYS. To find it, look for the C that’s three letters down on the far-left row, and wind across.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Toughest Strands puzzles

Here are some of the Strands topics I’ve found to be the toughest in recent weeks.

#1: Dated slang, Jan. 21. Maybe you didn’t even use this lingo when it was cool. Toughest word: PHAT.

#2: Thar she blows! Jan.15. I guess marine biologists might ace this one. Toughest word: BALEEN or RIGHT.

#3: Off the hook, Jan. 9. Similar to the Jan. 15 puzzle in that it helps to know a lot about sea creatures. Sorry, Charlie. Toughest word: BIGEYE or SKIPJACK.

Technologies

Judge Blocks Texas App Store Age-Check Law

A preliminary injunction found the Texas law, set to begin Jan. 1, is «more likely than not unconstitutional.»

A new Texas state law set to take effect on Jan. 1 would have required app stores to implement age verification processes. But the law has been put on hold, at least temporarily, by a federal court judge.

As reported by the Texas Tribune, Senate Bill 2420, also known as the Texas App Store Accountability Act, is the subject of a temporary injunction issued by US District Judge Robert Pitman.

Pitman said in his decision that the law as written is broad, vague and «more likely than not unconstitutional.» However, he also wrote the court «recognizes the importance of ongoing efforts to better safeguard children when they are on their devices.»

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

The Texas law, signed into law by Governor Greg Abbott in May, requires app store operators — including Apple, Google, Nintendo, Steam and more — to build age verification processes for the storefronts and to only allow downloads to minors who obtain parental consent. The injunction is a ruling in an October lawsuit filed by the Computer & Communication Industry Association.

CCIA senior vice president Stephanie Joyce said in a statement, «This Order stops the Texas App Store Accountability Act from taking effect in order to preserve the First Amendment rights of app stores, app developers, parents, and younger internet users. It also protects parents’ inviolate right to use their own judgment in safeguarding their children online using the myriad tools our members provide.»

Other individuals and the advocacy group Students Engaged in Advancing Texas also filed suits over the law, the Texas Tribune reported.

App Store Accountability Act

The bill author, State Senator Angela Paxton, said the bill was meant to give parents «common sense tools to protect their kids and to survive court challenges by those who may have lesser priorities.»

The language of Texas Senate Bill 2420 does not only include mobile app stores from Apple or Google, but any «website, software application, or other electronic service that distributes software applications from the owner or developer of a software application to the user of a mobile device.»

By that definition, websites with links to browser games or mobile game consoles with download options would fall under the Texas law as written. The law also defines mobile devices as including phones and tablets, as well as any other handheld device capable of transmitting or storing information wirelessly.

The parental consent aspect of the law requires those under 18 to have an app store account affiliated with a parent or guardian to purchase or download applications.

Age verification elsewhere

In an effort to keep adult materials out of reach of minors and to protect children from potentially harmful content and interactions, tech companies have been compelled by law or through legal action to verify the age of users.

Roblox, which has a huge audience of minors, began rolling out stricter age verification after investigations and lawsuits hurt its reputation as a safe gaming space. Australia is perhaps the most large-scale example of a government restricting access to online content. In December, Australia began restricting social media access to those 16 and older. Reddit recently challenged that law.

In the US, age verification laws have primarily targeted adult sites. Texas already has a law on the books that requires adult sites to age-block their content. The Supreme Court upheld that law in a June ruling. The UK has also enacted age restriction rules for adult sites as have other US states.

Technologies

Today’s NYT Mini Crossword Answers for Thursday, Dec. 25

Here are the answers for The New York Times Mini Crossword for Dec. 25.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

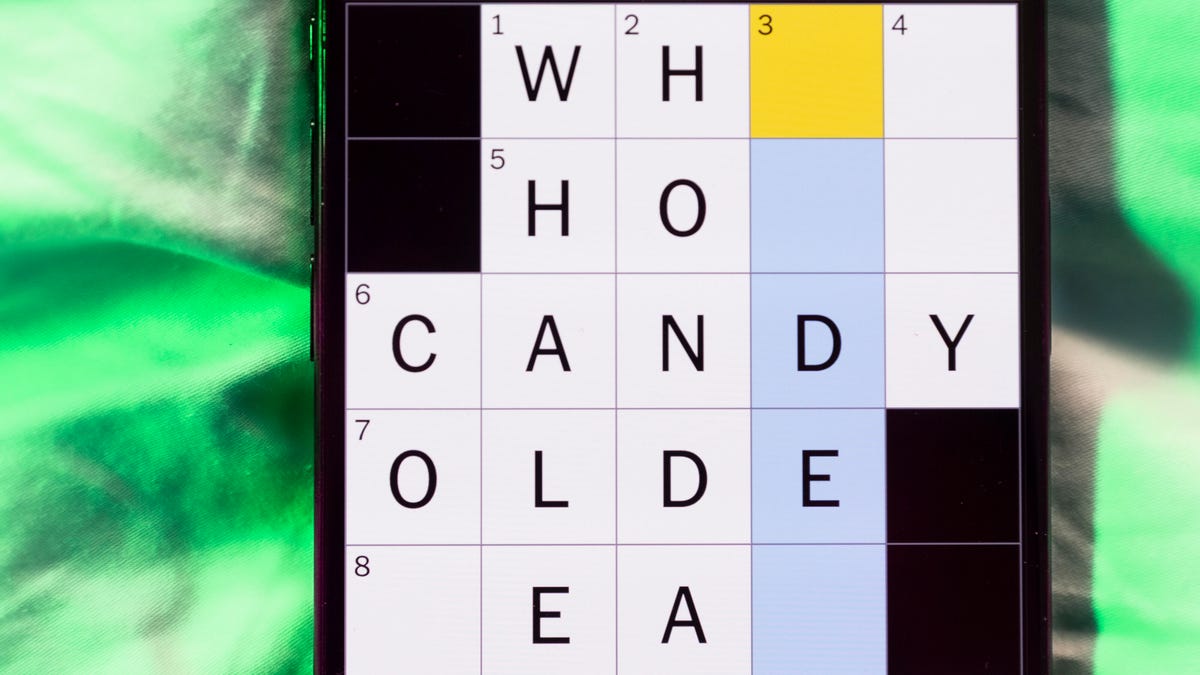

Need some help with today’s Mini Crossword? Of course, there’s a very Christmassy clue involved. And once you solve the entire puzzle, look at the letters used in all the answers and see what they have in common. (5-Across will tell you!) Read on for all the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: ___ King Cole, singer with the album «The Magic of Christmas»

Answer: NAT

4A clue: Body drawings, informally

Answer: TATS

5A clue: Letters to ___ (what this Mini was made with)

Answer: SANTA

6A clue: Huge fan, in slang

Answer: STAN

7A clue: «Illmatic» rapper

Answer: NAS

Mini down clues and answers

1D clue: Grandmothers, by another name

Answer: NANAS

2D clue: Abbr. before a name on a memo

Answer: ATTN

3D clue: Org. with long lines around the holidays

Answer: TSA

4D clue: «See ya later!»

Answer: TATA

5D clue: Govt.-issued ID

Answer: SSN

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Technologies4 года agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow