Technologies

Your Venmo Privacy Could Be Compromised. How to Protect Your Account

When it comes to your funds, it’s important to be aware of privacy risks for payment apps.

Millions of people use mobile payment apps like PayPal’s Venmo and Square’s Cash App everyday to transfer money directly from their bank accounts to friends, family and merchants. These platforms offer convenience, but they aren’t without security risks, due in part to their combination of finance and social media. Users can also be targets for hackers looking to drain financial accounts.

But don’t worry — there are plenty of ways for you to secure your Venmo and Cash App accounts with a few simple settings changes and privacy best practices. Here’s what to do.

Basic tips for protecting your privacy on Venmo and Cash App

Both payment apps use encryption and fraud detection technology to protect account information. But to better ensure your security, you should take a few extra steps.

Use a randomly generated password

We know — you’re tired of hearing about how you need to use unique, hard-to-guess passwords for every account. But it’s still true, especially when your money’s involved. One easy way to do this is to use a password manager. Our favorites — including LastPass

, 1Password and Bitwarden — offer a free tier of service with all of the basics: password storage, strong and secure password generation and autofill capabilities.

A password manager can help keep your Venmo and Cash App accounts secure.

Angela Lang/CNETBeware of common scams

Criminals target users of apps like Venmo and PayPal in all kinds of clever ways. There have been reports of hackers posing as Venmo and Cash App support staff, calling or texting users, «helping» them change their passwords and then draining the accounts.

Scammer landlords have asked prospective renters for a deposit before offering apartment tours. Scammer pet owners have used a similar bait-and-switch, offering purebred animals at extremely low prices, asking for advance payment and then disappearing. Cash App’s support page is full of these types of calamities.

«Nobody at Venmo will ever contact you to request a password or verification code to your account,» according to the app’s security support page. The same is true for Cash App.

If you fall victim to a scam on either app, you should contact support@venmo.com or access resources through Cash App’s site.

Don’t use banking apps on public Wi-Fi (or invest in a VPN)

When you log into a financial app on any public Wi-Fi network — at a hotel, airport or coffee shop, for example — it can give malicious actors an opportunity to break into your account. It’s happened on cash-sharing apps before.

If you absolutely need to access your account and can’t use a reliable network, we recommend using a VPN to hide your activity from spying eyes. Here’s how to set up a VPN on your iPhone or Android and our list of the best VPNs of 2022.

Using a VPN while on public Wi-Fi is a good way to protect yourself while using any app related to finance.

Sarah Tew/CNETDon’t send money to strangers

Avoid sending payments to people you don’t know and trust through Venmo and Cash App. Neither app is currently optimized for buying or selling goods or services, though Venmo is working on a business profiles feature to make retail and commercial sales more secure. If you’re a vendor considering using Cash App, you’re better off creating a business account through Square Payments.

Read more: 6 Best Payment Apps

Make all of your Venmo transactions private

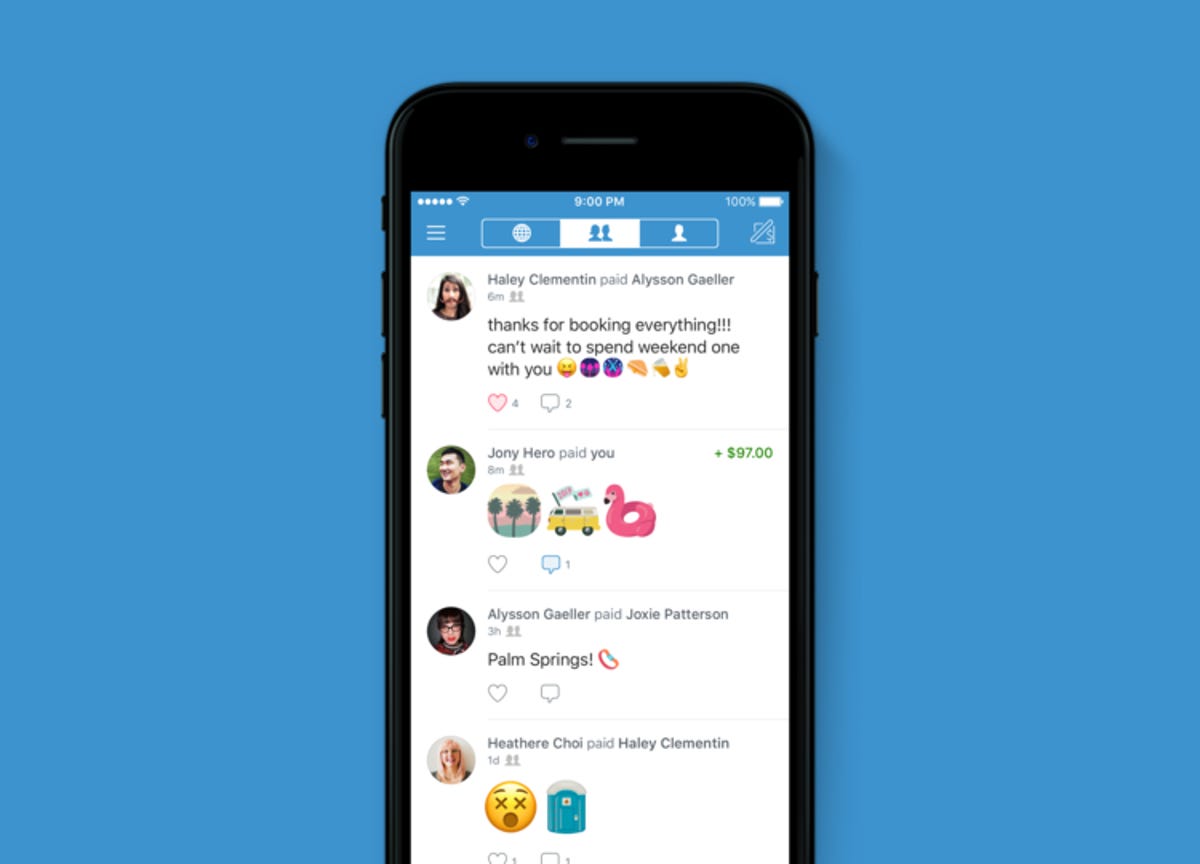

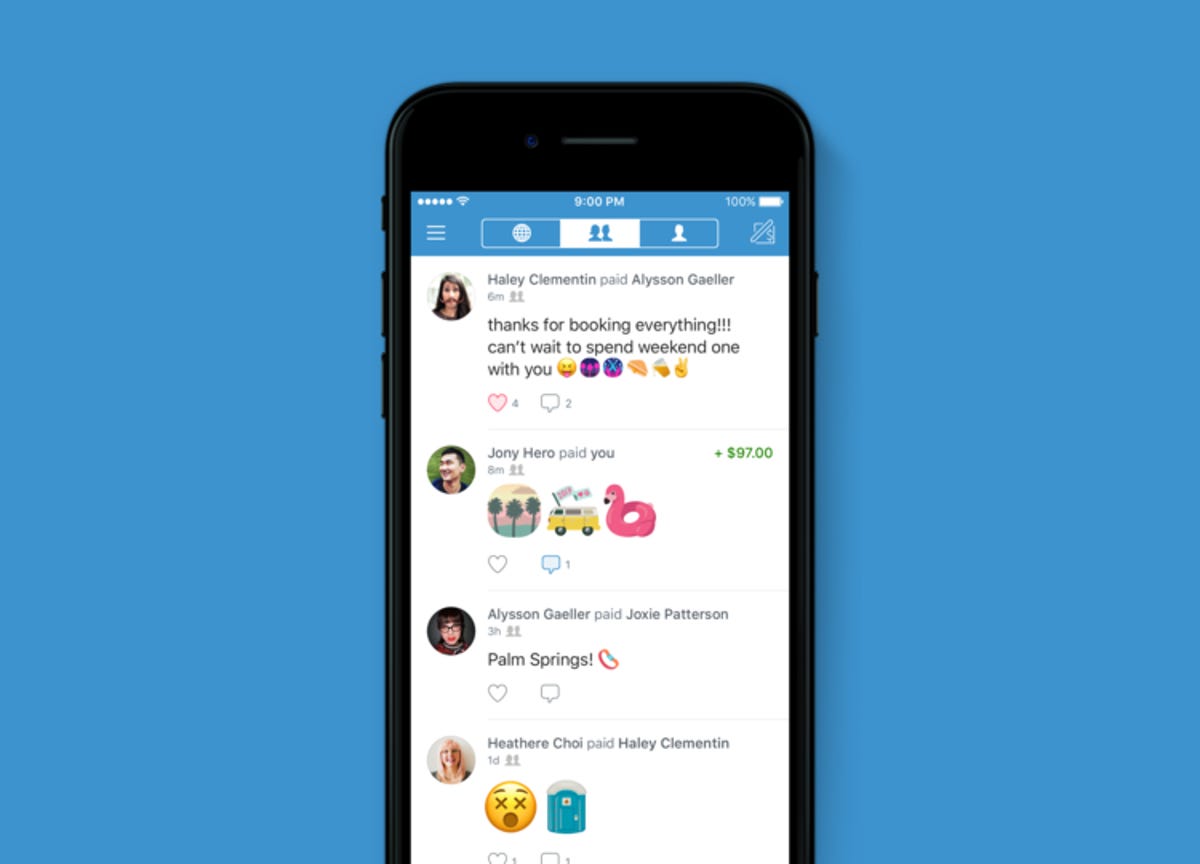

This is an absolute must. When you create a Venmo account, by default all of your transactions are public — which means anyone on the internet can see exactly what you’re sending, and to whom. This public record has been used to figure out everything from who won The Bachelor before a season aired to an alleged political sex trafficking investigation.

Making all of your transactions private by default is extremely easy. Open the Venmo app, and tap the three lines in the upper right corner for the menu. Tap Settings > Privacy, and under Default Privacy Setting, tap Private. Now all of your future payments will only be visible to you and the recipient.

You can also change the privacy settings for past transactions. On the same Privacy page, under more, tap Past Transactions. You’ll see the option to Change to Friends, or Change All to Private.

One benefit of Cash App: All transactions are private by default.

If you don’t make your Venmo transactions private, anyone can see them.

VenmoEnable two-factor authentication

Two-factor authentication is a solid way to add another layer of security to your account. When you sign in on a new device, Venmo will send a code to the phone number registered with your account, that you’ll need to enter correctly to access your account.

To enable two-factor authentication on Venmo, open the app and tap the three lines in the upper right corner for the menu. Tap Settings, and under security, tap Remembered Devices. You’ll see the device you’re currently using, and possibly others you’ve used in the past. When you sign on with any of the devices on your list, you won’t need to enter a verification code. To remove any of the devices, swipe left and tap Delete. If you want to enable two-factor authentication on all devices, you can delete them all from this list.

On Cash App, every time you sign into your account on a new device, you’ll be sent a one-time login code. The app recommends adding two-factor authentication to your email account associated with the app for better protection.

Set up a pin or turn on Face ID

Enabling Face ID or a pin adds more security to your account when opening the app or making a transaction.

On Venmo, you can set this up so that every time you open the app, you’ll need to enter either your Face ID (or fingerprint scan depending on device) or your pin. To get started, tap the three lines in the upper right corner for the menu. Tap Settings, and under security, tap Face ID & PIN. Tap the toggle to Enable Face ID & PIN. The app will prompt you to enter a new passcode, and, if you’re on an iPhone, you’ll get a pop up notification asking if you’d like to allow Venmo to use Face ID to unlock your account. Tap OK. If you’re on an Android phone, it may say PIN code & biometric unlock.

On Cash App, you can set up a security lock that requires your Face ID, Touch ID or a pin to transfer funds. Tap your profile icon in the top right corner. Tap Privacy & Security, and under Security, toggle on Security Lock. The app will prompt you to enter a pin, and then enter your email address to confirm your selection with a code.

Setting up a pin or biometric login can help secure your accounts.

Brett Pearce/CNETTurn on payment send notifications

Get alerted to any unauthorized activity on your Venmo or Cash App accounts by turning on notifications.

On Venmo, go to Settings > Notifications. Choose from push, text or email notifications. Under Push notifications, you can toggle on and off notifications for bank transfers, payment received, payment sent and lots more. Turning on at least the payment sent notification is a good way to get an immediate alert of anyone else sending money through your account.

On Cash App, tap your profile icon, and tap Notifications. Tap to turn on push notifications by text or email.

Link a credit card instead of your bank account

Though you can add a checking or savings account to Venmo, it’s more secure to link it to a credit card. Though you’ll be subject to a 3% transaction fee, credit cards typically have much stronger theft and fraud protection than a conventional bank account.

To change your payment method on Venmo, go to Settings > Payment methods, and tap Add bank or card. Then tap Card, and enter your credit card information.

On Cash App, you need to enter your bank account information before entering a credit card. However, you can sign up for a free Cash Card debit card so you can use funds people send you through the app on the card.

For more, check out the best checking accounts, best savings accounts and best credit monitoring services.

Technologies

Anthropic Pinky-Promises It Won’t Add Ads to Claude

Anthropic’s Super Bowl ads are funny, but can we really trust them?

In the latest chapter of Anthropic’s «We’re not like the other guys» campaign, the AI company is pledging not to introduce advertisements into conversations with its chatbot, Claude. And it’s spending big on Super Bowl ads to make sure you know that fact.

Anthropic’s announcement takes a clear shot at competitor OpenAI. The ChatGPT-maker said a few weeks ago that it would begin testing ads in its products that will be «clearly marked» as sponsored posts. The company also said that ads wouldn’t be served around sensitive or regulated topics, like mental health and politics.

The news was a stark reversal from previous statements — OpenAI CEO Sam Altman had called ads a «last resort» in 2024. But it wasn’t entirely unexpected, given the general chaos of the AI industry’s financing.

For a long time, AI startups operated at a loss, spending billions of dollars from venture capitalists and others to build their chatbots without making money. OpenAI and many others now have a complex web of circular deals to keep the lights on, but newer advanced models require more compute, better chips and generally more maintenance and money to keep up. Anthropic certainly isn’t immune to these financial pressures; the company is the the process of securing a new $10 billion funding deal.

That’s why AI companies are seeking new revenue streams. Hence the ads.

The concern with including ads in chatbots (beyond general irritation) is that it will push products at the expense of helping users. Anthropic wrote, «Users shouldn’t have to second-guess whether an AI is genuinely helping them or subtly steering the conversation towards something monetizable.»

There’s also the risk that tech companies will prioritize advertising metrics and revenue over safety or user autonomy. OpenAI did not immediately respond to a request for comment.

Anthropic, for its part, has been very outspoken about the risks posed by AI technology, so it’s not surprising to hear the company weigh in on this issue. CEO Dario Amodei has spoken at length about the potential threat that AI systems may pose to humanity.

But we have a wealth of examples to draw on — streaming services, smart TVs and now chatbots — where tech companies tried and eventually failed to resist the allure of advertiser money. We can never say never. Anthropic didn’t.

Technologies

Overwatch’s New Season 1 Is What the Game Was Always Meant to Be

A commitment to an ongoing story and more frequent new heroes, including five right now, move the game in the direction it always seemed to promise.

In late January, I was among a group of journalists from all around the world packed into the Blizzard Theater in Irvine, California, to watch the 40-minute Overwatch spotlight and hear from Blizzard execs about where the game was going next. I was not prepared for what we saw. Nor were the other journalists, who gasped, laughed and sometimes comically swore as the video showed us what’s coming next for the hero shooter franchise — which turns a decade old later this year.

What stirred up such audible reactions? An ongoing story that’s reflected directly in the game. New subroles with distinct passive abilities. Ten new heroes are coming this year, five of which are arriving next week. One of the later heroes is freaking Jetpack Cat, who was dreamed up in concept art and scrapped before the game was even released. And maybe most surprisingly, dropping the «2» so the game returns to simply being «Overwatch.»

One of the first questions to that group of execs was about changing the title from Overwatch 2 back to Overwatch — why change, and what does it mean? Johanna Faries, president of Blizzard Entertainment, said the team thought it was the right time for Overwatch to turn the corner in a big way. «It sets us up for a much broader conversation on where the future of this universe [is] and where these characters are going to go.»

Blizzard’s big swing to revitalize Overwatch comes as the game approaches its 10th anniversary in May. Gaming is different in 2026, as newer live-service games can disappear in an instant, and even more tenured franchises like Call of Duty and Battlefield can struggle to retain players. Even Overwatch finally has a major, direct competitor in the team hero shooter genre in Marvel Rivals. So for Blizzard to step up and commit so boldly to this vision is a jolt, a burst of life into a game that has already spent the past couple of years solidifying and expanding its identity with new game modes and features like perks and map voting.

The announcements are both a celebration of the game’s history and a statement that the game is building a bolder future for itself.

Across my own nine-year history playing Overwatch, I’ve experienced its ups and downs, from the heights of queuing with a full six-stack and joining organized team play to the lows of the seemingly interminable double shield meta. And after talking to hero designers, narrative designers, systems designers, artists and voice actors, I left the Blizzard campus reflecting on the idea of playing Overwatch and following its larger story after all these new initiatives launch. One thought stuck with me.

This is how the game was always supposed to feel.

The emotion of a new cinematic driving the story of Overwatch forward, of puzzling over 10 hero silhouettes and learning that five of them would be ready to play almost immediately… it kindled the same kind of anticipation I had in the movie theater where I first awed over an early Overwatch trailer.

Best of all, fans won’t have to wait for this new era of Overwatch, as its fittingly rebadged Season 1 is launching next week with five heroes up-front and another new hero roughly every other month in each new season. We’ll get two new maps later in the year, alongside the return of postmatch accolades, which updated the old voting cards that let you show some love to players on either team who performed particularly well in a match.

I got an early look at the journey awaiting Overwatch fans this year during my time at Blizzard. And while I have some lingering questions about how certain elements will play out, here’s why I’m more excited about the game than I’ve ever been.

Overwatch embraces storytelling directly in the game

The world of Overwatch has always felt vibrant and pulsing with lore, but the game has struggled to tell a story outside of an impressionistic narrative you could vaguely piece together between cinematics, comics and occasional in-game events.

Season 1 promises to change that by kicking off the year-long Reign of Talon storyline, beginning with a cinematic that shows major upheaval in the villainous organization and longtime antagonist to Overwatch. The rest of that story will play out over the course of the year, through traditional avenues like hero trailers, short stories and comics, as well as more immersive methods like new voice lines and map changes that reflect story events.

The Overwatch Spotlight video includes a clip of Talon aircraft assaulting Overwatch’s Gibraltar base, home of operations for genius ape hero Winston. In the media playtest, I fought across a Watchpoint: Gibraltar map that showed the damage of that attack. The bridge outside the starting attacker spawn was partially collapsed, and a flaming beam had crashed down on the airship in the hangar. These map changes breathe life into the larger narrative of a new, more aggressive Talon and make sure players see the consequences of these story beats.

In addition to map changes that illustrate the ongoing story, Overwatch’s narrative and audio designers said that character interactions will also change to reflect the story’s progression, noting an «outrageous amount» of voice lines being added to the game.

Collectively, these changes help bridge the gameplay with the wider world of conflicts and characters that have been the initial point of interest for so many players.

Five new heroes headline a massive influx over the next year

Overwatch 2 launched with three new heroes and has added another 10 in the three-plus years since then. Now we’re getting 10 heroes in a single year, starting with five who all have connections to existing characters and factions in the game.

- Domina, the new ranged tank and ally of Talon, is the heiress of Vishkar Industries, the same company that damage hero Symmetra works for and that also suppressed and exploited support hero Lucio’s hometown with technology his father had developed.

- Anran, a new fire-themed damage hero, is the older sister of support hero Wuyang. She wields hand fans that can shoot fire, and is a new Overwatch recruit alongside her brother.

- Emre, a damage hero wielding multiple weapons, is a former Overwatch agent now turned to Talon’s aims. He’s an old friend of damage hero Freja, though the person she found in their recent reunion is very different from the friend she remembers.

- Mizuki, an offensively focused support hero, is part of the Talon-aligned Hashimoto clan, which has been facing opposition from the support hero Kiriko and her allies in Japan.

- Jetpack Cat, a cat wearing a jetpack, is based on an early Overwatch hero concept long thought to be scrapped. Overwatch support hero Brigitte builds the kitty a jetpack to let her support allies from the skies by towing teammates and trolling enemies.

Multiple developers reiterated that this superdrop of new heroes wasn’t the result of cutting corners or rushing the process, but instead a benefit of improved tools and systems that have shrunk the design time for new heroes from eight months down to four or five.

«We still wanted to give the characters the same level of care we give any hero that we build,» the game’s Art Director Dion Rogers said in a panel on the new Reign of Talon story’s art.

In the leadership panel, Keller noted that the team wanted to kick off this year with an update that would feel like an expansion for the game, and the best way to do that for a hero shooter was to give them a bunch of new heroes: «People play this type of game … to learn more about these heroes, pick them up and continuously master them,» he said. Launching five heroes at once gives players that much more to engage with and could substantially shake up the meta of hero picks and team compositions.

Buzzing enthusiasm among developers

There’s plenty more driving my optimism beyond the new narrative focus and influx of new heroes. It’s the vibe of the announcements, the willingness for the game to go big, chase ideas and deliver a uniquely Overwatch experience to players.

There was palpable excitement among the five groups of Blizzard developers that journalists got to hear from at the Overwatch Spotlight event. In a panel about the game’s narrative, Lead Narrative Designer Miranda Moyer buzzed with enthusiasm, speaking alongside Scott Lawson, the game’s audio and technical director, about planning a year-long story, bringing Talon into the fray and how characters and allegiances might change over the course of that story.

«I think a lot of this new story is predicated on questions that have existed since, y’know, Overwatch was an entity [before eventually being disbanded],» Moyer said. She also noted that while some characters may have felt a little out of the loop of any sort of larger narrative throughout previous years of the game’s story, in the new structure «every single character … is pertinent to the overall plot.»

Developers being excited about their game isn’t surprising, but the degree of enthusiasm was encouraging for a game that suffered a years-long content drought followed by a troubled launch for Overwatch 2, stumbling over gated hero releases and long-announced game features that never saw the light of day. The conversations with devs gave me confidence that there’s a vision and passion for Overwatch that can fuel exciting updates like this for a long time to come.

The question marks amid the coming changes

The promises of ongoing stories and new heroes every season — six per year — are two of the most exciting things the game could announce. That said, some announcements from the spotlight raise more curiosity or concern than confidence.

A major overhaul of the menus forces us to relearn where things are and how to navigate them. The systems design team asserted that the new layout will add value, minimize interruptions and give players choices in menus, and I’m hopeful that the time spent relearning how to get around is worth the payoff. I like the cleaner look, but it will take some time to see how the new layout really feels.

The team also announced that some heroes, such as Ana and Genji, would be getting their second mythic skins before others received their first. I say this as someone who plays lots of Ana and wasn’t at all excited by her mythic skin, but that feels pretty unfair to the rest of the roster, especially given how many new faces we’re getting this year.

Balancing is the other element that feels like a bigger question mark in 2026. Dropping five heroes simultaneously and adding a new hero every season is going to put a lot more pressure on the team responsible for balance.

I asked Associate Game Director Alec Dawson about the challenge of balancing five new heroes at once. He acknowledged that the team does still want heroes to feel «impactful» at launch, but said they «probably went a bit too far» with recent releases.

«It’s good to have an impactful launch. It’s not good if your hero is banned in almost every match you’re in,» Dawson said.

The hero design team told us that they’ll be keeping a close eye on Jetpack Cat, especially given that permanent flight is an entirely new element in the game, and there are very few restrictions on her Lifeline ability that lets you fly allies around the map. Hero designer Scott Kennedy added that the team knows it’s going to be difficult to figure out all at once and that they’ll react quickly if things are out of line.

A new day and a familiar feel for Overwatch

The Spotlight video alone felt like Overwatch returning to the wonder and imagination that powered its 2016 launch. And the experience of talking to a variety of developers — and particularly seeing the seemingly unseverable thread of enthusiasm that connected them — made me as hopeful for the game as I’ve been since I started playing. The promise driving a story forward seems to mirror the team’s own internal hopes for shepherding the game into something bigger and bolder.

In a group interview with global media, I asked the game’s director, Aaron Keller, whether the Spotlight announcements were a commitment to moving the game forward — not just in terms of game mechanics but using it to tell a story beyond just brief snippets we’ve gotten from cinematics and events. He referenced the «amazing, sentimental» character pieces they’ve done so far, but said the team wants the new story to go somewhere.

«We want to take players on a journey over the course of this year — and over the course of many years,» Keller said. «We want to be doing this for as long as players are going to tune in for it.»

Technologies

I Bought the Galaxy Z TriFold for Over $3,000. Follow Along as I Test It (Live Updates)

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow