Technologies

How Apple’s New Buy Now, Pay Later Plan Works

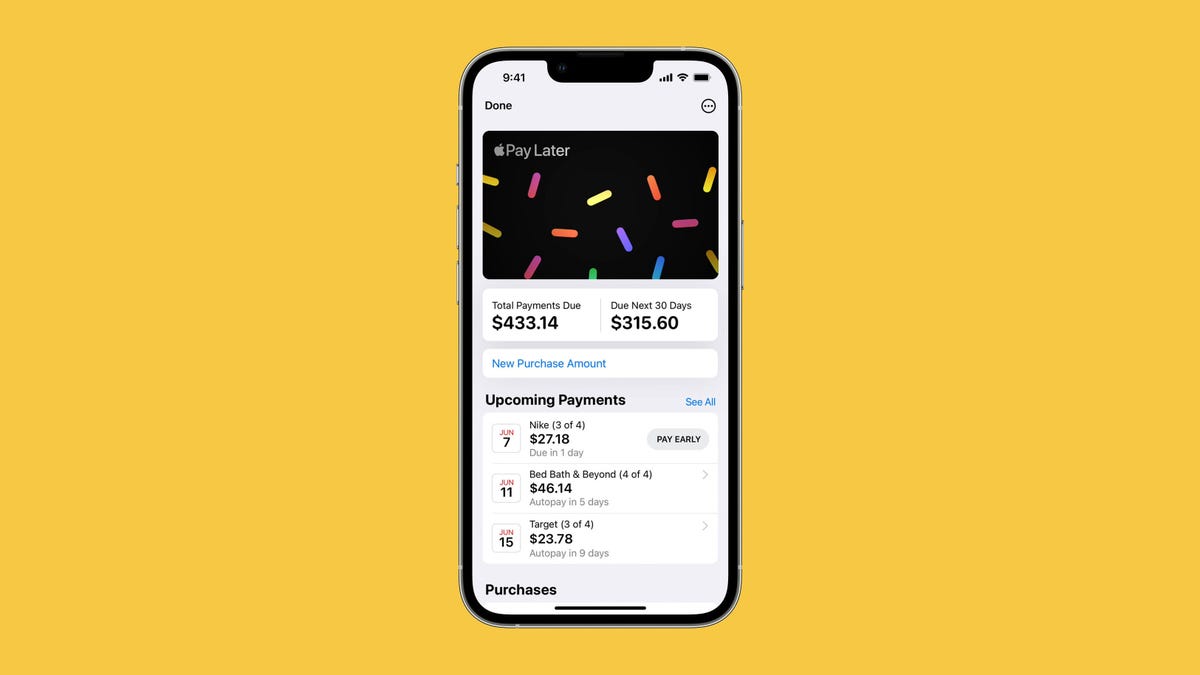

A prerelease version of Apple Pay Later now lets select users quickly finance purchases up to $1,000.

Apple has finally launched its long awaited buy now, pay later plan — Apple Pay Later — but only for some iPhone owners.

In a press release Tuesday, Apple announced that a «prerelease version» of Apple Pay Later is now available for «select users.» The company didn’t specify which users or how many, though it says it «plans to offer it to all eligible users in the coming months.»

Apple Pay Later was first announced in June 2022 at Apple’s WWDC event and was expected to be released sometime in the fall of that year, but the product’s launch was delayed due to «significant technical and engineering challenges,» per Bloomberg. Apple’s new features page for iOS 16 still says that Apple Pay Later is «coming in a future update for qualifying applicants.»

Apple Pay is a feature within Apple Wallet, the iPhone’s digital wallet app that also includes Apple Card and Apple Cash. Apple Pay lets you save debit and credit cards electronically and make purchases online or in brick-and-mortar stores; Apple Card is a digital credit card issued by MasterCard and Goldman Sachs; and Apple Cash is a peer-to-peer payment service.

Apple’s entry into BNPL financing with Apple Pay Later comes at a time when many retailers are accepting payments from BNPL apps such as Affirm, Klarna and Afterpay. Most of these apps provide similar short-term interest-free payment plans, while a few offer longer installment plans with variable interest rates.

Learn everything there is to know about Apple Pay Later, including how it works, where it is accepted and when it will be available for all iPhone users.

For more on iPhones, learn all the cool new features in iOS 16.4 and 22 iPhone settings you should change right now.

How do I use Apple Pay Later?

Apple Pay Later lets you break the cost of purchases into four equal payments spread over six weeks. The first payment is due when you make your purchase, and the remaining payments are due every two weeks after that.

Once Apple Pay Later is set up on your phone, you have two options when completing a purchase: Pay in Full and Pay Later. Selecting the latter option will bring up a payment schedule displaying the amount of each of the four payments and when they will be due.

Stores and merchants don’t have to implement any changes in order to accept payments through Apple Pay Later. Transactions occur as they did before — the only difference will lie in how back-end payments are made. Apple Pay Later will work with any merchants who accept Apple Pay.

MasterCard Installments, the credit card company’s white-label BNPL service, is providing the merchant payments for Apple Pay Later. Apple has created its own financial subsidiary — Apple Financing LLC — that handles loan approvals and credit checks. Banking partner Goldman Sachs is the official loan issuer.

Payments for Apple Pay Later must be made with a debit card; you can’t use a credit card. You can set up automatic payments or make additional payments at any time. Each BNPL purchase will be reviewed and approved or rejected using a soft credit check.

Apple Pay Later has no plan to charge fees for late payments, though it may use late payments as an excuse to reject future BNPL loans. The minimum purchase for Apple Pay Later is $50; the maximum is $1,000.

When can I use Apple Pay Later on my iPhone?

If you’re one of the «select users» to receive an invite from Apple, you can start using Apple Pay Later now. For the rest of us, based on the wording in Apple’s press release, Apple Pay Later will likely be enabled for all Apple Wallet users in a future update to iOS.

Apple has already released four point upgrades since iOS 16 launched in September 2022. The first update — iOS 16.1 — came in October 2022; the second — iOS 16.2 in December 2022; the third — iOS 16.3 — in January 2023; and the fourth — iOS 16.4 — in March 2023.

Based on that bimonthly release schedule, all Apple Wallet users can probably expect access to Apple Pay Later some time in May 2023.

How is Apple Pay Later different from Apple Card Monthly Installments?

Apple Card Monthly Installments is an Apple program that lets you finance the purchase of certain Apple products when using the Apple Card credit card. The length of the 0% APR period for these purchases depends on the product. Installment plans range from six months to two years.

Apple Pay Later isn’t restricted to Apple products, nor does it require the use of the Apple Card. With Apple Pay Later, you can finance any purchases from $50 to $1,000 using a debit card, as long as it’s connected to Apple Wallet. Also, the interest-free installment period for Apple Pay Later — six weeks — is much shorter than the payment plans offered by Apple Card Monthly Installments.

What other Apple Wallet features were added in iOS 16?

One new Apple Wallet feature that launched with iOS 16 is Apple Pay Order Tracking, which adds the ability for merchants to provide detailed receipts and delivery statuses for purchased products to customers via Apple Wallet.

Apple also expanded support in Apple Wallet for driver’s licenses and identification cards. Following IDs from Colorado and Arizona, Apple Wallet plans to add support for 11 more states.

These driver’s licenses can be used at select Transportation Security Agency checkpoints. They can also be shared with other apps that require identification, such as alcohol purchases through Uber Eats.

Apple Wallet has also added support for sharing keys for locations such as hotels, offices or automobiles. New features let users share keys with friends or associates using email, text messaging or other messaging apps.

What other online services let you buy now and pay later?

Some existing online payment systems provide buy now, pay later short-term financing similar to what Apple Pay Later is offering. PayPal’s Pay in 4 program works very much like Apple Pay Later, except that purchases are limited to between $300 and $1,500.

BNPL app Sezzle also uses a system of four payments over six weeks, but permits users to reschedule one payment for up to two weeks later at no cost and postpone further payments for an additional fee.

Other BNPL apps such as Affirm and Klarna offer interest-free installment plans for short periods, or longer installment plans that add a variable interest rate.

Technologies

The 3 iOS Features You Definitely Aren’t Using (but Are Silently Draining Your Battery)

If you find that your phone loses battery too fast, you may just need to disable these features to solve the problem.

It’s 2026, and if you’re constantly toggling on «Low Power Mode» just to survive a commute, you may as well be carrying around a brick. While it’s true that lithium-ion batteries naturally degrade over time, most people are draining their «juice» prematurely by leaving on high-performance features they don’t even need.

Your iPhone has a few key settings that drain your battery in the background. The good news is, you can turn them off. Instead of watching your battery percentage plummet at the worst possible moment, a few simple tweaks will give you hours of extra life.

Before you even think about buying a new phone, check your Battery Health menu (anything above 80% is decent) and then turn off these three settings. It’s the easiest way to make your iPhone battery last longer, starting right now.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Turn off widgets on your iPhone lock screen

All the widgets on your lock screen force your apps to automatically run in the background, constantly fetching data to update the information the widgets display, like sports scores or the weather. Because these apps are constantly running in the background due to your widgets, that means they continuously drain power.

If you want to help preserve some battery on iOS 18, the best thing to do is simply avoid widgets on your lock screen (and home screen). The easiest way to do this is to switch to another lock screen profile: Press your finger down on your existing lock screen and then swipe around to choose one that doesn’t have any widgets.

If you want to just remove the widgets from your existing lock screen, press down on your lock screen, hit Customize, choose the Lock Screen option, tap on the widget box and then hit the «—« button on each widget to remove them.

Reduce the motion of your iPhone UI

Your iPhone user interface has some fun, sleek animations. There’s the fluid motion of opening and closing apps, and the burst of color that appears when you activate Siri with Apple Intelligence, just to name a couple. These visual tricks help bring the slab of metal and glass in your hand to life. Unfortunately, they can also reduce your phone’s battery life.

If you want subtler animations across iOS, you can enable the Reduce Motion setting. To do this, go to Settings > Accessibility > Motion and toggle on Reduce Motion.

Switch off your iPhone’s keyboard vibration

Surprisingly, the keyboard on the iPhone has never had the ability to vibrate as you type, an addition called «haptic feedback» that was added to iPhones with iOS 16. Instead of just hearing click-clack sounds, haptic feedback gives each key a vibration, providing a more immersive experience as you type. According to Apple, the very same feature may also affect battery life.

According to this Apple support page about the keyboard, haptic feedback «might affect the battery life of your iPhone.» No specifics are given as to how much battery life the keyboard feature drains, but if you want to conserve battery, it’s best to keep this feature disabled.

Fortunately, it is not enabled by default. If you’ve enabled it yourself, go to Settings > Sounds & Haptics > Keyboard Feedback and toggle off Haptic to turn off haptic feedback for your keyboard.

For more tips on iOS, read about how to access your Control Center more easily and why you might want to only charge your iPhone to 95%.

Technologies

These Are the Weirdest Phones I’ve Tested Over 14 Years

These phones tried some wild things. Not all of them succeeded.

I’ve been a CNET journalist for over 14 years, testing everything from electric cars and bikes to cameras and, er, magic wands. But it’s phones that have always been my main focus and I’ve seen a lot of them come and go in my time here. Sure, we’ve had the mainstays like Apple and Samsung, but I’ve also seen the rise of brands like Xiaomi and OnePlus, while once-dominant names like BlackBerry, HTC and LG have vanished from the mobile space.

I’ve seen phones arrive with such fanfare that they changed the face of the mobile industry, while others simply trickled into existence and disappeared just as uneventfully. But it’s the weird ones that stick in my memory. Those devices that tried to be different, that dared to offer features we didn’t even know we wanted or simply the ones that aimed to be quirky for the sake of quirky. Like someone who thinks an interesting hat is the same as having a personality.

Here then are some of the weirdest phones I’ve come across in my mobile journey at CNET. Better yet, I still have them in a big box, so I was able to dig them out and take new photos — though not all of them still work. Let’s start with a doozy.

BlackBerry Passport

At the height of its power RIM’s BlackBerry was one of the most dominant names in mobile. It was unthinkable then that anything could unseat the goliath, let alone that it would fade into total nonexistence. The once juicy, ripe BlackBerry withered and died on the bush, but not without a few interesting death rattles on its way.

My pick from the company’s end days is the Passport from 2014, notable not just for its physical keyboard but its almost completely square design. The rationale behind this, according to its maker, was that business types just really love squares. A Word document, an Excel spreadsheet, an email — all square (ish) and all able to be viewed natively on the Passport’s 4.5 inch display with its 1:1 aspect ratio. Let’s not forget that all Instagram posts at that time were also square so it had that going for it too. YouTube, not so much.

In theory it’s a sound idea. In practice the square design made it awkward to use, as the physical keyboard was too wide and narrow. Its BlackBerry 10 software, especially the app availability, lagged behind what you’d get from Android at the time. BlackBerry quickly ditched the new shape. After trying to claw back some credibility with its Android phones — including the stupidly named Priv, a phone I quite liked — and by bringing on singer Alicia Keys as Global Creative Director (because BlackBerry phones had keys, get it?) the company stopped making its own phones in 2016.

YotaPhone 2

You’d be forgiven for having never heard of this phone or its parent company, Yota. Based in Russia, Yota made two phones: the creatively named YotaPhone in 2012 and the similarly inspired YotaPhone 2 in 2014, pictured above. Both were unique in the mobile world for their use of a second display on the rear. From the front, these phones looked and operated like any other generic Android phone. Flip them over though and you’d get a 4.3-inch E Ink display.

The idea was that you’d use your Android phone as normal for things like web browsing, gaming or watching videos, but you’d switch to the rear display if you wanted to read ebooks or simply have it propped up to show incoming notifications. E Ink displays use almost no power, so it made a lot of sense to preserve battery life by viewing «slow» content on the back.

The reality though is that beyond ebooks — which aren’t great to read on such a tiny screen anyway — there’s very little anyone might want to use an E Ink display for when out and about. It was difficult to operate, too, thanks to a slow processor and clunky software. After just two generations of YotaPhones, the company went into liquidation.

HTC ChaCha

Remember when Facebook was the cool place to be instead of just the place your parents and their friends go to publicly air their most troubling of opinions? When I was at university, instead of trading phone numbers when you met someone, the default thing was to add each other on Facebook and then begin poking each other. Facebook was so ubiquitous at the time that it was simply the way every single person I knew communicated.

Keen to capitalise on Zuckerberg’s social media success, HTC brought out the ChaCha in 2011. The phone came with an utterly ludicrous name and a dedicated Facebook button on the bottom edge. Tapping this would immediately bring up your Facebook page, allowing you to post the lyrics to Rebecca Black’s Friday, ask what Fifty Shades of Grey is about or do whatever else it was we were all up to in 2011.

Facebook might still be around in one form or another, but HTC abandoned its phone-making business back in 2018. Unsurprisingly, phones with dedicated hardware buttons tied to social media haven’t caught on.

Sirin Labs Finney U1

«Bro!» I hear you shout, all-too loudly. «BRO! You’ve got to check out what my Bitcoin is doing!» You’d then show me your phone and I’d watch while your crypto account plummeted, rebounded and plummeted again over the course of 12 seconds. The phone you’d be showing me, of course, would be the Sirin Labs Finney, a 2019 phone specifically targeted at crypto bros who wanted a device that would perfectly match their high-living, high-fiving crypto-trading lifestyle.

At its core, the Finney is just another Android phone, but a hidden second screen pops up from the back of the phone, with the sole purpose of giving you secure access to your crypto wallet. The phone had a whole host of security features to ensure that only you could access your Bitcoin or Etherium, and it allowed you to send and receive cryptocurrency without having to use a third-party online platform. Apparently that was a good thing.

If you were entrenched in the crypto world, this phone might have been the dream. But the wallet wasn’t easy to use and the phone was expensive, thanks to the cost of that second screen. Sirin Labs stopped making phones soon after and the mobile industry learned an important lesson about not developing hyper-niche devices that aren’t even that well-suited for the handful of customers that might be interested.

Planet Computers Gemini PDA

Half phone, half laptop, all productivity. The Gemini PDA by UK-based mobile startup Planet Computers was a clamshell device in 2018 with a large (at the time) 5.99-inch display and a full qwerty keyboard. It was basically a slightly more modern interpretation of a PDA, like 1998’s Psion 3MX, in that it was effectively a tiny laptop that would fold up and fit in your pocket. The full keyboard allowed you to type away comfortably on long emails or documents while the regular Android software on the top half meant it also functioned like any other phone — apps, games, phone calls, whatever.

It had 4G connectivity for fast data speeds and a later model even got an update to 5G. But, like the BlackBerry Passport, its focus on business-folk and productivity above all else meant it was a niche product that failed to garner enough appeal to succeed. It didn’t help that it was utterly enormous and fitting it in a jeans pocket was basically impossible, so it didn’t impress either as a laptop or as a phone.

LG G5

LG remains a huge name in the tech industry today thanks to its TVs and appliances, but it also tried to be a big player in the phone world, too. I liked LG’s phones — they were quirky and often tried weird things which kept my days as a reviewer interesting, perhaps none more so than the LG G5 in 2016.

LG called the G5 «modular,» meaning that the bottom chin of the phone snapped off allowing you to attach different modules such as a camera grip or an audio interface. Like many items on this list I can say that it’s a nice idea in theory, but in practice the phone fell short. Swapping out modules meant removing the battery, which of course meant restarting your phone every time you wanted to use the camera grip.

It was an inelegant solution to a problem that never needed to exist. But its bigger issue was that the camera grip and audio interface were the only two modules LG actually made for the phone. It’s as though the company had this fun notion in creating a phone that can transform according to your needs but then forgot to assign anyone to come up with any ideas on what to do with it. As a result, the end product was uninspiring, over-engineered and expensive.

Samsung Galaxy Note

Samsung’s Galaxy Note series helped transform the mobile industry. It literally stretched the boundaries of phones, encouraging larger and larger screens — even creating the unpleasant and mercifully short-lived term «phablet.» But the first-generation model in 2011 was controversial, mostly due to what was then considered its enormous size.

At 5.3 inches, it was significantly bigger than almost any other phone out there, including Samsung’s own Galaxy S2 — which, at a measly 4.3 inches, paled into insignificance against the mighty Note. It was mocked for being so huge, with memes appearing online poking fun at people holding it up when making calls. And while times have changed and we now have Samsung’s 6.9-inch Galaxy S25 Ultra, the original Note’s boxy aspect ratio meant it was actually wider than the S25 Ultra. So even by today’s standards it’s big.

It was also among the first phones to come with its own stylus shoved into its bottom. It’s a feature that few mobile companies have mimicked, but Samsung kept it as a differentiator on its later Note models before incorporating it into its flagship S line starting with the S22 Ultra.

Nokia Lumia 1020

Nokia’s Lumia 1020 was my absolute favorite phone for quite some time after its launch in 2013. And it’s because of its weirdness.

Nokia had an amazing history of bonkers mobiles — 2004’s 7280 «lipstick phone,» for example — and while the Lumia range was much more sedate, the 1020 had a few things that made it stand out. First, it ran Windows Phone, Microsoft’s brief and unsuccessful attempt to launch a rival to Android and iOS. A rival that I happened to quite like.

It was also made of polycarbonate, with a smoothly rounded unibody design that strongly contrasted the angular metal, plastic and glass designs of almost all other phones launching at that time. Its look was unlike anything else on sale, and I loved it.

But the main thing I loved was its camera. With a 41-megapixel sensor, Carl Zeiss lens, raw image capture and optical image stabilization, the Lumia 1020 packed the best camera specs of any phone I’d ever seen. It made the phone a true standout product, especially for photographers like me who wanted an amazing camera with them at all times, but didn’t want to have to carry both a phone and a compact digital camera.

While incredible image quality from a phone is a given in almost all camera phones in 2026, the Lumia 1020 was an early pioneer in what could be achieved from a phone camera.

LG G4

LG, twice in one list? Oh yes, my friend, because the G5 seen above was not the first time LG went weird. Launched in 2015, the LG G4 had two main features that raised a few eyebrows. Most notably was LG’s decision to wrap the phone in real leather. Yes, real actual leather. Like what you’d get when you peel a cow. It even had stitching down the back, making it look like a handbag or a boot.

While it’s not a phone for vegans, I actually liked the look, especially as real leather — even the really thin stuff LG used on the G4 — naturally wears over time, gaining scuffs and scratches that give each phone a unique patina. It’s why I love my old leather Danner boots, and it’s why a vintage, worn-in leather jacket will almost always look better than a brand new one. Still, with leather being an expensive — and arguably controversial — material to use on a phone, it’s no surprise LG didn’t return to this idea.

But it’s not the only weird thing about the phone — the G4 was among a small number of phones released around that time that experimented with curved displays. It’s gently bent into a banana shape, the theory being that it makes watching videos more immersive, as is the case with curved screens in movie theaters. The problem is that movie screens are immense, so that curve makes sense. On a 5.5 inch phone like the G4, that curve is barely noticeable and only really served to push the price up.

Motorola Moto X and Moto Maker

I’ve just pointed out how weird the LG G4 was for using leather and now I’m pointing out another phone that, as you can see in the image above, is also wrapped in leather. But the weird thing here isn’t that the Motorola Moto X came in leather — it’s that I personally got to choose that it came in leather.

With the Moto X in 2013, Motorola launched a service called Moto Maker that allowed you to customize your phone in a wild variety of ways. From different-colored backs and multicolored accents around the camera and speakers through to using materials including leather and even various types of wood, there were loads of options to make your Moto X look unique. Each phone would then be made to order and you could even have it personalised with lazer etching and provide your Google account for it to be prelinked on arrival.

If custom-making phones with a vast number of potential options en mass sounds like an absolute logistical nightmare then you’re on the same page as Motorola eventually found itself. Moto Maker only existed for a few years before the company retired its customization service.

Samsung Galaxy Fold

I’m ending on a wildcard addition with the original Galaxy Fold. It’s a wildcard because Samsung’s Fold and Flip range are now up to number seven and we’ve got foldable devices from almost all major Android manufacturers. Though still not Apple.

While the original Fold might have kicked off the foldable revolution, there’s no question it was a weird phone. I was among the first to test it in the world when it launched in 2019 and while I was certainly impressed by the bendy display, its hinge felt weird and «snappy» to use. The outer display was, let’s face it, terrible.

On paper its 4.6-inch size is reasonable, but it’s so tall and narrow that it was borderline unusable for anything more than checking incoming notifications. Trying to type on it meant whittling down your thumbs to pointy nubs so I spent most of my time interacting with the phone’s much bigger internal screen. Cut to today when the Galaxy Z Fold 7’s outer screen measures a healthier 6.7 inches and as a result can function like any regular smartphone, with the bigger inside screen only required when you want more immersive content.

Looking back at the original Fold and its bizarre proportions, it’s honestly a surprise that Samsung persisted with the format. But I’m glad it did.

Technologies

How Verum Ecosystem Is Rethinking Communication

David Rotman — Founder of the Verum Ecosystem

For David Rotman, communication is not a feature — it is a dependency that should never rely on a single point of failure.

As the founder of the Verum Ecosystem, Rotman developed a communication platform designed to function when internet access becomes unreliable or unavailable.

Verum Messenger addresses real-world challenges such as network outages, censorship, and infrastructure failures. Its 2025 update introduced a unified offline-capable messaging system, moving beyond Bluetooth-based or temporary peer-to-peer solutions.

Verum’s mission is simple: to ensure communication continuity under any conditions.

-

Technologies3 года ago

Technologies3 года agoTech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Technologies3 года agoBest Handheld Game Console in 2023

-

Technologies3 года ago

Technologies3 года agoTighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Technologies4 года agoBlack Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies5 лет ago

Technologies5 лет agoGoogle to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies5 лет ago

Technologies5 лет agoVerum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Technologies4 года agoOlivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

Technologies4 года agoiPhone 13 event: How to watch Apple’s big announcement tomorrow