Technologies

4 Apps That Help Track Your Streaming Subscription Bills

Are you making payments for a streaming service you barely use? Here’s how to keep up.

Your streaming subscriptions for Netflix, Spotify, Disney Plus and other accounts are probably all on autopay. Because you don’t have to think about due dates, that may mean you’ve overlooked the monthly expense or who to contact if you want to cancel. You could be spending more money than you want by paying for a phantom streaming service.

Is Netflix billing you directly? Has your forgotten Hulu 30-day free trial turned into a paid subscription? Did you buy your Disney Plus subscription through a third party like Apple, Amazon or Verizon? With all the streaming price changes creeping in, unwatched content, and missed opportunities for deals, it’s a good idea to keep up with who’s billing you, when and for how much. Luckily, there are apps that can make keeping track of your streaming subs a lot easier.

Here’s our list of recommendations for apps that help you track payments for your streaming service subscriptions. Most of these offer a free option, but you can upgrade to a paid version if you want extra features.

Read more: Keep Up With What’s Streaming on TV Using These 5 Free Apps

Formerly known as Truebill, Rocket Money is a well-rounded budgeting app with the option to track your streaming subscriptions. There are free and paid versions available.

It uses Plaid to link your financial accounts and syncs information about automatic payments from your bank, credit card or services like PayPal. After signing up and setting up multifactor authentication, you can begin managing your recurring payments. Rocket Money provides a snapshot of your yearly spending on subscriptions like Spotify and Netflix, and you can also view upcoming payments including a countdown to the due date. A calendar icon takes you to a screen that outlines all payments for the month.

You can cancel subscriptions within the app, view your history of payments or remove them from the Rocket Money list. There is a seven-day free trial, but its recurring fee is on a sliding scale from $4 to $12 per month, billed annually. Rocket Money is easy to use, but the free account lacks some features such as having the app cancel your streaming accounts.

Hiatus is a budget- and bill-managing app that includes a subscription manager feature. When you create an account, you can track your streaming services in an organized «upcoming bills» category. The app also allows you to enter missing subscriptions manually.

Hiatus connects your financial institutions through Plaid, with options that include banks, PayPal or the Google Play Store. In addition to showing all your streaming subscriptions on autopay, the app provides insights on how much you’ve spent at different intervals — seven days, 30 days and the last 365 days. You may opt to set spending limits for your streaming services using the budget feature.

You can use the app for free, but if you sign up for a premium plan at $8 per month, Hiatus offers other features like canceling your subscriptions on your behalf. You also have the option to cancel on your own. Hiatus is available for Android, iOS and web browsers.

Like Hiatus and Rocket Money, Bobby helps you keep up with your streaming subscriptions and how much you’re spending on them. Unlike Hiatus and Rocket Money, Bobby does not require you to link your financial information to track your recurring payments.

Instead, you click through the app’s list of providers to create a list of streaming subscriptions. Then you manually enter information such as how much and how often you pay. We admit this may not be helpful if you can’t remember all of your active services. But with Bobby, you can receive notifications for upcoming due dates, organize the bills into a category and monitor your average spending on streaming. And it’s free.

Foreign currency breakdowns and security features like Touch ID and passcodes are available. Bobby can be downloaded on iOS devices only.

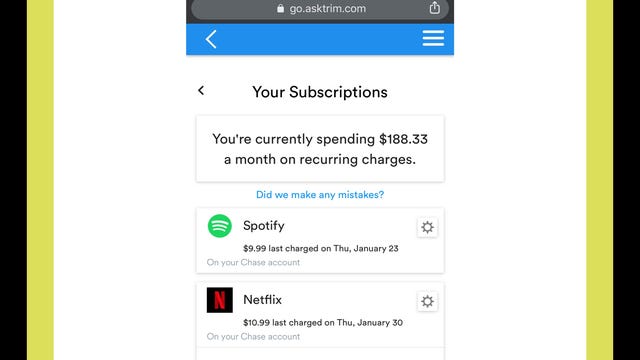

Trim allows you to find, track and cancel subscriptions at no charge. Like Hiatus and Rocket Money, you can connect your financial institution through Plaid, and the app will collate all your recurring subscription payments.

You can view your transaction history for each streamer and cancel a service within the app or by visiting its site directly. Trim is not available as a mobile app, but you can access it on a web browser on your phone or other device.

Streaming service bill tracker FAQs

What about privacy?

Sharing access to your financial information with a third party raises genuine concerns about security. We urge you to review the privacy policies for each service to learn how information is used and stored. With the exception of Bobby, all the services on this list use Plaid to connect your accounts. Plaid does not provide your login credentials to Rocket Money, Trim or Hiatus, so none of the apps receive or store your banking or credit card information.

Why isn’t Mint on this list?

Mint (by Intuit) is a popular user-friendly app that’s used for budgeting. There’s a feature meant to help you track bills and subscriptions, but when I clicked on the Subscriptions tab in the Bills section, none of my subscriptions or recurring payments showed up. I did receive a message saying Mint couldn’t find any subscriptions in my transaction history. Additionally, we’ve seen numerous users reporting that the subscription feature is unreliable.

Are there any other apps you considered?

In addition to Mint and the four tools on this list, we checked out other budget/subscription tracker apps, including PocketGuard, Wallet by Budgetbakers, Billbot, Petal and Everydollar. We decided to highlight the four we discussed here based on robust features, accessibility, fees and ease of use.

PocketGuard syncs with many banks but you’re unable to link PayPal and other third parties like the Google Play Store. Billbot is not available for newer versions of Android, Petal requires you to apply for an account and EveryDollar charges $13 monthly if you don’t want to manually track your financial transactions. To digitally sync Wallet with your financial institutions, you must pay for a premium account.

Technologies

ChatGPT Has a New Language Translation Option for You

It’s like Google Translate, but ChatGPT.

OpenAI is putting Google Translate on notice: It now has a dedicated ChatGPT Translate webpage that can convert writing in 50 languages. At first glance it looks like a basic text-to-text translator that resembles Google Translate and other simple language translation tools on the web. But scrolling down the page reveals more about OpenAI’s ambitions for Translate.

You’ll come across a line that mentions adding voice or an image (for instance, a photo of a sign) to get a translation, although the page doesn’t indicate when those capabilities will become available.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

OpenAI’s breakout of Translate comes as its chief competitor, Google, is aggressively deploying AI to support features like live translations using headphones and new language learning tools. In 2024, Google added 110 languages to its translations.

Language translation is a hot field for artificial intelligence in general. At CES 2026 last week, for instance, CNET’s Macy Meyer tried out a phone-sized device and companion headphones that let her carry on a live conversation with a Polish speaker even though she doesn’t speak Polish herself.

The skills that ChatGPT Translate currently provides are things you can already do in the chatbot itself. In fact, once you translate text on the webpage, ChatGPT offers a set of sample prompts as one-click buttons for what you can do with that text, such as «translate this and make it sound more fluent» or «translate this as if you’re explaining it to a child.»

Selecting one of those prompts takes you to a ChatGPT conversation where options like image uploads are readily available.

OpenAI didn’t immediately respond to a request for comment.

(Disclosure: Ziff Davis, CNET’s parent company, in April filed a lawsuit against OpenAI, alleging it infringed Ziff Davis copyrights in training and operating its AI systems.)

Technologies

Don’t Miss the Samsung Galaxy Z Fold 7 While It’s $400 Off

A Galaxy Z Fold 7 is $50 cheaper on Amazon than at Samsung right now.

Who knew that foldable phones would be so popular again? If you’re looking for a foldable iPhone, you’re gonna need to wait until later this year. If you’re on the hunt for the best foldable phone you can get your hands on right now, you need to take a look at the Galaxy Z Fold 7. Normally $2,000, right now at both Amazon and Samsung, you can get a decent amount off that hefty price tag.

Amazon is dropping the silver version of Samsung’s foldable phone to $1,600. That’s an impressive $400 discount. If you prefer to shop at Samsung directly, you’ll end up paying $50 more as all colors of the Galaxy Z Fold 7 are down to $1,650. Neither of these are record-low prices, but Amazon is close enough at just $43 more.

Samsung’s unique foldable phones had an awkward adolescence, but after getting her hands on the new lineup, CNET reviewer Abrar Al-Heet confirms that the latest Z Fold 7 «just feels right.» For one, it’s incredibly sleek at just 8.9mm thick when closed or 4.2mm thick when open, which is so thin you may even forget that it’s foldable.

Despite weighing just 215 grams, this foldable features some serious hardware. It has a 6.5-inch cover screen and an 8-inch interior display with a fluid 120Hz refresh rate. It’s equipped with a cutting-edge Snapdragon 8 Elite processor and 12GB of RAM to support tons of helpful AI features and functions, and comes with Android 16 and Samsung One UI 8 right out of the box.

The camera system is also pretty impressive, boasting a 200-megapixel rear camera, 12-megapixel ultrawide shooting and a 10-megapixel front camera on both the cover and interior screens. Plus, it’s equipped with a 4,400-mAh battery for all-day use.

MOBILE DEALS OF THE WEEK

-

$749 (save $250)

-

$298 (save $102)

-

$241 (save $310)

-

$499 (save $300)

Why this deal matters

With an unbelievably sleek design and cutting-edge hardware, the impressive Samsung Galaxy Z Fold 7 is our favorite foldable phone on the market. But it also comes with a staggering $2,000 price tag, and if you’re hoping to get your hands on one, this $400 discount is a way to save and help cushion the blow of its considerable cost. Just be sure to get your order in soon, as we doubt this deal will remain live for long.

Technologies

Today’s NYT Connections Hints, Answers and Help for Jan. 15, #949

Here are some hints and the answers for the NYT Connections puzzle for Jan. 15, #949

Looking for the most recent Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections: Sports Edition and Strands puzzles.

Today’s NYT Connections puzzle has a fun purple category that expects you to find two words hidden in four separate clue words. It’s tricky, but intriguing. Read on for clues and today’s Connections answers.

The Times has a Connections Bot, like the one for Wordle. Go there after you play to receive a numeric score and to have the program analyze your answers. Players who are registered with the Times Games section can now nerd out by following their progress, including the number of puzzles completed, win rate, number of times they nabbed a perfect score and their win streak.

Read more: Hints, Tips and Strategies to Help You Win at NYT Connections Every Time

Hints for today’s Connections groups

Here are four hints for the groupings in today’s Connections puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: For planting things.

Green group hint: Not going anywhere.

Blue group hint: Little pieces of something.

Purple group hint: Combine two names.

Answers for today’s Connections groups

Yellow group: Gardening tools.

Green group: Unmoving.

Blue group: Things that come in flakes.

Purple group: Words formed by two men’s names.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections answers?

The yellow words in today’s Connections

The theme is gardening tools. The four answers are hose, rake, shovel and spade.

The green words in today’s Connections

The theme is unmoving. The four answers are frozen, static, stationary and still.

The blue words in today’s Connections

The theme is things that come in flakes. The four answers are cereal, dandruff, salt and snow.

The purple words in today’s Connections

The theme is words formed by two men’s names. The four answers are jackal, levitate, melted and patron.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Toughest Connections puzzles

We’ve made a note of some of the toughest Connections puzzles so far. Maybe they’ll help you see patterns in future puzzles.

#5: Included «things you can set,» such as mood, record, table and volleyball.

#4: Included «one in a dozen,» such as egg, juror, month and rose.

#3: Included «streets on screen,» such as Elm, Fear, Jump and Sesame.

#2: Included «power ___» such as nap, plant, Ranger and trip.

#1: Included «things that can run,» such as candidate, faucet, mascara and nose.