Technologies

CNET Daily Tariff Price Tracker: I’m Watching 11 Key Products for Changes, Here’s What’s Happened

The deadline for the start of Trump’s heaviest tariffs has been delayed until next month, leaving consumers stuck with more uncertainty over prices.

For the last three months, tariffs have been a hot topic, leaving consumers and businesses alike worried: Will they hike prices and by how much? It’s a question more relevant than ever this week, as President Trump punts another major deadline down the road and price-slashing Amazon’s Prime Day sales wind down as the week ends.

Amid those worries, I’ve been tracking prices every day for 11 key products likely to be hit by tariff-induced price increases, and the answer I’ve come to so far is this: Not so much, at least not yet. The winding road of tariff inflation still stretches before us into an uncertain future, so the threat of price hikes continues to cloud the horizon.

To date, I’ve seen two noteworthy price increases, one for the Xbox Series X and the other for a popular budget-friendly 4K TV. Some other products — including Apple’s popular AirPods and printer ink — have gone on sale for brief periods.

CNET Tariff Tracker Index

Above, you can check out a chart with the average price of the 11 products included in this piece over the course of 2025. This will help give you a sense of the overall price changes and fluctuations going on. Further down, you’ll be able to check out charts for each individual product being tracked.

We’ll be updating this article regularly as prices change. It’s all in the name of helping you make sense of things, so be sure to check back every so often. For more, check out CNET’s guide to whether you should wait to make big purchases or buy them now and get expert tips about how to prepare for a recession.

Methodology

We’re checking prices daily and will update the article and the relevant charts right away to reflect any changes. The following charts show a single bullet point for each month, with the most recent one labeled «Now» and showing the current price. For the past months, we’ve gone with what was the most common price for each item in the given month.

In most cases, the price stats used in these graphs were pulled from Amazon using the historical price-tracker tool Keepa. For the iPhones, the prices come from Apple’s official materials and are based on the 128-gigabyte base model of the latest offering of the iPhone 16. For the Xbox Series X, the prices were sourced from Best Buy using the tool PriceTracker. If any of these products happen to be on sale at a given time, we’ll be sure to let you know and explain how those price drops differ from longer-term pricing trends that tariffs can cause.

The 11 products we’re tracking

Mostly what we’re tracking in this article are electronic devices and digital items that CNET covers in depth, like iPhones and affordable 4K TVs — along with a typical bag of coffee, a more humble product that isn’t produced in the US to any significant degree.

The products featured were chosen for a few reasons: Some of them are popular and/or affordable representatives for major consumer tech categories, like smartphones, TVs and game consoles. Others are meant to represent things that consumers might buy more frequently, like printer ink or coffee beans. Some products were chosen over others because they are likely more susceptible to tariffs. Some of these products have been reviewed by CNET or have been featured in some of our best lists.

- iPhone 16, 128GB

- Duracell AA batteries, 24-pack

- Samsung DU7200 65-inch TV

- Xbox Series X

- Apple AirPods Pro 2 with USB-C case

- HP 962 CMY Printer Ink

- Anker 10,000-mAh, 30-watt power bank

- Bose TV speaker

- Oral-B Pro 1000 electric toothbrush

- Lenovo IdeaPad Flex 5i Chromebook, 256GB

- Starbucks 28-ounce ground dark roast coffee

Below, we’ll get into more about each individual product, and stick around till the end for a rundown of some other products worth noting.

iPhone 16

The iPhone is the most popular smartphone brand in the US, so this was a clear priority for price tracking. The iPhone has also emerged as a major focal point for conversations about tariffs, given its popularity and its susceptibility to import taxes because of its overseas production, largely in China. Trump has reportedly been fixated on the idea that the iPhone can and should be manufactured in the US, an idea that experts have dismissed as a fantasy. Estimates have also suggested that a US-made iPhone would cost as much as $3,500.

Something to note about this graph: The price listed is the one you’ll see if you buy your phone through a major carrier. If you, say, buy direct from Apple or Best Buy without a carrier involved, you’ll be charged an extra $30, so in some places, you might see the list price of the standard iPhone 16 listed as $830.

Apple’s been taking a few steps to protect its prices in the face of these tariffs, flying in bulk shipments of product before they took effect and planning to move production for the US market from China to India. A new Reuters report found that a staggering 97% of iPhones imported from the latter country, March through May, were bound for the US. This latter move drew the anger of Trump again, threatening the company with a 25% tariff if they didn’t move production to the US, an idea CEO Tim Cook has repeatedly shot down in the past. This came after Trump gave a tariff exemption to electronic devices including smartphones, so the future of that move seems in doubt now.

Duracell AA batteries

A lot of the tech products in your home might boast a rechargeable energy source but individual batteries are still an everyday essential and I can tell you from experience that as soon as you forget about them, you’ll be needing to restock. The Duracell AAs we’re tracking are some of the bestselling batteries on Amazon.

Samsung DU7200 TV

Alongside smartphones, televisions are some of the most popular tech products out there, even if they’re an infrequent purchase. This particular product is a popular entry-level 4K TV and was CNET’s pick for best overall budget TV for 2025. Unlike a lot of tech products that have key supply lines in China, Samsung is a South Korean company, so it might have some measure of tariff resistance.

After spending most of 2025 hovering around $400, this item has now seen some notable upticks on Amazon, most recently sitting around $450. This could potentially be in reaction to Trump’s announcement of 25% tariffs against South Korea this week.

Xbox Series X

Video game software and hardware are a market segment expected to be hit hard by the Trump tariffs. Microsoft’s Xbox is the first console brand to see price hikes — the company cited «market conditions» along with the rising cost of development. Most notably, this included an increase in the price of the flagship Xbox Series X, up from $500 to $600. Numerous Xbox accessories also were affected and the company also said that «certain» games will eventually see a price hike from $70 to $80.

Initially, we were tracking the price of the much more popular Nintendo Switch as a representative of the gaming market. Nintendo has not yet hiked the price of its handheld-console hybrid and stressed that the $450 price tag of the upcoming Switch 2 has not yet been inflated because of tariffs. Sony, meanwhile, has so far only increased prices on its PlayStation hardware in markets outside the US.

AirPods Pro 2

The latest iteration of Apple’s wildly popular true-wireless earbuds are here to represent the headphone market. Much to the chagrin of the audiophiles out there, a quick look at sales charts on Amazon shows you just how much the brand dominates all headphone sales. For most of the year, they’ve hovered around $199, but ahead of Prime Day sales this week they are currently on sale for $149.

HP 962 CMY printer ink

This HP printer ink includes cyan, magenta and yellow all in one product and recently saw its price jump from around $72 — where it stayed for most of 2025 — to $80, which is around its highest price over the last five years. We will be keeping tabs to see if this is a long-term change or a brief uptick.

This product replaced Overture PLA Filament for 3D printers in this piece, but we’re still tracking that item.

Anker 10,000-mAh, 30-watt power bank

Anker’s accessories are perennially popular in the tech space and the company has already announced that some of its products will get more expensive as a direct result of tariffs. This specific product has also been featured in some of CNET’s lists of the best portable chargers.

Bose TV speaker

Soundbars have become important purchases, given the often iffy quality of the speakers built into TVs. While not the biggest or the best offering in the space, the Bose TV Speaker is one of the more affordable soundbar options out there, especially hailing from a brand as popular as Bose. You can currently get this model at a healthy discount for Prime Day, down to $200 from $280.

Oral-B Pro 1000 electric toothbrush

They might be a lot more expensive than their traditional counterparts but electric toothbrushes remain a popular choice for consumers because of how well they get the job done. I know my dentist won’t let up on how much I need one. This particular Oral-B offering was CNET’s overall choice for the best electric toothbrush for 2025.

While this product hasn’t seen its price budge one way or another most of the year, there is a $10 coupon listed on Amazon right now.

Lenovo IdeaPad Flex 5i Chromebook

Lenovo is notable among the big laptop manufacturers for being a Chinese company making its products especially susceptible to Trump’s tariffs.

Starbucks Ground Coffee (28-ounce bag)

Coffee is included in this tracker because of its ubiquity —I’m certainly drinking too much of it these days —and because it’s uniquely susceptible to Trump’s tariff agenda. Famously, coffee beans can only be grown within a certain distance from Earth’s equator, a tropical span largely outside the US and known as the «Coffee Belt.»

Hawaii is the only part of the US that can produce coffee beans, with data from USAFacts showing that 11.5 million pounds were harvested there in the 2022-23 season — little more than a drop in the mug, as the US consumed 282 times that amount of coffee during that period. Making matters worse, Hawaiian coffee production has declined in the past few years.

All that to say: Americans get almost all of their coffee from overseas, making it one of the most likely products to see price hikes from tariffs.

Other products

As mentioned, we occasionally swap out products with different ones that undergo notable price shifts. Here are some things no longer featured above, but that we’re still keeping an eye on:

- Nintendo Switch: The baseline handheld-console hybrid has held steady around $299 most places — including Amazon — since it released in 2017. Whether that price will be affected by tariffs or the release of the Switch 2 remains to be seen. This product was replaced above with the Xbox Series X.

- Overture PLA 3D printer filament: This is a popular choice on Amazon for the material needed to run 3D printers. It has held steady around $15 on Amazon all year. This product was replaced above by the HP 962 printer ink.

Here are some products we also wanted to single out that haven’t been featured with a graph yet:

- Razer Blade 18 (2025), 5070 Ti edition: The latest revision of Razer’s largest gaming laptop saw a $300 price bump recently, with the base model featured an RTX 5070 Ti graphics card now priced at $3,500 ahead of launch, compared to the $3,200 price announced in February. While Razer has stayed mum about the reasoning, it did previously suspend direct sales to the US as Trump’s tariff plans were ramping up in April.

- Asus ROG Ally X: The premium version of Asus’s Steam Deck competitor handheld gaming PC recently saw a price hike from $799 to $899, coinciding with the announcement of the company’s upcoming Xbox-branded Ally handhelds.

Technologies

Tinder Users Must Start Logging In With Their Faces, Starting Nationwide

The social app now has new US requirements including face identification to help quell longstanding problems with catfishing and more.

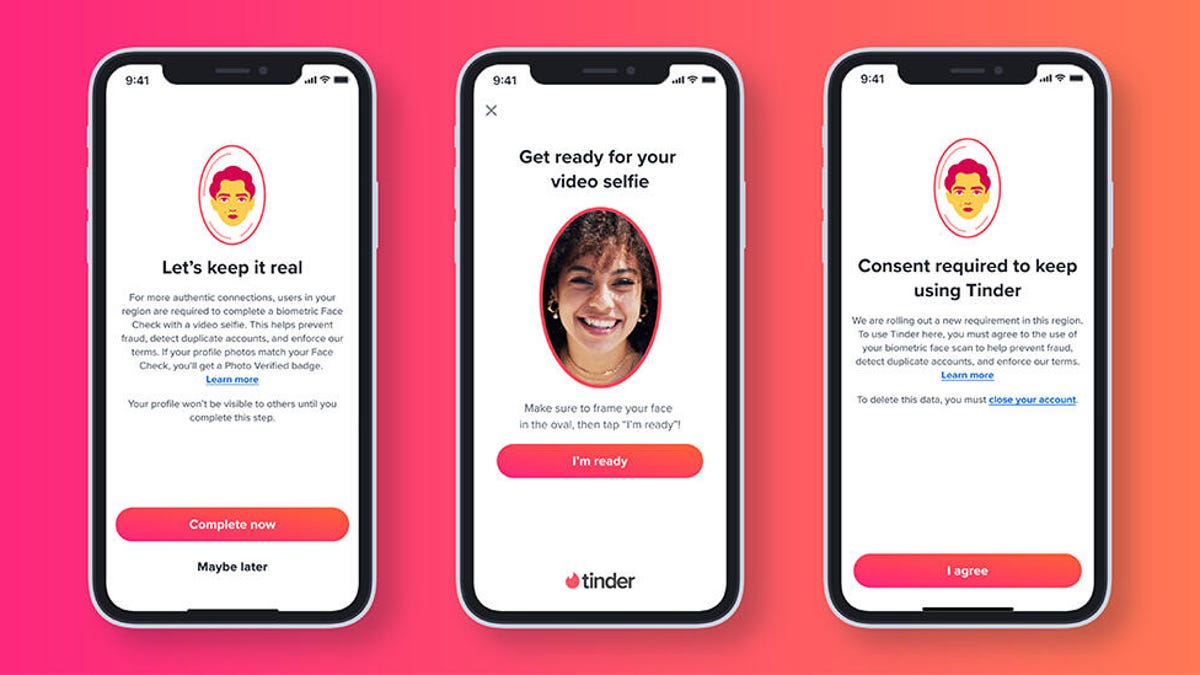

US Tinder users will find a new feature when they open up the dating app starting Wednesday: A mandatory Face Check on their phones will be required before they can log into their profiles.

The Face Check step will begin with a new request to record a video of your face, a more casual version of setting up Apple’s Face ID login. Tinder will then run checks comparing your face data to your current profile pics and automatically create a small face badge for your profile. We already know how it works, because Tinder has already launched the feature in Canada and California before the full US rollout.

The technology, powered by FaceTec, will keep biometric data of the user’s face in encrypted form but discard the scanning video for privacy. Tinder will be able to use the face data to detect duplicate accounts, in an effort to cut down on fake profiles and identity theft.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Tinder’s facial recognition rollout is also made to prevent catfishing, or people pretending to be someone else on Tinder to scam or blackmail them. But that also points to a deeper problem on the rise in dating apps — a growing number of bots, many controlled by AI, are designed to glean personal information or fool users into scammy subscriptions, among other problems.

Tinder’s working against these bots on several fronts, including this Face Check push as well as ID Check, which requires a government-issued ID and other types of photo verification.

The dating app also recently released a feature in June to enable double-dating with your friends, which Tinder reports is especially popular with Gen Z users. If you’re worried about the latest hazards on Tinder, we have guide to safety practices.

A representative for Tinder did not immediately respond to a request for comment.

Technologies

Today’s NYT Mini Crossword Answers for Thursday, Oct. 23

Here are the answers for The New York Times Mini Crossword for Oct. 23.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? Read on. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Like some weather, memories and I.P.A.s

Answer: HAZY

5A clue: Statement that’s self-evidently true

Answer: AXIOM

7A clue: Civic automaker

Answer: HONDA

8A clue: What fear leads to, as Yoda told a young Anakin

Answer: ANGER

9A clue: Foxlike

Answer: SLY

Mini down clues and answers

1D clue: Verbal «lol»

Answer: HAHA

2D clue: Brain signal transmitter

Answer: AXON

3D clue: Hits with a witty comeback

Answer: ZINGS

4D clue: Sing at the top of a mountain, maybe

Answer: YODEL

6D clue: Name of the famous «Queen of Scots»

Answer: MARY

Technologies

Today’s NYT Strands Hints, Answers and Help for Oct. 23 #599

Here are hints and answers for the NYT Strands puzzle for Oct. 23, No. 599.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle might be Halloween-themed, as the answers are all rather dangerous. Some of them are a bit tough to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: Please don’t eat me!

If that doesn’t help you, here’s a clue: Remember Mr. Yuk?

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- POND, NOON, NODE, BALE, SOCK, LOVE, LOCK, MOCK, LEER, REEL, GLOVE, DAIS, LEAN, LEAD, REEL

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- AZALEA, HEMLOCK, FOXGLOVE, OLEANDER, BELLADONNA

Today’s Strands spangram

Today’s Strands spangram is POISONOUS. To find it, look for the P that is the first letter on the far left of the top row, and wind down and across.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow