Technologies

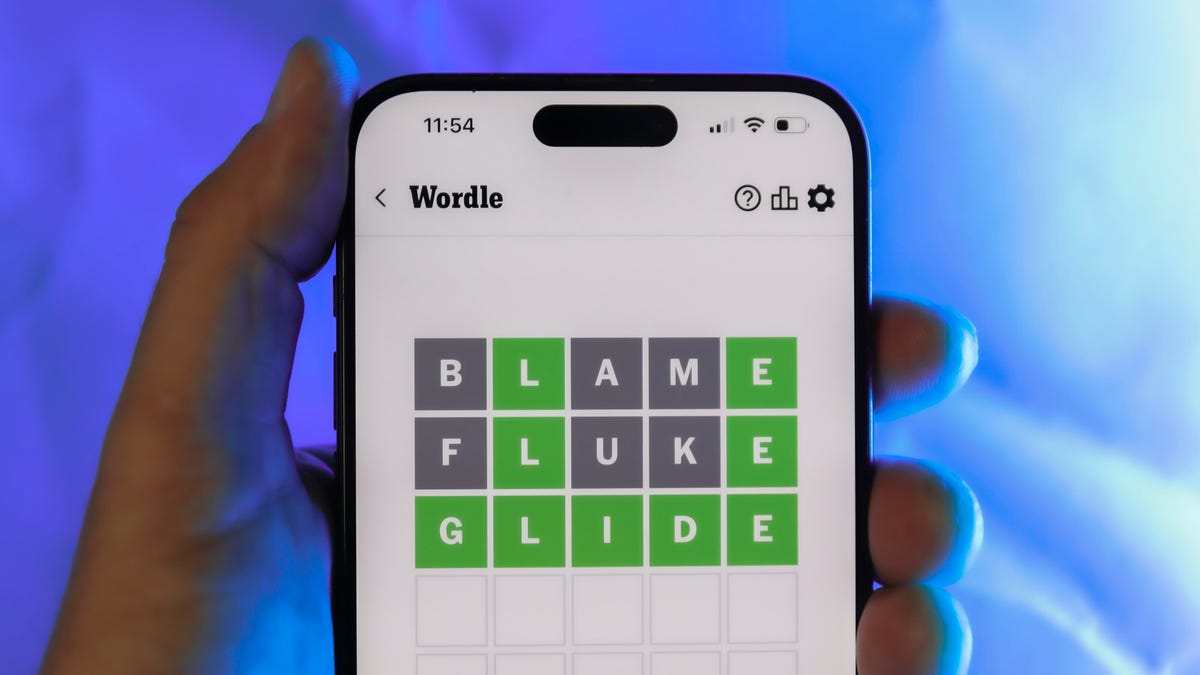

Today’s Wordle Hints, Answer and Help for June 16, #1458

Here are hints and the answer for today’s extra-difficult Wordle No. 1,458 for June 16.

Looking for the most recent Wordle answer? Click here for today’s Wordle hints, as well as our daily answers and hints for The New York Times Mini Crossword, Connections, Connections: Sports Edition and Strands puzzles.

Today’s Wordle puzzle has a double letter and a vowel that might not always be guessed. If you need a new starter word, check out our list of which letters show up the most in English words. If you need hints and the answer, read on.

Today’s Wordle hints

Before we show you today’s Wordle answer, we’ll give you some hints. If you don’t want a spoiler, look away now.

Wordle hint No. 1: Repeats

Today’s Wordle answer has one repeated letter.

Wordle hint No. 2: Vowels

There is one vowel and one sometimes vowel in today’s Wordle answer.

Wordle hint No. 3: First letter

Today’s Wordle answer begins with P.

Wordle hint No. 4: Sing out

Today’s Wordle answer is the last name of a singer whose hits include «Free Fallin'» and «I Won’t Back Down.»

Wordle hint No. 5: Meaning

Today’s Wordle answer can refer to something that is trivial or of little importance.

TODAY’S WORDLE ANSWER

Today’s Wordle answer is PETTY. RIP, Tom.

Yesterday’s Wordle answer

Yesterday’s Wordle answer, June 15, No. 1457 was QUAIL.

Recent Wordle answers

June 11, No. 1453: PLAID

June 12, No. 1454: BILGE

June 13, No. 1455: VIXEN

June 14, No. 1456: GHOST

Technologies

Kohler Wants to Put a Tiny Camera in Your Toilet and Analyze the Contents

The company’s new Dekoda toilet accessory is like a little bathroom detective.

Some smart litter boxes can monitor our pets’ habits and health, so having a camera in our human toilet bowls seems inevitable. That’s just what kitchen and bathroom fixture company Kohler has done for its new health and wellness brand, Kohler Health.

The $599 Dekoda clamps over the rim like a toilet bowl cleaner, pointing an optical sensor at your excretions and secretions. It then analyzes the images to detect any blood and reviews your gut health and hydration status. Depending on the plan you choose, the subscription fee is between $70 and $156 per year.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

At toilet time, you sign in via a fingerprint sensor so that the device knows who’s using the facilities. (Please wash your hands before signing out or tracking your progress.) Then, check in with the app for the day’s analysis and trends over time.

Wait until you’re off the pot, though, before you start doomscrolling your health. The device has a removable, rechargeable battery and uses a USB connection.

Kohler says it secures your data via the aforementioned fingerprint scanner and end-to-end encryption, and notes that the camera uses «discreet optics,» looking only at the results, not your body parts.

«Dekoda’s sensors see down into your toilet and nowhere else,» the company says.

Kohler warns that the technology doesn’t work very well with dark toilet colors, which makes sense. I’m sure there could be an upsell model with a light on it. Maybe the company could add an olfactory sensor, since smell reveals a lot about your gut health too. It could track «session» length or buildup under the rim to alert whoever has responsibility to clean it.

Kohler must have been straining to find appropriate lifestyle photos to include with the publicity materials. Many of the images are hilarious, featuring fit-looking men and women drinking water and staring off into space contemplatively — probably thinking about gas.

Technologies

Who’s Up to Fight Mega-Corporations in the Outer Worlds 2 on Xbox Game Pass?

Save the universe by fighting one CEO at a time in The Outer Worlds 2, plus play other great games coming to Xbox Game Pass in October.

Space is the final frontier, and it’s packed with some devious mega-corporations who are out to make a buck in The Outer Worlds 2. Xbox Game Pass subscribers can fight them in the highly anticipated sequel starting on Oct. 29.

Xbox Game Pass offers hundreds of games you can play on your Xbox Series X, Xbox Series S, Xbox One, Amazon Fire TV, smart TV and PC or mobile device, with prices starting at $10 a month. While all Game Pass tiers offer you a library of games, Game Pass Ultimate ($30 a month) gives you access to the most games, as well as Day 1 games, like Hollow Knight: Silksong, added monthly.

Here are all the games subscribers can play on Game Pass soon. You can also check out other games the company added to the service in October, including Ninja Gaiden 4.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

PowerWash Simulator 2

Game Pass Ultimate and PC Game Pass subscribers can start playing on Oct. 23.

If you’ve ever spent hours watching people on YouTube clean dirty rugs, cars and other grimy objects, you should check out PowerWash Simulator 2. As the name suggests, this sequel is all about blasting away dirt and filth from pools, homes and other objects around town. You have a furry kitty companion, and yes, you can pet them when you’ve finished cleaning.

Bounty Star

Game Pass Ultimate and PC Game Pass subscribers can start playing on Oct. 23.

The American Southwest has devolved into a lawless, post-apocalyptic desert called the Red Expanse in this game. You’re out to clean the place up in this game by taking down major bounties issued by the government, and the best way to do that is by piloting and customizing a giant mech, of course. When you want to nurse your wounds, head back to your run-down garage to rest, grow and cook food and raise animals. It’s like a cozy Armored Core game.

Super Fantasy Kingdom (game preview)

Game Pass Ultimate and PC Game Pass subscribers can start playing on Oct. 24.

After returning from a hunting trip, you find your 8-bit kingdom wrecked in this game. You must rebuild your domain in this roguelite, city builder. But as night falls, hordes of monsters emerge to tear everything back down. Build, mine, cook and grow your home, and prepare to defend it from all dangers.

Halls of Torment

Game Pass Ultimate, Game Pass Premium and PC Game Pass subscribers can start playing on Oct. 28.

Get ready to descend into the deadly Halls of Torment in this retro, horde survival game. You can choose between 11 playable characters, each with their own playstyle, and equip various items and abilities to survive waves of enemies. This game is like Vampire Survivors, so if you like that game give this one a shot.

The Outer Worlds 2

Game Pass Ultimate and PC Game Pass subscribers can start playing on Oct. 29.

Clear your calendar for this sequel to the award-winning sci-fi adventure, The Outer Worlds. This time, you’re an Earth Directorate agent investigating the cause of devastating rifts that could destroy humanity. You have a new ship, new crew, new enemies and mega-corporation goons standing between you and the answers.

1000xResist

Game Pass Ultimate, Game Pass Premium and PC Game Pass subscribers can start playing on Nov. 4.

One thousand years in the future, humanity is hanging on by a thread after a disease spread by alien occupation forces people to live underground in this sci-fi adventure game. You play as Watcher, and you fulfill your duties well, until one day you make a shocking discovery. This game won a Peabody Award in 2024, and it was nominated for the Nebula Award for Best Game Writing that same year, so get ready for a story like no other.

Football Manager 26

Game Pass Ultimate and PC Game Pass subscribers can start playing on Oct. 29.

Get ready for a more immersive matchday experience in the latest installment of the Football Manager franchise. You can build a star-studded squad with new transfer tools, and this entry features official Premier League licenses and women’s football for the first time in the series’ history.

Game Pass subscribers can play the standard or Console edition of this game.

Games leaving Game Pass on Oct. 31

While Microsoft is adding those games to Game Pass, it’s also removing three others from the service on Oct. 31. So you still have some time to finish your campaign and any side quests before you have to buy these games separately.

Jusant

Metal Slug Tactics

Return to Monkey Island

For more on Xbox, discover other games available on Game Pass now and check out our hands-on review of the gaming service. You can also learn about recent changes to the Game Pass service.

Technologies

Does Charging Your Phone Overnight Damage the Battery? We Asked the Experts

Modern smartphones are protected against overcharging, but heat and use habits can still degrade your battery over time.

Plugging your phone in before you head to bed might seem like second nature. That way by the time your alarms go off in the morning, your phone has a full charge and is ready to help you conquer your day. However, over time, your battery will start to degrade. So is keeping your phone plugged in overnight doing damage to the battery?

The short answer is no. Keeping your phone plugged in all the time won’t ruin your battery. Modern smartphones are built with smart charging systems that cut off or taper power once they’re full, preventing the kind of «overcharging damage» that was common in older devices. So if you’re leaving your iPhone or Android on the charger overnight, you can relax.

That said, «won’t ruin your battery» doesn’t mean it has no effect. Batteries naturally degrade with age and use, and how you charge plays a role in how fast that happens. Keeping a phone perpetually at 100% can add extra stress on the battery, especially when paired with heat, which is the real enemy of longevity.

Understanding when this matters (and when it doesn’t) can help you make small changes to extend your phone’s lifespan.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

The science behind battery wear

Battery health isn’t just about how many times you charge your phone. It’s about how it manages voltage, temperature and maintenance. Lithium-ion batteries age fastest when they’re exposed to extreme levels: 0% and 100%.

Keeping them near full charge for long stretches puts additional voltage stress on the cathode and electrolyte. That’s why many devices use «trickle charging» or temporarily pause at 100%, topping up only when needed.

Still, the biggest threat isn’t overcharging — it’s heat. When your phone is plugged in and running demanding apps, it produces heat that accelerates chemical wear inside the battery. If you’re gaming, streaming or charging on a hot day, that extra warmth does far more harm than leaving the cable plugged in overnight.

Apple’s take

Apple’s battery guide describes lithium-ion batteries as «consumable components» that naturally lose capacity over time. To slow that decline, iPhones use Optimized Battery Charging, which learns your daily routine and pauses charging at about 80% until just before you typically unplug, reducing time spent at high voltage.

Apple also advises keeping devices between 0 to 35 degrees Celsius (32 to 95 degrees Fahrenheit) and removing certain cases while charging to improve heat dissipation. You can read more on Apple’s official battery support page.

What Samsung (and other Android makers) do

Samsung offers a similar feature called Battery Protect, found in One UI’s battery and device care settings. When enabled, it caps charging at 85%, which helps reduce stress during long charging sessions.

Other Android makers like Google, OnePlus and Xiaomi include comparable options — often called Adaptive Charging, Optimized Charging or Battery Care — that dynamically slow power delivery or limit charge based on your habits. These systems make it safe to leave your phone plugged in for extended periods without fear of overcharging.

When constant charging can hurt

Even with these safeguards, some conditions can accelerate battery wear. As mentioned before, the most common culprit is high temperature. Even for a short period of time, leaving your phone charging in direct sunlight, in a car or under a pillow can push temperatures into unsafe zones.

Heavy use while charging, like gaming or 4K video editing, can also cause temperature spikes that degrade the battery faster. And cheap, uncertified cables or adapters may deliver unstable current that stresses cells. If your battery is already several years old, it’s naturally more sensitive to this kind of strain.

How to charge smarter

You don’t need to overhaul your habits but a few tweaks can help your battery age gracefully.

Start by turning on your phone’s built-in optimization tools: Optimized Battery Charging on iPhones, Battery Protect on Samsung devices and Adaptive Charging on Google Pixels. These systems learn your routine and adjust charging speed so your phone isn’t sitting at 100% all night.

Keep your phone cool while charging. According to Apple, phone batteries perform best between 62 and 72 degrees Fahrenheit (16 to 22 degrees Celsius). If your phone feels hot, remove its case or move it to a better-ventilated or shaded spot. Avoid tossing it under a pillow or too close to other electronics, like your laptop, and skip wireless chargers that trap heat overnight.

Use quality chargers and cables from your phone’s manufacturer or trusted brands. Those cheap «fast-charge» kits you find online often deliver inconsistent current, which can cause long-term issues.

Finally, don’t obsess over topping off. It’s perfectly fine to plug in your phone during the day for short bursts. Lithium-ion batteries actually prefer frequent, shallow charges rather than deep, full cycles. You don’t need to keep it between 20% and 80% all the time, but just avoid extremes when possible.

The bottom line

Keeping your phone plugged in overnight or on your desk all day won’t destroy its battery. That’s a leftover myth from a different era of tech. Modern phones are smart enough to protect themselves, and features like Optimized Battery Charging or Battery Protect do most of the heavy lifting for you.

Still, no battery lasts forever. The best way to slow the inevitable is to manage heat, use quality chargers and let your phone’s software do its job. Think of it less as «babying» your battery and more as charging with intention. A few mindful habits today can keep your phone running strong for years.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow