Technologies

Mortgage Rates and the Fed: Everything to Know Before This Week’s Meeting

Don’t expect big changes to mortgage rates soon, as the Fed maintains its cautious approach.

On Wednesday, the Federal Reserve is expected to extend a pause on interest rate cuts for a fourth consecutive time this year. Though mortgage rates could see some volatility, many economists expect them to stay somewhat flat until the economic picture drastically changes.

Rates will stay in the 6.75% to 7.25% range unless the Fed signals multiple cuts soon and backs it up with data, said Nicole Rueth, of the Rueth Team with Movement Mortgage. «Homebuyers waiting on rates to drop drastically might be disappointed,» Rueth said.

The relationship between the central bank’s interest rate decisions and home loan rates isn’t direct or immediate. Case in point: The Fed’s three interest rate cuts in 2024 didn’t translate into cheaper mortgages. The average rate for a 30-year fixed home loan has hovered around 6.8% since late fall.

Often, what the central bank says about future plans can move the market more than its actual actions. Mortgage rates are driven by the bond market, investor expectations and a host of other economic factors.

«Mortgage rates move on expectations, not announcements,» said Rueth.

The focus will be on what Fed Chair Jerome Powell says following the meeting. Should Powell express concern over lingering inflation or a reduced number of rate cuts, bond yields and mortgage rates are expected to rise. If he conveys optimism about inflation and suggests further policy easing, mortgage rates may decline.

«It’s most often the case that longer-term interest rates begin to decline before the Fed cuts rates,» said Keith Gumbinger, vice president at HSH.com.

Here’s what you need to know about how the government’s interest rate policies influence the mortgage market.

What is the Fed’s relationship to mortgage rates?

The Fed sets and oversees US monetary policy under a dual mandate to maintain price stability and maximum employment. It does this largely by adjusting the federal funds rate, the rate at which banks borrow and lend their money.

When the economy weakens and unemployment rises, the Fed lowers interest rates to encourage spending and propel growth, as it did during the COVID-19 pandemic.

It does the opposite when inflation is high. For example, the Fed raised its benchmark interest rate by more than five percentage points between early 2022 and mid-2023 to slow price growth by curbing consumer borrowing and spending.

Changes in the cost of borrowing set off a slow chain reaction that eventually affects mortgage rates and the housing market, as banks pass along the Fed’s rate hikes or cuts to consumers through longer-term loans, including home loans.

Yet, because mortgage rates respond to several economic factors, it’s not uncommon for the federal funds rate and mortgage rates to move in different directions for some time.

Why is the Fed putting off interest rate cuts?

After making three interest rate cuts in 2024, the Fed is now in a holding pattern. With President Donald Trump’s unpredictable tariff campaign, immigration policies and federal cutbacks threatening to drive up prices and drag on growth, economists say the central bank has good reason to pause.

«The Federal Reserve is in one of the trickiest spots in recent economic history,» said Ali Wolf, Zonda and NewHomeSource chief economist.

Lowering interest rates could allow inflation to surge, which is bad for mortgage rates. Keeping rates high, however, increases the risk of a job-loss recession that would cause widespread financial hardship.

Recent data show inflation making slow but steady progress toward the Fed’s annual target rate of 2%. But given the uncertainty surrounding Trump’s economic agenda, the central bank isn’t in a hurry to lower borrowing rates.

What is the forecast for interest rate cuts in 2025?

Though Powell remains noncommittal on any specific time frame, experts now predict an interest rate cut in the fall.

«I’m eyeing September for the first rate cut, if inflation keeps cooling and the labor market weakens,» Rueth said.

However, tariffs are the big wildcard. Rueth said that if a trade war fuels inflation, rates could jump even without a Fed move. Political dysfunction, rising debt and global instability are also a recipe for rate volatility.

«The mortgage market reacts fast to uncertainty, and we’ve got no shortage of it this summer,» Rueth said.

On the flip side, if unemployment spikes — a real possibility given rising jobless claims — the Fed could be forced to implement interest rate cuts earlier than anticipated. In that case, mortgage rates should gradually ease, though not dramatically.

Most housing market forecasts, which already factor in at least two 0.25% Fed cuts, call for 30-year mortgage rates to stay above 6% throughout 2025.

«We might see rates settle into the low to mid-6% by year-end,» Rueth said. «But we’re not going back to 3%.»

What other factors affect mortgage rates?

Mortgage rates move around for many of the same reasons home prices do: supply, demand, inflation and even the employment rate.

Personal factors, such as a homebuyer’s credit score, down payment and home loan amount, also determine one’s individual mortgage rate. Different loan types and terms also have varying interest rates.

Policy changes: When the Fed adjusts the federal funds rate, it affects many aspects of the economy, including mortgage rates. The federal funds rate affects how much it costs banks to borrow money, which in turn affects what banks charge consumers to make a profit.

Inflation: Generally, when inflation is high, mortgage rates tend to be high. Because inflation chips away at purchasing power, lenders set higher interest rates on loans to make up for that loss and ensure a profit.

Supply and demand: When demand for mortgages is high, lenders tend to raise interest rates. This is because they have only so much capital to lend in the form of home loans. Conversely, when demand for mortgages is low, lenders tend to slash interest rates to attract borrowers.

Bond market activity: Mortgage lenders peg fixed interest rates, like fixed-rate mortgages, to bond rates. Mortgage bonds, also called mortgage-backed securities, are bundles of mortgages sold to investors and are closely tied to the 10-year Treasury. When bond interest rates are high, the bond has less value on the market where investors buy and sell securities, causing mortgage interest rates to go up.

Other key indicators: Employment patterns and other aspects of the economy that affect investor confidence and consumer spending and borrowing also influence mortgage rates. For instance, a strong jobs report and a robust economy could indicate greater demand for housing, which can put upward pressure on mortgage rates. When the economy slows and unemployment is high, mortgage rates tend to be lower.

Read more: Fact Check: Trump Doesn’t Have the Power to Force Lower Interest Rates

Is now a good time to get a mortgage?

Even though timing is everything in the mortgage market, you can’t control what the Fed does. «Forecasting interest rates is nearly impossible in today’s market,» said Wolf.

Regardless of the economy, the most important thing when shopping for a mortgage is to make sure you can comfortably afford your monthly payments.

More homebuying advice

Technologies

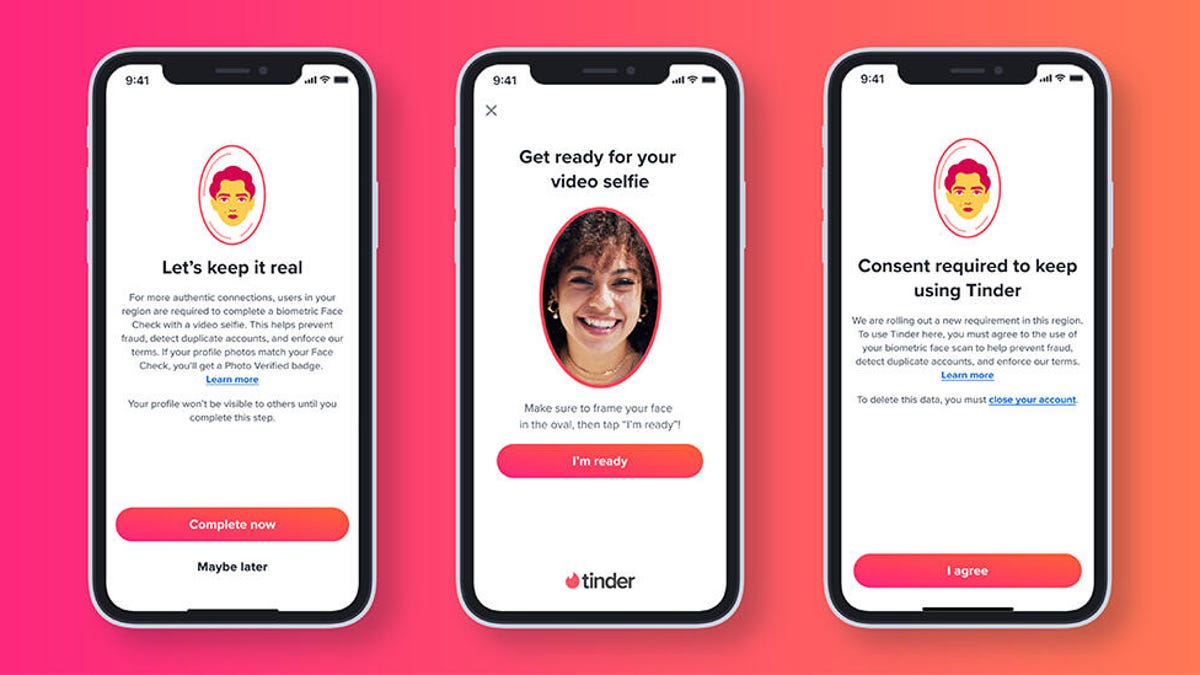

Tinder Users Must Start Logging In With Their Faces, Starting Nationwide

The social app now has new US requirements including face identification to help quell longstanding problems with catfishing and more.

US Tinder users will find a new feature when they open up the dating app starting Wednesday: A mandatory Face Check on their phones will be required before they can log into their profiles.

The Face Check step will begin with a new request to record a video of your face, a more casual version of setting up Apple’s Face ID login. Tinder will then run checks comparing your face data to your current profile pics and automatically create a small face badge for your profile. We already know how it works, because Tinder has already launched the feature in Canada and California before the full US rollout.

The technology, powered by FaceTec, will keep biometric data of the user’s face in encrypted form but discard the scanning video for privacy. Tinder will be able to use the face data to detect duplicate accounts, in an effort to cut down on fake profiles and identity theft.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Tinder’s facial recognition rollout is also made to prevent catfishing, or people pretending to be someone else on Tinder to scam or blackmail them. But that also points to a deeper problem on the rise in dating apps — a growing number of bots, many controlled by AI, are designed to glean personal information or fool users into scammy subscriptions, among other problems.

Tinder’s working against these bots on several fronts, including this Face Check push as well as ID Check, which requires a government-issued ID and other types of photo verification.

The dating app also recently released a feature in June to enable double-dating with your friends, which Tinder reports is especially popular with Gen Z users. If you’re worried about the latest hazards on Tinder, we have guide to safety practices.

A representative for Tinder did not immediately respond to a request for comment.

Technologies

Today’s NYT Mini Crossword Answers for Thursday, Oct. 23

Here are the answers for The New York Times Mini Crossword for Oct. 23.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? Read on. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Like some weather, memories and I.P.A.s

Answer: HAZY

5A clue: Statement that’s self-evidently true

Answer: AXIOM

7A clue: Civic automaker

Answer: HONDA

8A clue: What fear leads to, as Yoda told a young Anakin

Answer: ANGER

9A clue: Foxlike

Answer: SLY

Mini down clues and answers

1D clue: Verbal «lol»

Answer: HAHA

2D clue: Brain signal transmitter

Answer: AXON

3D clue: Hits with a witty comeback

Answer: ZINGS

4D clue: Sing at the top of a mountain, maybe

Answer: YODEL

6D clue: Name of the famous «Queen of Scots»

Answer: MARY

Technologies

Today’s NYT Strands Hints, Answers and Help for Oct. 23 #599

Here are hints and answers for the NYT Strands puzzle for Oct. 23, No. 599.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle might be Halloween-themed, as the answers are all rather dangerous. Some of them are a bit tough to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: Please don’t eat me!

If that doesn’t help you, here’s a clue: Remember Mr. Yuk?

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- POND, NOON, NODE, BALE, SOCK, LOVE, LOCK, MOCK, LEER, REEL, GLOVE, DAIS, LEAN, LEAD, REEL

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- AZALEA, HEMLOCK, FOXGLOVE, OLEANDER, BELLADONNA

Today’s Strands spangram

Today’s Strands spangram is POISONOUS. To find it, look for the P that is the first letter on the far left of the top row, and wind down and across.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow