Technologies

Homebuyers Are Scoring 5% Mortgage Rates With These Simple Strategies

You don’t have to settle for high rates in 2025. Here’s how to cut your mortgage rate by 1% or more.

If you’re looking to buy a home, you probably know that housing affordability is in the dumps. Record-high prices and high mortgage rates are serving a double whammy to prospective buyers everywhere.

But mortgage rates aren’t set in stone. Although current rates are hovering near 7%, more borrowers are finding creative ways to snag rates below what lenders advertise. Last year, nearly half of buyers purchased a home at a rate below 5%, according to Zillow.

«With borrowing costs elevated, buyers can take steps to reduce their housing expenses by securing a lower mortgage rate,» said Hannah Jones, senior research analyst at Realtor.com.

The market forces that influence mortgage rates are out of your control. However, if you’re financially prepared and shop around, you can save up to 1.5% on your personalized rate. Optimizing your credit score, making a larger down payment and negotiating with multiple lenders could also help you unlock homeownership in 2025.

Even a 1% difference in your rate can translate to about 10% savings on your monthly mortgage payment and tens of thousands of dollars in savings over the course of your loan.

Here are several ways to reduce your mortgage rate.

1. Improve your credit score

If your credit needs work, consider taking steps to raise your credit score before applying for a mortgage.

Lenders look at your credit score to decide whether you qualify for a home loan and what interest rate you receive. FICO credit scores range from 300 to 850, with 850 being the best score possible. Higher credit scores show you’ve managed debt responsibly in the past so it lowers your risk to a lender. This can help you secure a lower interest rate and save big.

«The best mortgage rates and products are typically reserved for those with a credit score of 740 or better,» said Sarah DeFlorio, vice president of mortgage banking at William Raveis Mortgage.

According to a 2024 Lending Tree study, when borrowers moved from the «fair» credit score range (580 to 669) to the «very good» range (740 to 799), they shaved 0.22% percentage points off their interest rate. That rate difference helped borrowers save $16,677 over the lifetime of a home loan.

2. Increase your down payment

Your down payment is the amount of money you contribute to your home purchase upfront. Each type of home loan comes with a minimum down payment, usually ranging from zero to 5%, but a higher down payment means a cheaper interest rate. That’s because the lender takes on less risk when you contribute more toward the loan.

Because a down payment lowers your mortgage rate and builds your home equity, home loan experts often recommend making a large down payment of at least 20%.

3. Take out an adjustable-rate mortgage

An adjustable-rate mortgage, or ARM, is a home loan with a fixed rate for a set introductory period, such as five years. Once that period ends, the interest rate can go up or down in regular intervals for the remaining term.

The big appeal of ARMs is that the introductory interest rate is often lower than the rate on traditional mortgages. In general, the average 5/1 ARM rate is about 0.5% lower for the first several years than the average rate for 30-year fixed-rate mortgages.

4. Negotiate your mortgage rate

When you’re applying for mortgage loans, you don’t have to go with the company that did your preapproval. In fact, research shows that getting rate quotes from multiple lenders and comparing offers can result in significant savings.

If you want to use this strategy, start by submitting a mortgage application with lenders that fit your criteria. Once you have a few loan estimates in hand, use the best one to negotiate with the lender you want to work with.

The loan officer may lower your rate, help you save on closing costs or offer other incentives to get you onboard. In a 2023 LendingTree survey, 39% of homebuyers negotiated the interest rate on their most recent home purchase. Out of that pool of buyers, 80% were able to get a better deal.

5. Choose a shorter home loan term

Nearly 90% of homebuyers choose a 30-year fixed mortgage term because it offers the most flexibility and monthly payment affordability. Payments are lower because they’re stretched over a longer timeline, but you can always put more toward the principal here and there.

But when you take out a longer-term home loan, «you’re holding up the lender’s money, and there’s an opportunity cost for the funds to be invested elsewhere,» said Nicole Rueth, SVP of the Rueth Team Powered by Movement Mortgage.

Shorter loan terms, such as 10-year and 15-year mortgages and ARMs, have lower interest rates, so you can reduce your rate now.

Choosing a shorter repayment term could help you save money because you’ll be paying less in interest over the long term. But don’t make the homebuying mistake of choosing a shorter loan term just for the lower rate. Shorter loan terms mean you’ll have less time to repay the money you borrow, resulting in higher monthly payments, so it’s important to ensure they fit within your budget.

6. Buy mortgage points

A mortgage point, also known as a mortgage discount point, is an upfront fee you can pay the lender in exchange for a lower interest rate on your home loan.

Each point costs 1% of the purchase price of a home and usually knocks the rate down by 0.25%. On a $400,000 home, you’d pay $4,000 for one discount point. The lender may even allow you to buy four mortgage points to lower the rate from 7% to 6%, although you’d have to shell out $16,000 to get there.

To check whether this strategy is worthwhile, take the total cost of the points and compare it to the overall monthly savings. In this case, when you pay $16,000 to buy four points and save $210 per month, it would take you more than six years to reach your break-even point.

Some experts encourage putting any extra money you have toward a down payment instead of buying points. That’s because if you sell the home or refinance before reaching your break-even point, you lose money. But the amount you spent on your down payment becomes part of your equity.

7. Get a temporary mortgage rate buydown

A temporary mortgage rate buydown involves paying a fee at closing to lower your interest rate for the first few years of your loan term. Because of the considerable upfront cost, this strategy only makes financial sense when someone else pays that fee. Home builders, sellers and even some lenders may offer to cover this type of buydown to boost sales, especially when market rates are elevated.

For example, a lender may offer a «3-2-1» buydown, where the interest rate is slashed by 3 percentage points in the first year, 2 percentage points in the second year and 1 percentage point in the third. Starting in the fourth year, you pay the full rate for the rest of the loan term.

Buyers often choose a temporary buydown and plan to refinance later on. Your buydown funds are refundable and you can use them toward closing costs when you refinance (if rates do drop).

What is a ‘good’ mortgage rate?

The majority of US adults would consider purchasing a home if rates were to drop to 4% or below. Yet most mortgage forecasts don’t project average rates dipping below 6.5% this year.

In a historical sense, a good mortgage rate is generally at or below the national average. Since 1971, the 30-year fixed mortgage rate has averaged 7.72%, according to Freddie Mac. In the last year, average mortgage rates have mostly fluctuated between 6% and 7%.

Affordability is relative to your overall financial situation. And because mortgage rates can change daily and even hourly, the definition of a «good» rate can change quickly.

«What matters is the rate you can get today,» said Colin Robertson, founder of The Truth About Mortgage. According to Robertson, the only way to know if you’re getting a good deal is to speak with a few different lenders and brokers and then compare their quotes against the daily or weekly averages.

Buying a home is a personal decision so it should feel right for your situation and budget. As you shop for a home, consider multiple strategies to lower your rate. A mortgage calculator can help you estimate what you’d pay each month.

Read more: Still Chasing 2% Mortgage Rates? Here’s Why It’s Time to Let Them Go

Technologies

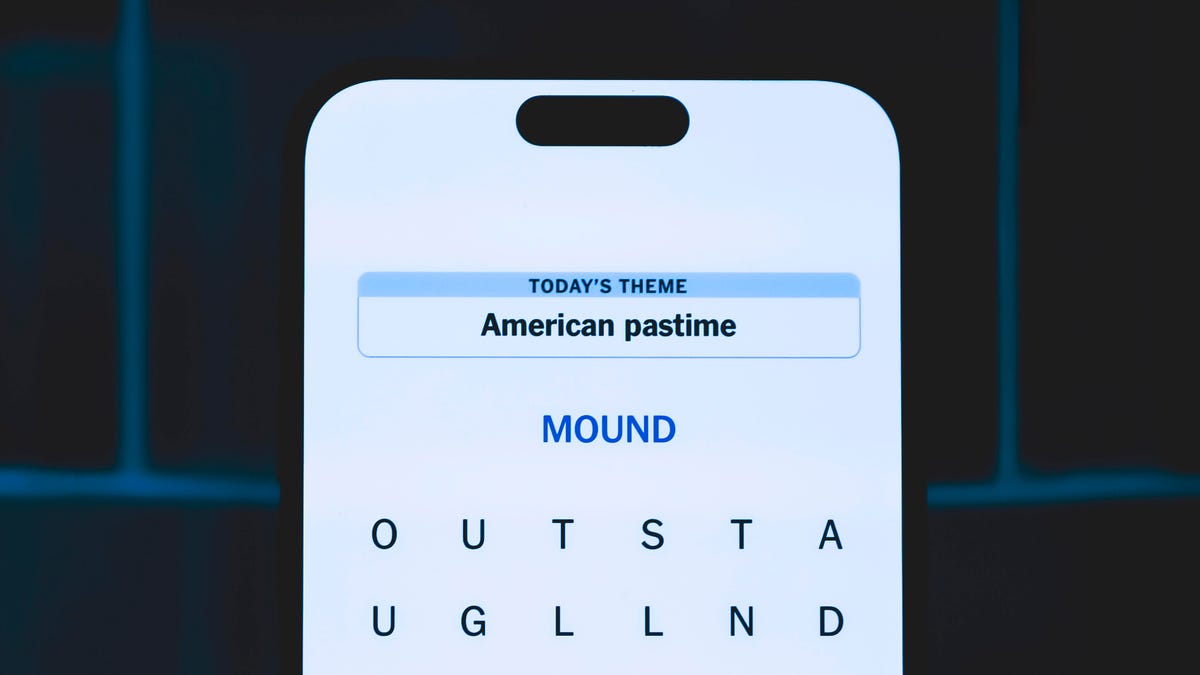

Today’s NYT Strands Hints, Answers and Help for Oct. 23 #599

Here are hints and answers for the NYT Strands puzzle for Oct. 23, No. 599.

Looking for the most recent Strands answer? Click here for our daily Strands hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections and Connections: Sports Edition puzzles.

Today’s NYT Strands puzzle might be Halloween-themed, as the answers are all rather dangerous. Some of them are a bit tough to unscramble, so if you need hints and answers, read on.

I go into depth about the rules for Strands in this story.

If you’re looking for today’s Wordle, Connections and Mini Crossword answers, you can visit CNET’s NYT puzzle hints page.

Read more: NYT Connections Turns 1: These Are the 5 Toughest Puzzles So Far

Hint for today’s Strands puzzle

Today’s Strands theme is: Please don’t eat me!

If that doesn’t help you, here’s a clue: Remember Mr. Yuk?

Clue words to unlock in-game hints

Your goal is to find hidden words that fit the puzzle’s theme. If you’re stuck, find any words you can. Every time you find three words of four letters or more, Strands will reveal one of the theme words. These are the words I used to get those hints but any words of four or more letters that you find will work:

- POND, NOON, NODE, BALE, SOCK, LOVE, LOCK, MOCK, LEER, REEL, GLOVE, DAIS, LEAN, LEAD, REEL

Answers for today’s Strands puzzle

These are the answers that tie into the theme. The goal of the puzzle is to find them all, including the spangram, a theme word that reaches from one side of the puzzle to the other. When you have all of them (I originally thought there were always eight but learned that the number can vary), every letter on the board will be used. Here are the nonspangram answers:

- AZALEA, HEMLOCK, FOXGLOVE, OLEANDER, BELLADONNA

Today’s Strands spangram

Today’s Strands spangram is POISONOUS. To find it, look for the P that is the first letter on the far left of the top row, and wind down and across.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Oct. 23, #395

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Oct. 23, No. 395.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition has one of those crazy purple categories, where you wonder if anyone saw the connection, or if people just put that grouping together because only those four words were left. If you’re struggling but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t show up in the NYT Games app but appears in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Fan noise.

Green group hint: Strategies for hoops.

Blue group hint: Minor league.

Purple group hint: Look for a connection to hoops.

Answers for today’s Connections: Sports Edition groups

Yellow group: Sounds from the crowd.

Green group: Basketball offenses.

Blue group: Triple-A baseball teams.

Purple group: Ends with a basketball stat.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is sounds from the crowd. The four answers are boo, cheer, clap and whistle.

The green words in today’s Connections

The theme is basketball offenses. The four answers are motion, pick and roll, Princeton and triangle.

The blue words in today’s Connections

The theme is triple-A baseball teams. The four answers are Aces, Jumbo Shrimp, Sounds and Storm Chasers.

The purple words in today’s Connections

The theme is ends with a basketball stat. The four answers are afoul, bassist, counterpoint and sunblock.

Technologies

Amazon’s Delivery Drivers Will Soon Wear AI Smart Glasses to Work

The goal is to streamline the delivery process while keeping drivers safe.

Amazon announced on Wednesday that it is developing new AI-powered smart glasses to simplify the delivery experience for its drivers. CNET smart glasses expert Scott Stein mentioned this wearable rollout last month, and now the plan is in its final testing stages.

The goal is to simplify package delivery by reducing the need for drivers to look at their phones, the label on the package they’re delivering and their surroundings to find the correct address.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

A heads-up display will activate as soon as the driver parks, pointing out potential hazards and tasks that must be completed. From there, drivers can locate and scan packages, follow turn-by-turn directions and snap a photograph to prove delivery completion without needing to take out their phone.

The company is testing the glasses in select North American markets.

Watch: See our Instagram post with a video showing the glasses

A representative for Amazon didn’t immediately respond to a request for comment.

To fight battery drain, the glasses pair with a controller attached to the employee’s delivery vest, allowing them to replace depleted batteries and access operational controls. The glasses will support an employee’s eyeglass prescription. An emergency button will be within reach to ensure the driver’s safety.

Amazon is already planning future versions of the glasses, which will feature «real-time defect detection,» notifying the driver if a package was delivered to the incorrect address. They plan to add features to the glasses to detect if pets are in the yard and adjust to low light.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow