Technologies

Does Next Week’s Fed Meeting Matter for Mortgage Rates? Yes and No

Homebuyers are still waiting on lower mortgage rates as the Fed looks to push off interest rate cuts.

If you followed the Federal Reserve’s monetary policy decisions last year, you might have been puzzled: The Fed’s three interest rate cuts didn’t translate into cheaper mortgages. In fact, the average rate for a 30-year fixed home loan has hovered around 6.8% since late fall.

On Wednesday, the central bank is expected to extend a pause on interest rate cuts for a fourth consecutive time this year. Though mortgage rates could see some volatility, many economists expect them to stay somewhat flat until there’s a drastic change in the economic picture.

Rates will stay in the 6.75% to 7.25% range unless the Fed signals multiple cuts soon and backs it up with data, said Nicole Rueth, of the Rueth Team with Movement Mortgage. «Homebuyers waiting on rates to drop drastically might be disappointed,» Rueth said.

The relationship between the Fed’s interest rate decisions and home loan rates isn’t direct or immediate. Often, what the central bank says about future plans can move the market more than its actual actions. Mortgage rates are driven by the bond market, investor expectations and a host of other economic factors.

«Mortgage rates move on expectations, not announcements,» said Rueth.

All eyes will be on Fed Chair Jerome Powell’s post-meeting remarks. If Powell signals concerns about lingering inflation or the chance of fewer cuts, bond yields and mortgage rates are likely to climb. If he expresses optimism about inflation being under control and hints at ongoing policy easing, mortgage rates could dip.

«It’s most often the case that longer-term interest rates begin to decline before the Fed cuts rates,» said Keith Gumbinger, vice president at HSH.com.

Here’s what you need to know about how the government’s interest rate policy influences your home loan.

What is the Federal Reserve’s relationship to mortgage rates?

The Fed sets and oversees US monetary policy under a dual mandate to maintain price stability and maximum employment. It does this largely by adjusting the federal funds rate, the rate at which banks borrow and lend their money.

When the economy weakens and unemployment rises, the Fed lowers interest rates to encourage spending and propel growth, as it did during the COVID-19 pandemic.

It does the opposite when inflation is high. For example, the Fed raised its benchmark interest rate by more than five percentage points between early 2022 and mid-2023 to slow price growth by curbing consumer borrowing and spending.

Changes in the cost of borrowing set off a slow chain reaction that eventually affects mortgage rates and the housing market, as banks pass along the Fed’s rate hikes or cuts to consumers through longer-term loans, including home loans.

Yet, because mortgage rates respond to several economic factors, it’s not uncommon for the federal funds rate and mortgage rates to move in different directions for some time.

Why is the Fed postponing interest rate cuts?

After making three interest rate cuts in 2024, the Fed is now in a holding pattern. With President Donald Trump’s unpredictable tariff campaign, immigration policies and federal cutbacks threatening to drive up prices and drag on growth, economists say the central bank has good reason to pause.

«The Federal Reserve is in one of the trickiest spots in recent economic history,» said Ali Wolf, Zonda and NewHomeSource chief economist.

Lowering interest rates could allow inflation to surge, which is bad for mortgage rates. Keeping rates high, however, increases the risk of a job-loss recession that would cause widespread financial hardship.

Recent data show inflation making slow but steady progress toward the Fed’s annual target rate of 2%. But given the uncertainty surrounding Trump’s economic agenda, the central bank isn’t in a hurry to lower borrowing rates.

What is the forecast for Fed cuts and mortgage rates in 2025?

While experts now predict an interest rate cut in the fall, Powell remains noncommittal on any specific time frame.

«I’m eyeing September for the first rate cut, if inflation keeps cooling and the labor market weakens,» Rueth said.

However, tariffs are the big wildcard. Rueth said that if a trade war fuels inflation, rates could jump even without a Fed move. Political dysfunction, rising debt and global instability are also a recipe for rate volatility.

«The mortgage market reacts fast to uncertainty, and we’ve got no shortage of it this summer,» Rueth said.

On the flip side, if unemployment spikes — a real possibility given rising jobless claims — the Fed could be forced to implement interest rate cuts earlier than anticipated. In that case, mortgage rates should gradually ease, though not dramatically.

Most housing market forecasts, which already factor in at least two 0.25% Fed cuts, call for 30-year mortgage rates to stay above 6% throughout 2025.

«We might see rates settle into the low to mid-6% by year-end,» Rueth said. «But we’re not going back to 3%.»

What other factors affect mortgage rates?

Mortgage rates move around for many of the same reasons home prices do: supply, demand, inflation and even the employment rate.

Personal factors, such as a homebuyer’s credit score, down payment and home loan amount, also determine one’s individual mortgage rate. Different loan types and terms also have varying interest rates.

Policy changes: When the Fed adjusts the federal funds rate, it affects many aspects of the economy, including mortgage rates. The federal funds rate affects how much it costs banks to borrow money, which in turn affects what banks charge consumers to make a profit.

Inflation: Generally, when inflation is high, mortgage rates tend to be high. Because inflation chips away at purchasing power, lenders set higher interest rates on loans to make up for that loss and ensure a profit.

Supply and demand: When demand for mortgages is high, lenders tend to raise interest rates. This is because they have only so much capital to lend in the form of home loans. Conversely, when demand for mortgages is low, lenders tend to slash interest rates to attract borrowers.

Bond market activity: Mortgage lenders peg fixed interest rates, like fixed-rate mortgages, to bond rates. Mortgage bonds, also called mortgage-backed securities, are bundles of mortgages sold to investors and are closely tied to the 10-year Treasury. When bond interest rates are high, the bond has less value on the market where investors buy and sell securities, causing mortgage interest rates to go up.

Other key indicators: Employment patterns and other aspects of the economy that affect investor confidence and consumer spending and borrowing also influence mortgage rates. For instance, a strong jobs report and a robust economy could indicate greater demand for housing, which can put upward pressure on mortgage rates. When the economy slows and unemployment is high, mortgage rates tend to be lower.

Read more: Fact Check: Trump Doesn’t Have the Power to Force Lower Interest Rates

Is now a good time to get a mortgage?

Even though timing is everything in the mortgage market, you can’t control what the Fed does. «Forecasting interest rates is nearly impossible in today’s market,» said Wolf.

Regardless of the economy, the most important thing when shopping for a mortgage is to make sure you can comfortably afford your monthly payments.

More homebuying advice

Technologies

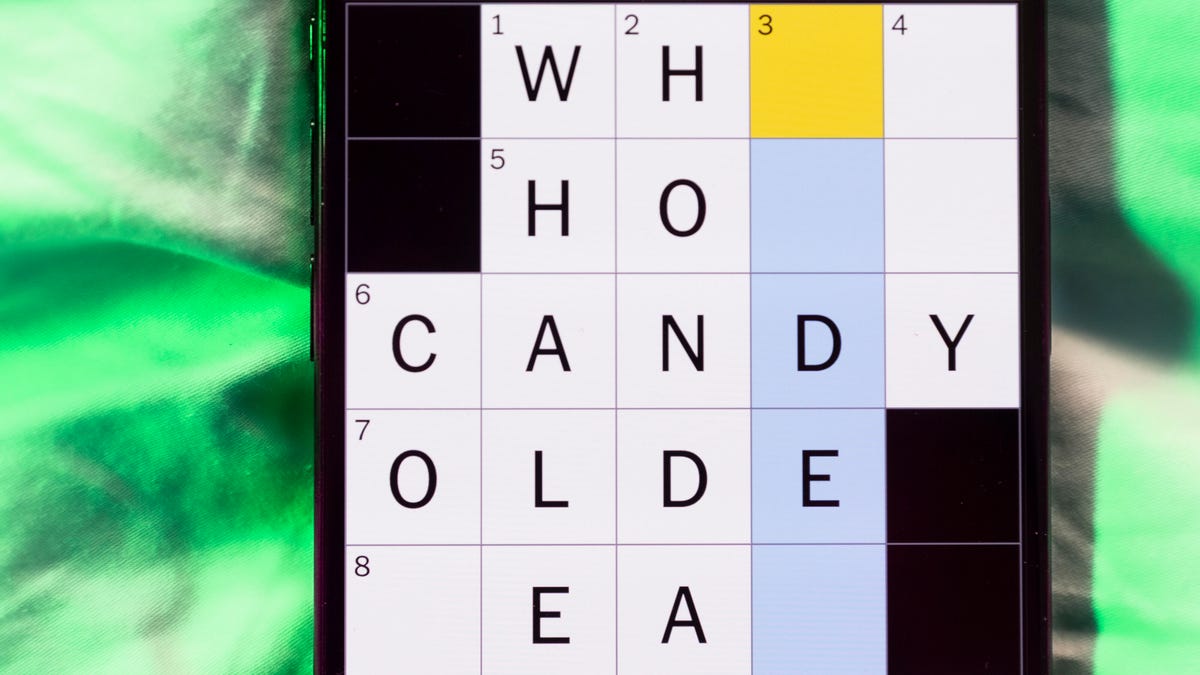

Today’s NYT Mini Crossword Answers for Sunday, Dec. 14

Here are the answers for The New York Times Mini Crossword for Dec. 14.

Looking for the most recent Mini Crossword answer? Click here for today’s Mini Crossword hints, as well as our daily answers and hints for The New York Times Wordle, Strands, Connections and Connections: Sports Edition puzzles.

Need some help with today’s Mini Crossword? It’s fairly easy, but 1-Across will make you think. Read on for the answers. And if you could use some hints and guidance for daily solving, check out our Mini Crossword tips.

If you’re looking for today’s Wordle, Connections, Connections: Sports Edition and Strands answers, you can visit CNET’s NYT puzzle hints page.

Read more: Tips and Tricks for Solving The New York Times Mini Crossword

Let’s get to those Mini Crossword clues and answers.

Mini across clues and answers

1A clue: Stringed instrument that becomes an exclamation if you switch its second and third letters

Answer: VIOLA

6A clue: Place for unread emails

Answer: INBOX

7A clue: Back of a 45 record

Answer: BSIDE

8A clue: Olympic fencing event

Answer: EPEE

9A clue: Emergency call in Morse code

Answer: SOS

Mini down clues and answers

1D clue: Good ___ only

Answer: VIBES

2D clue: Bit of creative motivation, for short

Answer: INSPO

3D clue: Theater awards since 1956

Answer: OBIES

4D clue: Ore deposit

Answer: LODE

5D clue: Tool for a firefighter or lumberjack

Answer: AXE

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Technologies

Today’s NYT Connections: Sports Edition Hints and Answers for Dec. 14, #447

Here are hints and the answers for the NYT Connections: Sports Edition puzzle for Dec. 14, No. 447.

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition has a purple category that could be super-easy, if you spot the connection right away. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it for free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Enjoy the game.

Green group hint: Look up there!

Blue group hint: Remember the Alamo.

Purple group hint: The worldwide leader in sports.

Answers for today’s Connections: Sports Edition groups

Yellow group: Information on a ticket.

Green group: Things in the sky at sporting events.

Blue group: Members of the San Antonio Spurs.

Purple group: Where the initialism «ESPN» came from

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The yellow words in today’s Connections

The theme is information on a ticket. The four answers are date, row, seat number and section.

The green words in today’s Connections

The theme is things in the sky at sporting events. The four answers are blimp, fireworks, flyover and skycam.

The blue words in today’s Connections

The theme is members of the San Antonio Spurs. The four answers are Barnes, Castle, Fox and Wembanyama.

The purple words in today’s Connections

The theme is where the initialism «ESPN» came from. The four answers are entertainment, sports, programming and network.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

Technologies

Today’s NYT Connections Hints, Answers and Help for Dec. 14, #917

Here are some hints and the answers for the NYT Connections puzzle for Dec. 14, #917.

Looking for the most recent Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle, Connections: Sports Edition and Strands puzzles.

Today’s NYT Connections puzzle is an odd one in that the purple category, usually the toughest, was the easiest — if you know a certain group of fictional animals. If you need help sorting them into groups, you’re in the right place. Read on for clues and today’s Connections answers.

The Times now has a Connections Bot, like the one for Wordle. Go there after you play to receive a numeric score and to have the program analyze your answers. Players who are registered with the Times Games section can now nerd out by following their progress, including the number of puzzles completed, win rate, number of times they nabbed a perfect score and their win streak.

Read more: Hints, Tips and Strategies to Help You Win at NYT Connections Every Time

Hints for today’s Connections groups

Here are four hints for the groupings in today’s Connections puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Butter up.

Green group hint: Like The Little Match Girl.

Blue group hint: Letter that makes no sound.

Purple group hint: Oink!

Answers for today’s Connections groups

Yellow group: Lay it on thick.

Green group: Hans Christian Anderson figures.

Blue group: Silent «L.»

Purple group: Fictional pigs.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections answers?

The yellow words in today’s Connections

The theme is lay it on thick. The four answers are fawn, flatter, gush and praise.

The green words in today’s Connections

The theme is Hans Christian Anderson figures. The four answers are duckling, emperor, mermaid and princess.

The blue words in today’s Connections

The theme is silent «L.» The four answers are calf, chalk, colonel and would.

The purple words in today’s Connections

The theme is fictional pigs. The four answers are Babe, Napoleon, Piglet and Porky.

Don’t miss any of our unbiased tech content and lab-based reviews. Add CNET as a preferred Google source.

-

Technologies3 года ago

Tech Companies Need to Be Held Accountable for Security, Experts Say

-

Technologies3 года ago

Best Handheld Game Console in 2023

-

Technologies3 года ago

Tighten Up Your VR Game With the Best Head Straps for Quest 2

-

Technologies4 года ago

Black Friday 2021: The best deals on TVs, headphones, kitchenware, and more

-

Technologies4 года ago

Verum, Wickr and Threema: next generation secured messengers

-

Technologies4 года ago

Google to require vaccinations as Silicon Valley rethinks return-to-office policies

-

Technologies4 года ago

Olivia Harlan Dekker for Verum Messenger

-

Technologies4 года ago

iPhone 13 event: How to watch Apple’s big announcement tomorrow